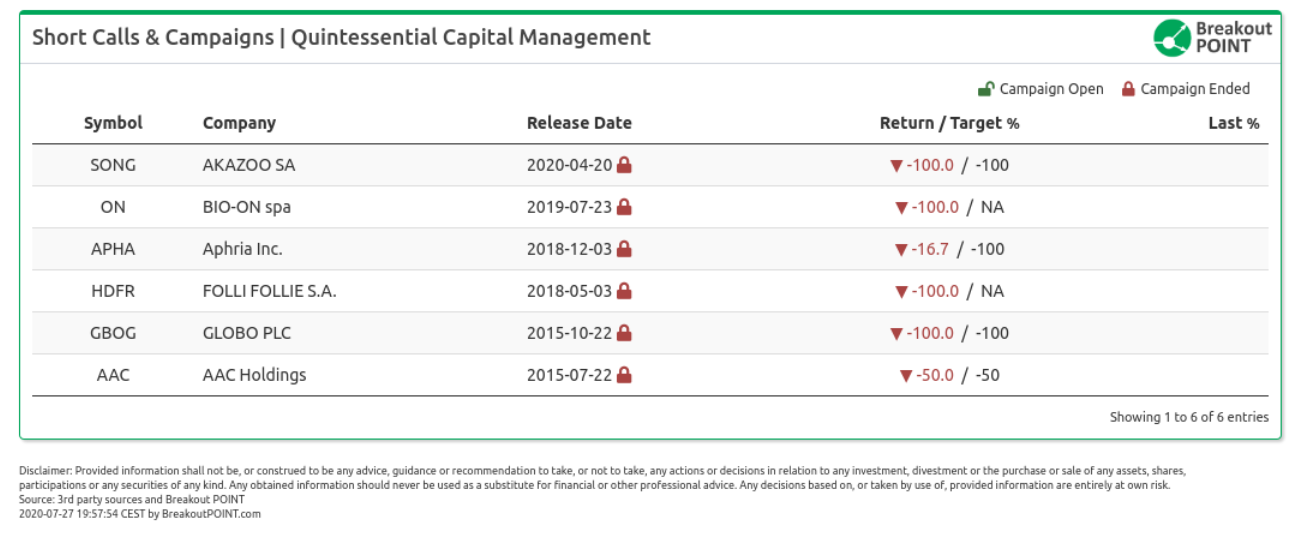

ValueWalk’s next Contrarian Investor Virtual Conference in partnership with the Contrarian Investor Podcast and Breakout Point is coming up on Aug. 11. Gabriel Grego of Quintessential Capital will be presenting.

Q2 2020 hedge fund letters, conferences and more

He has made quite a name for himself as a short seller, but he doesn't make all of his bets on the short side. One of his previous wins has been his long position in Allergan, which was bought out by AbbVie last year.

Grego's thesis for Allergan

In the months before AbbVie's buyout, Grego presented Allergan as a long idea at the 2019 Sohn Hong Kong Conference. He noted at the time that many were concerned about loss of exclusivity on some drugs, especially Botox. Other issues were serial write-offs and the involvement of activist shareholders.

At first glance, Allergan didn't appear to be a thriving business as it had racked up $13.4 billion in write-downs. However, Grego noted that the company had over $6 billion in free cash flow per quarter. He also said Allergan was inexpensive by most measures at 13% free cash flow yield, 8 times P/E, and 10 times EV/EBITDA.

He said the company was cheap due to high levels of uncertainty. Many investors feared competition for Botox, and the high levels of write-offs suggested poor management. He argued that the loss of exclusivity on some of the company's drugs could be managed. He said only 9% of Allergan's sales were affected, and that was mitigated by core growth which should result in little to no impact on valuation.

As far as management, he noted that the company had made some questionable mergers and acquisitions and had some spectacular failures like Rapastinel with no new champions. The company's pipeline was underperforming.

While Botox was a great franchise, new competition was looming. The cosmetic drug made up 24% of the company's total sales and had a fast 9% growth rate with high margins, limited regulatory risk and a demographic tailwind.

He looked at Botox's main competitors, which were Jeuveau and Daxi. However, he noted that the Botox brand was very strong, and there was some customer lock-in. Allergan's cosmetic portfolio also had some synergies and was resilient versus old stronger competitors. The new competing products offered little or no new benefits and no clinical history.

On the other hand, he noted that some Botox customers would switch if the incentives are high enough, although the product choice is usually driven by the doctor rather than the patient. Competitors could provide discounts to doctors, and the safety profile might not be seen as an issue because the new products are seen as nearly equivalent to Botox.

He noted that medical Botox was not as threatened as cosmetic Botox, which was only 10% of Allergan's revenue. Doctors store only two or three products at the most, and Botox is a must-have. In the end, Grego felt that Allergan had a strong core portfolio and that the threats to Botox were probably overblown.

On the Allergan buyout

After AbbVie agreed to buy Allergan for $63 billion, Grego said he was pleased that his long thesis for the pharmaceutical giant was validated. He wasn't surprised that AbbVie grabbed up the Botox maker at what he felt was an attractive price even after the 45% premium.

He also believed that Allergan was worth more than the offer price. He estimated the company's value at $200 or more per share, noting that the shares traded at more than $300 not that long before the buyout.

He expected shareholders to accept the generous premium and noted that there was some uncertainty on the company's future prospects. He believed that the uncertainty was unjustified, although many were concerned about looming competition for Allergan's booming Botox franchise.

Based on his due diligence, he doesn't believe Botox sales would be drying up any time soon. He expected Allergan's cosmetic franchise to be here to stay.