Past were the days when banking was very slow compared to these days. It has begrudgingly opted for advanced technology stack. FinTech has undoubtedly modernized inwardly focused industries to a great extent, however, some of the crucial aspects one the finance increase is still experienced. FinTech business models on the basis of finance or banking industries are developed and have helped them leverage various advantages such as clings stubbornly, float income, and much more.

Q4 2019 hedge fund letters, conferences and more

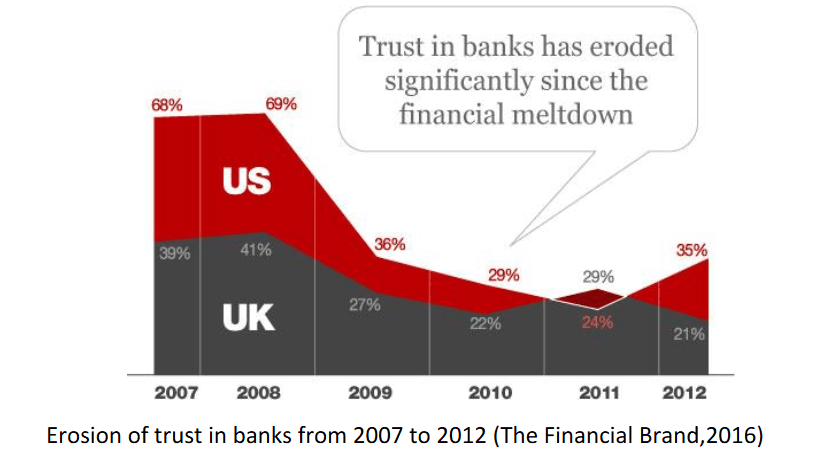

The financial meltdown was experienced by most of the FinTech Firms between 2007 to 2012. This meltdown was mainly caused due to the traditional method of performing various operations, this led them to face a large number of business frauds and human errors, which finally resulted in the financial meltdown. Hence it becomes mandatory for FinTech firms to adopt new ways and technology to automate most of the work, which helps them in avoiding most of the human errors and frauds.

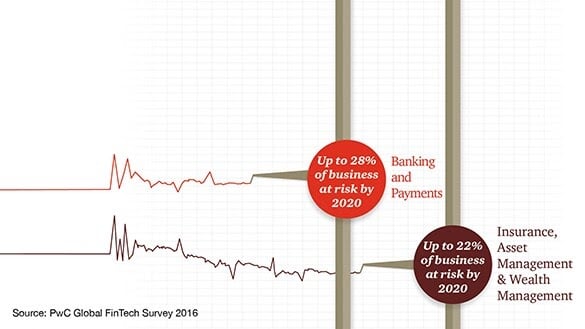

In PwC's recent Global Survey about FinTech, most of the industry responded that a quarter of their business could be at risk, they also added that they might get lost to standalone FinTech companies within the upcoming 5 years. In the same report, it was also shown that Global investments in the FinTech solutions tripled in 2014, it has reached around $12 billion. Compared to that, the banks spent was estimated to reach around $215 billion that also only on IT worldwide in 2014. This investment can include internal service, external services, hardware, software, and much more. The number represented here is material number, and as it is targeted very high, it is expected that FinTech spending will really have a great impact on the coordinated sectors.

10 Disruptive FinTech Business Models: Know How it is Scanning the Banking Sector

From insurance underwriting to credit profiling to opening accounts, FinTech startups are successfully piggybacking on almost all the banking services which were carried out in the traditional manner in the past days. It has introduced and flipped the conventional business models in the sector, exploring which those models are which have brought a drastic change in the finance industry.

1. Bitcoin

Numerous attempts have been made by experts when it comes to building virtual currency. They faced some of the consequences and impediments have to be abandoned, but finally bagged success by developing Bitcoin. It can be considered as one of the most secure and innovative virtual currencies. Due to the crypto currency's highly secured network, Bitcoins gained huge popularity and was accepted widely as virtual currency by the modern-day customers. This virtual currency can even be used in exchange for real currency.

Bitcoin is advanced software that enables users with an online payment system and by making online transactions process much easier and a convent for users. Peer-to-peer technology when users use the virtual currency to make any type of transaction, hence it is much safer and secure than their imagination. Any of the individuals can use Bitcoin for online transactions. Know more about the Bitcoin by having quick glance over the video:

2. BlockChain

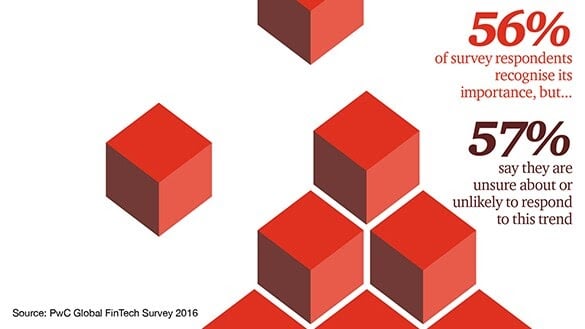

Most of the financial sectors have come together to commercialize the technology for applying it to financial services scenarios. They came up with the latest technology known as blockchain and FinTech. This technology proved to be more beneficial for almost all the financial sectors, including the most institutional use. Many of the financial sectors will not be able to survive for the next three to five years if they don't opt for modern technology such as blockchain for automating their business process. The use of blockchain in the “public ledger” will become an integral part of their operational infrastructure.

3. Tag Cash

It is one of the most innovative FinTech business models. Tag Cash has decreased the inconvenience of receiving and paying money online. When it comes to making any transaction through any of the banking channels, then IBAN and SWIFT codes are used to process the transaction. IBAN and SWIFT codes are the advanced banking identities used for any of the individuals. Without using it, the transfer can be done between banking accounts, hence it becomes vital to use the same when it comes to making the transaction.

4. Oradian

It is one among other software providers who believe in catering to the needs of microfinance institutions. Microfinance institutions offer financial services to businesses that face difficulty in raising funds from traditional banking channels. Those who belong to the low-income groups can easily raise a fund with the help of microfinance institutions as it provides specialized services. Oradian has developed an advanced system pertaining to microfinance. It also facilitates various finance-related operations on a regular basis. There are multiple areas in which the Oradian advance system can offer the worth outcome to the microfinance institution, these areas include:

- Deposit tracking

- Accounting

- Security

- Administration

- Loan Portfolio Management

5. Satago

An organization that wants to automate its accounts department completely can opt for Satago's solution. They can go for a registered connection to manage the accounts receivables accordingly. It helps organizations to keep track of accounts and enables them to place reminders for those debtors whose payment is due. It is an advance solution that helps in addressing all the aspects of accounts receivables and enables them to make smart choices for their business. Explore the video to know what Satago co-founder says about the platform.

6. Holvi

It is one of the innovative FinTech business models. Holvi also offers businesses to sell their business product or services like radiofrequency skin tightening or any other. It enables businesses to perform all the transactions related to selling and buying the product on its platform without the involvement of any intermediary. Holvi facilitates users to manage all the information related to finance more accurately and efficiently.

7. TRDATA

Investors need to have access to all the information related to finance. And TRDATA is proved to be the best solution for all the investors who demanded to have quick access to all the finance-related information. It provides them with timely data related to their investment and the market in which they have invested their penny. It also allows its users to perform all the investment tasks online, and facilitate them to strike deals among other investors.Finally, it is a secure tool that any of the investors can use to have access to all the information related to their investment.

8. Transferwise

It is one of the most innovative FinTech business models which enables any of the individuals to transfer money internationally at very lower costs than individuals' imagination. Transferwise allows users to transfer their money through normal credit cards, they can transfer it into their respective local currencies.

Users are notified about the transaction through the mail when they transfer their money using this advance solution. It costs almost 90% less compared to other local banking channels, thus if any of the individuals want to transfer their money internationally, then Transferwise is one of the best solutions. Check the video to know how Transferwise actually work:

9. Simple Tax

It is an advanced software solution that makes the tax filing process much easier and faster for the users. Simple Tax is serving accurately to the Canadian market presently. It possesses automatic updates related to recent regulations when it comes to the tax system. Moreover, it provides online support for taxation, and as it is user friendly, it makes the tax process more efficient for the users.

10. Technological Advancement

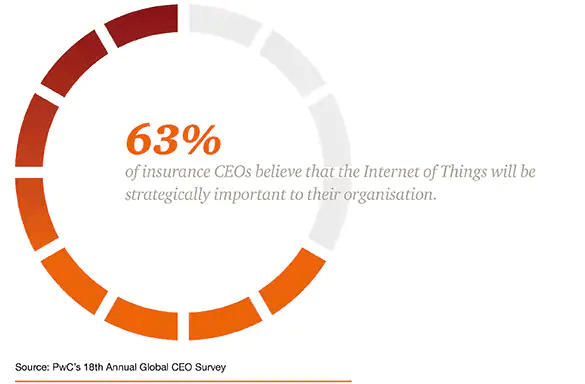

Most of the financial and technology companies use modern technology to address all the demand for their prospective customers. They use AI and robotics to address all the key pressure points which they find in their sector. Besides this, they also use it to reduce costs and risks. In one of the surveys, more than 63% of individuals said that modern technology like the internet of things or any other helps them to generate the best outcome for their business in less time. Modern technology is here to make the tax filing process more efficient for users.

Ending Note

There are many other FinTech business models available in the market these days. Any of the individuals who are dealing in the financial sector have to opt for any of the business models, which helps them to address all the requirements of their banking business more accurately or efficiently.

Be it a mobile banking solution or agency banking solution it is the essence of fintech, this advanced solution has transferred the control for every individual starting from the consumers to the bank officials. This innovative digital banking idea can lead consumers with more convenience, they can carry out any of the functions of their choice that provides the businesses the potential rank high in the competitive business market.