Arquitos Capital Management commentary for the first quarter ended March 31, 2020, discussing the real uncertainty about the new normalcy.

I approach investing like I’m buying the business outright and retaining management. This mindset ties valuation to understanding and forces me to think through qualitative factors and potential threats to long-term earnings power. – Allan Mecham

Q1 2020 hedge fund letters, conferences and more

Dear Partner:

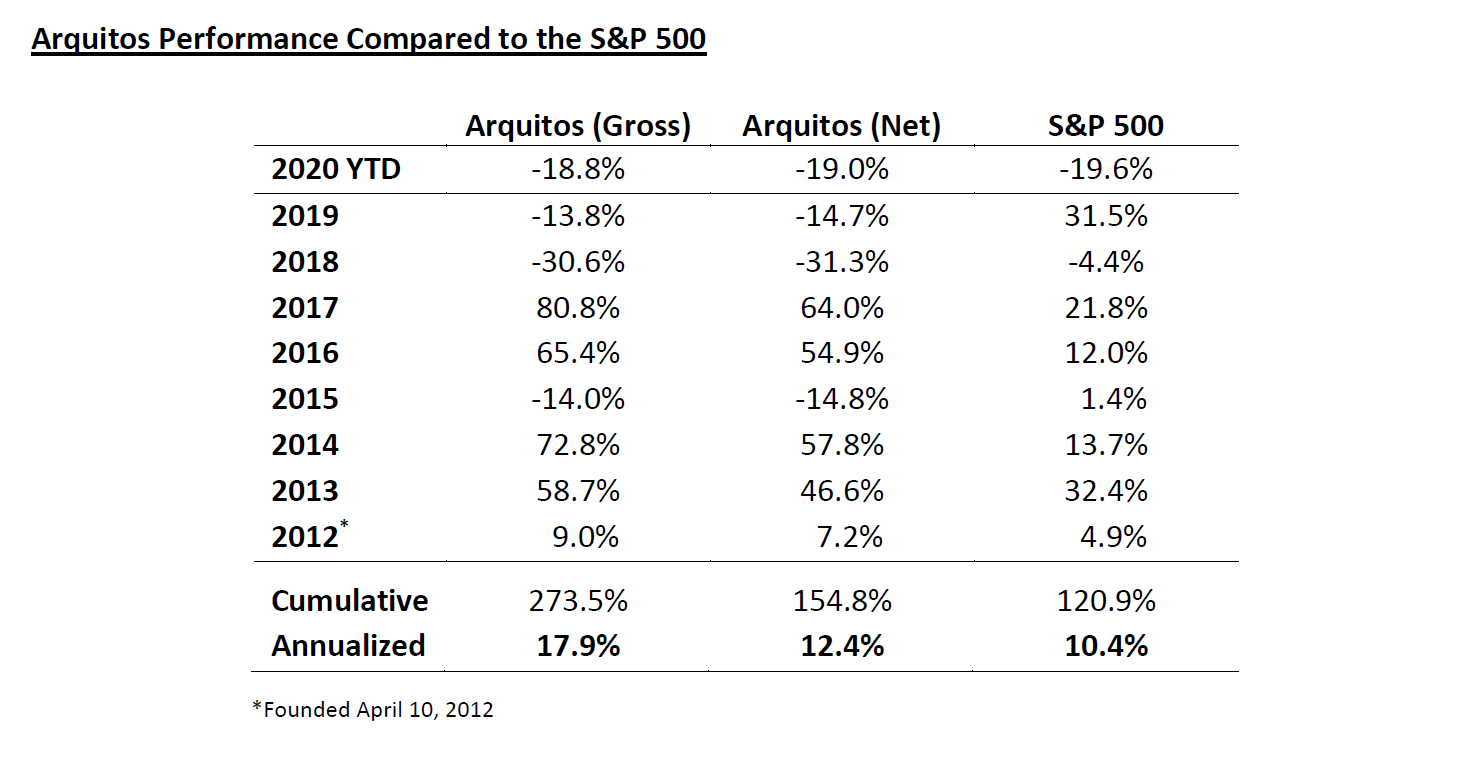

Arquitos returned -19.0% net of fees in the first quarter of 2020.

Exploiting Investment Opportunities

Now is a time to be extremely selective and thoughtful about what to invest in. It is a time for caution. There are opportunities in individual companies and some sectors which we are attempting to exploit—in some cases, aggressively so. However, the overall markets themselves are in a perilous place.

Commentators have attempted to compare the current situation to a multitude of historical events. Is this like the SARS outbreak in Asia in 2003? What about the flu epidemic in 1918? Will there be economic effects like 2008/2009? Or the Russian crisis in 1998? Will a recovery in certain industries be similar to the post-9/11 time period?

We feel more comfortable when we identify a reason why something happened. We have less stress when we feel like there is a reliable explanation even if that explanation is wrong. Successful investors need to be skilled at pattern recognition. The problem is that there is no reliable historical example for COVID-19 and the economic consequences resulting from it. That hasn’t stopped prognosticators, of course; but their faux certainty should be met with skepticism.

This need for explanation shows itself in the short-term market movements all the time. A reliable headline is, “Stocks are up (or down) today because of…” Headline writers simply fill in the blank. These simplified explanations are nearly always wrong, of course; yet we find comfort that there is a reason. We crave meaning even if we know the world is much too complicated for a one-sentence description.

Investors Enter Survival Mode

In the absence of certainty and simple explanations, people tend to panic. We often default to assuming worst-case scenarios. This is understandable. There is a valid, evolutionary reason behind this. Loss aversion is a survival mechanism. In the absence of reliable information, people go into survival mode. In investing, they sell now and ask questions later. In real life, they buy enough toilet paper to last three years.

Survival mode is the right mode to be in right now. The markets took the elevator down in 2008. The next decade it took the escalator up, rather than the stairs. That long bull market is over. Uncertainty that has existed along the way has now revealed itself.

We have competing issues to consider going forward. On the negative side, we don’t know when this virus will be eradicated. There is positive news about effective treatments and potential vaccines. There is also positive information about the spread slowing. But the timing of this is unknown. We don’t know when—and in what form—economic activity will return. Some industries may be permanently changed, both for better and worse. There has been real value destruction in certain industries, and that destruction may be long-lasting and permanent. It would be naïve to think that once this virus is eradicated, life will simply return to what it was like before.

Post-9/11 Security Measures

Post-9/11 brought new security measures, increased government involvement, wars and their consequences, and government policies that later led to the 2008 crisis. This period of economic shutdown will also bring severe consequences over the coming years and decades. Some consequences are somewhat predictable, such as an increase in telecommuting. Other consequences won’t be known in advance.

The other issue to consider, on the positive side for the markets, is that the risk-free rate of return is now even lower than before. At the time I am writing this, the yield is 0.6% on 10-Year Treasuries. The 30 Year is at 1.2%. This justifies extremely high multiples on equities. There will be long-term consequences to the actions from the Fed and Treasury. But all of the liquidity being pumped into the markets in the near-term should, in theory, support stock prices.

All that we need is some certainty on earnings yields. Something we don’t have at the moment and may not have for some time.

Unfortunately, there is no free lunch with these actions. How much inflation will we have and when? When will deficits matter? How will the Fed unwind its balance sheet? Or will they ever unwind it? What effect will this have on the dollar? What about all of the new debt we just put on small- and medium-sized businesses, many of which won’t survive?

I am extremely negative on the government offering and subsidizing debt to small businesses. A high percentage of these small businesses receiving these loans will not be able to repay them. Yes, there will be some debt forgiveness, but what sort of message is being sent to these business owners?

Real Uncertainty About The New Normalcy

When has this worked? We have a student loan crisis right now. We had a debt crisis in 2008. Debt enslaves its recipients and destroys their financial discipline. Yes, we need to get through this crisis, but is pushing debt on the masses the best way to do it?

So, we have real uncertainty about when life will return to some form of normalcy. We have real uncertainty about what new normalcy will be. And we have real uncertainty about the consequences of decisions that are being made during this time period.

All of this being said, there are unique, attractive opportunities out there right now in individual companies. How does that happen? Extreme volatility causes forced selling in select individual securities. If these companies can survive and, in some cases, thrive, then this forced selling brings investment opportunities of a lifetime. We are looking for those situations and have already taken a few small positions in companies where this has happened.

Strong companies can use this time of stress to take market share, reduce their share count, and make strategic acquisitions. The acquisition stage has not happened yet, but it will. This past week brought a wave of bankruptcy announcements. There will be many more to come. Market leaders will have their pick of the best assets and any brands that maintain value but are in distress situations because of poor financial management.

Opportunities are coming and going by the day, so it is not worthwhile for me to reference individual companies at which we are looking. Rest assured, though, there have been opportunities. In some cases, it has been fruitful to rotate out of a company that trades at an attractive price to a company that has asymmetric potential. We are doing that on the edges right now, but that may accelerate depending on how things continue to evolve.

A Black Swan-Style Hedge

I have kept a Black Swan-style hedge on since the beginning of the fund. It served us well in February and March, protecting the portfolio by approximately 8% overall. Ultimately, the price from that position went from $0.34 at cost to $51 when I closed the position completely. I trimmed the hedge along the way by design, but this movement shows just how extreme the volatility was during that time period. It is possible that some form of this volatility can return, so we currently are maintaining a larger-than-normal hedge.

My general view right now is that there will be continued market volatility, which is an area where the hedge will be helpful. And, there will be asymmetric opportunities in select companies.

Looking back to the first quarter, our position in MMA Capital (MMAC) accounted for 10% of the overall decline in our portfolio. MMAC makes up 38% of the portfolio. It ended the quarter trading at $24.73.

The company reported outstanding results just a few weeks before the end of the quarter. Book value stood at $48.43 per share. There was a dramatic increase in book value due to the recognition of a deferred tax asset. Adjusting for that asset, book value was still $38.49 per share. It remains to be seen how much the economic shutdown will affect their primary solar lending business, but it certainly won’t destroy their book value by the 36% discount from this adjusted book value being applied by the markets.

MMAC had a huge pile of cash prior to the economic shutdown—more than $60 million. They also had a new $120 million credit facility. This is a company that can thrive during this period of stress.

Position In Enterprise Diversified And Westaim

Our position in Enterprise Diversified (SYTE) cost the overall portfolio 5% in the first quarter. Shares ended the quarter 26% below the stated liquidation value of the company, as measured on December 31, 2019. The company carried out several transactions in 2019 to eliminate debt and restructure the business. SYTE’s focus going forward is on its Willow Oak Asset Management subsidiary. The company is excited about the progress being made in that area. More information will be provided when SYTE reports its first-quarter results in May.

Finally, Westaim (WED.V) is the other position that has gotten unusually cheap during this time period. This position has negatively affected the overall portfolio by 2% in the first quarter. They are a company that is taking advantage of this crisis. A recent news article indicated that Westaim’s credit fund subsidiary, Arena Investors, has launched two new funds to take advantage of the current environment. These new funds are reportedly looking to raise $550 million and appear to be having fundraising success so far. We likely won’t have more information until Westaim’s first-quarter filings are complete but, considering assets under management as of December 31, 2019, were $1.3 billion, this appears to be a promising development.

Westaim has been thriving operationally even without this recent news. Book value as of December 31, 2019, stood at C$3.22 per share. Shares ended the first quarter at C$1.74.

As I mentioned, we also have several new positions and are continuing to look for unusual opportunities with asymmetric potential. I look forward to reporting on those positions in the future if they have a meaningful impact on the portfolio.

*******************************

I’d like to take a moment to recognize Allan Mecham and his fund at Arlington Value. Allan recently announced that he is closing down his fund due to health reasons. He was an inspiration to me and many other fund managers, quietly growing his fund through the years while investing in an independent way that led to long-term success. I wish Allan and his partner, Ben Raybould, all the best.

*******************************

Adjustment Of Several Live Events

While COVID-19 has not caused disruptions for our operations, it has led to the adjustment of several live events in which I typically participate. The Berkshire Hathaway annual shareholder meeting, which is set to occur in a few weeks, will now be completely virtual. Thus, the annual trek to Omaha won’t happen and Willow Oak Asset Management’s annual event won’t either. In its place, Willow Oak has started an online series which can be viewed at their YouTube channel. If you’d like to follow along, please subscribe at youtube.com/willowoakassetmanagement. I recently led a discussion with David Waters of Alluvial Fund, Keith Smith of Bonhoeffer Fund, Thomas Braziel of 507 Capital, and Jeremy Deal of JDP Capital. Willow Oak’s Jessica Greer will soon be doing an interview with one of our service providers discussing operational due diligence matters, as well.

Enterprise Diversified’s annual shareholder meeting will also be virtual only. That meeting will be on May 28, 2020, and can be accessed at colonialstock.com/enterprisediversified2020. Additional information can be found in the proxy statement filed with the SEC.

This truly is an unprecedented time. The most important thing is for you and your loved ones to be safe and healthy. As the economy re-opens, we expect to gain some additional clarity on the long-term ramifications from this situation. We will not be in the clear, however, from an economic perspective. There will be difficult financial results, bankruptcies, calls for additional bailouts, massive unemployment, and unforeseen consequences. This will create opportunities for intelligent investors. We look forward to taking advantage of those opportunities on your behalf.

Thank you again for your continued support.

Best regards,

Steven L. Kiel