ValueWalk’s Raul Panganiban interviews Crescat Capital’s Kevin Smith And Tavi Costa, discussing their trade of the century idea. In this part, Tavi and Kevin discuss what led them to finance and investing,what working at Crescat like, their focus on global macro themes and value driven models, and finding contrarian ideas.

Q4 2019 hedge fund letters, conferences and more

kreatikar / Pixabay

Raul Panganiban: All right. Yeah, if we can just begin with your backgrounds and what led you to finance and investing?

Kevin Smith: Sure, I’ll start. So my background I grew up in the San Francisco Bay Area. I went to Stanford and got an economics undergrad there. I went to University of Chicago, where I got my MBA and finance and statistics. Got my CFA along the way. So I’ve kind of been on the path of, you know, towards finance and investing from an early educational career, took some other twists and turns along the way.

But, here I am, I started in the business with Kidder Peabody, which was in 92. At the time, they were the largest fixed income underwriter on Wall Street and had the biggest inventory of mortgage backed securities. And so my indoctrination into the business was in in 1994, when we had the bond bear market and kidder Peabody, you know, pretty much almost blew up and Jack Welch, Kidder was owned by GE at the time Jack Welch ended up having to sell the firm to Paine Webber. And so that was kind of my indoctrination into risk in the business.

Tavi Costa: All right. My insurance obviously it’s a little shorter given my age, but I was born and raised in Brazil, moved to the US to play tennis in college. I was recruited to play tennis at Liberty University in Virginia. D1 school, play tennis there, did a transfer to another school in St. Louis called Lindenwood University and then finish up college and move to Denver and started working with Gavin really, and that was sort of my introduction to hedge funds in general and started working as a more in the emerging markets area, I was focused in that part of the portfolio and kind of graduated from that and became more of a global macro analyst and then now a portfolio manager together with Kevin.

So today I help in the process in general, not just in managing the portfolio, but also building models in our investment process overall and evolving that and in also helping to find the big trends, macro wise as well.

Raul Panganiban: Oh, nice. Very nice. Yeah. If you don’t mind me asking, How did you find the opportunity to work at crescat?

Tavi Costa: To work at Crescat? Guess that’s a that’s an interesting question. Actually. I since I played tennis, I moved to a while I’m a since I’m foreigner, I’m a foreigner. I was not, didn’t have a lot of opportunities when I finish up college. So move to Denver and start working at a country club as a tennis coach. And guess who was one of my lessons was Kevin Smith and then I started to talk to him about finance and he needed someone to he I think he thought that I was more of a marketing guy at the time and it got me to work with him initially as an intern, and it was more of a I would say more of a marketing position at the time. But really wearing a lot of hats and kind of didn’t want to be much of the marketing and wanted to be more on the analytical side and kind of grew and, you know, at the wheel. At the time, we had one Bloomberg terminal and I remember, this guy would leave at around 4 or 5pm.

And I would take his Bloomberg terminal would stay with Kevin until late night, just just learning with him and learning about companies and the macro themes that he believed at that time and helped him to to really validate a lot of those statements at the time. And I think that was really the start and then started going more on my own and really, hopefully, adding to the to the team overall.

Raul Panganiban: Now that’s super cool. Yeah, just just out of curiosity, the name Crescat. Where did that come from?

Kevin Smith: So, Crescat actually comes from the University of Chicago motto and it’s me basically means to grow or let it grow. And so Crescat Capital means essentially let your money grow.

Raul Panganiban: Oh, nice. Yeah. And then on your site, you lay out your process and focuses on global macro themes, value driven models and prudent risk management. Can you tell me more about your process and elaborate on each of those?

Kevin Smith: Sure, really, those are the three key tenets of what we do when it comes to the investment process. We are, we’re a global macro shop in the sense that that we we like to look for big picture themes relative to to global GDP, you know, whether it’s the most overvalued US equity market in history, according to a composite of eight different indicators that we look at.

As it was recently here things like that, or the biggest currency bubble that we think we’ve seen in history in China, based on their enormous banking imbalances and banking system that they’ve created with the huge non performing loans or if you look at something like the battle between the value of fiat money and versus gold. Another big theme of our so we like to look at Big Picture things, but we’re also value oriented. And so, you know, my background is very much coming up from the value oriented stock picking side and using quant models.

So that’s a big part of what we do, you know, the value driven model side of what we do. I have a model that I’ve used to help pick stocks that I developed more than 20 years ago, when I was a kid or actually originally and use that to launch along only my first investment strategy, which was a long only strategy still around today, we call Crescat large cap. And, you know, there’s over 50 underlying factors in this in this quant model, and then we still use it today. It’s a big part of what we do in terms of picking stocks. And then the risk management just the other third key tenet of the investment process.

You know, that’s probably the most difficult one and, you know, I’d say me personally, I do have a higher risk tolerance than most people. And, so we’re willing to take you in as a value investor, too, I think you have to have a pretty high risk tolerance, because because intrinsic value and market price can, can differ so so much, and those tend to be the things we get the most excited about. And so when, you know when you have such a big divergence, you know, You have to be willing to you know, to be able to ride out the volatility. Anyway, so that’s a little bit on that.

Tavi Costa: I’m just going to echo Kevin here. I mean, stepping back, I think I think it was important to, to understand the history of how the investment process really started to evolve. But Kevin was always very, into a not just value investing but but macro overall. And building this quote model that he started back in the 90s, I think was very helpful to build a lot of the macro themes that we had back in ’06 and ’05 or so this model, for instance, was flagging a lot of the homebuilders and banks prior to the global financial crisis that really helped him at the time to build the themes.

And when I came in, I realised how successful he was a really selecting and identifying as macro events, large macro events, and I thought that we should give more emphasis to that and perhaps that was more of where I wanted to lean towards to more on the macro side and really build things in terms of finding factors that have identify, you know, the changes in the business cycles in the past, especially when those indicators are very highly correlated to the changes in markets in general.

So I think that combined with, with the value investing approach was a big difference. And now, even combining now more technicals to kind of reaffirm the trends of those of those macro themes that we believe that that we should be, perhaps adding to it in a big way. So I think that that’s really how everything is starting to evolve. We really went from the quants to now more of a macro and it’s becoming it never really was a fully systematic process but that’s that’s basically how the whole thing developed in general.

Raul Panganiban: Yeah, very cool. Now, when you were developing those macro models, how do you go about it?

Tavi Costa: Well, I would say, I started by spending a lot of time aggregating data, looking at data in general and pulling data from, from different sources and, and just spending less time reading the news and more time looking at the data itself.

And seeing if anything, if there’s a real trend on on anything, if there’s anything alarming for me to to point out, and that was really the beginning of that was, you know, sort of leading a macro presentation that we had on a weekly basis with Kevin and the team and it was just kind of sharing some of the things I was finding and that kind of evolved from there and then started to combine and use Kevin’s process of building models in terms of ranking things in general and started to apply the same idea on the macro side.

And that’s really when we started to build those models. We actually only report a few of those models to the world, a lot of them, we keep it to ourselves and it really helps us to to validate our thesis overall.

So I think that’s sort of the answer. It’s not, again, it’s not so systematic, actually how do you build models is really out of curiosity of thinking outside of the box, and then saying, well, how can I confirm it? Especially like the situation that we’re having right now with the virus outbreak, you know, how what’s the impact in the economy in general?

What are things that I can look at that other people are not looking at? Our things that can focus that people are not focusing on, that can maybe give us an edge in terms of have foreseen something about the markets and I think that that has been really helpful and I think it will continue to be. It’s incredible how a lot of investors in general don’t put the homework of really looking at the data. And I think that anybody who is willing to do that will probably have an edge on a lot of things.

Kevin Smith: Yeah, I mean, when we talk about how we develop themes, and use models, macro models to do that, I think it’s, you know, it’s, it’s really important that to let the data you know, help you to build the narrative. So there’s a lot of narratives out there, but when you when you just start by looking at the data, and then build your narrative around that, it really, you know, really helps to to, I think have a better combination of the you know, being able to explain what’s going on in the market and have it have a unique narrative to tell on what you know, what you believe is happening.

Raul Panganiban: Yeah, before we go into the present moment. I just remember, I think it was an interview that Tavi Costa had on the MBA podcast. Where you said that you like to have a contrarian thinking and to challenge the consensus thinking, like by looking at themes that everyone is believing in today that won’t do well in five years. So yeah, just want to know if there’s, if you can comment first on the present day, and then the consensus thinking that you’re seeing today that won’t do well in five years and that you guys will have an edge on.

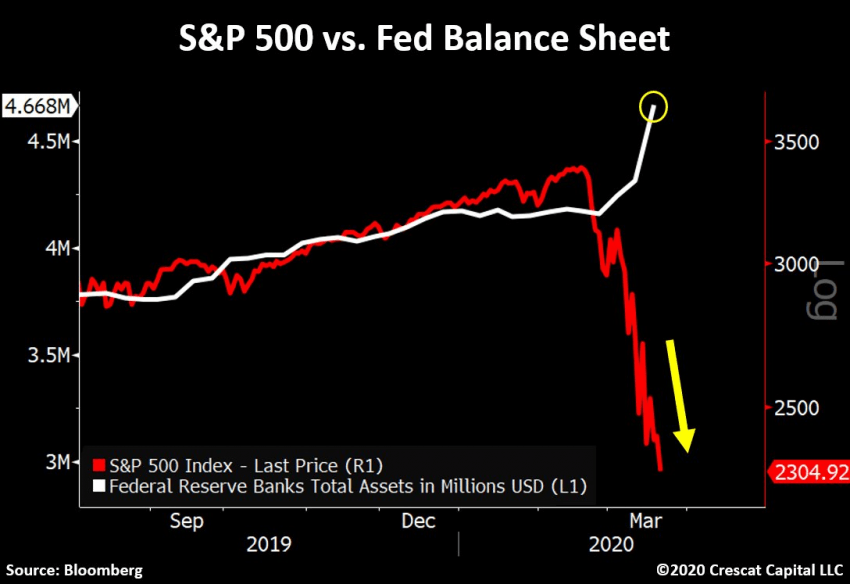

Kevin Smith: Yeah, well, certainly some of the consensus thinking that we have seen recently has just been you know, what’s been driving this this incredible had been an incredible bull market and really the longest running economic expansion and bull market in US history. And, you know, this idea that that the on debt the the ongoing liquidity that that that the Fed is providing is somehow going to support rising stock prices indefinitely, you know, has been, you know that that was such a pervasive narrative. I mean, we get trolled just incredibly in most of our tweets, you know, trying to show the contrarian view to that. And really the, you know, that was the common thread one of the common threads for us and it was its liquidity is going is just going to ensure that that the market is going to go up forever.

And it’s nonsense when you have such absurd valuations and particularly when you look at the data and you see that that massive liquidity injections and interest rate decreases coincide much more with recessions and economic crises than they do with being able to predict preempt and continue the business cycle. I’m sure there’s some soft landings and extensions of the business cycle. And you know, we’ve had that, but there is a business cycle the tide does go out and and we you know, obviously we think now that it is going out.

Tavi Costa: [inaudible] to Kevin’s idea. Well obviously the idea of finding contrarian ideas is just for more of the asymmetric returns. I think that’s, that seems kind of obvious, really. But when you can find enough reasons to take an uncrowded view, I think it makes a lot of sense. And this is what we found, especially when we started looking at China back in 2014, and 15. And now, Hong Kong, and you can see that on how those currencies are being priced in the markets today, especially on the implied volatility of those currencies.

I know, I should say I point out the Hong Kong dollar is even more important because it really is not pricing in the possibility of a real depeg in In terms of a real banking issue, or crisis that that could have, but the central bank reliance that we were seeing this days, which is actually something that we we see most times and then it’s when the Federal Reserve and central banks overall begin to cut rates and inject liquidity in the markets and investors begin to actually think the opposite way actually thinking that that’s bullish in and that’s really when central banks are actually in panic mode and starting to lose control of the whole situation and they have a very poor track record of doing of preventing cycles from turning in anyway, so I’m not sure why does reliance is so high these days.

I think we’re very close to a peak levels of that and its exactly why gold for instance, becomes a more of a relevant position for any portfolio especially in case of central banks in a lot of fiat currencies are actually backed by those leaders and central banks and cooked government’s overall. But you know, when you look back in terms of the macro trade of the century, or just you know, which I know, you might want to touch in that, which is being long gold and Renminbi terms and be short global stocks, well, that thesis has started to work already.

It’s not at a symmetric as it was before, but the room for growth in that trade is incredible. Still, I mean, it’s just the beginning. So, you know, understanding that understanding that you know, the when things start to play out, you know, it’s it validate your thesis, obviously, that’s not so. So contrarian as it was, you know, a few months ago, but still, it still looks incredibly attractive to us as a trade in general. I think that searching for that, what’s at the centre of a lot of the imbalances is very important, and we think it’s China.

See the full transcript here