Global M&A plummeted last week, two weeks after effects were seen on global equity issuance, as the world comes to terms with the seriousness of the coronavirus pandemic and its impact on both the human health and the global economy. The below Refinitiv reports analyze Q1 2020 Global M&A, Capital Markets and Syndicated Loans activity. Click each link to view full report, layered with data-driven commentary and rich visuals. Below are top highlights.

Q4 2019 hedge fund letters, conferences and more

Watch this special video from Cornelia Andersson, Head of M&A and Capital Raising, Refinitiv as she discusses the impact on M&A from the Coronavirus:

*Video as of Friday, March 13th

Q1 2020: Global M&A, Capital Markets, Syndicated Loans Reviews

- M&A Financial Advisory Review

- Global M&A (full report here)

- Worldwide Deal Making Falls 25%; Lowest Opening Quarter Since 2016

- Cross-Border M&A Declines 16% to 7-Year Low

- Deals Greater Than US$10 billion Fall 53%

- Emerging Markets M&A (full report here)

- Emerging Markets Deal Making Falls 27% to 6-Year Low

- Targets in China, Russia & India Drive Two-Thirds of Emerging Markets M&A

- Mega Deals Account for 32% of Announced Emerging Markets Value

- Global M&A (full report here)

- Global Equity Capital Markets Review (full report here)

- Global ECM Activity Hits 4-Year High Amidst Record Volatility

- March IPO Proceeds Down 37%; First Quarter IPOs Up 75%

- US Issuers Account for 29% of Global ECM

- Global Debt Capital Markets Review (full report here)

- Global DCM Activity Breaks All-Time Quarterly Record

- US Investment Grade Corporate Debt Sets Weekly, Monthly & Quarterly Records

- Despite March Market Shutdown, Global High Yield Up 11%, Hits 3-Year High

- Global Syndicated Loans Review (full report here)

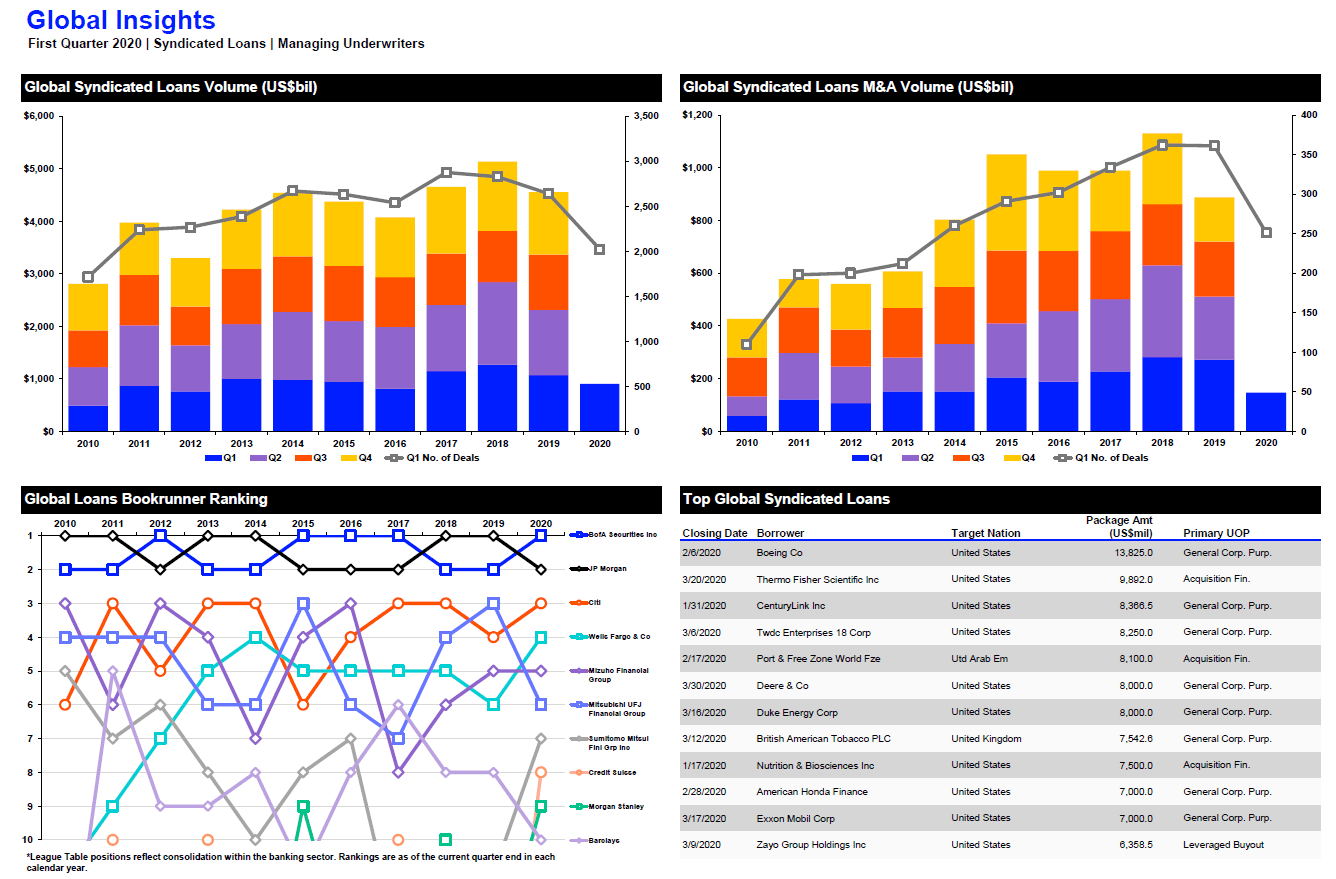

- Global Syndicated Lending Declines 16%

- Acquisition-related Financing Falls 46%

- European Borrowing Hits 16-Year Low, Down 43%

Global Syndicated Lending Declines 16%

Global syndicated loans totaled US$904.2 billion during the first quarter of 2020, a 16% decline in total proceeds compared to the first quarter of 2019, and the slowest opening period for lending since the first quarter of 2016. By number of deals, 2,022 loans reached financial close during the first quarter of 2020, a decrease of 23% compared to a year ago and the slowest opening period, by number of deals, since the first quarter of 2010. Compared to the fourth quarter of last year, first quarter 2020 loan proceeds decreased 24%.