Everybody wants to achieve financial wellness. Having the capability to give comfort to your loved ones or the feeling of being able to deal with all of your expenses seamlessly is undoubtedly a feat that every person wants to accomplish. But, just like any other task that deals with the complications of money, achieving it easier said than done. Here is why you should consider financial milestones to help you achieve success.

Q1 2020 hedge fund letters, conferences and more

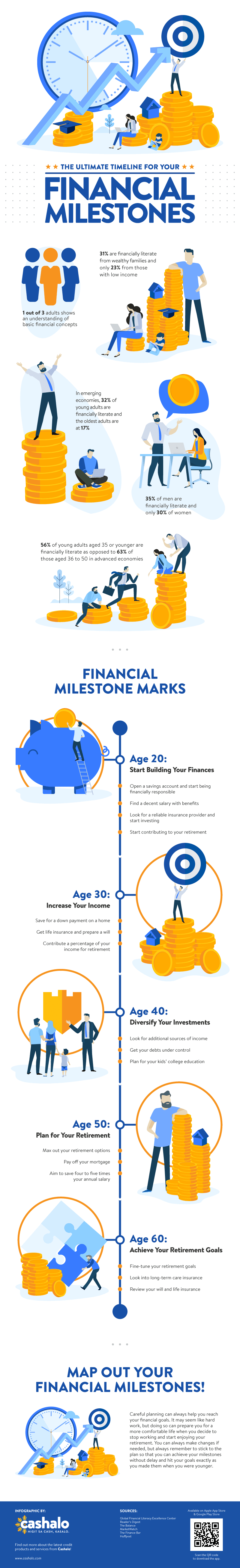

Financially Literacy Around The Globe

Unfortunately, studies show that only one out of three adults have basic knowledge of financial concepts. Due to the high number of financially illiterate people from around the globe, many individuals aren’t able to experience the joys of being financially independent.

When monthly bills, daily expenses, and unforeseen events come into play, most people tend to mismanage their cash and end up feeling that attaining financial accomplishment is a close to impossible task.

When it comes to saving cash, your attitude towards money will end up defining how much you’re able to set aside. Even though your business may be flourishing or if you’re earning a reasonable sum off a monthly salary, your monthly profit won’t really matter if you don’t have the necessary tools, knowledge, and discipline.

The good news is you can make up for the lost time and cash by reflecting and reassessing all of your priorities.

Why Setting Financial Milestones Is An Absolute Must

At the end of the day, people that have a lot of negative spending habits usually end up living a paycheck-to-paycheck lifestyle. Relying too much on your monthly income and spending aimlessly on your wants can prevent you from enjoying life to the fullest, and this is the biggest reason why setting financial milestones is an absolute must for every person.

If you want to take steps towards financial well-being, you’ll need to follow a timeframe to manage your savings properly. Instead of spending aimlessly on things that may not even matter in the future, the timeline you’re following can remind you to put your money to good use and eventually enable you to accomplish all the investment milestones you’ve set.

It may not seem evident at first, but over time, you’ll come to realize that a timeline to follow can be just as effective as any other investment instrument to help you achieve your goals. By setting the necessary deadlines for your home, children’s education, and more, tweaking your habits and making the right choices with your money will be a lot easier to make.

SMART Goals

Regardless of what your profession may be, you should always remember that the first step towards any successful project is by setting SMART (Specific, Measurable, Attainable, Realistic, and Timebound) goals. Having a financial plan from the moment you start earning to the day you finally retire will pave the way for a prosperous future for you and your loved ones even after you’re gone.

Learn the value of frugality and save your money for more important matters. To get you started, take a look at this infographic for an ultimate guide on how to set your financial milestones.