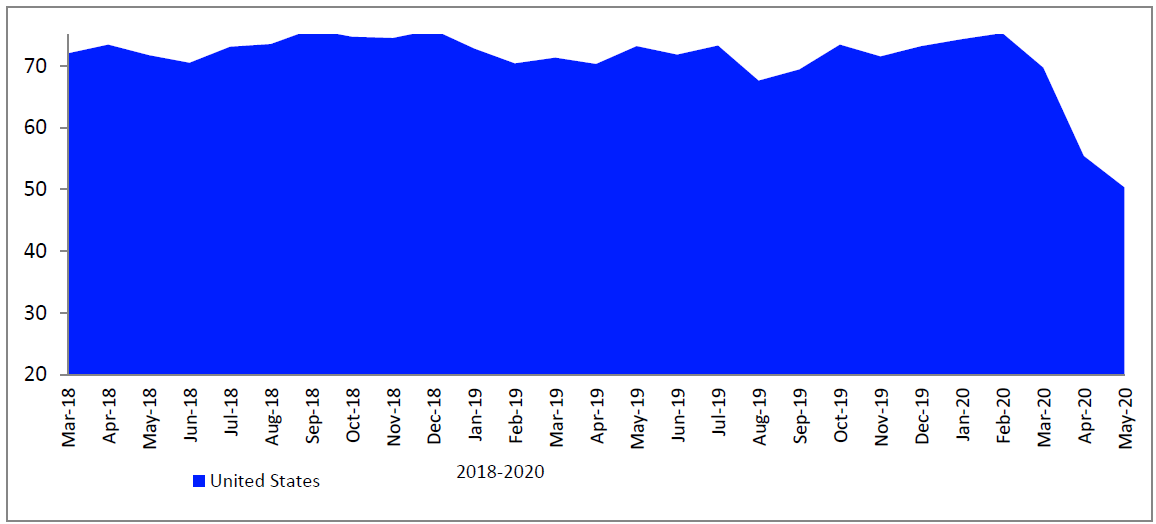

WASHINGTON, DC – American consumer confidence, as measured by the Refinitiv/Ipsos Primary Consumer Sentiment Index, is at 45.4 for the month of May 2020. This represents a 2.4 point decrease from last month.

Q1 2020 hedge fund letters, conferences and more

Current And Jobs Indices See Significant Declines

Declines in the overall PCSI are on a smaller scale than they were last month. This is driven by an increase in the Expecations Index but drops in Current, Investment, and Jobs indices. The most significant declines are seen across the Current and Jobs indices, both of which are down roughly 5 points.

"Even though the Coronavirus outbreak continues across the country, consumers and business owners are beginning to see glimmers of hope as some states and communities begin to open their economies again. However, there is still a lot of concern around the long term outlook and potential fear around resurgence of future waves of the virus." reports Chris Jackson of Ipsos, "Even though consumers are hopeful, there remains some concern about how many people will be willing to take part in the economy for fear of contracting the virus. Meanwhile, business owners and consumers are learning to adapt to a new normal."

Jharonne Martis, Director of Consumer Research at Refinitiv, said, “Omnichannel is key for retailers in the new normal, as consumers gravitate online and use mobile devices to order curbside pickup and ship their orders. U.S. retailers that have reopened abroad are telling us that store traffic has picked up, but consumers are still going online to finalize their shopping orders. Best Buy’s ecommerce alone grew 250% over Q1 2019, as consumer’s make the shift towards the omnichannel experience. Still, retailers have taken a hit because of the coronavirus pandemic and Refinitiv retail earnings index is expected to see a 31.7% decline for Q1 2020.

Current

The PCSI Current Condition Index shows a decrease of 5.6 points since last month (currently at 32.2) While Americans are generally more pessimistic about the economy as a whole, their confidence on their current financial situations remains unchanged.

Expectations

The PCSI Expectations Index is up 7.8 points to stand at 62.7. Americans are beginning to feel more confident about the economy's impact on their personal finances and their job security.

Investment

The PCSI Investment Index is down 3.6 points from last month to 37.6. Comfort in making major purchases as well as other household purchases is down. Moreover, Americans feel less confident in their ability to invest in the future.

Jobs

The PCSI Jobs Index is down 5.1 points currently standing at 50.3. There is an elevated actual experience with job loss. Job security and expectations for job security have both continued to weaken in the last month.