Based on the understanding of our research on the impact of the coronavirus crisis on startups globally, based on the world’s first global startup survey on the topic, it is critical that governments rapidly inject capital into their startup ecosystems. This document explains both the rationale for a venture capital injection policy and how to design it. This continues our broader initiatives about the impact of Coronavirus on global startup ecosystems, like the Global Startup Survey on COVID Impact, the Global Policy Knowledge Base and our ongoing Research Series.

Q1 2020 hedge fund letters, conferences and more

Key issues from this funding policy white paper:

1) Why Tech Startup Ecosystems Matter

- Last year, the global startup economy was valued at $2.8 trillion and growing over 10 percent per year, about three to four times faster than the rest of our economies.

- With the world’s transition to a digital economy, technology startups and their ecosystems have become more important and the jobs they create more sustainable, because they are better adapted to our economic future. The current crisis has accelerated the digitization of the offline economy, making tech companies even more important.

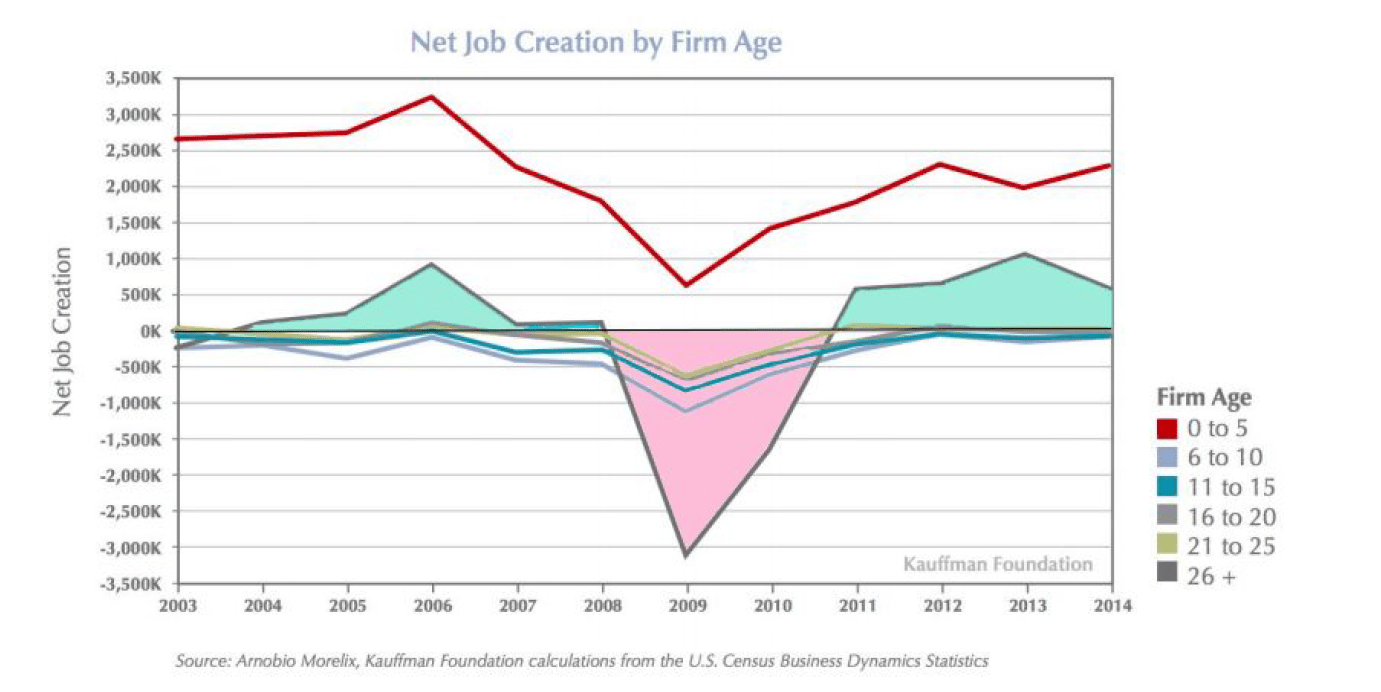

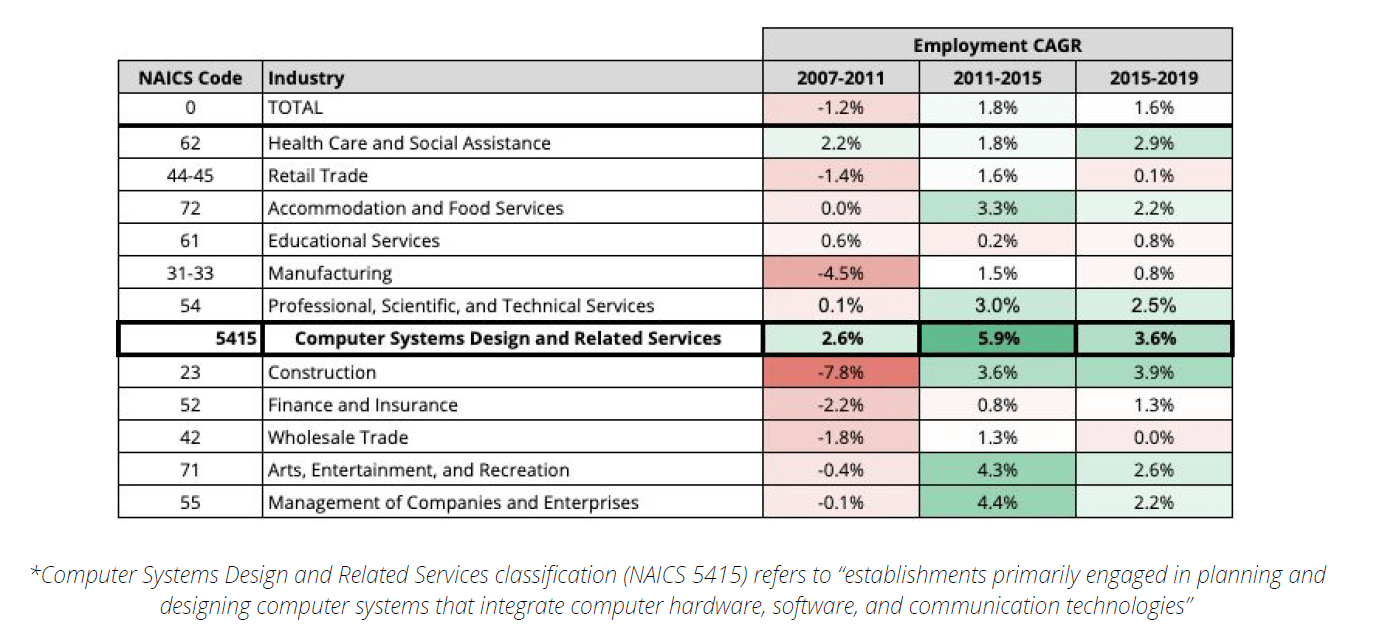

- In the wake of the last crisis, startups contributed strongly to the economic recovery. By 2011 employment in the ‘Computer Systems Design and Related Services’ industry had grown by 2.6% per year from pre-recession level, a rate higher than that of large sectors including healthcare.

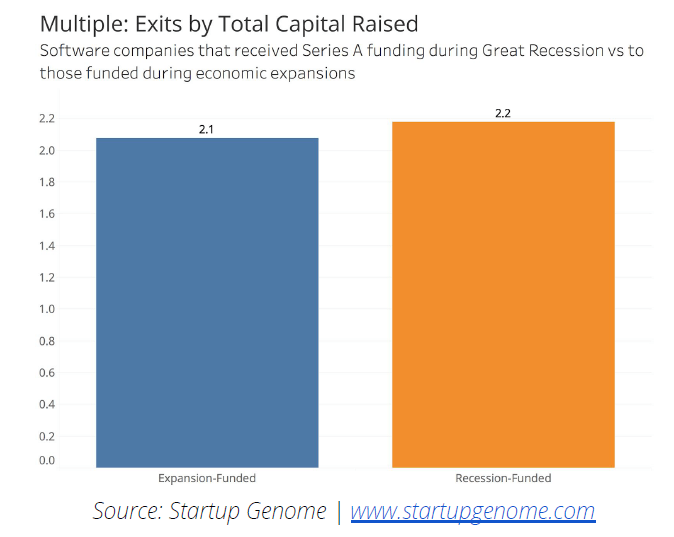

- Startups funded during the Great Recession had slightly higher exit multiples over total money invested than those funded during economic expansions, and VC returns for recession-year startup investments were, at 13%, higher than for all but one of the prior ten years, with startups including Facebook, LinkedIn, Palantir, and Dropbox.

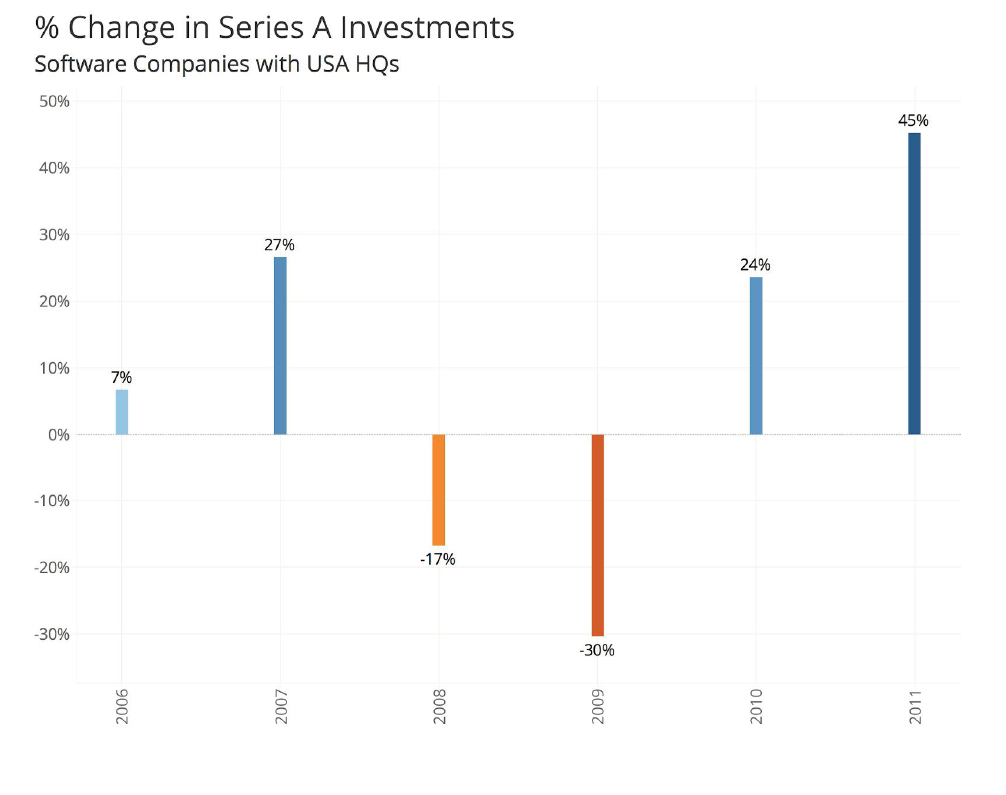

2) Drop in Private Investments, Death of Startups

- In the crisis of 2007-2009, which might well prove to be milder than the one we have just entered, venture capital investment deals dropped 30 percent (2008 to 2009) for Series A investments in software in the U.S. Drop in Series B investments was even sharper: 48 percent.

- While it took 4 quarters for the U.S. Series A and B venture investments to drop from their peak in 2008-9, a few weeks ago we had already documented a drop of 50% of Chinese Series A investments.

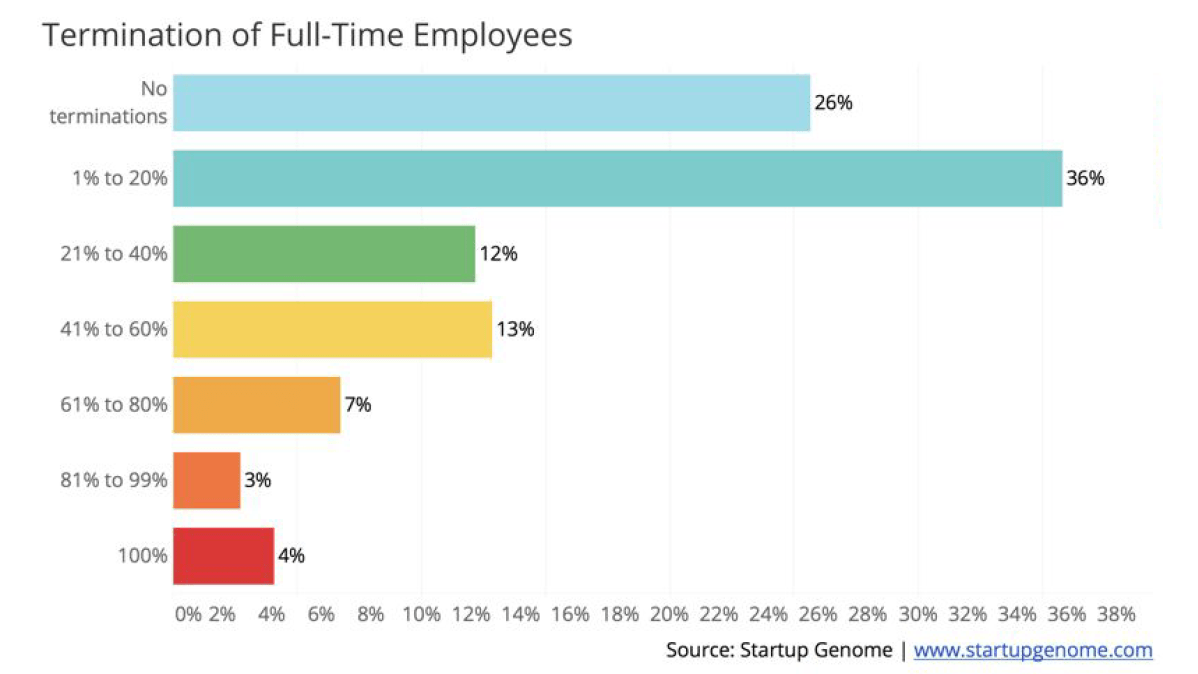

- Our global startup survey revealed that 65 percent of all companies, including 34 percent of Series A+ startups, have less than 6-month worth of cash and 74 percent of startups have had to let go of full-time employees, with 26 percent of them having to let go of 60 percent or more of their full-time staff.

- This talent is highly valuable and subject to being hired away in Silicon Valley, New York, London or elsewhere.

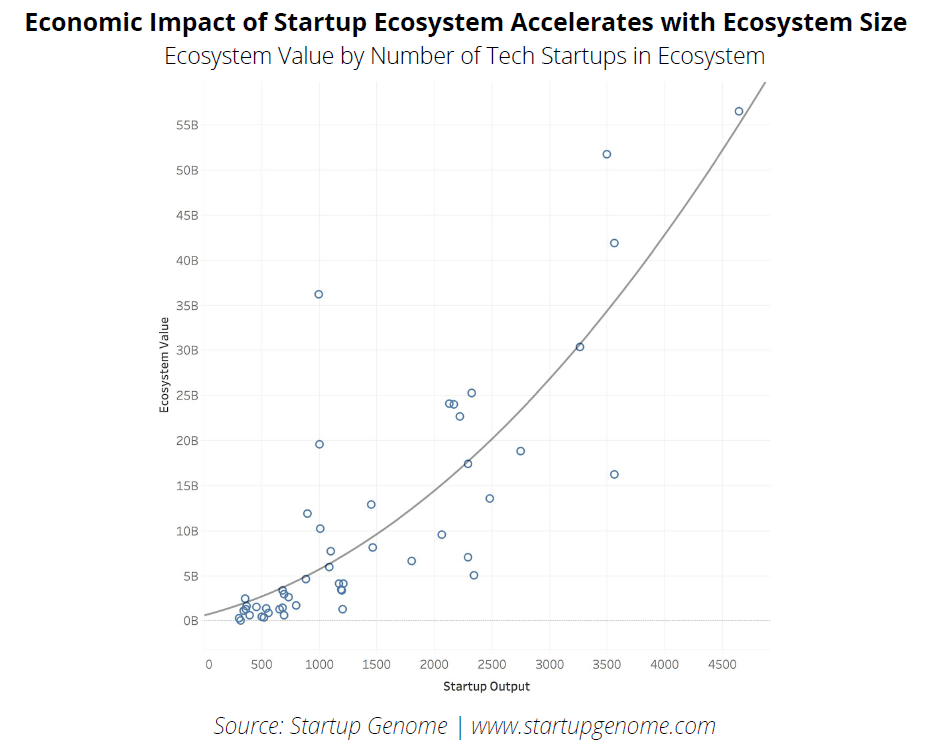

- Because size matters—ecosystems that are 3 times bigger produce 5 times more economic value—governments must act to prevent a massive extinction of startups and dispersion of their high-value talent pool.

3) Cost-Benefit of Policy Investments in Startups

- Governments stand to make money by injecting six months worth of cash in those startups or, if we assumed a negative 10% return on the equity, the cost per job saved will be 41% lower for startups than for SMEs, respectively costing $14,766 and $24,928.

- Startups offer a higher job multiplier because of the higher wages they pay, their higher rate of exports and of FDI (foreign direct investment) from foreign investors. They are also more “future-proof” as we globally transition to a digital economy.

- The sum of exits—a proxy for economic value—that an average 10 U.S. startups from the 2006 and 2007 millesimes produced is $ 322 million.

4) Defining Your Goal

- The first goal is to increase capital in the hands of angels and Series A fund by about 100%.

- The second goal is to save 80 percent to 90 percent of existing VC-backed startups, and especially those at Series A and B, then at seed.

5) Key Policy Principles for Supporting Startups

- Depending on whether startups could qualify for SME payroll support programs, allocate 12.5% to 25% of all early stage investment made in local startups in the last eight quarters ending Q1 2020.

- For extending 6-month worth of cash to VC-backed startups, flow government funds to VC-backed startups through VCs and through a Fund of Funds structure, without asking for co-investments VC firms and letting them distribute the funds to startups with limited guidance, as they are best at doing.

- Design a Structure Allowing Rapid Flow of Government Money

- Do Not Expect VC Firms to Lead

- Do Not Create a New Instrument or Trigger New Terms

- Provide Great Flexibility in Terms of Use of Funds

- Align Investor Incentives with Those of the Government

- To increase venture capital investments during the crisis and recession, match Angel investments at a ratio of 3 to 1, seed-stage investments by institutional investors at a lower ratio of 2 to 1, and Series A investments at a ratio of 1 to 1.

In the coming weeks and months Startup Genome will continue publishing insights on the impact of the coronavirus crisis on startups, and building tools for governments and ecosystems to support their startups through the crisis. You can sign up here to get it.

If you are a policymaker or ecosystem support organization and would like to deploy the Coronavirus Impact Global Startup Survey in your community and get detailed insights about what is happening on the ground (and how your ecosystem stack up with what is happening globally), please reach out to Adam Bregu ( [email protected] ).

More than 1,500 respondents have answered the survey across every continent and in over 50 countries. If you are a startup and want to take the survey to share what is happening in your business and market, you can take it here. Your input is crucial.

Article by JF Gauthier, Founder & CEO and Arnobio Morelix, Chief Innovation Officer - Startup Genome

Chief Innovation Officer

Arnobio is a Silicon Valley-based executive leading a global team researching and advising governments and private organizations across 35 countries to help them boost their economies through entrepreneurship. Previously, he worked at Kauffman Foundation, where he created the Growth Entrepreneurship Index and the Main Street Entrepreneurship Index, hailed as the “bible of entrepreneurship trends” by The Huffington Post and used by senators, governors, city leaders, Fortune 500 companies, and the White House.

Founder and CEO of Startup Genome

Silicon Valley serial entrepreneur and Founder & CEO of Startup Genome. He is the world’s leading voice in innovation ecosystem development, having advised—and learned from—more than 100 government and private-public partnerships leading ecosystem development across 35 countries. He also is an active angel investor and previously worked in tech strategy and corporate innovation, advising IBM, Cisco, Agilent/HP, J&J, Abbott and others, for the firm of Kim Clark (former dean of Harvard Business School) alongside Clayton Christensen and other thought leaders. Harvard MBA.