Whitney Tilson’s email to investors discussing that Berna Barshay is joining the Empire Financial Research team; I nailed the timing of the top; Where does the market go from here?; Quick survey on the intraday low for the S&P 500; Hiking yesterday.

Q1 2020 hedge fund letters, conferences and more

Berna Barshay Joining The Empire Financial Research Team

1) A key element of my long-term plan to build Empire Financial Research is to persuade the most talented, stone-cold-moneymaker investors I know to join our team.

Enrique Abeyta was the first addition, and he's been a grand slam.

Today, I'm delighted to announce that another old friend and two-decade veteran of the hedge fund world, Berna Barshay, is also joining our team.

Over the course of this week, I'll introduce her briefly, and then allow her to introduce herself more fully once she starts writing for us in the near future.

Berna earned a bachelor's degree from Princeton and then an MBA from Harvard Business School in 1997.

But I know a lot of people with fancy degrees who blew up in 2002 and 2008 as the internet and housing bubbles burst. But not Berna – she made money both years!

How has she been so successful? Well, she's smart, experienced, and rational, to be sure, but so are a lot of folks. But she has one thing few others do in this industry: she's a woman! And she focuses on sectors in which 80% of consumer purchase decisions are made by women, yet over 90% of investment decisions are made by men. Berna is going to be exploiting that gargantuan market inefficiency for Empire Financial Research readers.

I can't wait for her to start sharing her unique market insights and perspective with you in the coming weeks...

S&P 500 Soars 27.3%

2) From its intraday low on Monday, March 23 of 2,191.86 – the very hour that Enrique and I were recording our coronavirus webinar (which aired the next evening), in which we pounded the table and said this was the best buying opportunity we'd seen since the global financial crisis – the S&P 500 has soared 27.3% (as of Friday's close). It's been one of the fastest, biggest rallies in history. In fact, last week and three weeks ago were two of the top 10 weeks for the Dow Jones Industrial Average in its entire 135-year history!

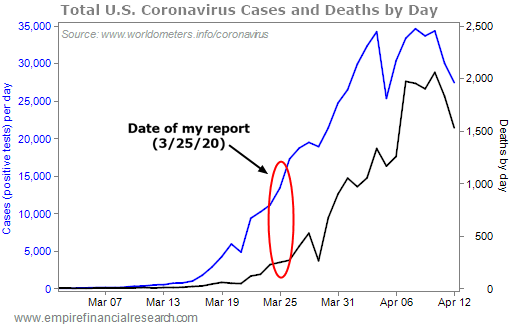

Our bullishness was rooted in my in-depth analysis, outlined in my report, Why I'm Optimistic That We'll Soon Stop the Coronavirus, which we released publicly. In it, I wrote (emphasis added):

As it becomes clear that we've controlled the spread of the virus and know exactly where the outbreaks are – which could happen as soon as a couple of weeks from now – we can start bringing our economy back to life.

In fact, this is exactly what happened, as you can see in this chart of new cases (positive coronavirus tests) and deaths each day in the U.S...

And the stock market has reacted exactly as I expected it would.

But the key question everyone is asking now is, "Where does the market go from here?"

My best guess – and it's only an educated guess – is that the market trades in a 10% to 15% range for a few months, as investors wait to gauge the impact of the coronavirus crisis. Then, as clarity emerges and we start to recover, the market moves materially higher and closes the year roughly 10% higher than today (which would be just over 3,000 for the S&P 500).

Quick Survey On The Intraday Low For The S&P 500

3) Do you think the market will, at some point this year, give back its recent gains and close lower than 2,191.86 (down 21.4% from Friday's close – i.e., another bear market)?

I think not – but I'm not certain. I'd estimate that there's a 70% chance that 2,191.86 will end up being the low for the year.

What do you think?

I've put together a quick two-question survey, asking two questions:

- On March 23, 2020, the intraday low for the S&P 500 was 2,191.86. Do you think this will be the low for the year?

- How likely do you think it is that 2,191.86 will be the low for the S&P 500 for the year?

I'd be grateful if you'd take five seconds to fill it out – again, you can do so here.