Google stock 2020 analysis. We are going to use Peter Lynch’s categorization of fast growing stocks to analyze Google stock. Fast growing stocks have certain characteristics and expectations and we are showing how Google stock fits those expectations. This should give you an answer whether Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) is a stock you should buy or not.

Q1 2020 hedge fund letters, conferences and more

Google Stock Analysis - Risk Reward Valuation

Transcript

Good day fellow investors. In this video we're going to analyse Google by using the things that we have learned while summarising One Up On Wall Street from Peter Lynch. We have discussed many things among which were the categories of stocks to analyse and how to approach and analysis. So, we are going to start with categorising Google in what kind of stock it is, is it the fast grower, slow grower, turnaround, asset play, cyclical. And you have also learned that about how to do that on this YouTube channel through the videos, but if you want everything systematised, check my comprehensive stock market investing course, in the link below.

We're going to discuss why Google fits the long term investment strategy perhaps for you, perhaps not, you will know that at the end of this video. We're going to apply the fast grower analysis look at what are the expectations for a fast grower stock, discuss the earnings. Which we will learn how to analyse earnings by continuing to summarise in the book, which will come in the next month. So please subscribe and click that notification bell if you want more stock analysis and you want to understand investing in analysing stocks better.

So let's start immediately with Google. Why it is a long term stock and why Google is a top fund position with the Sequoia Fund. So where do you find ideas? I found this idea Google by looking at the freelance portfolio from Mohnish Pabrai. so shameless cloning you look at what are the top positions of other funds, and then you research them yourself to see how those fit your portfolio. We have five shameless clothing from Markel insurance from Apollo Asset Management etc. We have Uber cannibals and we have spin offs that are usually companies where you can find really investing gems. I've researched Uber cannibals, find a few of them. I'm doing now the shameless cloning and then I'll do the spin offs. And I'll also do a video on a spin off or something. So that will be interesting to look.

But let's discuss Sequoia fund and it's top position Google. They are long term investors, what does that mean? So we can't predict what will happen over the next 3-6 months. And that's a clear story for long term investors. However, if you look at what will happen over the next 10 years, that's a little bit easier. It's not much easier, but you can understand that crisis like the current one we are in will pass and the things will look better in 10 years, then it is the case now. That's usually what happens through history and that's an advantage with long term investors have. Also earnings growth, earnings are the key and if you can find businesses that have the qualities, which certainly Google has, it is a great business. That have the qualities that can improve earnings per share for a long time, keep compounding, then you found yourself a great investment. And Google, it is definitely a great stock.

Let's see how great of an investment it is. Is it a good or a great investment? That's the key question we have to ask ourselves and find an answer. The long term investing is pretty much like this. You don't sell immediately when something goes up, but you wait for the company to really start compounding and then when it starts starts slowing down, then you might start thinking about selling not earlier. So the longer you hold, the more you're rewarded if you own great companies. What does this mean? How do you find how do you find those great companies? Well, you do intensive research, you scout ideas, you do financial analysis, and then on the businesses you really want to know you know, like them like the palm of your hand. I know like the palm of my hand pretty much about 10 to 15 businesses now. I have about 30-40 in my cupboard stock list. And from those I source the 7-8 positions that are the core of my portfolio. And when you focus on the long term, you can have a small advantage over the market and you can do good for yourself.

What does a small advantage mean? Well, it means a lot. Sequoia fund, if you started, if you invested 10,000, 50 years ago, would be now at 4.2 million, the S&P 500 only in 1.4 million. Here are the holdings. We are going to analyse Google for now. But what's the difference? The difference between 1.4 and 4.2 million, which is a big difference is just 2.5 percentage points better per year. So not the crazy difference not I'm going to double my money in 3-6 months in a year or two year now. I'm going to double my money in six years, not seven years.

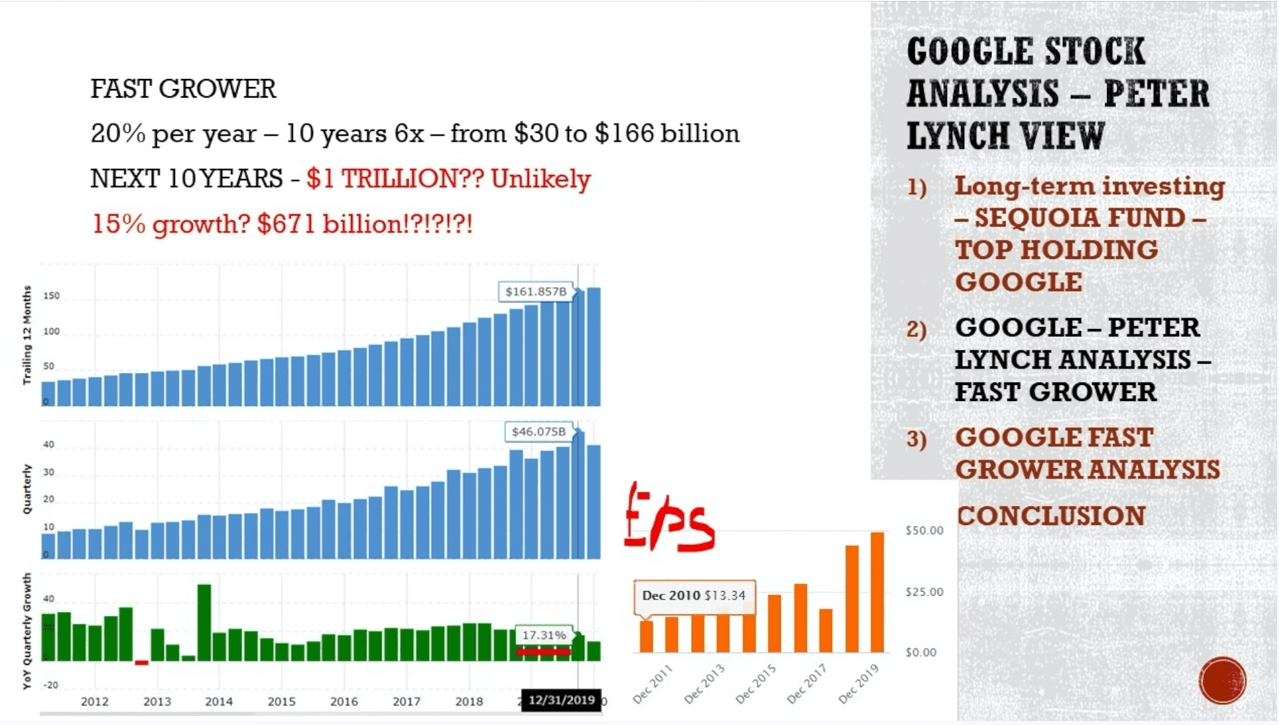

Over the long term that compounds and that is what reinvesting really is. Now, let's go on to Google. It's a fast growing company, 19% growth per year. And what are the questions we have to ask ourselves? What is the safety of the investment? What are the main risks? What is the business yield? What is the growth rate? And what is the investment outcome I can expect over the long term? Investment outcome? Or how much should I pay to own a company like Google? So as I said, fast grower, last quarter of 2019, the growth was 17%. But on average over the last 7-8 years, the growth was 20% per year should be 6x growth over 10 years. That is what happened, revenues went from 20 something billion to 166 billion. Not bad.

However, what will be the future growth rate is the key thing to ask. Are they going to grow 20% over the next 10 years? Are they going to reach 1 trillion in revenues then? So that's unlikely. Are they going to grow 15% per year and reach 671 billion in the next 10 years? That's more likely but that's also a pretty big number to reach 670 billion per year. And then an earnings per share will those quadruple, quintuple over the next 10 years, or a little bit less due to slower growth. If we look at the global advertising spending, growth, it is just 4%. The market is yes growing, but it's still just 4%. So not that big, and we have to see whether Google will be able to continue to grow at that staggering rate of 20% that they have been delivering over the last decade.

The risk factors are mostly related to the advertising market because 83% of total revenues come from display of ads online. Now, there is more to Google than advertisement and that is Google Cloud, Google Play, hardware, YouTube, etc. And they are also putting a lot of research and effort and money into artificial intelligence, machine learning, quantum computing, and we will see what will that bring in the future that is an unknown and as an unknown as a value investor, I prefer to focus on the knowns and leave the unknowns to the potential upside as bonuses as pluses to reward me I don't like to bet on the unknown.

So let's start with the expectations. If you want to read them, this will be a great exercise. Pause the video here. Write down what do you think? How does Google Fit all these expectations? Write what is the positive? What is the negative for you? And then you will compare with what I see Google. And we can discuss in the comments whether I'm right or wrong. So it's about the growth, the valuation, so write everything down for yourself and then we'll compare, it will be interesting.

Let me start. So if the growth slows down, the market, of course will not like it, the valuation might get hit, and that's a negative reward, negative investment return and that's something you would avoid. And I see this probably as the biggest risk for Google on a price to earnings ratio of 27. Any change, negative change in growth would impact the valuation too. On finances, are finances an issue? Definitely not. Great balance sheet, great business model, great margins, great cash flows, that's a positive. Finances are a positive for Google. And also the business model is a very good positive, a great business, we can't argue about that. So there are two positives. Therefore Google then figure out when they'll stop growing and how much to pay for growth.

The fact is that with each company at some point, they will stop growing and turn into something else. That's the only warranty with fast growing stocks. And we have to see how much more room is there for growth. Analysts always focused on the next few years, they can see beyond. There is still room in advertising, YouTube, cloud, but there might also be competition. And I have made here two tables, starting with the current, okay, 2019 earnings of $50 per share, 2020 let's say those stay stable this year due to the advertising decline and COVID crisis. And then let's put the 15% growth rate over the next 10 years. Earnings go from 50 to 172. If the valuation stays the same at 13, the top right yellow column is what I'm discussing now, then the stock price will touch $5,000, which is a great return from the current 1300 to 5000. That's a return inline with the growth rate of 15%. But what if the growth slows down to 10% after year 5, and then to 4% after year 10. Because they have used their expanding possibilities there is competition. I don't know why. But then the valuation will not be 30. And we've discussed into when we discussed these growth stock and the Delta of the Delta the change of the growth rate, how that impacts growth stock. And let's say the valuation falls down to 12. Then the stock price in year 10 would be only 1666. That's not such a great return from the current level and would give you a return of just 2.3% per year, over 10 years. I don't think that's something as an active investor you are aiming at.

So we have other expectations 20 to 25% is the best growth rate. 50% is for hot industries, and those investments usually don't end up well. That's good for Google. They have a proven profitable expansion in more than one city or country they are global, that's also good. But they are global already, which is also a risk. Then on the price earnings ratio, it should be below the growth rate. The price earnings ratio is unfortunately above the growth rate, price earnings ratio of 2730 and the growth rate is 20%. Now whether the growth is expanding or slowing down, unfortunately, slowing down. Again another negative characteristic and risky characteristic for growth stocks. Everyone has heard of it so it's not like you're finding growth gem, which is another negative. And then also, as we said, If growth slows down, there's a big risk another negative finances and balance sheets are okay. And they will stop growing definitely, which is another negative. So you have to see how much are you willing to pay for Google.

Of course, as they say, in their own annual report, there are the moonshots, the power of machine learning, the investments that they do like the when they acquired YouTube, every one call them crazy. So they'll try to do something like that. But that's a risky unknown to bet on. And therefore see, how fast will Google grow? What will it be capable to do? And then compare this good business that will definitely grow but we don't know what what growth rate with what you like to have in your portfolio and what other options you have.

So to conclude, it's all about earnings in 10 years, Google will be making between, I don't know, 100, 138, 172 per share. That would give me a return between 10 and 15% from the business in 10 years. That is great. And that will be a good investment for most of you. But that's in 10 years, and I think I can come better. Call me whatever but I think I can find better than 10% or 15% in 10 years. So we'll keep analysing great businesses will, you can create the research database based on the researcher [unintelligible] that might help you in learning about businesses understanding about businesses, See also how Google fits your portfolio, whether you have something better or not to invest. And keep in mind Google is a great business, you can't go wrong with that. It will be a good investment very likely, might not be a great investment at these levels, but the good definitely so.

So please subscribe click that notification bell. Let me know about your thoughts in the comments below. And don't forget to check the free stock market course also in the description of the video below on YouTube or on my website, SvenCarlin.com. Thank you for watching and I'll see you in the next video.