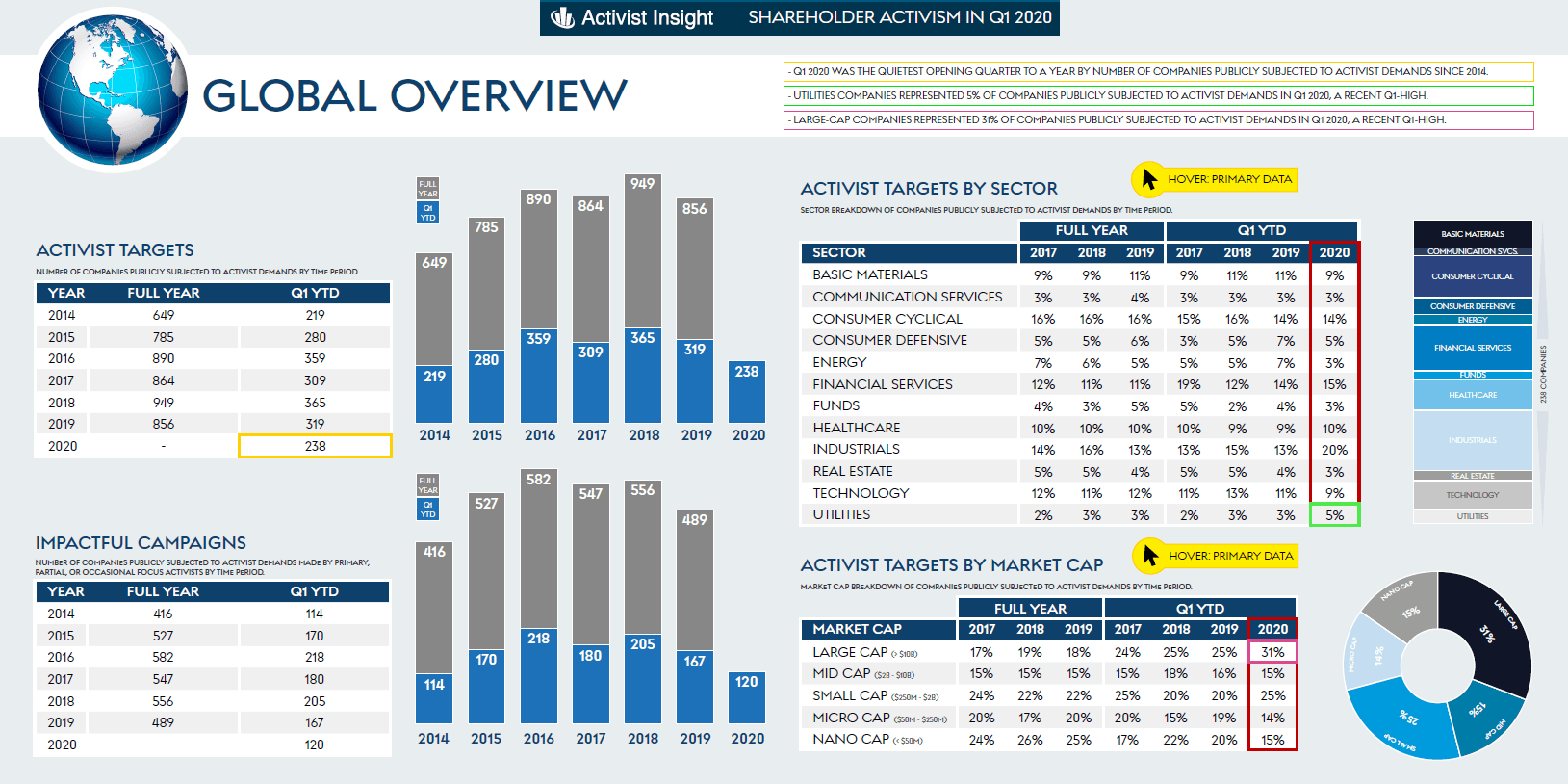

Exacerbated by the ongoing coronavirus pandemic, activist activity was sharply down at the beginning of 2020 according to a new report from Activist Insight Online. A total of 238 companies worldwide were publicly subjected to activist demands in the first quarter of 2020, a 25% decline compared with the same period last year and the lowest Q1 total since 2014.

Q1 2020 hedge fund letters, conferences and more

The data, sourced from Activist Insight Online, confirmed that 2020 might have an unusually quiet proxy season – the period when most companies hold their annual meetings and activists have the greatest opportunity for enacting changes. Activism had declined more gradually in 2019 – a good year for most markets.

Among the report’s findings:

- The number of companies publicly subjected to activist demands fell by 14% in the U.S., 35% in Europe, and 33% in Asia, although Japan’s tally was in line with recent totals.

- Activists gained 56 board seats through contested meetings and settlements in the U.S. during the first quarter, one more than in Q1 2019. More generous settlements may indicate hurried settlements as the pandemic set in.

- Globally, the industrial and utility sectors were the only two sectors to see more activist activity than last year.

The report can be downloaded here.

Data on directors, bylaw amendments, and poison pills for U.S. companies, as well as global data on activist demands, is available on request from [email protected].

About Activist Insight

Since 2012, Activist Insight (www.activistinsight.com) has provided its diverse range of clients with the most comprehensive information on activist investing worldwide. Regularly quoted in the financial press, Activist Insight is the trusted source for data in this evolving space. Activist Insight offers five industry-leading products: Activist Insight Online, Activist Insight Shorts, Activist Insight Governance, Activist Insight Vulnerability, and Activist Insight Monthly, the world’s only magazine dedicated to activist investing.