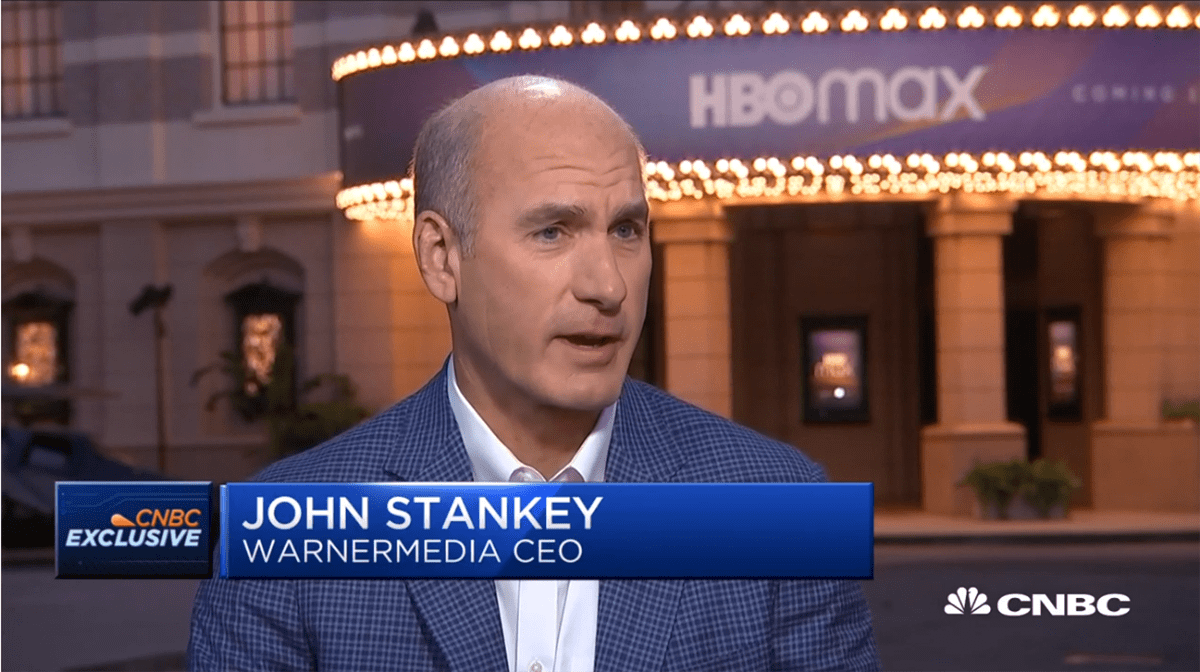

CNBC Exclusive: CNBC Transcript: AT&T CEO John Stankey Speaks with CNBC’s “Squawk on the Street” Today

Q2 2020 hedge fund letters, conferences and more

AT&T CEO John Stankey on the decision to wait to release 'Tenet' in theaters

DAVID FABER: Welcome back. Wireless and entertainment giant, AT&T, reporting earnings this morning. The conference call around those earnings has just concluded and we're very happy to have John Stankey. The company's CEO joins us now on CNBC and john happy to have you for your first interview as CEO you've just completed your first conference call as well. And I guess I'd love to just start there, which is the Stankey era so to speak at AT&T has begun. How is it going to differ from that of your predecessor?

JOHN STANKEY: Thank you, David. It is nice to be here. I think we need to find a better way to brand that than the Stankey era. It doesn't sound very good does it I need a different last name. You know, I think there's been a lot of work that Randall and I have done together over the last several years and we've been real close on a lot of things and I think there's a very strong consistency of our mind and I don't know that there's going to be any dramatic shift, what I would say is if I were to characterize what I would expect to see happen is, I'd be very happy with a business that maybe is a little bit more focused business that, as I've talked about and I talked about on the call focused on our priorities of ensuring that we're growing connectivity. As you know, wireless broadband and its fiber broadband that we're focused on what we can do as software-based entertainment products and using premium content to drive customer affinity on how to use those things and if we are very focused on doing really well on those areas. And we execute very well in those areas. I will be very satisfied you know as my tenure year in this job and working with the team to make that happen.

FABER: Yeah. You know it's interesting, John. It's comments like the ones you just made in terms of focusing on the assets that have been assembled but making sure you sort of focus on those that are growing, and even a comment that you just made on the conference call when you answer the question about is satellite necessary that gets people to believe that you may consider jettisoning Direct TV. Is that something you're considering?

STANKEY: Well, I'm not going to speculate on anything, David. We always have a policy as you know of not doing that, but you know what I care about our customers and our relationship with customers and as I said from the start. When we did the direct tv transaction what we were interested in is ensuring that we could build a platform that allowed us to do things like offer advertising into our customer base allow them to take their entertainment wherever they go to do it on their terms, and we were talking about that back in 2015, and HBO Max and what we've done with AT&T TV gives us some very capable platforms to ensure we can continue to evolve the product in that way. And to the extent that we're able to get those customers engaged with us on those platforms, then you know, we're in a good place and we're okay with that. And if that takes us down a path that says satellite delivery is less important, so be it. But I'm not going to speculate on where we go.

FABER: Understand, although satellite delivery does seem to be becoming less important given you continue to lose subs. This is obviously a very difficult time, bars and restaurants, for example, not open and they're big users of the product, but you've also said john as well that TV and SVOD you see them becoming one over the next few years, that would seem to indicate your belief that it's not necessarily a core asset DirecTV.

STANKEY: Well again, you’re distinguishing Direct TV and you're looking at it as labeling it. I view the customers of Direct TV oftentimes is not necessarily attached to the asset per se. So, you know what I clearly believe as its software-based technology platforms are really important for our business moving forward. And they're able to deliver the kind of product that a customer likes and that's where we're focused on our investment in what we're going to do moving forward.

FABER: All right, well let's talk about some of that HBO Max, of course, launches during this last reported quarter. I'm looking at the sub numbers for HBO at the end of the year 34.5 million, you end June with 36.3 million. Are you happy with the progress you made? Obviously, the service was just rolled out at the end of May.

STANKEY: Yeah, I'm really proud of what the team's done, and there were a lot of execution steps to get this done in the timeframe, we got it done to navigate through our existing relationships with many of our wholesale distributors to build the software platform and do it in a way where it is performed incredibly well, to build a brand and a marketing position. You know that that's not an insignificant amount of work and if you, you know, think back to the launch of Hulu or the launch of Netflix and gaining subscribers, you know to do what we did in 30 days there, You know I'm, I'm really pleased with the team and it's very consistent with how we expected to come out of the gate. We, we told you in October when we announced this, this was not something that we were in for the short haul we clearly indicated this was imperative that we work over a number of years and that we build this new distribution base, and we recognize that we're going to have to do it quarter by quarter and year by year, and we're right on plan with where we needed to be and I'm particularly pleased with what I'm seeing in the wireless space right now our attach rates on these more premium unlimited plans and how we're seeing the buy up in our wireless subscriber base is really encouraging to me, and right on point and consistent with what we what we wanted to see the sequential increase in our broadband subscribers over last quarter. Our fiber broadband subscribers. Again, directly correlated to where we're offering HBO Max with our fiber product, so feel good about that.

CARL QUINTANILLA: Hey John, it's Carl. A lot of movie lovers have spent the week talking about Tenet. And you said you can assure us that it will not migrate away from theatrical release. Does that mean that you're seeing something more constructive in theaters than consensus?

STANKEY: No, I don't think so. I think as I said on the call, Carl, that I don't know that I can predict exactly when theater goers are going to return And what's one of the problems around kind of reopening theaters if you think about it, is you can't go and release something like Tenet and open it up geographically. When it releases in a theater, it pretty much needs to release nationwide. So, if you have a major metropolitan area, say Los Angeles, it's totally out of check. But you have some part of the country that maybe is more in control, that doesn't necessarily give you an option to go open it in half the country, it just doesn't work very well that way. You know my point on Tenet is it's a movie and an experience, it should be seen in theaters and it was engineered to be that way. And as a result of that, it needs to show up that way. And certainly, Christopher would like it to be validated. That's how he wants that piece of work that he's done to be seen by movie goers, and that's why it's going to be something that shows up in a theater.

JIM CRAMER: Mr. Stankey, Jim Cramer. First time I've ever asked you a question. So, I'm going to ask you a pointed one. 338,000 people stopped paying next month, we're going to get rid of that 600 bucks in additional. I know that I am fortunate enough to be able to have done well in my career, but the one thing I would do if I lost that money, I'd say listen maybe I have to cut out AT&T. But I really -- they don't care, they won't cut me off. This is like one of the great free rides. What do you do? You are one of the great free rides.

STANKEY: Well, Jim, first of all, feel free to call me John. You don't have to call me Mr. Stankey. And I will tell you that I think we've been very disciplined around how we've managed to keep America connected construct. In fact, the, the reality that we are telling you that there are going to be some customers that we have pulled out of our customer accounts for the second quarter in anticipation that they may not pay us is indicative of the fact that we've kept a careful eye on this and been very aggressive around how we manage it. Now, there's a limit to everything. As you know, the “keep America connected” promise did conclude at the end of June. That's why we're making this adjustment to the customer base now. We've defined it and contained it for you. Think we've been very conservative in the assumptions that we put out there and we talked a lot about that on the call. So, I don't feel this is something that's going to get out of control and we'll continue to work with our customers moving forward as we always do to try to be as flexible as we can and working through with them. But I don't know that I would consider our business model right now a free ride business model.

FABER: You know, John, back to the broader business model of course and wireless being such a key part of it. I mean you connect to a lot of small and medium sized businesses, what are you seeing on the ground right now? You're not issuing guidance, I would assume that's a reflection of your lack of certainty in terms of what's coming in the economy.

STANKEY: Yeah visibility's tough right now, David. We've, you know, given some little bit better clarity right now what our investment levels are going to be for the balance of this year and we clearly have given you indications and we feel very comfortable that the cash production of the business is going to put us in a very comfortable place on our dividend coverage as we move through this year. So, you know, we have reasonable visibility on what we can do to manage the cash dynamics on things, but you know where we are on the segment, the business segment in particular, it's a bit of a challenge right now to guess where that's going to come out or forecast where that's going to come out. You know, we are in a bit of a unique position where our enterprise business definitely scales more to mid and up market. We’re a little less dependent on smaller businesses. I do expect that those types of firms are going to have a tough third and fourth quarter of this year. I mentioned on the call, where we've already taken a lot of heat in our entertainment business in terms of bars and restaurants and what we do for satellite TV services into those locations. And you know, it has impacted us. But you know, I think we've been very careful about our estimates on cash, assuming that we're going to see a high correlation to pressured economic numbers in the third and fourth quarter, how that's going to impact, you know, all of our customers that – you know, you had Gary on right before I came on and we are a big provider of services into the airline industry and we’ve had to look at that and say what’s that going to do to our business moving forward, and there’s aspects of manufacturing that have been hit harder than others and we’ve had to make estimates on that. So, we’re not optimistic and robust that we’re going to see this strong economic recovery that’s going to help our enterprise space in the third and fourth quarter. And our forecasts have tried to include that as much as possible.

FABER: And finally, John, just to end on 5G. Many people expected this would be the year of a big rollout. You're spending 20 billion in capital. A lot of that is going towards 5G. But you've said that you're over indexed to Apple products, and you'll line up well to Apple,. Apple doesn't have a 5G phone, so I would assume we're not really going to be talking a lot about this for AT&T customers until what? Next year?

STANKEY: Not at all. I mean in fact, today is the day we actually went nationwide on our 5G coverage.

So whether you are an Apple customer or if you're, for example a Samsung customer right now that has a 5G device, you now have 5G access on the AT&T network nationwide as of today. And that timing to get that work done was very much coordinated to an expectation that in the latter part of this year that we may see other 5G devices coming out from other manufacturers that are more broadly available. And we would expect that when that occurs, we're going to be in a great position.

expect as we've communicated, we're going to see an increase in the handset upgrade cycle as we get in the latter part of this year. In fact, that's one of the things that gives us confidence that we can still continue to grow our wireless service revenues as we get in the latter part of this year. And what we had originally communicated, you know, we said that the combination of what we're going to be able to do with HBO Max, and getting people to buy up on unlimited plans, and what would happen in 5G upgrade cycles would give us a good opportunity to get customers into those more robust unlimited plans.

And whether we can get that, you know, growth in service revenues with the economic environment remains to be seen, but we still expect that there's going to be a pretty strong buy cycle in the latter part of this year that we will benefit from.

FABER: John, we have to leave it there for now. Certainly appreciate your taking some time with us this morning. Thank you.

STANKEY: I appreciate you having me and I hope you guys have a good rest of the week.