J2 Global Inc (NASDAQ:JCOM): Troubling Related Party Transactions, Looming Impairments And A Suspicious History Of Insider Enrichment Spanning Decades

Q1 2020 hedge fund letters, conferences and more

- J2 is a digital media roll-up that has acquired 186 businesses since its inception. Its CEO describes the company’s “acquisition system” as its “single great competitive advantage”.

- We suggest the contrary and believe J2’s opaque acquisition approach has opened the door to egregious insider self-enrichment, which we approximate totals $117 million to $172 million based on publicly available information.

- For example, we uncovered that J2 acquired a newly formed entity based out of its own VP of Corporate Development’s personal residence for an estimated $20 million. The entity had undefined “intellectual property” and no employees or apparent assets. No conflict was disclosed.

- The VP of Corporate Development who was on the receiving end of the payday handled 135 of J2’s acquisitions, representing ~73% of the company’s acquisitions to date.

- It appears to be a pattern. J2’s Chairman formerly controlled a different publicly traded company alongside the noted VP, stacked with various J2 board members and insiders. Its European subsidiary racked up ~€14 million in losses despite having virtually no assets. The entity was based out of the same personal residence and was also acquired in part through a related party transaction with the Chairman. The stock of the parent company is down ~99%.

- J2 recently committed $200 million of shareholder cash to a newly-formed investment vehicle run by its Chairman, who has a track record of venture investment failures. The investment vehicle’s leadership includes other J2 execs and insiders. J2 expects to commit another $100 million to the vehicle.

- That investment vehicle, in turn, made its first investment of an estimated $12 million into a newly-formed home video business established by the Chairman’s nephew. That business is already dormant, according to a former employee. Once again, no conflict was disclosed.

- Despite J2’s proxy describing all but one of its board members as “independent”, we found decades of intertwined financial interests between board members and executives, calling that independence into question.

- Concurrently, a slowing stream of acquisitions has helped to unearth a decline in J2’s key business metrics: digital traffic is down (despite support from recent acquisitions), and cloud cancel rates are ticking up with ARPU falling.

- The underperformance has been masked by tricky accounting. The company has never taken a goodwill impairment, yet subsidiary filings report multiple material goodwill impairments that don’t appear to coincide with parent financials. We estimate at least $155 million in impairments based on visibility into $700 million in acquisitions.

- J2’s European business (13% of revenue in 2016), which was overseen by the aforementioned VP of Corporate Development, has seen its revenue decline 27% in the subsequent 3 years with operating income swinging from $5.5 million to negative $13 million.

- We believe the company’s audit committee simply cannot be relied upon, as a majority of the committee has worked together for years prior to serving on the board of J2 in roles that reveal conflicts of interest.

- The “independent” board approved the cancellation of J2’s dividend to “create greater shareholder returns over the near, medium and long term”. This apparently includes massive loss-making capital commitments and management fees to related parties.

- J2’s young, newly minted CEO was compensated over $45 million during his first year in the role, more than the CEOs of Microsoft and J.P. Morgan, despite J2 being a fraction of the size. We can’t help but wonder whether the board and executive team could be simply trading favors, in a manner consistent with J2’s actions for decades.

- COVID-19 has now officially halted the company’s acquisition model. We feel this is a crucial opportunity for the company’s auditors to examine all of the transactions we lay out in this report (including all acquisitions made under the former VP of Corporate Development) and take necessary measures to prevent what we believe to be additional misuse of shareholder capital going forward.

Introduction To J2 Global

J2 Global describes itself as a “leading internet information and services company”. Its business consists of a portfolio of over 40 major digital media brands, including well-known sites such as IGN, Mashable.com, SpeedTest.net and numerous others.

The company started as “JFax” in 1995, originally focused on forwarding faxes and voicemail messages to e-mail. It changed its name to “J2 Global Communications” in 2000 to pursue a more diversified strategy.

These days, the company can best be described as a perpetual roll-up that has engaged in a decade-long spree of acquisitions in the digital media space.

J2 segments its business into two categories: “Cloud Services” and “Digital Media”. [Pg. 16] The company’s Cloud Services business generates ~48% of its revenue from its legacy online fax service customers, but also includes online backup services, e-mail services, encryption services and other subscription-based cloud services.[1]

The digital media side generates revenues primarily from advertising and sponsorships, subscription and usage fees, performance marketing and licensing fees.

In the past, notable short sellers [1,2] have taken aim at J2’s roll-up model, alleging aggressive accounting and unsustainable business metrics. The company has withstood these critiques, helped by sell-side cheerleading of J2’s acquisition roll-up model and economic tailwinds that had buoyed most businesses.

Today we bring new evidence to light that we believe should catalyze an auditor intervention —we have discovered a series of related-party transactions that appear designed to enrich insiders over the course of the past decade. We have also found evidence of undisclosed goodwill impairments at JCOM’s subsidiaries.

Combining the above with what we believe is a complete lack of corporate governance at the company, we think our findings should be a wake-up call for J2’s shareholders and its auditors. We are notifying their auditors of our findings as well.

The Bull Case: J2 is a Finely-Tuned Acquisition Machine That Has Grown Revenue For 24 Straight Years and Has Generated Positive Operating Cash Flow

J2 bulls argue that the company is a growing financial powerhouse, having achieved 24 consecutive fiscal years of revenue growth. It is an active acquirer of businesses, having deployed approximately $3 billion of acquisition capital since its founding to acquire 186 different companies.

It has never taken a goodwill impairment in its history, which bulls point to as an example of its disciplined acquisition approach.

The company’s CEO, Vivek Shah, recently stated:

“If you asked me, ‘what is the single great competitive advantage of the company’? It’s that acquisition system.” [3:52]

The company says its “deep industry knowledge, technological expertise and investment acumen” allows it to invest capital wisely and successfully integrate each acquisition. The company has generated $418 million in operating cash flow over the TTM period, with 34% EBITDA margins. [Source: FactSet]

J2 now consists of over 40 major brands with 4.6 million subscribers and over 1,100 advertising partners.

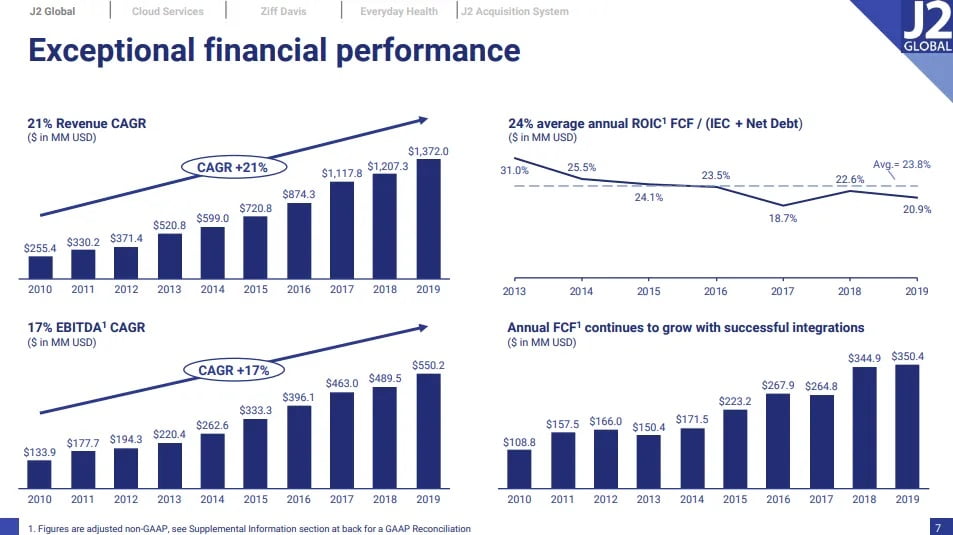

A March 4, 2020 investor presentation described the firm as having “exceptional financial performance”. Its charts paint the picture of a perfectly consistent growth trajectory.

From the outside, JCOM looks like a perfectly tuned acquisition machine that has integrated hundreds of disparate media companies into a cash flow-generating powerhouse.

Reality Check: The Stark Reality At J2 Includes Insider Self-Dealing, An Alarming Lack Of Governance Since Inception, Looming Financial Impairments And A Legacy Business In Decline

Contrary to the picture that the company has painted, we found a vastly different reality at J2.

Related Party Transactions: J2 and its executives have a several decades long history of related party acquisitions and undisclosed self-dealing, including:

- Using what we estimate to be $20 million in shareholder capital to acquire a newly-formed entity set up by J2’s then VP of Corporate Development. The entity was headquartered at his personal residence in the Netherlands, and the conflict was never disclosed.

- Committing $200 million of shareholder cash to the J2 Chairman’s newly-formed VC firm despite a consistent track record of prior investment failures. J2 expects to commit an additional $100 million, for a total of $300 million.

- One of the earliest investments made by the VC vehicle, an estimated $12 million, was to an entity whose incorporation documents list J2 Chairman Richard Ressler’s nephew and lawyer – an indirect related party transaction. We discuss this entity in more detail below.

- J2 Chairman’s track record includes the initial backing, majority ownership, directorship and affiliated executive role in publicly traded biotech company called Presbia that itself operated a newly-formed entity out of the exact same personal residence owned by J2’s VP of Corporate Development. That company has seen its stock fall ~99% in the last 5 years.

- Previously, J2 had acquired yet another entity based out of the same employee’s personal residence back in 2004.

To reiterate: J2’s former VP of Corporate Development had formed 3 entities out of his house that were then acquired/operated by J2 and another company headed by J2’s Chairman that cost/incurred losses totaling an estimated $30 million.

That same VP of Corporate Development was responsible for 135 M&A transactions at J2, according to his LinkedIn profile. That number represents ~73% of the acquisitions in the company’s history.

J2 has historically provided limited disclosure to investors on its acquisition portfolio, raising the prospect of broader malfeasance given 1) this individual’s oversight of these transactions and 2) the close ties he had with the company’s Chairman. He was also integral in J2’s European expansion, helping J2 acquire dozens of businesses. Contrary to sell-side perception, many of these businesses have shown significant fundamental deterioration and warrant further impairment testing.

Executive enrichment: Executives have also enriched themselves overtly, which shareholders have ignored due to J2’s perceived impressive growth: J2 paid $45 million in total compensation to its CEO in 2018 [Pg. 38]; more than the CEO of $1 trillion dollar Microsoft and $250 billion J.P. Morgan. Shah was named CEO three days after J2 agreed to commit $200 million to the investment vehicle managed by J2’s outgoing CEO, the EVP of Strategy, and the current Chairman. [Pg. 51] We find it uncanny that Shah was awarded a ludicrous pay package precisely when related party transactions diverted assets to other key insiders.

J2 Executive Excess Self-Enrichment

Undisclosed Goodwill & Intangible Impairments: Whereas J2 hasn’t recognized goodwill impairments at its parent level, audits at J2’s subsidiaries show a slew of goodwill impairments. We have also found signs that multiple acquisitions are clearly underperforming and likely necessitate obvious impairments that haven’t been taken.

- As one example, a key J2 subsidiary recorded an €22 million impairment despite zero goodwill impairment recognized at the parent corporation.

- Of J2’s 14 “feature” web-based brands, 9 have seen Alexa traffic rankings plummet in the past several years, making them obvious candidates for goodwill impairments.

- Trouble with the perfect acquisition machine:

- Everyday Health, J2’s largest acquisition, saw an immediate post-acquisition revenue drop of ~25%, yet no impairment was recorded. Instead, J2 went on a spree of asset disposals/acquisitions that obfuscated the entity’s financial position.

- J2’s key European subsidiary has seen its revenue decline 27% in the past 3 years, with operating income swinging from €5.2 million to negative €11.5 million.

- VDW, a dissolved undisclosed related-party transaction that should likely be a full write-off.

- The VC vehicle J2 has invested in has an asset that appears to be a conflicted related party. A former employee we spoke with said the operations are currently dormant and its staff have been laid off. (Note that another of the VC vehicle investments is down 50% since IPO which will reflect on the financials on a mark-to-market basis.)

Even though the company has completed $2bn of acquisitions since 2012, mostly in digital media (and cloud services businesses), J2’s predominant legacy fax segment still represented 64% of LTM operating income. Last quarter, it accounted for 83% of operating income despite the time, cash, and assumed debt through J2’s acquisition spree.

Approximately ~$700m of acquisitions for which we have visibility are seeing revenue declines, appear to be underperforming, or have been outright dissolved. That is approximately 1/3 of acquisitions completed since 2012 (of $2bn) – yet we have seen no impairment of goodwill to date. We estimate $155 million in impairments across this subset based on our review. If extrapolated across the acquisitions for which we have zero to little visibility the picture likely worsens.

The disproportionate underperformance of the marquee Everyday Health acquisition should round-out the need for investigation. The opaque nature of J2’s M&A program has also left investors in the dark on the magnitude of insider enrichment and fundamental deterioration of the underlying businesses.

Corporate governance appears to be non-existent—Clear Conflicts Among Independent Board Members

The current situation at J2 has been enabled by a corporate governance vacuum. The Chairman and multiple “independent” board members, including the chairs of the audit and compensation committees, have numerous overlapping business interests, calling their actual independence into question.

- “Independent” Chairman Richard Ressler has outside business ties with much of the board, along with multiple J2 executives. As noted above, Ressler’s new investment firm Orchard Capital Ventures (“OCV”), which itself is staffed with senior J2 executives, received a $200 million commitment from J2’s shareholders, with the expectation that it will increase to $300 million. [ 21] The transfer was approved by J2’s audit committee [Pg. 22], which is Chaired by long time Ressler associate Brian Kretzmer.

2. “Independent” director and audit committee chair, Brian Kretzmer, has a work history with J2 Chairman Richard Ressler dating back nearly three decades.

Most importantly, Kretzmer consulted for the OCV affiliate Orchard Capital. This is a flagrant conflict of interest, given that as chair of the audit committee Kretzmer then approved the $200 million commitment of J2 Capital to OCV.

This conflict was not disclosed to investors. Instead, it appears steps were taken to conceal it. Kretzmer removed his role at Orchard from his personal website, but we can see from an earlier Google cached version that Kretzmer worked on M&A for Orchard Capital:

Beyond working for the predecessor entity of a $200 million related-party transaction that he “independently” approved, Kretzmer had additional ties to Ressler. Kretzmer was CEO of IT company MAI Systems Corp while Ressler was Chairman. [Pg. 19] Kretzmer was also a Director at investment company CIM Real Estate Finance Trust, founded by Ressler. He also worked with telecommunications company Universal Telecom, one of Ressler’s former portfolio companies.

3. “Independent” director and audit committee member, Stephen Ross, has a 20-year history with J2 Chairman Ressler and director/audit committee chair Kretzmer. Ross served as director at MAI Systems together with Ressler (Chairman) and Kretzmer (CEO & President). Ross’s son was also employed at CIM Group, where Ressler was Chairman, eventually becoming CTO. [ 9]

Note again that the “independent” audit committee, whose chairman and majority of its members had multiple overlapping business ties with Ressler, were responsible for providing the approval of $200 million in J2 cash being directed into Ressler’s newly-formed investment entity.

Years ago, while serving at MAI systems, Ross Chaired a special committee that approved a reverse stock split deal that explicitly benefited Ressler. [Pg. 9]

Kretzmer and Ross were hired to the J2 board on the same day 13 years ago.

4. “Independent” compensation committee chair, Douglas Bech, also serves as director/chairman of the corporate governance committee at CIM Commercial Trust, a business founded by J2 Chairman Richard Ressler.

Corporate governance appears to be non-existent—Clear Conflicts Between the “Independent” Board Members and The Executives They Are Supposed to Be Overseeing

The company’s auditor, BDO, has collected increasing audit fees while apparently staying silent on potential conflicts and clear looming write downs. Total audit fees that J2 Global has paid to BDO have more than doubled to $4.4 million in 2019 from $2.1 million in 2016.

Legacy business flatlined. The company’s eFax business has essentially flatlined for the past several years [Pg. 117]. Overall, its cloud services segment is seeing cancellation rates tick up while average revenue per user declines as the company has attempted to increase topline metrics through acquisition. [Pg. 42]

Digital media business in decline. The company’s other segment, digital media, is showing sharp declines in page views among key brands. The segment also faces headwinds from the Covid-19-associated economic crisis, particularly as advertising budgets and rates are slashed across the board.

Overall: Investors in the Dark and Auditors Sitting On Their Hands Leads to J2 Global’s Equity Being Uninvestible

Investors have taken for granted that the company’s acquisition spree has been additive. Yet the absence of thorough disclosure related to the company’s governance and unexamined deals has left investors in the dark to potential write-offs and insider self-dealing. This state of affairs has been permitted by a lack of truly independent board oversight and a sleepy auditor. All told, we think J2’s executives have used the booming equity markets to steadily enrich themselves at the expense of shareholders.

At the moment, shareholders likely feel secure with the business generating free cash flow (~$75 million as of last quarter). But its reported growth metrics (both cash flow and revenue) have largely relied on acquisitions. The company has paid $375 million for acquisitions over the past 4 quarters alone. On the company’s recent quarterly conference call, management announced a halt on M&A due to COVID-19. In the absence of M&A, we expect free cash flow will materially erode over the coming quarters, leaving shareholders with a $1.5 billion pile of debt that presents a danger to equity holders.

We think this is a crucial time for auditors to closely examine the evidence we will present below.

An Estimated $20M In J2 Shareholder Cash Was Used to Purchase A Newly-Formed Entity Based Out of J2’s Long-Serving VP of Corporate Development’s Personal Residence In The Netherlands

As we will show, we think J2 has engaged in insider self-dealing for a long time, continuing to this day, with investors completely unaware.

In one obvious example, in 2015, the company acquired an 11-month old entity based out of a J2 employee’s apartment in the Netherlands for an estimated $20 million, without disclosing it as a related-party deal.

The J2 employee, Jeroen van der Weijden, had a decade-long relationship with J2’s Chairman and had worked at J2 for at least 11 years by the time of the acquisition, per his LinkedIn page. Per the same LinkedIn page, he “sourced and handled over 135 M&A transactions” for J2 since 2004, serving as “GM Europe” and “VP Corporate Development”.

This apparently included advising the company to purchase his own entity where he was the sole employee and its “intellectual property”.

The Company Completely Failed to Disclose the Clear Conflict (And Barely Disclosed the Deal at All)

In October 2015, J2 announced in a press release that it had acquired 9 businesses. Among the acquisitions, listed under “Intellectual Property” on the press release, was a company called VDW (Netherlands).

(Source: J2 October 5, 2015 press release)

J2’s 2015 annual report did not mention the transaction by name or give any more color on it. Since the press release tucking it in with eight other acquisitions was the only evidence we could find of the transaction, it was easy to miss.

The company only reported the initials of the entity, “VDW”. Its full name, according to Dutch corporate records, is actually Van der Weijden M&A Consultancy BV. It was set up 11 months earlier, in December 2014, in the name of long-time J2 employee Jeroen van der Weijden, according to the same records. Perhaps that is why the company thought “VDW” was a better choice for its disclosures.

The company was registered to Van der Weijden’s personal residence in Amsterdam (at Pieter Pauwstraat 2A-H), according to the same corporate records, and listed a total of zero employees.

(Source: Netherlands Chamber of Commerce)

Dutch real estate records confirm that the residence belonged to Jeroen.

(Source: https://www.kadaster.nl/)

And here is a picture of the residence, via Google Maps:

The company never disclosed the purchase price for VDW, but based on an analysis of the price of the other transactions that quarter we estimate that it paid around $20 million.[2]

We emailed the company asking to provide the number and have not received a response as of this writing.[3]

We urge the company to provide shareholders and its auditors full detail on this transaction, including a clear explanation for its omission along with any additional conflicted transactions.

As we will show, this personal residence housed four different businesses: (1) J2 Global NV (2) VDW (3) Presbia (discussed below), and (4) a business run by Jeroen’s brothers.

A Month Later, the Newly Enriched Employee Purchased a California Mansion

About one month after the purchase of his “Intellectual Property” company, Jeroen bought a $2.5 million mansion in California with a heated saltwater pool, tennis court and steam room, according to California real estate records.

(Source: Zillow, 11920 Laurel Hills Road, Studio City, California)

The Acquired Entity Was Dissolved Shortly After the Employee Left the Firm

Jeroen left J2 in 2018, according to his LinkedIn profile. The Netherlands Chamber of Commerce registry for VDW says that the corporation had been dissolved shortly thereafter, effective October 18, 2019.

(Source: www.kvk.nl company profile for Van der Weijden M&A Consultancy BV)

Given that Jeroen was already working for J2 as an M&A advisor, we find it tremendously odd that the company acquired his M&A advisory consultancy firm for an estimated $20 million, without disclosing the obvious conflict, then just dissolved the entity shortly after he left.

Lastly, and perhaps most troubling, Jeroen held key responsibility for the 135+ acquisitions he oversaw while at J2. We only went through a fraction of the deals (largely because of J2’s opaque disclosures) and found obvious red flags. Per Jeroen’s LinkedIn profile, he managed:

“Sourcing and handling over 135 M&A transactions, while managing all aspects of the acquisition process from scoping, planning, execution, follow up, and reporting.”

Note that J2 has completed 186 acquisitions, suggesting that Jeroen, who was apparently the beneficiary and key participant in an undisclosed related-party transaction, was involved in over 73% of J2’s acquisitions. Given that the audit committee nor the head of M&A appear to be functioning appropriately, it is our view that independent and external parties should conduct investigations on each and every one of the 135 deals that Jeroen oversaw.

Related Party Transactions and Insider Self-Dealing: J2 Committed $200 Million Of Shareholder Cash to a Newly-Formed Investment Vehicle Run by J2’s Chairman, Richard Ressler

Two years after the VDW acquisition, J2 continued its string of insider self-dealing with a massive allocation of cash to an investment entity controlled by insiders.

In 2017, J2 committed $200 million of shareholder funds to Orchard Capital Ventures (“OCV”), a venture capital fund formed in the prior year by J2’s Chairman Richard Ressler. Ressler is OCV’s majority equity owner despite J2 comprising almost 77% of the equity of the fund. [Pg. 88] [Pg. 21]

The deal was approved by J2’s audit committee [Pg. 51], which as we detail further in Part II, likely unbeknownst to investors, appears heavily conflicted.

We calculate that J2 will pay OCV $36 million in management fees alone, given its fee structure. [Pg. 88, Pg. 2] This could increase if the fund earns any performance fees.

It might seem strange that (once again) J2 is paying millions to its own insiders to invest in ventures, given that J2 is already in the business of investing in and acquiring other ventures.

The overlap with J2’s business model is clear from OCV’s own description of itself:

“OCV’s core focus sectors include information technology, cloud businesses, e-commerce, media & telecommunications, life sciences & healthcare, and clean technology.”

Meanwhile, J2’s website states:

“At J2 Global, we seek to acquire and support internet-enabled companies in a variety of sectors, including media, technology and services.”

Bizarrely, when pressed on this issue, J2 seemingly tried to explain this away by stating that OCV’s investments are a strategic misfit for J2. Specifically, the company claimed to be shelling out the $200 million in order to “invest in promising businesses and technologies that were not a fit with J2’s public company environment.”

The lack of liquidity in these investments is noteworthy. J2’s leverage has continued to climb and has constrained J2’s balance sheet. The company’s dividend was suspended in mid-2019, making room for large capital calls into its Chairman’s illiquid investment vehicle.

J2 Chairman Richard Ressler’s Track Record Includes a Slew of Failures, Along With Signs of Other Undisclosed Related-Party Dealings

Given that the newly-formed OCV had no track record, we explored Ressler’s track record outside of J2 in order to understand whether the massive diversion of resources to his firm was the best possible use of investor capital.

We found that Ressler’s other venture investments comprised a remarkable string of investment failures, marred by signs of related-party transactions and forms of self-enrichment. A brief case study of his investment in a company called Presbia follows. (In Appendix A we break down Ressler’s track record – in summary, 10/12 investments were 0s or near 0s.)

Other venture investors seem to have come to the same conclusion on Ressler’s track record. In January 2018 (shortly after J2’s massive allocation to OCV was signed), J2’s CFO, Scott Turicchi, stated that OCV would raise a further $100m+ dollars from other investors – predominantly on the back of Ressler being a “savvy investor”. [Pg. 20]

That interest never seemed to materialize however. Per OCV’s 2020 ADV filing with the SEC, it manages around $240 million, meaning that J2’s commitment likely will make up almost 85% of the firm’s gross assets.

J2 Chairman’s Questionable Investing Record: Key Role at a Public Biotech Company That Saw 14 Million Euro Disappear Through an Entity Based out of the Same J2 Employee Residence in The Netherlands.

Its Stock is Now Down ~99%.

Richard Ressler’s “savvy” investment experience includes controlling publicly traded biotech company, Presbia, a medical device company focused on a product meant for aging-related farsightedness. The company, whose board is stacked with J2 insiders, is down ~99% since going public in 2015, amidst a series of questionable dealings.

Presbia’s board is stacked with J2 insiders:

- Richard Ressler, J2 Chairman

- Robert Cresci, J2 Director

- Zohar Loshitzer, J2 EVP of Corporate Strategy and former Chief Information Officer

- Mark Yung, recent managing principal of related OCV

(Source: Presbia website, accessed on 5/4/2020 – since then, Yung, Farrell, Auffarth and Cresci have been taken off the site)

Shortly after its IPO, on June 9, 2015, Presbia dismissed its big-4 auditor, Deloitte “effective immediately” in favor of lesser known Square, Milner, Peterson, Miranda & Williamson, LLP.

This move appears to have foreshadowed what was to come. Recall from the earlier section that we identified an apparent undisclosed related party transaction whereby J2 acquired an entity based out of the personal residence of its employee, Jeroen Van Der Weijden, in the Netherlands. Here is the address:

We discovered that Presbia also had an entity based out of the exact same residential address:

(Source: Presbia brochure, accessed from Presbia’s website 5/4/2020)

The entity run out of Jeroen’s house seemed to be focused on selling and marketing [Pg. 71]. It managed to rack up ~14 million Euro in losses despite minimal assets and seemingly minimal operations, per Dutch corporate filings:

(Source: Presbia Netherlands annual statements 2018)

The entity was apparently sold to Presbia in part from Orchard Capital, an investment vehicle run by Richard Ressler, per the Dutch corporate records. Once again, we view this as a major red flag and a clear pattern of behavior:

The entity didn’t seem to be critical to Presbia’s operations—it was eventually placed under liquidation “in an effort to simplify the Company’s organizational structure.” [Pg. 26]

The loss Presbia drummed up, apparently from Jeroen’s 400 sq ft apartment, is alarming to say the least. Around this time, J2 also acquired VDW from Jeroen, as we noted earlier in our report.

We wonder—why were multiple businesses established at a key J2 employee’s apartment involved in deals overseen by J2 Chairman Richard Ressler?

By 2019, after burning through its resources, Presbia was delisted from the NASDAQ after failing to pay $55,000 in listing fees.

Jump BV Was Established By The Same Individual, Jeroen Van Der Weijden, At the Same Residential Address. It Was Also Acquired by J2

Why Are J2 and its Related Individuals Acquiring Multiple Entities Based Out of the Same Residence?

In 2004, J2 paid roughly $1 million to $2 million to acquire Jump B.V. [Pg. 8, Pg. 1], an entity based in the Netherlands founded by its eventual VP of Corporate Development, Jeroen Van der Weijden (for context, this ~$1-2m was 1-2% of the then JCOM revenue). Per J2’s filings, Jump was described as a provider of fax-to-email and unified messaging services, which fits with J2’s primary focus at the time.

Per Dutch corporate records, Jump was later reorganized as J2 Global Netherlands, and was based at the exact same residential apartment that later J2 acquisition VdW was registered (along with the subsidiary of Presbia mentioned earlier):

We reiterate: Why did J2 and its related individuals acquire multiple entities run by the same individual based out of the same residence?

Inside OCV’s Portfolio: An Estimated $12 Million Investment in a Niche Home Movie Business Formed By Ressler’s Nephew (That Now Appears to be Dormant)

So what investments are J2 paying OCV to manage? One example is Red Carpet Home Cinema, a niche business formed by Ressler’s nephew that allows the ultra-wealthy to screen movies in their homes for a $10,000 set up fee and $1,500 per movie.

Per his LinkedIn, Richard Ressler’s nephew, working for OCV as a Principal, became CFO of Red Carpet just as J2 got its first capital calls from OCV. [Pg. 45] He also set up the entity itself, according to California registration documents. OCV principals comprise half the board at the firm.

Red Carpet seems to also be a rather odd fit. The entity was a brand new startup with no revenue[4], which violates OCV’s own investment guidelines:

We attempted to visit the office pre-COVID during working hours but the door was locked and no one appeared to be there.

Similar types of businesses had already tried and failed, including one that included the CEO of Red Carpet as a director.

Similar types of businesses had already tried and failed, including one that included the CEO of Red Carpet as a director.

Red Carpet appears to be on a similar trajectory. A former employee told us that the film units are “sitting in a warehouse right now” and that due to COVID-19 they had to “rev everything down because the world changed”. Per the former employee:

“Once theaters close, studios don’t release films, and if they don’t release films the product I was working on doesn’t exist. Well it does, but it just doesn’t have any offerings.”

Inside OCV’s Portfolio: Part Overlap with J2’s Own Investment Approach and Part Biotech (Which OCV Principals Have a Disastrous Track-Record With)

We can’t help but wonder if J2 will end up paying for OCV’s tech portfolio down the line, further directing incentive fees and other benefits to its insiders for performing the work they were supposed to already be doing on behalf of J2’s shareholders. Thus far, OCV’s portfolio consists of:

- Four companies that have overlap with J2’s investment mandate. (Techstyle, Invoice2Go, Social Native, and SafeBreach). Our concern here is that OCV is just buying these companies with a view toward flipping them to J2 later at a premium, which would allow insiders to pocket performance fees and principal gains. Examples:

- Invoice2go sells invoicing solutions to small businesses via subscriptions. J2 has multiple small business subscription and technology services.

- Social Native, a marketing tech company offering branding and content solutions. J2 has an entire section of its website devoted to marketing tech.

- Six companies that are healthcare/biotech related, which OCV principals have a disastrous track record in (over 95% historical losses). (Finch, Ossio, Precision Biosciences, Praxis, 1200 Pharma, ByHeart.) OCV’s principals have little experience in this sector, with the exception of driving one biotech company, Presbia, into the ground, as we will show. Another, Precision Biosciences, is already public and down ~50% since its IPO last year.

- Two companies that are niche businesses. Figure 8 runs the Museum of Ice Cream and Red Carpet Home Cinema aims to cater to the ultra-high-wealthy with an in-home movie screening business.

Part II: Tricky Accounting: J2’s Public Entity Has Never Recognized Any Goodwill Impairments

J2 has impairment reviews on a yearly basis, yet we see no impairments to goodwill or intangibles on its acquisitions for the last decade. [pg.72, pg. 68, pg. 56, pg. 55, pg. 54]

We spoke with an investor relations representative about goodwill impairments and he explained:

“We haven’t really had any…we also think about the world more in terms of non-GAAP”

He also described the challenge of keeping track of performance in a roll-up with hundreds of acquisitions:

“All these tuck in acquisitions, they kinda just get shoved in to the broader J2 umbrella, within the business unit, within the division – and they don’t really get tracked anymore. It’s impossible to track the revenue that derives from ‘Acquisition Y’ versus what was there before. And the costs of course get blended together. It’s really hard to track some of these tuck-in M&A.”

We reviewed international filings for J2’s acquisitions to get a picture of how individual acquisitions are actually performing. This included filings from Sweden, Ireland, Britain and Denmark.

Our review uncovered multiple examples of goodwill write-downs and impairments at subsidiary levels that are simply not carried up to the parent company financials.

Furthermore, we found clear signs of a warranted impairment at J2’s largest acquisition, Everyday Health.

J2’s Largest Acquisition, Everyday Health, Was Acquired in 2016 for $493 Million. It Saw an Immediate Annual Revenue Decline of ~25%.

J2 Has Yet to Record An Impairment. Instead, Everyday’s Financials Have Been Obfuscated Through A Series of Acquisitions And Divestitures

In December 2016, J2 acquired Everyday Health for $493.7 million, its largest-ever acquisition. [Pg. 75]

At the time, Everyday Health was a portfolio of health-focused online properties that included consumer and professional oriented brands such as Mayo Clinic Diet, MedPage Today, and What to Expect.

A chart from J2’s March 2020 analyst day presentation shows consistent rising revenue at Everyday Health Group, suggesting that the acquisition has been a raging success:

The public financials of Everyday Health show that LTM revenue up until September 2016 (months before the acquisition) was $254 million [Pg. 2, Pg. 2, Pg. 2, Pg. 31]. The 2017 numbers declined precipitously (to $171 million), but rather than recognizing the underperformance and taking a goodwill impairment, J2 went on a spree of divestitures and acquisitions in the division that effectively obfuscated the reported metrics.

The company explained the 2017 dip by calling it a period of “shrink to grow” where it was divesting assets.

But even after factoring the 2 divestitures from that year, year over year revenue in the division declined by an estimated $65 million, or 25%.[5]

Revenue in the Everyday Health division still has not reached its pre-acquisition levels despite the 5 subsequent acquisitions folded into the subsidiary.

Such a steep revenue decline seems to clearly warrant a goodwill impairment, yet the company has taken none to date.

Once again, this is J2’s largest acquisition and shows clear signs of impairment. Rather than addressing it, a slew of new M&A deals have simply papered over the issue.

Tricky Accounting: A Wholly Owned Subsidiary of J2 Reported €36 Million (~$50 Million USD) in Impairments, Yet the Parent Reported None. (This Shouldn’t Be Possible)

For example, subsidiary J2 Global Holdings is the 100% owner of entity J2 Global Ireland. [Pg. 25] The parent shows zero impairments in 2015, but the latter—a wholly owned subsidiary—shows €22 million in impairments in the exact same year. This shouldn’t be possible.

Here is the parent showing no impairments:

(Source: J2 Global Holdings Limited 2015 Annual Report)

And here is the subsidiary showing €22 million in impairments in the same reporting section:

(Source: J2 Global Ireland Limited 2015 Annual Report]

Purely in the interest of being thorough, here is the same filing showing that the entity that recorded the impairment is the wholly owned subsidiary of the entity that didn’t [Pg. 59]:

Cumulatively, we found 36 million Euro (~US$50 million) of impairments at the subsidiary level that did not seem to make it to J2 Ireland’s parent. J2 Ireland’s parent shows no impairments (or diminution) to its investments as of our latest data for the year ended 2018. Inclusive of vdW, we have identified four dissolutions of acquired entities at the subsidiary level.

(Source: J2 Global Ireland Limited 2018 Financials Page 22)

A review of J2’s key European subsidiary, which holds many of its underlying European subsidiaries, shows significant declines in both revenue and operating income over the past 3 years.

(Source: J2 Global Ireland corporate filings (converted to USD)

Filings across multiple European subsidiaries shows several acquisitions have had significant revenue declines. These European acquisitions and entities look to have been supervised by Jeroen – the key man in a series of suspicious transactions described earlier.

All told, it seems that multiple J2 European assets are deteriorating, yet we have seen no goodwill impairments recorded at the parent level.

(Source: European corporate filings [converted to USD on a constant currency basis])

Bottom Line: The Market Has Been Enamored with J2’s Acquisition Spree, Yet It Has Been a Grand Waste of Time and Energy—83% of Last Quarter’s Operating Income Was Still its Legacy Fax and Email Marketing Business (and 64% on an LTM Basis)

The sell-side has consistently praised J2’s acquisition machine as a key driver of the business, awarding it growth multiples based on its ability to acquire and integrate new businesses:

Yet J2’s boring (and declining) legacy businesses remains the real driver of its results. While the e-fax and email marketing segment accounted for only 26% of revenue over the last twelve months (LTM), it accounted for over 64% of LTM operating income. Last quarter it accounted for 83% of operating income despite the time, money and effort invested into M&A. [Pg. 41]

Part III: A Corporate Governance Vacuum

Insider Enrichment: J2’s Newly Appointed CEO Was Paid An Astounding $45 Million In His First Year As CEO; More Than the CEOs of J.P. Morgan and Microsoft

J2’s CEO, Vivek Shah, is relatively young and had limited executive experience when starting his role as CEO of J2. He had served only as CEO of J2 acquisition Ziff Davis for two years and, prior to that, in various management positions at Time Inc.

Despite this relative lack of experience, Shah made an astounding $45 million in his first year as CEO.

(Source: JCOM 2019 Proxy Statement, pg. 38)

Shah strikes us as both articulate and intelligent, yet we find no justification for that compensation, stock-based or otherwise, which puts Shah among the highest paid CEOs in the world. For comparison, J.P. Morgan’s Jamie Dimon, who oversaw a $258 billion bank with $877 billion in assets, made $31 million in total compensation in 2018. Microsoft CEO Satya Nadella, who was running a $1.17 trillion company, made $28.5 million in total compensation the same year.

We think J2 has a looming problem with its historical acquisition portfolio, which makes us wonder whether Shah is being compensated for taking on hidden risks. We also wonder whether his generous compensation was related in any way to the generous commitment of hundreds of millions to the J2 Chairman’s/former CEO’s own investment vehicle, which took place within days of Shah’s assumption of the CEO role.

Corporate Governance: We Think J2’s Auditor/Audit Committee Is Missing In Action.

We believe that given the magnitude of the related party transactions, impairments that don’t show up in the parent level’s goodwill and aggressive accounting flagged by other critics, it’s obvious that the company’s auditor, BDO, and J2’s audit committee are either willfully ignorant or simply asleep at the wheel.

Unlike many similarly sized publicly traded companies, J2 does not use a big 4 accountant.

In 2015, J2 upgraded from auditor SingerLewak LLP to BDO (pg. 50, pg. 49), having earlier downgraded to SingerLewak in 2007 from the well-known Deloitte & Touche (2007 auditor, 2008 auditor).

Beyond the conflicting board and executive associations described earlier, there has been significant employee turnover in J2’s finance and accounting departments. We reviewed company disclosures and employee LinkedIn profiles and found a pattern of relatively short tenures and a large number of key departures.

(Source: JCOM Disclosures and Employee LinkedIn Profiles, Hindenburg Chart)

Part IV: J2’s Legacy Businesses In Decline

Underneath all of the acquisitions and supportive accounting, J2’s legacy businesses simply look to be fading. Key metrics from both of the company’s major segments show declines and the quality of each segment appears to be deteriorating.

Cloud Services Segment Cancel Rate Is Rising While Average Revenue Per User Falls

For example, while subscriber revenue continues to rise in the company’s cloud services segment as a result of continued acquisitions, the company’s average monthly revenue per Cloud Business Customer (ARPU) has fallen while, at the same time, the company’s Cancel Rate has ticked upward.

(Source: J2 Annual Reports, Hindenburg Chart)

The key to the Cloud Services is the company’s faxing software, which comprises 23% of total company revenue. [Pg.14] Faxing continues to be in secular decline as technology evolves and other internet-based solutions become more ubiquitous.

J2’s key patent that once gave it a moat in the fax-to-message space expired in 2017, allowing competition to chew away at its user base. Well-known players in the cloud computing industry, like DropBox which acquired HelloFax in 2019 (now HelloSign), are threatening J2’s historical cash cow. Ironically, J2’s own subsidiary PCMag, ranked its own faxing service (eFax) as just the fourth best service in its “Best Online Fax Services for 2020”, behind HelloFax.

J2’s Digital Media Assets Were Already Declining Pre-COVID.

Now the Pandemic Has Depressed Revenue Across the Sector.

BuzzFeed has called the coronavirus a “Media Extinction Event”, noting that there has been a “free fall” in advertising revenue, despite the fact that online traffic for many publishers has risen.

J2 notes that the “majority of [its] revenue within the Digital Media business is derived from short-term advertising arrangements and a reduction in spending by or loss of current or potential advertisers would cause our revenue and operating results to decline.” [pg.12]

Yet even prior to COVID-19, J2’s brands seemed to largely be underperforming. Traffic growth has been a difficult to measure metric for J2’s digital media segment, since traffic is inclusive of acquired assets. But despite J2’s acquisitions of BabyCenter, Castle Conolly Top Doctors and Spiceworks in 2019, the company recently posted declining annual traffic numbers for the first time in years.

(Source: J2 Annual Reports, Hindenburg Chart)

JCOM’s website is quick to tout ownership of its marquee names, like IGN, Mashable and Humble Bundle. But reviews of J2’s digital media portfolio up until April 2020 show that the Alexa rankings for its featured digital assets have mostly plunged over the last 3 years.

Per our call with a J2 investor relations rep, he emphasized that traffic does not always translate to revenue, and revenue does not always translate to EBITDA. While this is true, traffic and revenue certainly help.

9 of the 14 website-driven names appeared to be in major downtrends, even through the COVID-19 pandemic, while three sites appeared around the same and two sites have increased their rankings.

For example, here is IGN’s Alexa ranking over the last 3 years:

And HumbleBundle.com showing a similar decline:

Mashable’s Alexa ranking has also plunged over the last 3 years:

AskMen.com also appears to be in steep decline:

As is ExtremeTech.com:

And Geek.com:

Babycenter shows a similar trend:

Offers.com has also seen its Alexa rank fall:

Spiceworks.com is clearly in a downtrend:

EverydayHealth.com, J2’s largest acquisition, appears to be close to where it was 3 years ago:

BlackFriday.com, a seasonal business, is off its highs but slightly above where it was years ago:

PCMag.com is slightly higher than it was three years ago:

And Speedtest.net and WhatToExpect.com appeared to be the two brands that were able to buck the trend:

Overall, J2’s digital media assets already appeared to be struggling pre COVID-19. Without M&A to plug up the holes and obfuscate the declines, we expect the numbers to worsen materially. J2 pulled its guidance last quarter given the uncertainty.

Conclusion: We View J2 Global’s Equity As Uninvestable

While J2’s legacy business troubles and aggressive accounting have been addressed by other critics in the past, we believe the revelation of the major red flags we are bringing to the table today, combined with an unprecedented and existential macroeconomic threat to its legacy business, may finally put J2 in a position that could (and we think should) lead to:

- An external investigation into J2 acquisitions practices (in particular to those during Jeroen van der Weijden’s tenure) and the CEO’s compensation (including the decision making process that went into it).

- A review by the company’s auditors into the company’s acquisition history and aggressive accounting – and specifically goodwill and impairment testing.

- A much-needed board shake up.

- A repricing of the company’s stock to account for these risks, incrementally commensurate to the financial risks at a company with over 3x turns of leverage (as well as cancelled dividend) and looming impairment questions.

- Vastly more detailed disclosures about key metrics and beneficiaries of historical acquisitions and future acquisitions.

Disclosure: We are short shares of J2 Global (NASDAQ: JCOM)

Appendix A: Ressler’s Track Record At Orchard Capital Corporation (His Previous Venture Firm)

Here is a rundown of the investment portfolio of Ochard Capital Corporation (“OCC”), per the Wayback Machine. Note that OCC shared offices with J2 for multiple decades.

| Prior Investment | Outcome | Details |

| J2 Holdings | Success | Ressler’s entity made its first investment in J2 at $0.77/sh in 1997 and sold its stake by August 2005 at $10.94 |

| Coreolis Holdings | Failure | Coreolis was the holding company for two cargo aircraft companies that went bankrupt/insolvent. [Pg. 2 & Pg. 5] |

| ESW | Failure | ESW is a publicly traded company (that saw Jeffrey Epstein as one of its key holders, along with Ressler) that filed to revoke its own registration and now trades on the pink sheets with a market cap of ~$4 million. |

| Proficient Systems | Failure | The company raised $11.4 million dating back to 2002 (unclear at what valuation) and was sold for $8.4 million in 2006. |

| Vantage Surgical | Failure | Vantage looks to have quietly disappeared. |

| Ocata Therapeutics | Failure | Orchard principal Zohar Loshitzer joined the board of publicly traded Ocata in 2011 when the price was ~$10.34/sh. It was taken private in 2016 at a ~20% discount, $8.50/sh. |

| Orchard First Source | Failure | Publicly-traded BDC (NASDAQ:OFS) is down ~15% since going public in 2012, including dividends, according to FactSet |

| MAI Systems | Failure | Acquired at a ~99% discount to its original listing price |

| Inner Presence | Failure | The website no longer exists, and it looks to have been a short-lived project based on the CEO’s Linkedin. |

| Vector Group | Success | From 1988 to 1994 Ressler served as Vice Chairman & then executive at this company that later became publicly traded Vector Group. |

| Universal Telecom Services | Failure | Dissolved in 2016. |

| Presbia | Failure | A formerly publicly traded biotech company that was recapitalized by Cresci and later filed for delisting and registration termination in 2019. The last quote we could find for its stock was $0.01. |

The accountant at OCC (and CFO of its various entities at one time) lists amongst his skills the following “discovered legal method for company owners to withdraw funds from business while eliminating tax liability and not violating SEC minimum capital requirements”.

Appendix B: A Pattern of Related Parties Sharing the Same Addresses

- OCC’s office (the predecessor to OCV and Ressler’s family office) was located at JCOM’s address. As was Presbio LLC, related to Presbia.

- OCV’s office is same as CIM Group’s office (another Ressler entity with a publicly traded vehicle.)

- Pieter Pauwstraat was 400 square feet and housed VDW Consulting (bought by J2), VDW Hold Co. (which spun off VDW Consulting), Presbia (a public company that lost 99%, who’s subsidiary was managed by Jeroen), and J2 Netherlands (Jeroen’s first business sale to J2 Global).

Appendix C: A Close Associate of Ressler Worthy of Mention

We thought it was worth mentioning Zohar Loshitzer, J2 Global Executive Vice President of Strategy for over 15 years. Zohar has seemingly been Richard Ressler’s right-hand man for nearly thirty years and overlaps with him at no fewer than nine separate entities. His associations with Ressler include J2 Global, Presbia, OCC, and now OCV. Their relationship goes back as far as 1995 with the formation of OCC and Orchard Telecom – one of the telecom entities formed by Zohar that became part of Presbia. Others included Imali and MTP Consulting that drew significant fees from public entities on behalf of Zohar. These fees help to round out what we view as a long-running insider enrichment process that we estimate totals well over $100 million.

Appendix D: Estimated Impairment Components

| Impairment Components | |

| Everyday Health Acquisition | $70 million |

| European Acquisitions | $50 million |

| VDW Acquisition | $20 million |

| Red Carpet Home Cinema (OCV Investment) | $10 million |

| Precision Biosciences (OCV Investment) | $5 million |

| Total | $155 million |

We estimated based on the following factors:

- Everyday Health was a $493 million transaction that saw its revenue decline ~25% in one year. A correlation of acquisition value to revenue suggests an impairment of $123 million. We added back $30 million due to gains on sale of 2 subsidiaries of Everyday [Pg. 14, Pg. 79] and haircut our own estimates by 25% in the interest of being conservative.

- We estimated VDW based on footnote 2.

- We discounted the estimated $12 million Red Carpet investment based on J2’s proportional ownership of the LP equity in OCV.

- We estimated the small size of the OCV investment in Precision.

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] The company disclosed in its most recent 10-K that fax to email revenue was 23% of total revenue [Pg. 14], which corresponds to 315,572.4 (given total revenue of 1,372,054 [Pg. 40]). Total cloud services revenue was 661,835 [Pg. 117], suggesting that 47.6% of cloud services revenue was e-fax related.

[2] Estimate based on the following: acquisitions in Q3 2015 totaled $191.6 million (total 9 month acquisition consideration [Pg. 12] minus 1h 2015 acquisition consideration [Pg. 12]). Of that, we contacted the co-founder of Salesify that had been acquired in that quarter, who described the sale as being for a “near 9 figure exit”. We estimated this at $90 million total, and $73 million net of $17 million in earnout compensation [Pg. 81]. The other acquisition that quarter which was suggested as being on the larger side per J2’s quarterly conference call was LiveVault, which had originally sold for $50 million to Iron Mountain and then was later sold to J2. We contacted investor relations at Iron Mountain and asked for the sale price to J2 but they refused to disclose it. We assume given the quiet nature of the deal that it was a loss, and estimated $30 million. This left $88 million left for the quarter across the 7 deals, roughly $13 million each. Our review of several deals suggested a minimal revenue/likely acquisition price, which ultimately left us with an estimate of ~$20 million for VDW.

[3] We also spoke to an investor relations representative that seemed to think the acquisition was related to Ookla: “that was an Ookla IP acquisition. We wanted to keep that technology for ourselves…(it was) software that we were utilizing and we wanted to keep it in house. So we paid to keep it in house.” The explanation didn’t make a lot of sense to us (why would a U.S. company like Ookla be using software developed out of Jeroen’s apartment?) and we figured he may have simply been mistaken but we wanted to include it in the interest of not leaving something out that could be relevant.

[4] OCV set up a separate investment vehicle called “OCV Red Carpet 1” on June 20th, 2017, the same day Red Carpet was originally formed in Delaware, indicating its support for the business since inception.

[5] We arrive at a total revenue adjustment of $18 million as a result of the net divestitures. To arrive at this, see the press release announcing 3 divestitures, 2 of which are Everyday Health related. The company discloses a $23 million revenue decline for 2017 for all three. We add back ~$3 million for the unrelated acquisition (Web24) given its lack of reported revenue, suggesting its modest size [Pg.79]. We also add back $2.2 million for 1 month of eHealthCareers (which was acquired in December) per its run-rate prior to J2’s acquisition [Pg. 18]

Article by Hindenburg Research