What the record levels of implied volatility on WTI Nymex and other options tell us

On March 9 Russia called an OPEC meeting and killed the oil price by refusing to lower Russia’s production. Without any afterthought and certainly even less remorse thr OPEC states followed suit and killed the costly western oil production. All the dollar liquidity that had been taken out of the market had to be re-injected. By March 12 the Federal Reserve and other central banks to stop the downslope and calm the market.

While the worse in equity and fixed income seem to be behind us, dark clouds are hovering over energy and the commodities.

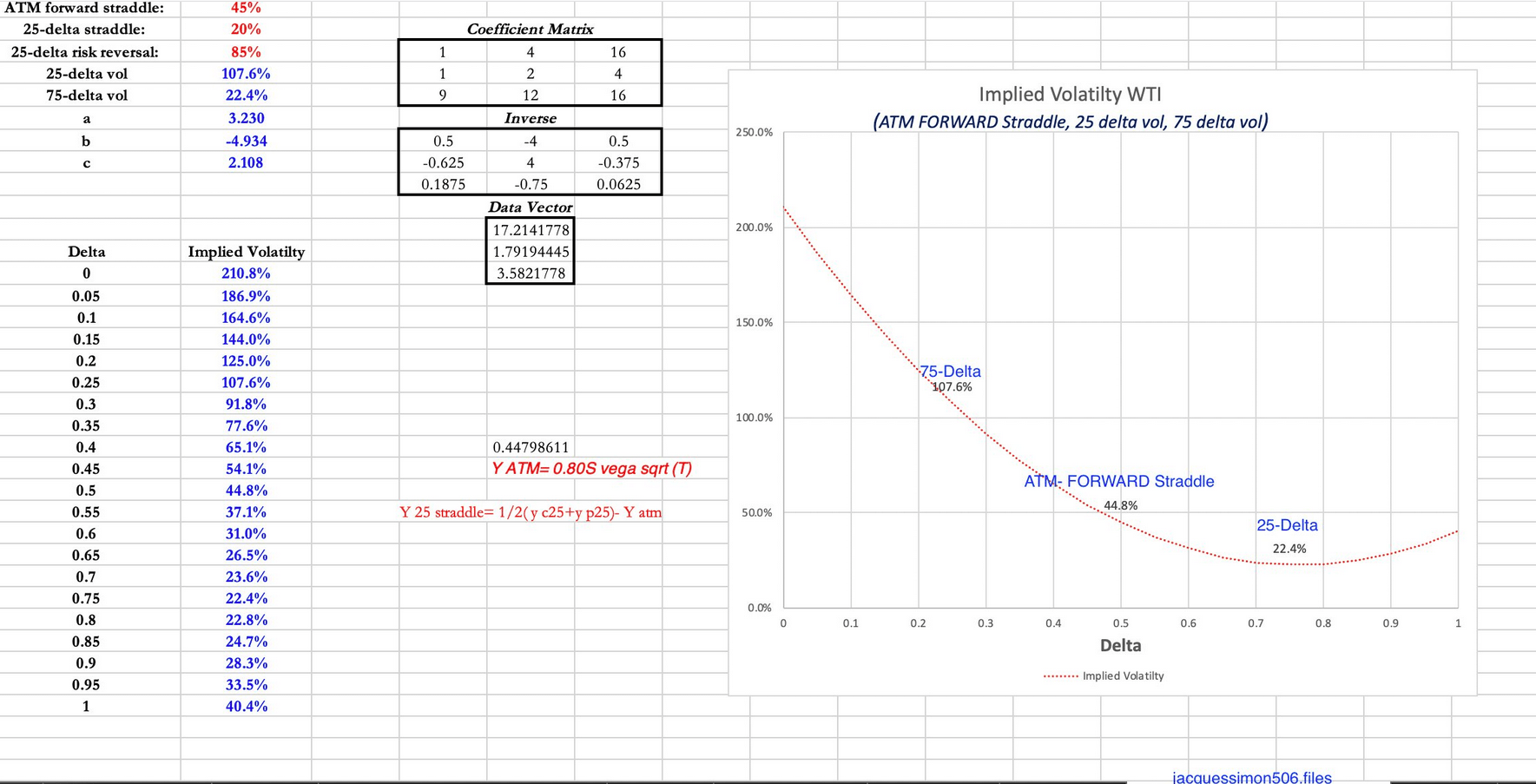

Using the following quotes by a major investment bank market-maker we can fit a smile ( the implied volatility surface).

25-delta Straddle is at 20%

ATM forward Straddle is at 45%

25-delta RR is at 85%

Figure 1 above. WTI NYMEX Options (90-days) volatility skew.

via jacquessimon506.files.wordpress

As of April, energy producers buy OTM puts to immunize themselves from market-risk. The WTI NYMEX exhibits a very pronounced skew, this can lead to increased volatility Implied volatility in the WTI NYMEX is positively correlated with lower delta.

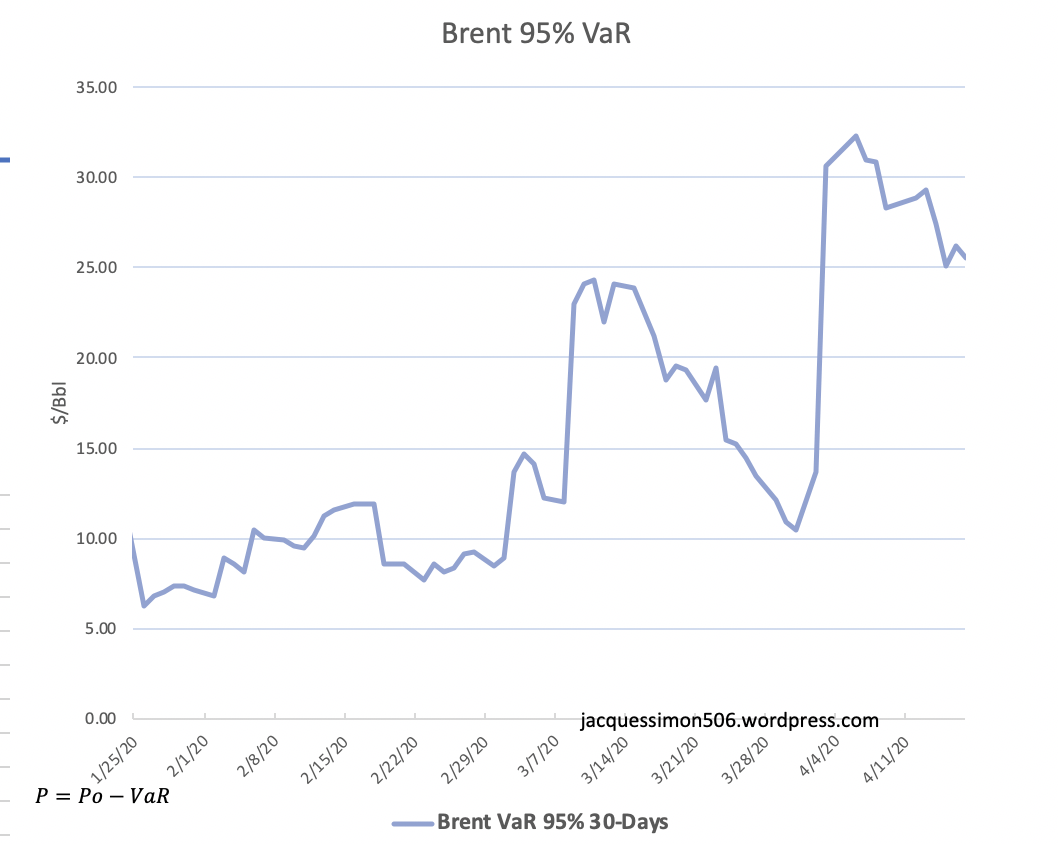

Figure 2. Brent Value-At-Risk @95% 30-Days

via jacquessimon506.files.wordpress

Value-at-risk from a commodity trader liquidity/credit perspective is the ultimate manifestation of the risk capacity per capital.

Brent commodity VaR shows few signs of abatement.

They are traders who have more than tripled their normal exposure since January without any increase in the corresponding physical sales/volume.

As the market-risk rises in tandem with credit, the pigs flying with no or a counterfeit credit for years get naturally uncovered. Who is left living ? – types who understand commodity linkage smoke the traders and land the F-16 safely on the aircraft carrier.

We summarized earlier :

“the houses, short in VaR are squandered by the excessive levels of market risk and limited capacity. Watch for renewed negative carry (incoming cash-flows that are smaller than their offsetting position obligations): some once again will face the too-big to fail moment in the game of the commodity capitalism”. “Banks/Financing should now be bracing for credit defaults”.

WTI Nymex and other oil markets at record vol

In addition to market-risk, sophisticated participants engaged in the physical markets are equally concerned about the severity of “credit-counterparty risk’ .

When both credit and market-risk rise, traders bleed.

When you know your House is in the flood zone, it would make sense to buy some kind of insurance (credit event).

A Commodity House has 35 billions circa debt but their statements indicates that they don’t pay financing interests, ‘net interest rates cost is negative’ and yet nobody can explain this.

The unprecedented levels of implied volatility for the energy market should be put in context: although the premium for price discovery paid to Wall Street is humongous it is commensurable, we think, with the current level of risk implied in the commodity trading structures.

The Houses trading energy are hooked on debt. The physical space for crude oil storage is scarce and the producers are all at once on the verge of collapse by the Saudi-Russian hit-and-runs.

A market that the FED cannot bail-out has no theoretical volatility up-limit.

Jacques S., Structurer