I read your article on Nikola and Tesla in which you brought up some very good points concerning bloated valuations, thank you for that.

However, I wanted to point out a few things you seemed to ignore.

Q1 2020 hedge fund letters, conferences and more

Nikola Corporation vs Tesla Inc Valuation

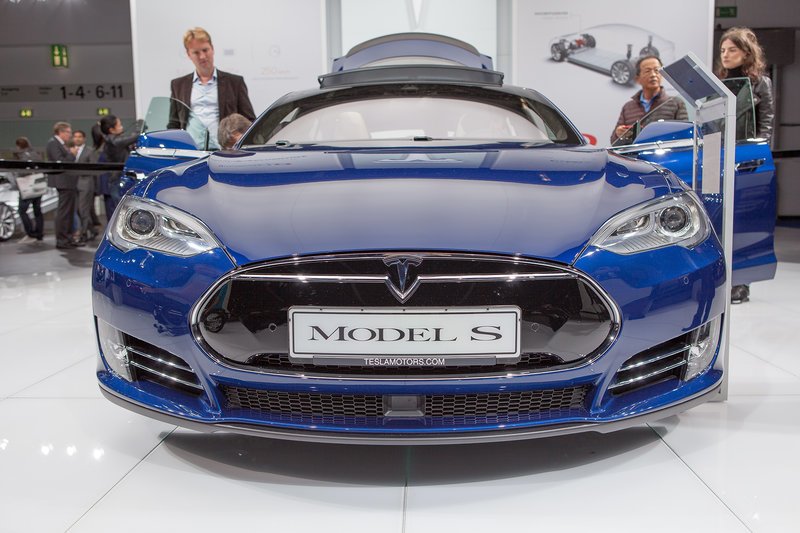

First, you made Tesla look like it has a realistic value attached to it when you compared both Nikola Corporation (NASDAQ:NKLA) & Tesla Inc (NASDAQ:TSLA), like it's the yardstick. If you look at the numbers of projected revenue vs cash burn at Tesla, American Airlines staying grounded has almost a better chance of future cash flows, but it always seems to defy gravity once it broke above $230 resistance. Many hedge funds blew out shorting Tesla, and it has yet to make any consistent money, but it certainly is no "Model" company as far as success goes when it comes to a balance sheet and treated like the Holy Grail.

Secondly, you are correct, Hydrogen had a run at the market 20 yrs prior, and but so have battery cars, they have been around as early as 1890. Obviously, the technology got better and so is the hydrogen technology of today versus decades ago.

Thirdly, you are trying to make sense out of valuation in this market. Just look at Retail ETFs or Discretionary ETFs..why are they near pre-Covid levels? I can basically throw out every finance book I have studied in college since NOTHING makes sense. Who buys bankrupt companies like Hertz, and waits for the judge's ruling to hope that there is some equity distribution left?

Pick practically any stock in the QQQ, then look at the option pricing for either a straddle or a strangle, you will find that investors are pricing Calls more by 5%-30% than Puts, unheard of and I had a seat and started trading Options on the Chicago Board of Options Exchange in 1985, and still do from home now.

IPO Trend Companies

I personally got tired of these IPO trend companies outperforming companies with actual growth and revenues, like BYND vs TSN, that I just started buying a little like Nikola to diversify the portfolio.

Actually last week, other than my option position where I have Put Protection on my equities, Nikola was my only winner.

I'm glad you decided to not fade Nikola and try to find some other hydrogen company that has a poor balance sheet to speculate on, it'll probably do well, investors seem to buy near broke companies. Of course this can't last, but try to profit on it safely, options or tight sell stops.

Is Fed policy propping up stocks like Nikola and Tesla?

After 35 years of trading options on the floor and on the screen, I'm telling you this because you will go broke if you try to make sense out of anything the market does. I lost a ridiculous amount of money in 2011, thinking that the money printing game would end, and the SP500 was going to take out March 09 lows, and I have couldn't been more wrong.

Remember, this is a $7trillion experiment the FED has been playing since 09, unfortunately your kids and my grandkids will be the ones paying for it if the game doesn't work. I pray that it keeps working, I hope that people keep playing these risky stocks because if you think about it, every stock in this market including Blue Chips are on FED eggshells.

Good luck and thanks for the Nikola article.

Sincerely,

Pat Perrotta