When it comes to stock market investing, you need to know what you are doing. You need to know when to buy stocks, when to sell stocks! The core of Peter Lynch’s book One Up On Wall Street are six categories under which all stocks fall under: Cyclical stocks, turnaround stocks, asset plays, slow growers, fast growth stocks and stalwarts.

Q4 2019 hedge fund letters, conferences and more

6 Stocks Categories Give You Answers When To Buy Or Sell A Stock

Transcirpt

Good day fellow investors. Thank you for commenting your ideas and your great businesses in yesterday's video, and today we're going to categorise those stocks into the six categories Lynch finds crucial when it comes to investing so that you can attach a story to the investment idea you have, and then see all the characteristics of that stories. So let me first discuss the stories and then we'll comment on a few stocks that you mentioned in yesterday's comments. So we have slow growers, stalwarts, fast growers, turnarounds, cyclical and asset place. Those are the six investments categories that Peter Lynch puts a stock into, and then those have specific characteristics.

And you have to see how, where is which stocks. Remember, stocks always evolve over time always change so one stock in over in 20-30 years can be niche category. That's something to keep in mind. Investing is always dynamic.

Peter Lynch stocks

Before just going into the categories Peter Lynch says big companies, small moves. So Coca-Cola was a great company is a great company. But over the last 22 years, it's up just 46%. It is globalised, it's growing, it's growing earnings and dividends, but it's also about valuation. And then it's also about how big the company already is to grow more into the future.

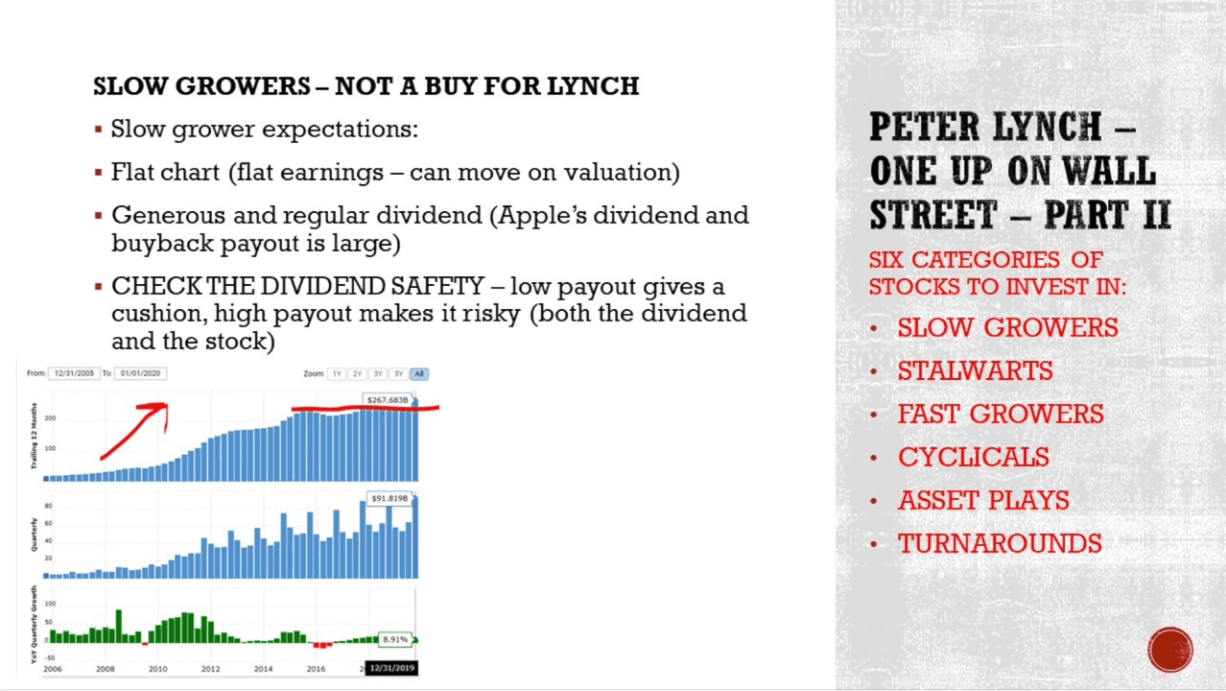

Also a concept that Lynch discusses diversification when a company starts investing into stupid things with lower return on capital, just to chase the growth that isn't coming from the main product so you see Coca Cola zero, healthy green, whatever. So let's go into the categories number one slow growers. Keep in mind that fast growers turning to slow growers at some point in time a recent example is Apple.

Apple and IBM are discussed in the book as fast growers. IBM became a slow grower market earlier than Apple, but sooner or later all stocks hit the upper limit and become slow grower so extremely fast growth since the introduction of the iPhone for Apple and then over the last five years very slow growth in revenues. And then what are the characteristics of slow growers? Flat chart, flat earnings and therefore a flat stock chart but can move on valuation as we have seen Apple do generous and regular dividend. Apple's dividend than buyback payout is very large compared to earnings.

So they're not investing into new things. And therefore, you have to check the dividend safety low payout gives a caution that the dividend will continue to be paid out. High payout makes it risky because you can have the coronavirus hitting Apple's revenues and then lowering its dividends and buybacks.

Growers

So growers are not to buy for Lynch because Lynch is looking for better companies slow are for those that want safety or perceived safety because when things turn south for slow growers, and we have seen many companies really drop despite the good dividends despite everything. So Lynch says if there is a slow grower with no perspectives to turn around to increase growth, to do smart things, to diversify into new things, new products and then you also have to see how much is that new product significant for the revenues, it's a no investment for Peter Lynch.

The second category are stalwarts. So Peter Lynch discusses companies that grow faster than other competent between 10 and 12%. Okay, this was in the 1980s. So inflation was higher so companies were naturally growing higher. We can now put it perhaps between 6 and 12%, which are good growth rates, but those are companies that okay can expand their business but you can can't expect miracles from there.

So it is about valuation and then if a company goes stalwart goes up 50 at 100%, you might think about selling it and buying something that's more undervalued because the up the spike in the price doesn't justify the earnings growth.

For example, Bristol Myers is a company that grew 10% since 2014. Okay, that's good. The earnings were made for those that bought in 2010. For example, over the last years, it wasn't that good but it recently spike so that those that have such a company might think about selling it now and then buying something that's still more undervalued according to Lynch.

Peter Lynch and growth investing

Now, Lynch owns and owned such companies because those give good protection in recessions, companies that continue to grow, do their own business, don't mind about what's going on in the economy. That's a good business and that gives you protection in a recession. Okay, you have to check how each performed in a recession over the previous three, four or five recessions, you need to go a lot back in time.

Now it was a different case in the 1980s. But check how it works, how are the earnings hit, what's the payout with the dividend and then see how much safety you want in your portfolio and how much weight you want for such companies in your portfolio.

The expectations for such companies make 30 to 50% and sell always keep some in your portfolio for recession protection check the ups and downs during recession. It's unlikely that these companies go out of business price to earnings ratio will tell you the value and beware of diversification where they invest in stupid growth at any cost.

Then the fast growers. Lynch's favourite stocks, the stocks that if you find one that is great makes it an investment career, not just a great investment. Those are the fast growers growing between 20 and 25% per year. Not Above 50% because that's a hot stock and Lynch doesn't like hot stocks because there is a lot of competition. If the market is growing so fast, everybody wants in, think about Uber, Lyft, DD and all those hot things. So a little bit slower.

Enter Starbucks

Not that hot, but strong sustainable growth, great business model, great earnings. One example of that is Starbucks in the 1990s. If they look at their growth, stock 29% 22, 24, 24, 30% in the 2000s, the company was growing had a confirmed business plan in the US and then it went for global expansion. Those that invested in the 1990s ended up with a 20 bagger. Those that invested later did still good but not as good as the company started growing, let's say more slowly.

So what are the expectations if growth slows down, the market doesn't like it, if finances become an issue, it's likely you go to chapter 11. So you have to look for good balance sheets making substantial profits, figure out when to stop growing and how much you will pay for that growth. At some time, they will stop growing and turn into something else. That's the only guarantee that's a certainty.

Check how much room for growth there is 20 to 25% is the best growth to avoid hot growth proven profitable expansion in more than one city or country that Starbucks did price earnings ratio should be below the growth rate. So still buying the earnings.

Check whether growth is expanding or slowing down, look for those few institutions own and that you have heard of. So this is an excellent explanation of what to look for, for those great investments.

Slow growers vs cyclicals

The next category is cyclicals. Cyclicals follow the economy, automotive, airlines, tire companies. Steel, chemical travel etc all cyclical companies and Ford stock is a perfect example down with every recession or slow down and down now again on the expectation that there will be a recession. This is a typical cyclical stock performance. So what are the expectations from such a stock to flourish when the economy turns good again to suffer when there is no economic growth. 50% jobs are normal if you buy at the wrong part of the cycle.

You can wait four years before seeing another upswing for this down since 2013. Large and well known companies that make the unwary stock picker most easily part with its money because a lot bought Ford in 2014 because it was a great thing. Timing is everything watch for inventories. And then stocks usually decline when peak earnings is reached and investors already start expecting a recession.

Look at Ford from 2014. So now your cyclical very well in the car industry free growth years free to four or five bad years and then you have to buy new cars. The worst the slump, the better the recovery. It's easier to predict an upturn than a downturn. So we will see when the upturn will come in the automotive industry and then we'll check the whole sector.

Turnarounds vs slow growers

Next are turnarounds, turnarounds are companies that are close to chapter 11, close to bankruptcy. However, when bankruptcy fierce ease, stocks explode, and that's how earnings are rerated, stock is rerated and there is a lot of potential. For example, Bank of America is a 10 bagger since 2009. What are the expectations explode on the upside when things improve, go bust when things don't improve.

You have to understand whether the issues are big as perceived or not. If you can simply say next. Can the company survive a raid from creditors? How will the company turn around is what you have to ask.

Restructuring is not good even if perceived as such. One time losses make buying opportunities, if those are real one time losses and what will be the effects of cutting costs. One company that might be a turnaround might not be at this moment is PG&E.

And then the last category is asset place. An asset place is a company sitting on something valuable that the market is overlooking, or it hasn't yet started to print cash, the asset can be cash, real estate, railroads, accounting, losses, inventories, number of users, whatever that the market isn't seeing. I remember buying Prime Adriatic Mediterranean real estate for one euro per square metre in 2010 because nobody was looking at the value of the land.

So that was what I was buying in place of Amazon as mentioned yesterday, so I was looking around me and finding great businesses to invest. So no the asset have patience until the value unlocks look at the debt, look at the management, is it destroying or creating value. Are there any hidden assets? Is there an activist investment involved?

Understanding the categories

Discussing your ideas, it's always great to look for businesses around you and then understand their value, their quality and systematise them into the six categories we discussed. I am very, very thankful for all the comments that came on yesterday's video and if someone wants to find, research ideas, stock market research ideas, then the video yesterday is full of ideas in the comments. From companies like American Airlines here that people use and definitely think it's a good business but that's a turnaround cyclical story to categorise it.

Then looking deeper, something very interesting theme almost every IT business uses their products and will continue to do so after pay even hardware stores put this on their adverts as a paid option. Quest Diagnostics, Labcorp used by the person that commented in the sector further coming from biotech scientists background we use GMO products in academic industry labs all the time.

And they can acquire great products increase the price one they get you because they know you want to change your scientific protocol. So very interesting businesses to look at and then you put them on the watch list, categorise them and buy them when those are a great buy.

Slow growers vs fast growers

More ideas from Austria in this case, Agrana that makes sugar, RTL Television utility company and the largest brick producer in the world, Wienerberger if you don't know the company. This is very interesting, I work for ALSTOM, and I see how the railway business is growing across the globe while everyone focus on electric cars, rail is very interesting also electric more scalability and everything and it's pays the high dividend already a very interesting stock to categorise.

More businesses Maisons du Monde, BIC, Eutelsat, European very interesting businesses. I have a lot of work to do a lot of research to do to really find what is a buy when it is a buy. See, what should I put on my research list etc. Spotify mentioned very often as a lot of people are using it so another stock to research.

PayPal, Restoration Hardware, etc. And then you see, okay, if you find such business, okay, we know like Marco says he's here about Atlassian then they offer great products and if you buy that at the right time, then this is the result. Look at it from 20 to 153 in just 3-4 years. So it's a shame we didn't see it, but it might still be. So a lot of research a lot of great ideas from you. And this is what Peter Lynch is always talking about self wealth from Australia also, expanding internationally could be very, very interesting.

So we have to research, I have to research all of these books reports, my stock market research platform members will be very happy from the quantity of reports coming interesting businesses continue in the sector analysis, but when you analyse them, then you have to see how it fits your investment strategy.

Slow growers and other strategies

So when it comes to investing strategy, you use these six categories and then you put the idea into those and then you know what to expect what to look for. And Peter Lynch says it's all about research. investing in stocks without doing research is like playing start poker without looking at the card. So you look research and he says you need just a few hours on each business to check what is important.

So first categorise the business. We'll discuss later the fundamentals and then you just need one hour a week to follow the stock, learn about the stock. That's also what I do. If you don't have the time to do the research to search, you can always check my stock market research platform, and then see all my research in detail reports on sectors and many, many stocks.

Now, going back to Peter Lynch, just look around yourself. categorise, and then we'll discuss on fundamentals. So please subscribe and click that notification bell. What are we going to talk next, the perfect stock to buy, stock to avoid, it's all about earnings. We'll talk about fundamentals and how to do research. Thank you looking forward to your comments, any questions, any ideas, and I'll see you in the next video.