Global Return Asset Management commentary for the month ended February 29, 2020, discussing the selloff during the month.

Dear Friends and Partners,

Q4 2019 hedge fund letters, conferences and more

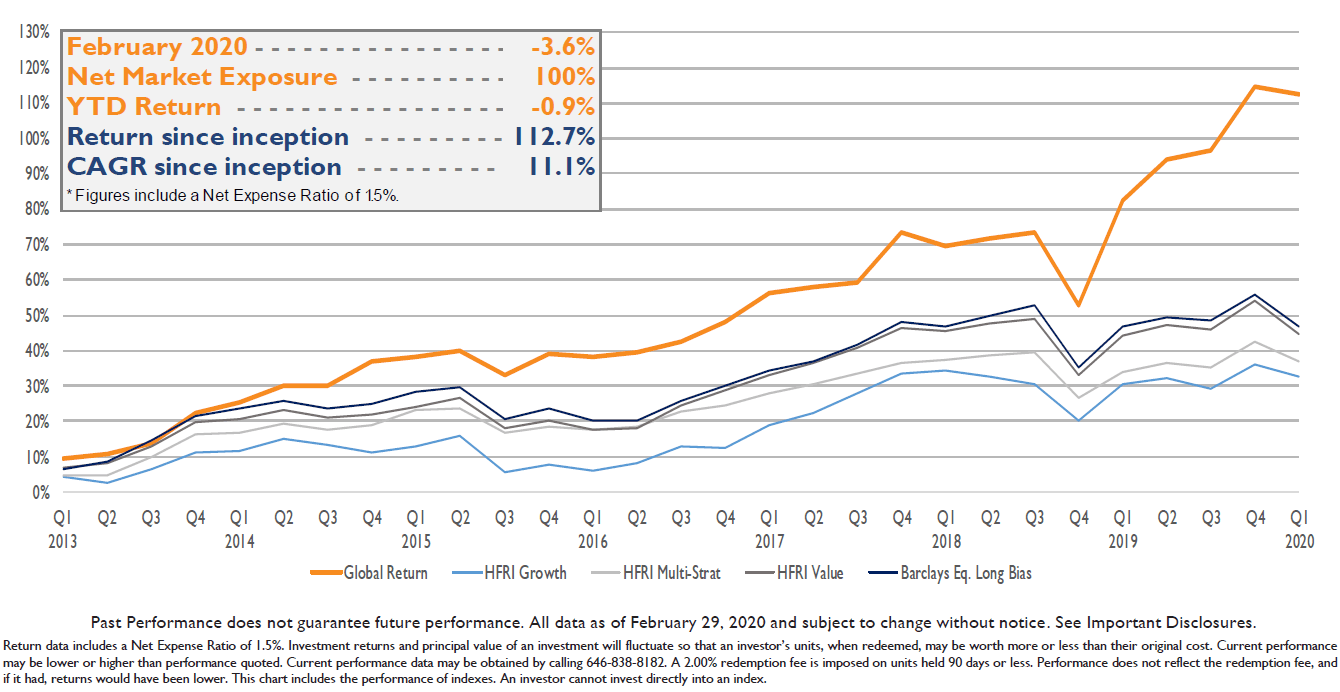

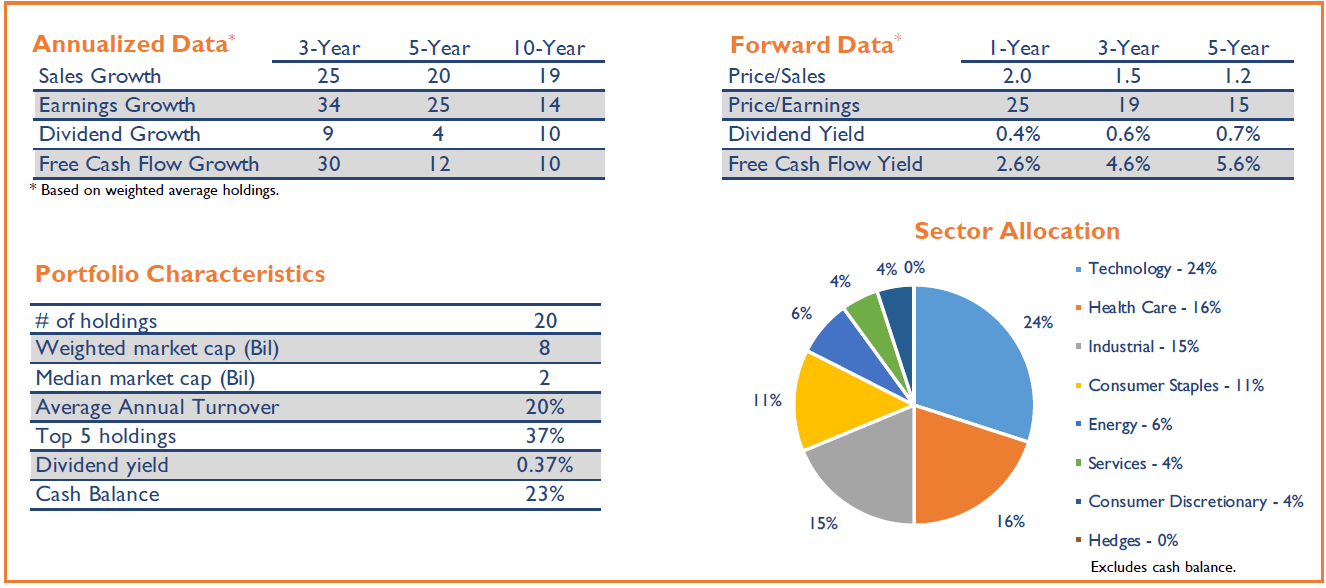

In February we generated a net return of (3.6%).1

Year to date, we've generated a net return of (0.9%).1

We ended the month with 23% of assets in Cash and a Net Market Exposure of 100%.

Our Net Market Exposure was due to the timing between entering and exiting hedges. We entered hedges on the first trading day of March.

Our strong out-performance is the result of our approach to risk management and I'm happy to see our portfolio perform as designed.

Expanded Commentary: Performance During February's Selloff

I’m excited about the opportunities developing and optimistic in our prospects. Here’s why:

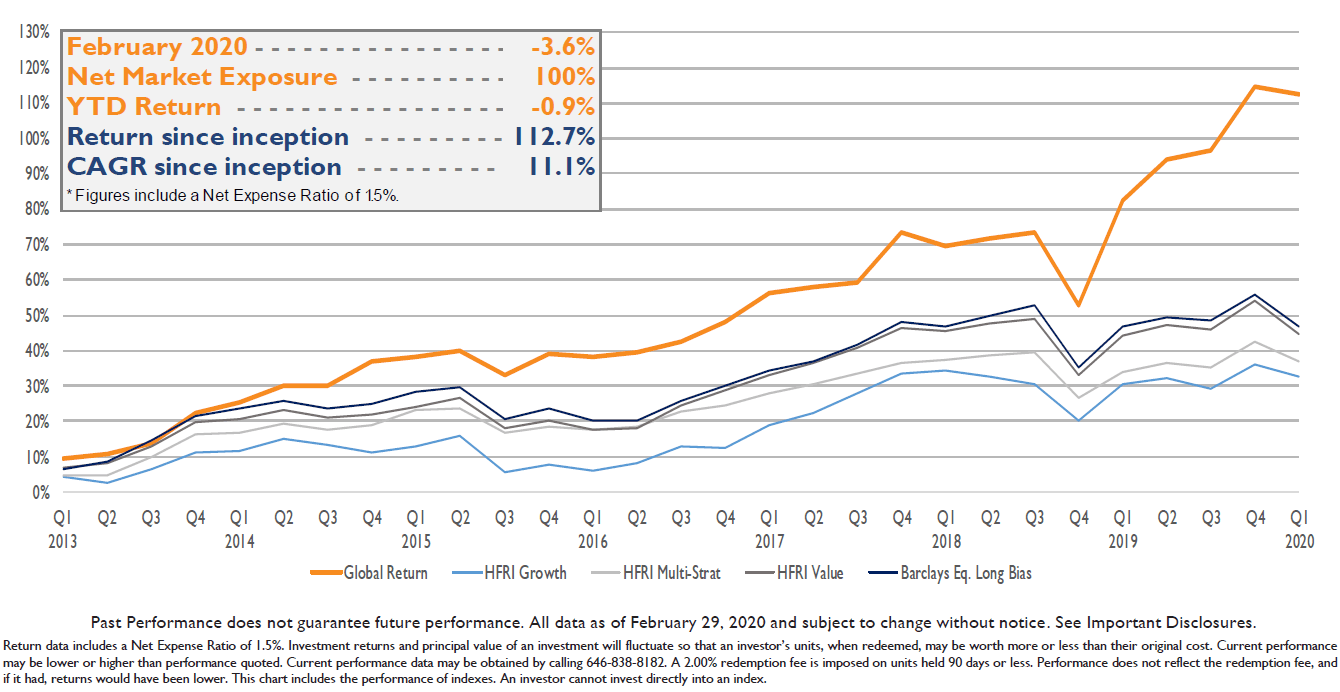

During the last three years, our average Cash Balance has been 27% (even while delivering an 11.3% net compounded annual growth rate over the same period).1 The reason for our Cash Balance is because I invest only when I believe superior risk/reward ratios favor us.

For example, when markets began selling-off in Q4 2018, I started investing our Cash and by the end of the year we were fully invested. In the following quarter (Q1 2019), we generated a net return of 19%, and a 41% net return for the year.1

So, when I see stock prices decline, I get optimistic because I know this is creating better risk/reward ratio opportunities. Plus, I’m able to buy more stock with less money – I get a bigger piece of the pie and I don’t have to pay as much for my slice of the pie.

That said, investors should prepare for a greater degree of volatility. There will be uncomfortable days and mark to market losses. However, investors who can shift their perspective to think differently about volatility – that it might be creating superior opportunities – can minimize the discomfort. Moreover, investors with the fortitude to remain invested, or increase their investment, will be rewarded handsomely.

As for our portfolio, it’s performing as I expected, and have written, it would. During periods of increased volatility our portfolio should outperform because of my approach to risk management, which begins with assessing each opportunity’s risk potential, not its return potential.

On a going forward basis, we’re not adjusting our portfolio because of the Coronavirus or the decline in oil prices. To the contrary, I'm sticking with our strategy of buying companies with durable balance sheets, under-valued operating assets and risk/reward ratios that favor us.

In closing, our portfolio was well-situated for February's selloff. We were in an enviable position: We had hedges in place that protected our downside exposure and Cash available to add to existing positions.

I would also like to express my gratitude to all of our existing partners who increased their investments over the last few months. Additionally, I'd like to welcome our newest partners. My personal investment and (obsessive) enthusiasm for investing ensures I'll continue working hard on your behalf.

As always, I welcome the opportunity to address any questions you may have about our technology, risk management or how we invest.

Sincerely,

Elliot Trexler

www.GlobalReturnAM.com