Ben Strubel’s letter to investors for the month of March 2020, discussing the market sell-off caused by Covid-19 and the payroll tax cut.

Q4 2019 hedge fund letters, conferences and more

Dear Investors,

Obviously, the subject on everyone’s mind is what is happening with Covid-19, also known as “novel coronavirus” or just “the coronavirus.” (I’m going to call it Covid-19 because it’s the easier to type).

Over the past days and weeks, I’ve read a lot of letters from various investment advisors. I always chuckle at the ones where they announce they aren’t medical, health care, or epidemiology experts and are out of their element and then proceed to pontificate on Covid-19. I’m not going to do that.

The Ups And Downs Of The Stock Market

What I am going to do is address the big concern for many of my clients. We all know that the market goes through ups and downs with roughly three 5% drops every year, a 10% drop once a year, and every four or so years drops of 20%. The regular ups and downs over things like oil prices, interest rates, Ebola, various armed conflicts around the world, SARS, trade wars, and more are uncomfortable but no reason to panic or change your long-term plans.

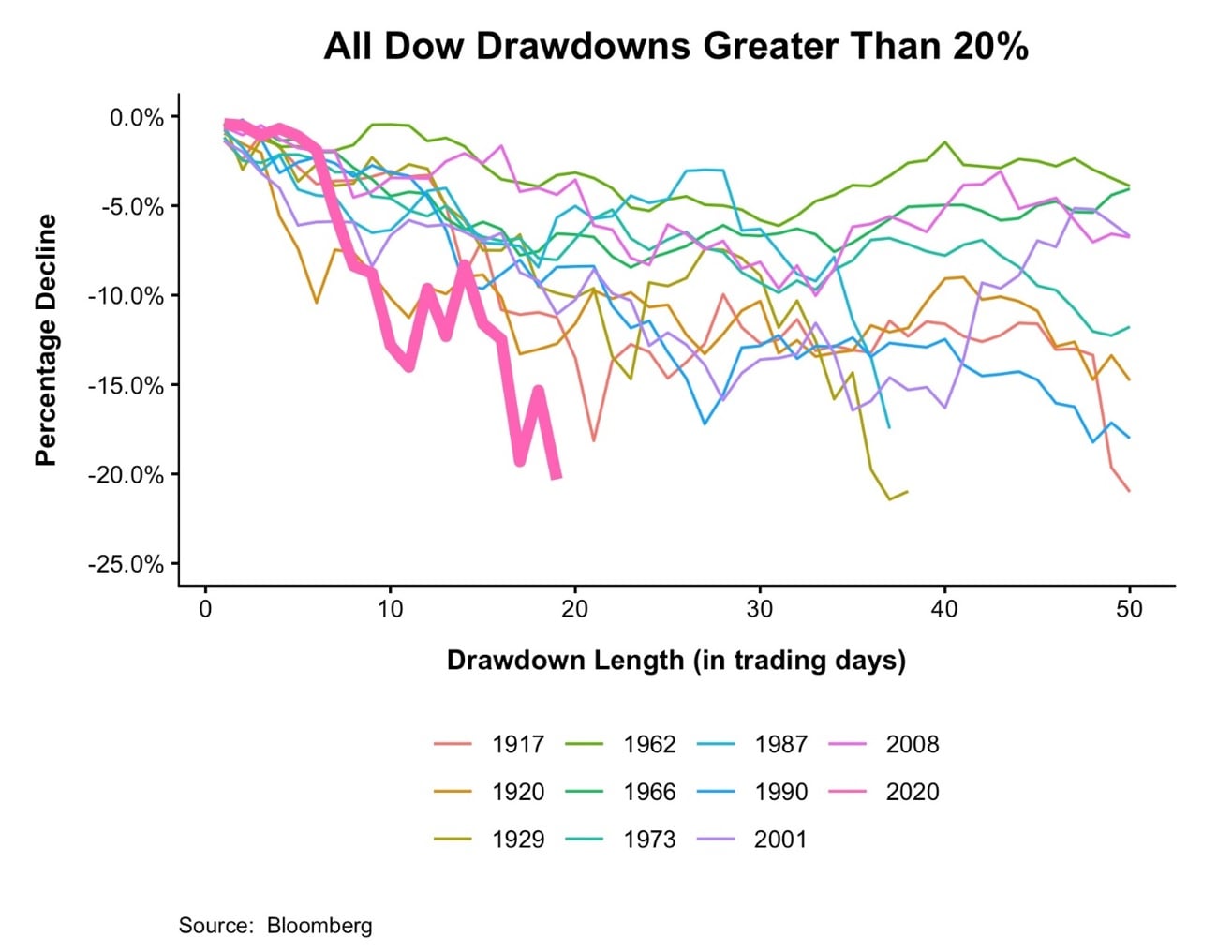

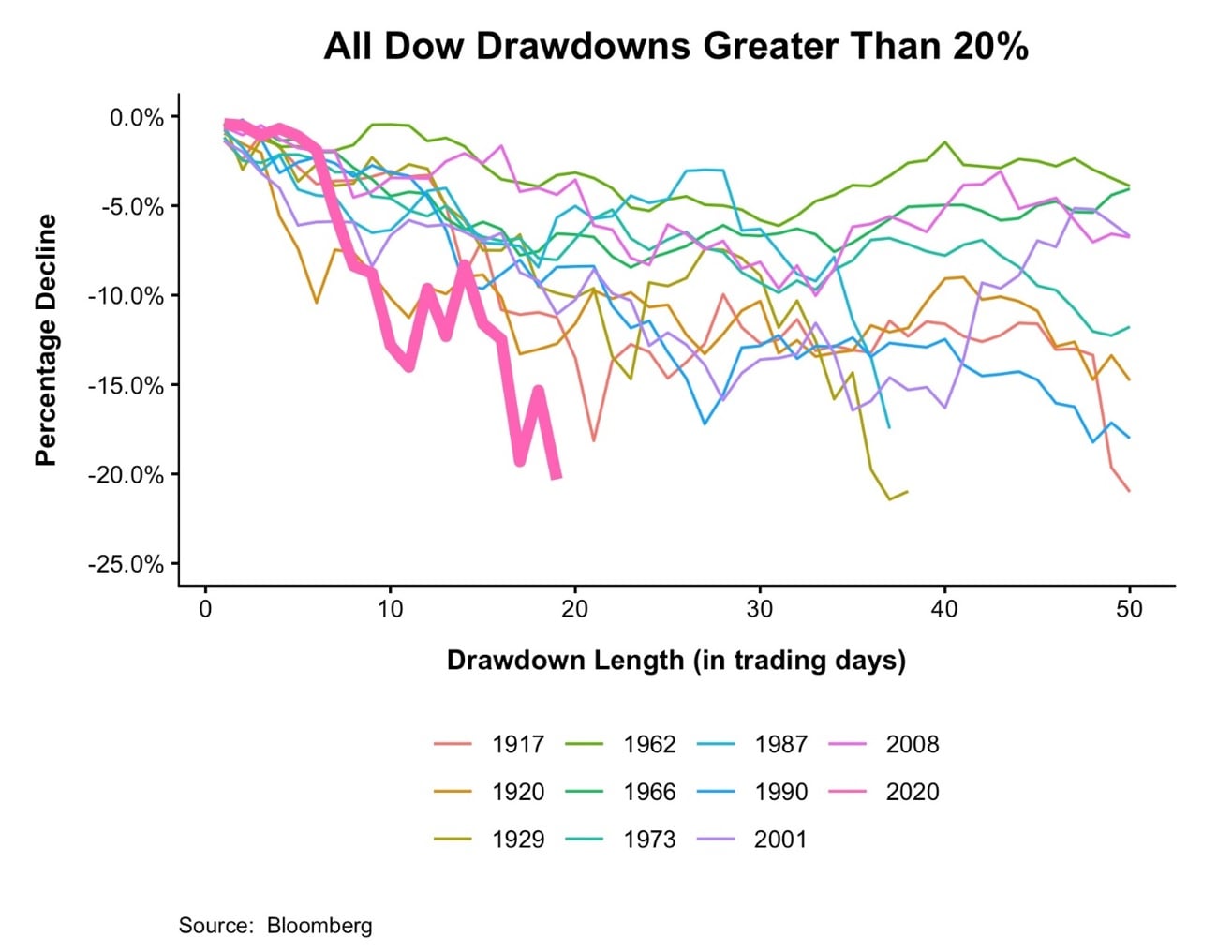

Today we have people panicking so much that we have the quickest 20% stock market draw down in history.

That’s right. The market has dropped faster than it did during the Great Depression or the Great Recession in 2008.

What really concerns people now is whether or not this is another 2008? Is this “the big one” that knocks your long-term plans off track permanently? The answer is no.

Let’s look at thing using an analogy. Recently my wife and I took a cooking class on how make gluten free pizza dough (my wife has Celiac disease and can’t eat gluten). The ingredients were gluten free flour, psyllium husk, sugar, salt, and yeast. To make the dough, you had to have those ingredients. If I had just a handful of broccoli and some peanuts, no matter how hard I would have tried there is no way I could make pizza dough. You need the proper ingredients.

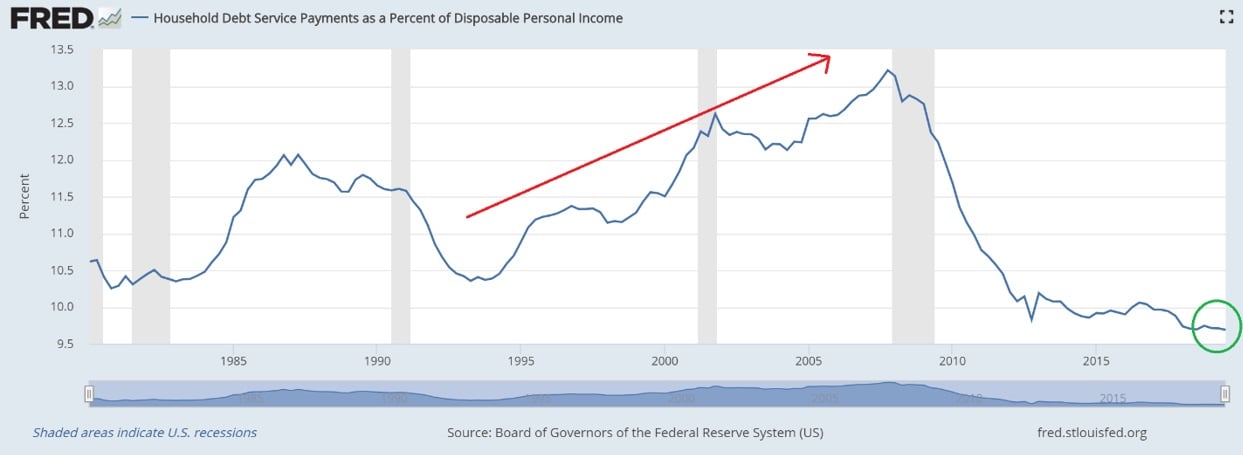

Right now, we simply do not have the ingredients to have another 2008-like crisis. The main ingredient for that crisis was sky high levels of household debt. The chart below shows how since the mid-90s household debt steadily rose and reached all-time highs! (The chart shows debt payments as a percent of income.)

All-Time Low Household Debt Payments

Today, household debt payments are at all-time lows. We just don’t have the key ingredient for a 2008-style crisis. Could we get a recession? Sure. It depends on how many events are closed and how drastic and widespread any quarantines are. But, because households are healthy, the economy will quickly bounce back.

It’s also encouraging to see Democrats and the White House agree that some type of economic stimulus response is needed. The ideas put forth so far range from OK to horrible as far as how much economic impact they’d have.

The Payroll Tax Cut

The payroll tax cut that has been floated is probably the best idea I’ve seen. From the previous payroll tax cut enacted as part of the stimulus to recover from the great recession, we know that for every dollar in payroll taxes that are cut, the economy gets about 80 cents in growth. Most importantly, this is something that would be enacted now, before people start losing jobs or the economy starts slowing. This, to me, is the most attractive option since it has a chance of preventing economic damage BEFORE it occurs.

Other proposals like enhanced unemployment benefits, while they help greatly, occur AFTER the economic damage has occurred.

Finally, policymakers have suggested a grab bag of proposals like loan guarantees and corporate income tax cuts for travel and hospitality-related industries that, while possibly helpful for those industries, aren’t going to do much for the economy as a whole. A cruise line with no passengers and idled ships isn’t going to keep staff on the payroll just because they have to pay fewer taxes.

Rest assured! I’m continuing to monitor the economic situation and our investments…and washing my hands often!

Disclaimer

Historical results are not indicative of future performance. Positive returns are not guaranteed. Individual results will vary depending on market conditions and investing may cause capital loss.

The performance data presented prior to 2011:

- Represents a composite of all discretionary equity investments in accounts that have been open for at least one year. Any accounts open for less than one year are excluded from the composite performance shown. From time to time clients have made special requests that SIM hold securities in their account that are not included in SIMs recommended equity portfolio, those investments are excluded from the composite results shown.

- Performance is calculated using a holding period return formula.

- Reflect the deduction of a management fee of 1% of assets per year.

- Reflect the reinvestment of capital gains and dividends.

Performance data presented for 2011 and after:

- Represents the performance of the model portfolio that client accounts are linked too.

- Reflect the deduction of management fees of 1% of assets per year.

- Reflect the reinvestment of capital gains and dividends.

The S&P 500, used for comparison purposes may have a significantly different volatility than the portfolios used for the presentation of SIM’s composite returns.

The publication of this performance data is in no way a solicitation or offer to sell securities or investment advisory services.