Amid the coronavirus pandemic, there has been plenty of news about pharmaceutical companies working vaccines for the virus. The Bill and Melinda Gates Foundation Trust wasn’t investing in any of those companies as of the first quarter, possibly to avoid any potential conflicts of interest.

Q1 2020 hedge fund letters, conferences and more

Bill and Melinda Gates Foundation Trust sold Berkshire Hathaway

According to the fund's latest 13F filing, one of the biggest changes in the Bill and Melinda Gates Foundation Trust's portfolio from the end of the fourth quarter to the end of the first quarter is the sale of 5 million shares of Warren Buffett's Berkshire Hathaway. At the end of the fourth quarter, the position was about 53% of the foundation's portfolio.

Despite the sale of 5 million shares, the Bill and Melinda Gates Foundation Trust still holds tens of thousands of shares in the firm. As of the end of the first quarter, Berkshire was about 47% of the trust's portfolio. The firm remains the largest holding in the trust's portfolio as of the end of the first quarter.

Another big change in the trust's portfolio was the purchase of about 7 million shares of Schrodinger, a life sciences and materials science company that works on software for computational chemistry.

Other changes in the portfolio

The Bill and Melinda Gates Foundation Trust also made several smaller changes to its portfolio during the first quarter. The trust bought about 500,000 shares of Apple and 552,000 shares of Alibaba during the first quarter.

The trust also bought about 272,000 shares of Twitter and about 43,000 shares each of Google's Class C and Class A shares. The Bill and Melinda Gates Foundation Trust also bought about 60,000 shares of Amazon during the first quarter.

As of the end of the first quarter, the trust's top 10 positions were: Berkshire Hathaway, Waste Management, Canadian National Railway, Walmart, Caterpillar, Crown Castle International, Ecolab, UPS, FedEx and Schrodinger.

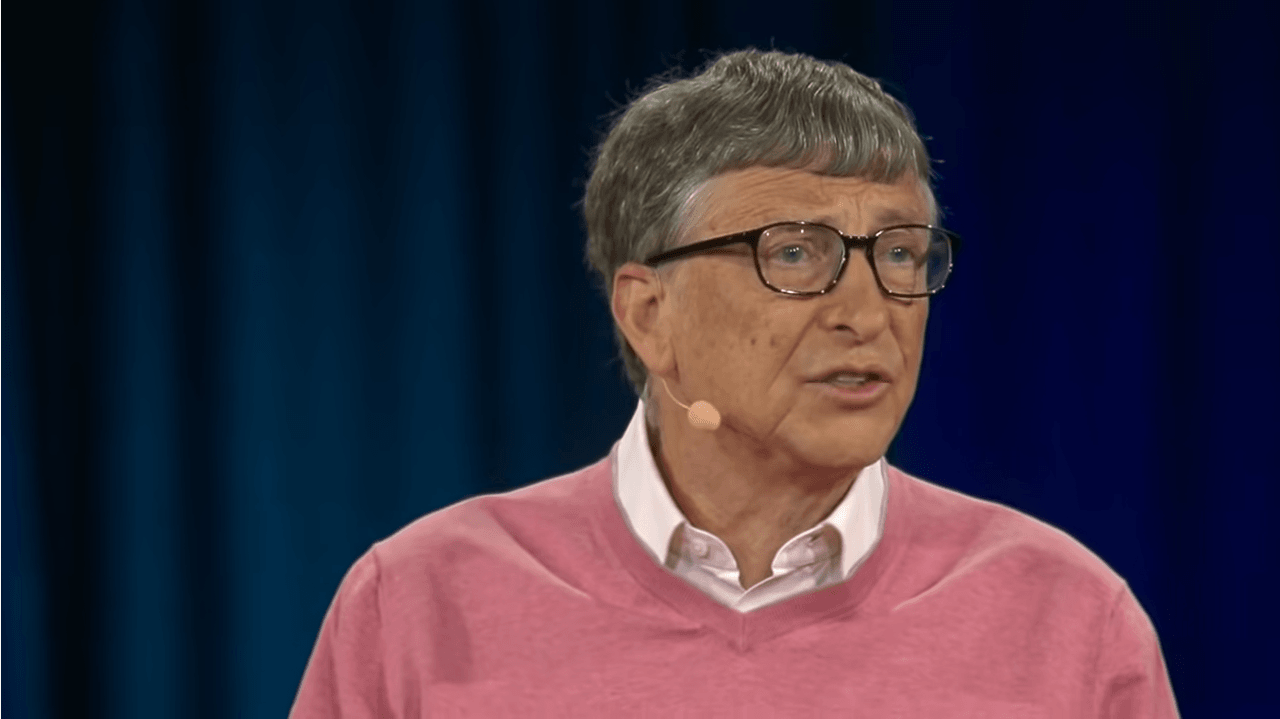

Bill and Melinda Gates Foundation spends billions on COVID-19 vaccines

The Bill and Melinda Gates Foundation has invested $10 billion in vaccine development over the last 20 years. In an interview on CNBC earlier this year, he said the world has put in about $100 billion in total. He estimated that the return would be more than 20 to one on investing in vaccines.

CNBC's Becky Quick said if $10 billion were put in the S&P 500 over the last 20 years, the investment would end up with about $17 billion with reinvested dividends. However, if investing in vaccines, it's estimated that the investor would have $200 billion.

Gates emphasized that the economic and human benefits of investing in vaccines are stronger than the financial benefits based on the millions of lives that are saved through the use of vaccines.

The Bill and Melinda Gates Foundation is investing billions of dollars into the development of seven coronavirus vaccine candidates. Gates told The Daily Show last month that the foundation is setting up factories for all seven candidates. He added that they will end up choosing only one or two out of the seven to fund all the way to production. That means they will waste billions of dollars building manufacturing that will never be used.

However, he believes the danger of the coronavirus is so great, including the loss of trillions of dollars in the economy, that wasting a few billion dollars to get the vaccine done faster will be worth it.