47% of retailers expect sales to fall because of the coronavirus as shoppers move online

48% of retailers surveyed say they are in touch with suppliers about keeping merchandise flowing during the pandemic. A separate consumer survey shows no mad rush to buy more online, with 69% of shoppers saying they are purchasing the same amount as before and only 6% are purchasing a lot more on retail websites.

Q4 2019 hedge fund letters, conferences and more

CHICAGO, March 27, 2020— With the coronavirus upending how consumers shop and undermining their confidence, nearly half of retailers (47%) expect revenue to fall in the near term, according to an early March survey of 304 retailers by Digital Commerce 360. To mitigate the downturn and uncertainty—37% of retailers are unsure about the implications of the pandemic—48% of retailers have been in constant communication with their suppliers.

More Than Half Of Online Shoppers have Not Changed Their Shopping Habits

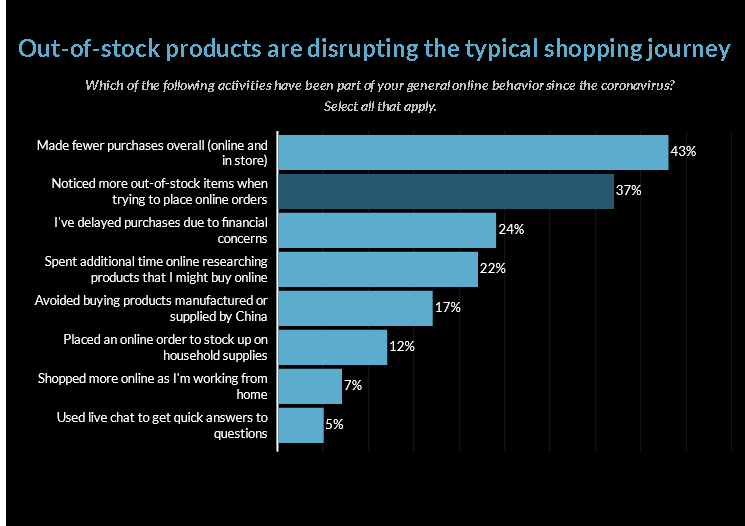

Consumers, meanwhile, say they are mostly shopping online as they normally do, with 69% of the 1,046 online shoppers surveyed in mid-March saying that their online shopping habits have not changed. 20% say they’ve placed a few more orders online since the coronavirus hit, 6% say a lot more and 5% placed fewer online orders on retail websites.

This survey data is only part of how Digital Commerce 360 has been covering the effects of the coronavirus on online retail. Exclusive retailer interviews and their experiences are spread throughout a series of online articles, such as the too-fast-to-keep-up sales of web-only retailer, Nuts.com.

Coronavirus: Impact On Online Shoppers

Impact On Retailers

About Digital Commerce 360 Research

Digital Commerce 360 Research (formerly Internet Retailer Research and B2BecNews Research) uses a unique journalistic approach and data-gathering process to establish worldwide relationships with retailers and collect benchmarking data and best practices in both business-to-business (B2B) and business-to-consumer (B2C) ecommerce. The data we collect is accessible to our members through online databases, annual analysis reports, and custom research.