In little over three weeks, COVID-19 put up formidable obstacles to everyday life. The new coronavirus is by no means only a financial story and our first concern is for the health and wellbeing of all of our readers and their loved ones. We hope you are all staying safe.

Q1 2020 hedge fund letters, conferences and more

Like everything else, we know shareholder activism has been dramatically affected by this new reality, even if we don’t always know how, or for how long. If the novel coronavirus is more than just a financial story, it is the financial story of 2020.

Consumer spending is drying up, guidance is out the window, and stocks fell sharply before beginning a surprising and unstable recovery. Access to credit is uncertain and cash is king. Talk of a V-shaped recovery is ever fainter. But proxy season – which thanks to advance notice bylaws began just as the crisis hit – is the one chance activists get to push for change at some companies. Dare activists risk the appearance of agitating at the wrong time? Is change essential for companies that might otherwise go out of business?

This report is a snapshot of Activist Insight’s attempts to answer those questions. Included are articles our subscribers have had access to for weeks, highlighting the chilling effect of COVID-19 on the 2020 proxy season, the opportunities it has unleashed for both long and short investors, and the hurdles that will have to be surmounted if activists are to remain an influential part of corporate life.

Although we draw on data from three modules on the Activist Insight Terminal (Activist Insight Online for campaign data, Shorts for activist short seller data, and Governance for poison pill data), a snapshot is all this is. Subscribers have access to much more, including regulatory news, campaign-specific developments, interviews, and analysis.

Our reporting for Activist Insight Monthly, our online magazine, will reflect the more nuanced trends in different regions and sectors (April, appropriately, is dedicated to the energy sector) and we are also tracking a substantial number of moves up the Activist Insight Vulnerability index, which uses financial and ownership metrics to indicate which companies meet the criteria of previous targets. A demonstration of that is also included in these pages.

We hope you find these insights enlightening and consider becoming a subscriber soon if you are not already. For our subscribers or media with questions, our support and editorial teams stand ready to answer your questions. Please email [email protected] for help.

On behalf of Activist Insight, thank you for your continued interest. Stay safe!

- Activist Insight Editor-In-Chief, Josh Black.

Five Uncertainties

The following article appeared as activism this week by Josh Black on March 20, 2020.

By now, it’s obvious that the crisis stemming from the spread of COVID-19 is going to be with us for some time – likely for the duration of the proxy season, at least. What does that mean for activism?

Like the many people adjusting to their new realities, these are no less confusing times for the corporate and financial worlds.

The first source of uncertainty is the stock market.

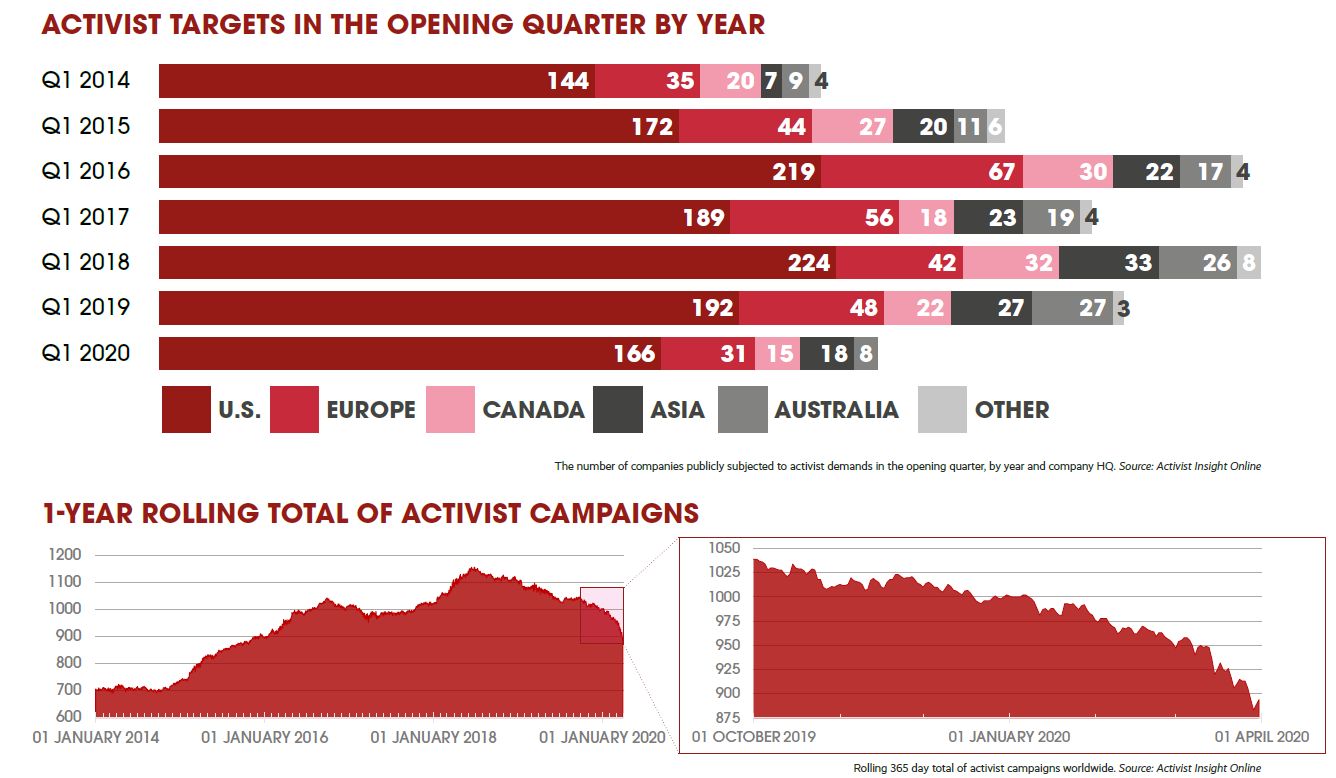

As of yesterday [March 19], the S&P 500 Index is down nearly 25% year-to-date to its lowest level in almost four years. If activists have cash readily available and the market finds some stability, this might be a buying opportunity. Certainly, the level of activism had started to drop last year as the market cruised upward, making value investment opportunities hard to find. That decline was accelerating in 2020 even before this coronavirus became an economic phenomenon.

However, things may not be so simple in as uncertain an environment as this. One activist target in the energy sector has reportedly begun exploring restructuring after the oil price crash caused by Saudi Arabia’s threat to increase production. The same day that Impala Asset Management launched a proxy contest at Harley-Davidson, the motorcycle manufacturer suspended production at its U.S. factories for 11 days.

As if to illustrate the confusion, Bill Ackman this week gave an emotional interview to CNBC in which he warned that certain stocks in his portfolio could go to zero if the health crisis requires a lockdown period of 18 months, then tweeted that he was buying stocks – “bargains of a lifetime if we manage this crisis correctly,” he said. Despite hedging his portfolio, his publicly listed fund was down 6.5% as of Tuesday [five weeks later, the fund is up 9% for the year].

Second is the impact of de-risking strategies on issuers and the wider shareholder base.

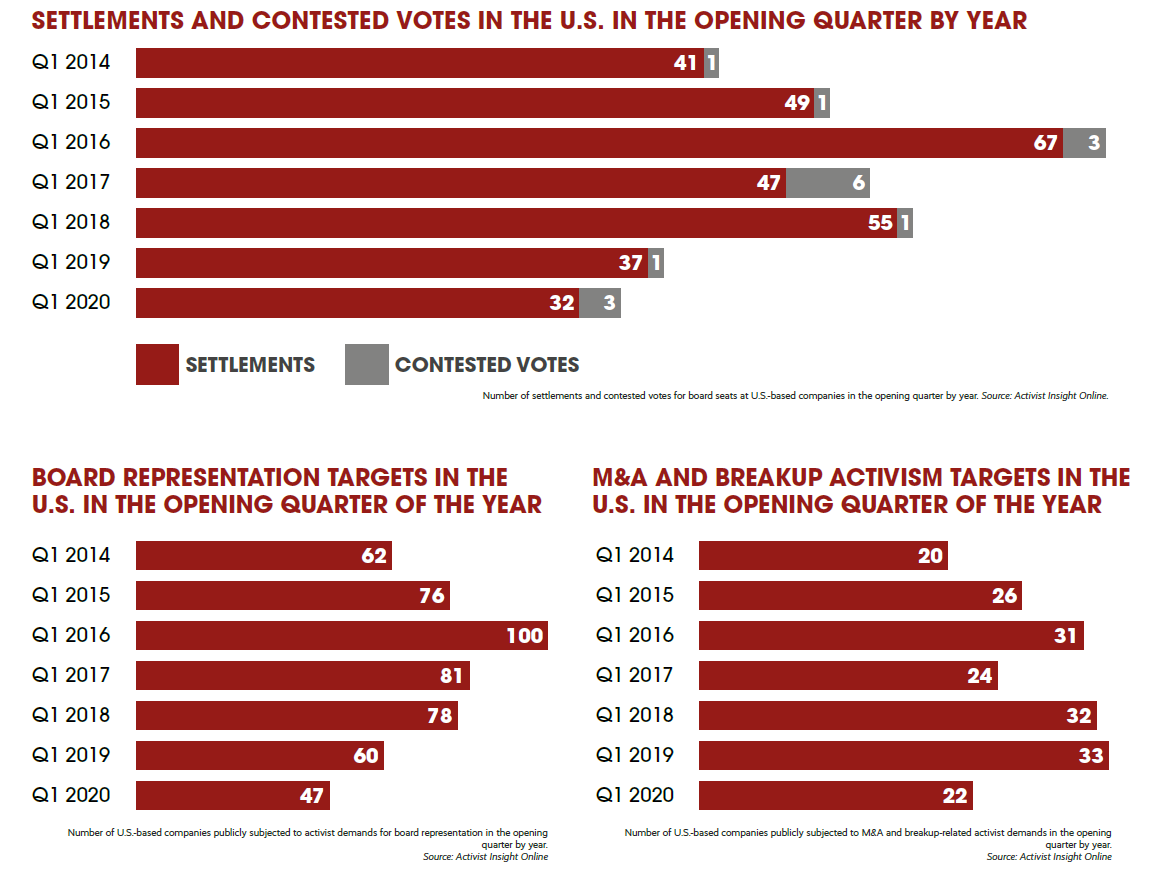

Returning cash to shareholders or changing managers is likely to look less appealing in the current climate, while underwater shareholders may rue lowball bids from strategic acquirors or private equity sponsors unless there is a desperate business need. Preserving value, more than creating it, will likely be the priority for this year.

“I think there’s going to be far less activism than we’ve experienced in past years. I can’t imagine an activist aggressively prosecuting a proxy contest,” MacKenzie Partners’ president, Bob Marese, told me this week. “There are the practical elements of logistics to consider in a time of social distancing, but perhaps more importantly the optics of it. How will the investor base view the activity in light of the broader macro conditions?”

Third are the logistics of annual meetings.

In a client memo this week, Ele Klein and Aneliya Crawford, two partners in Schulte Roth & Zabel’s shareholder activism group, warned of “logistical impediments and shifts in timing and strategy,” including delays in moving shares from street name accounts. The lawyers also speculated that a bare-bones Securities and Exchange Commission (SEC) might have less time for fact-checking proxy statements, leading to bareknuckle fight letters.

“The SEC is making it easier for people to hold virtual meetings, which automatically favors a company and disfavors an activist,” said Chris Davis, head of Kleinberg Kaplan’s M&A and investor activism groups.

Yet for activists, the urgency might be much greater than that stratagem allows, especially given much of their activity is governed by advance notice bylaws implemented by companies. A nomination letter by Starboard Value at eBay this week read almost apologetically, just as CEO Jeff Smith had said two weeks ago: “I don’t want to seem opportunistic because the first thing we care about is the health and well-being of employees and people around the country, but yes the volatility in the marketplace is a good opportunity for us.”

“We are disappointed that Starboard has decided to announce its previously provided nominations amidst the global COVID-19 pandemic while the board and management are trying to focus on the business, employee health and safety, and the important CEO search and portfolio review that are underway,” eBay shot back.

“The board by-and-large controls the annual meeting machinery and logistics,” with certain procedural protocols discussed between the activist and board in the two or three weeks leading up to the meeting, says Andrew Freedman, a co-head of Olshan Frome Wolosky’s activist practice.

Read the full report here by Activist Insight