In an earlier post published on March 23, 2020, we addressed the trade-off between health and the economy. It is now time to move past recognition of the trade-off to its management. The simple fact is that returning to normal is too dangerous from a health perspective, but maintaining the lockdown is too costly from an economic standpoint. The issue, therefore, is managing the trade-off.

Q1 2020 hedge fund letters, conferences and more

Managing The Trade-Off Issue

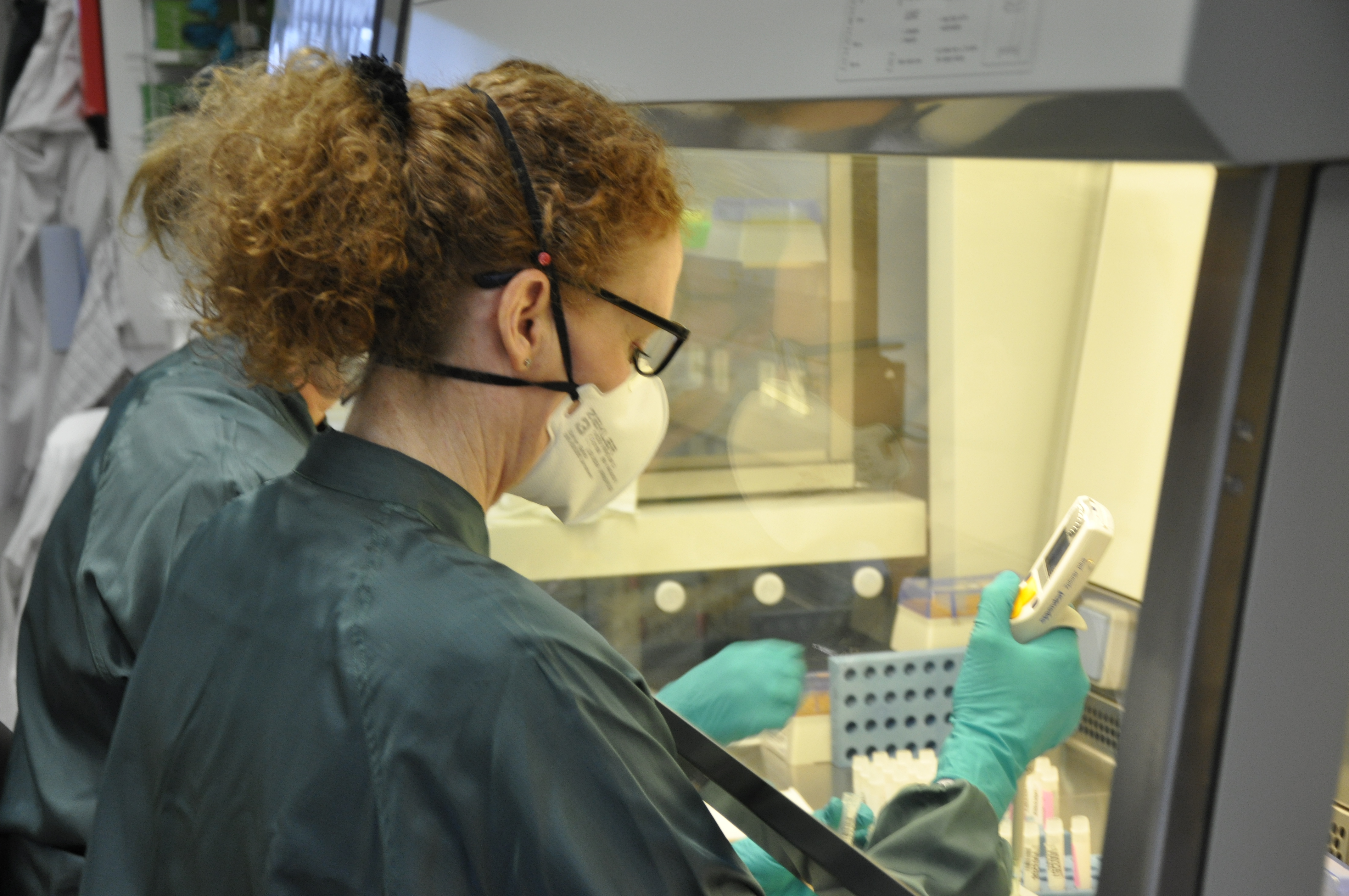

As is becoming widely recognized, a key aspect of managing the trade-off is widespread testing. In a particularly insightful article in the Wall Street Journal, Nobel prizing winning economist, John Romer, and Dr. Rajiv Shah make the point that widespread testing is a key aspect of managing the trade-off. With adequate testing, both for the infection and for the existence of antibodies in those previously infected, the country will be able to plan for the future and get back to work safely, thereby avoiding an economic depression.

Given the immense costs of keeping the economy in an induced coma, Prof. Romer calculates that a $100 billion investment in a nationwide testing system would be a massively profitable investment in light of the fact that the current “shelter in place” is costing the country about $350 billion in production each month. Put in more technical investment language, the net present value of a nationwide testing program would be huge. As Romer notes, a $100 billion investment in a crash program to make tests ubiquitous would pay for itself within a month.

There is much that can be done at the individual company level as well. For instance, health protocols such as frequent handwashing, social distancing, and the use of masks at work can be instituted. But that is just the tip of the iceberg, clever managers with detailed knowledge of the operations of their business can no doubt do much to expand on this basic list. One obvious pathway is to make more creative use of technology. Other than just “working from home” there are dozens of ways that creative ways to get people together electronically. Universities, for instance, are actively improving methods for on-line teaching and collaboration.

More prosaically, it should be possible to improve HVAC systems to reduce the risk of exchanging viruses. The point here is not to construct a comprehensive list, but to argue that America is full of millions of people who can compile such lists to meet the challenges of their individual businesses. There is already evidence of the creative use of technology and changed business practices in fields varying from health care, entertainment and retail. However, continued innovation will require proper coordination between the public and private sectors. Heavy handed actions, such as the current lockdown that may be required in the short run, are not long-run solutions.

CARES Bill Is Not The Stimulus Package

Turning to public policy, the CARES bill is often referred to as a stimulus package, but that is a misnomer. The economy does not need stimulus. It was not declining for some endogenous reason. In February, unemployment was at record lows and the stock market was at record highs. The economy was put in a self-induced coma to battle the virus. In this context, the CARES bill is better seen as a backstop to help people get through the lockdown period. However, the best way to help people is not to give them palliatives during the lockdown, but to get the economy back on its feet as quickly as is reasonable. The most important thing public policy makers can do is take steps that the private sector cannot to reduce the lockdown period. That leads back to Romer and Shah. The most critical public policy step is a crash program to make widespread, nationwide testing available.

There is a psychological element at play in all of this as well. There is something profoundly depressing about holing up in one’s house, watching the data on virus infections, and hoping to avoid getting sick. It is difficult to see yourself as battling the virus when you are cowering in your bedroom. Positive action and evidence of positive actions by others is much more invigorating. We need to be reading about the work that scientists are doing, hearing about the rate at which test kits are being produced, learning about the places where new testing centers are opening, and so forth. Even better would be options for regular citizens to help in these efforts along with trained professionals. In the same vein, as more widespread testing begins, and it allows at least some people get back to work, it will produce a growing sense that we are making progress.

Finally, what holds for individuals holds for the financial markets as well. In a previous post, we showed how the intrinsic level of the S&P 500 depended upon the extent of the earnings decline caused by the virus and the degree to which earnings would recover over the following five years. We also provided a market valuation tool that allows readers to alter our assumptions and to make their own calculations as to where the stock market should be. (That tool can be downloaded here.) The tool makes it clear that nothing would be more beneficial for stock prices than a clear path forward. It is past time to start laying out that plan and making the necessary investments beginning with the crash testing program.