Background:

More than five years ago I wrote about why it could make sense to invest into other actively managed funds even if one considers oneself an active investor. I would summarize the criteria that were important to me as follows:

Q2 2020 hedge fund letters, conferences and more

The interests of the manager should be long term aligned with investors and the manager should possess specific skills to complement the own portfolio as well as to enable some learning.

My first and only fund investment soon thereafter was the TGV Partners fund managed by my friend Mathias. Looking at his latest letter, my portfolio (+48,8%) performed pretty much in line with his portfolio (~+49,5%) since his Fund’s inception, however with one big difference: In real life, I paid a significant amount of taxes whereas my stake in his fund has been compounding on a gross basis (adjusted for some German tax specialties).

In addition, I have been learning a lot from following his letters and I think without this influence I would still mostly try to find investments below book value and performance would be a lot worse.

The Active Ownership Capital (AOC) Fund

Active Ownership Capital is a fund which is pretty unique in Europe: They specialize in “activist” value investing. This means that they are not only buying a significant stake in undervalued companies but are also actively pushing for change via different means, like board memberships etc. Normally this is the domain of Anglo Saxon players like Elliott, but AOC has established already a very decent track record in recent years.

Some readers might recall, that I followed Active Ownership Capital already 2 times into an investment: Stada and more recently Agfa Geveart.

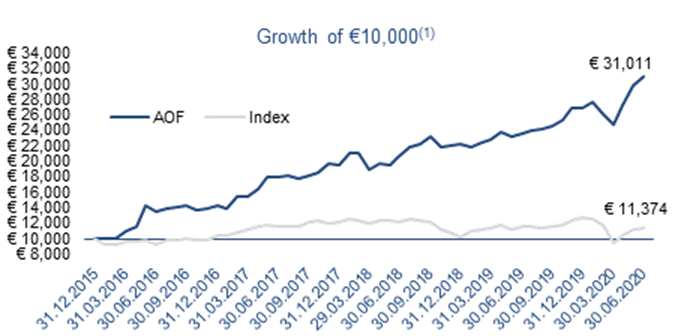

Their performance since launch has been nothing short of spectacular as this official performance sheet (which I was allowed to reproduce) shows:

| NAV | RETURN YTD | RETURN SINCE INCEPTION | RETURN PA | SHARPE RATIO | |

| Share Class A | 310.11 | 15.1% | 210.1% | 28.1% | 1.93 |

Quarterly net performance**

| SHARE CLASS A | Q1 | Q2 | Q3 | Q4 | AOF | BENCHMARK*** |

| 2020 | -8.2% | 25.4% | 15.1% | -10.7% | ||

| 2019 | 2.4% | 3.2% | 4.3% | 9.7% | 21.0% | 25.9% |

| 2018 | -2.9% | 8.5% | 12.3% | -3.7% | 14.0% | -17.3% |

| 2017 | 7.8% | 16.2% | 1.5% | 7.4% | 36.5% | 18.3% |

| 2016 | 9.9% | 22.7% | 5.6% | 0.5% | 43.1% | 3.5% |

| 2015* | n/a | n/a | n/a | 0.0% | 0.0% | 1.2% |

To be honest, I do not expect a similar performance going forward, especially as due to their investment style, performance can be “lumpy”.

As an “activist” fund they need to be of course tougher than a pure passive investor, but so far I have not seen any Carl Icahn style “Greenmailing” from them, where companies pay money just to get rid of the activist guys.

Being invested and following them even closer, I do hope that I can learn a lot here which I could then apply to my “special situation” bucket. So far I have been mostly active when actual bids were made, but going in earlier might make sense.

Additionally, with many non-digital companies struggling at the moment, I think there is ample opportunity for AOC going forward and the number of potential targets is increasing due to Covid-19.

Therefore I assume to have allocated 5% of my virtual portfolio into the fund at end of June 2020 at 301.1 EUR per unit.

Disclaimer. This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!!

Disclosure/Warning: The fund is targeted toward professional investors and doesn’t have a retail share class. For anyone who is going to invest because he read this or subsequent posts on my blog I have negotiated my “standard kick back” with AOC: 1 beer per new account in a pub of my choice.

Article by Value And Opportunity