The Broad Market Index was down 11.49% last week and 45% of stocks out-performed the index. With sales growth low and falling, an unusually high and falling average gross profit margin and corporate growth falling at a more rapid rate in each of the past 3 quarters, stocks are very likely to underperform bonds. With shares in December trading to the top end of a clear year-long downtrend, we were indicating to sell stocks and buy bonds.

Q4 2019 hedge fund letters, conferences and more

Now, after the recent 20% decline, shares are more broadly depressed. Active managers should be reducing fixed income exposure and buying good-quality well-capitalized companies with acceleration attributes. Choose those with shares trading at the bottom of their recent volatility range.

The stock market long-term downtrend will continue until corporate growth begins to rise again. Historically that is 6 to 10 quarters after the peak. We are 4 quarters into the decline now, so it is reasonable to expect stocks to remain in a downtrend until after the election.

The recent update of annual financial statements is 77% complete now and we see sales growth still lower at 6.7% down from 8.8% last quarter and 14.5% at the peak in 5 quarters ago (the third quarter 2018.) Frequency of improvements jumped for the second consecutive quarter, suggesting that the sales growth decline will reverse soon.

Use a rising-sales-growth and rising-gross-profit-margin screen for all your new idea searches and focus on good quality companies with shares trading at a discount price. Avoid high financial leverage.

Investors do not wait. Time to buy (not investment advice)!

NCR Corporation (NCR) $25.200 BUY this rich company getting better ▲20%

NCR Corporation (NYSE:NCR) has been a profitable company with inconsistently high cash return on total capital of 10.5% on average over the past 20 years. Over the long term, the shares of NCR Corporation have declined by 59% relative to the broad market index.

The shares have been correlated with trends in Growth Factors. The dominant factor in the Growth group is Net Shareholder Wealth which has been 79% correlated with the share price.

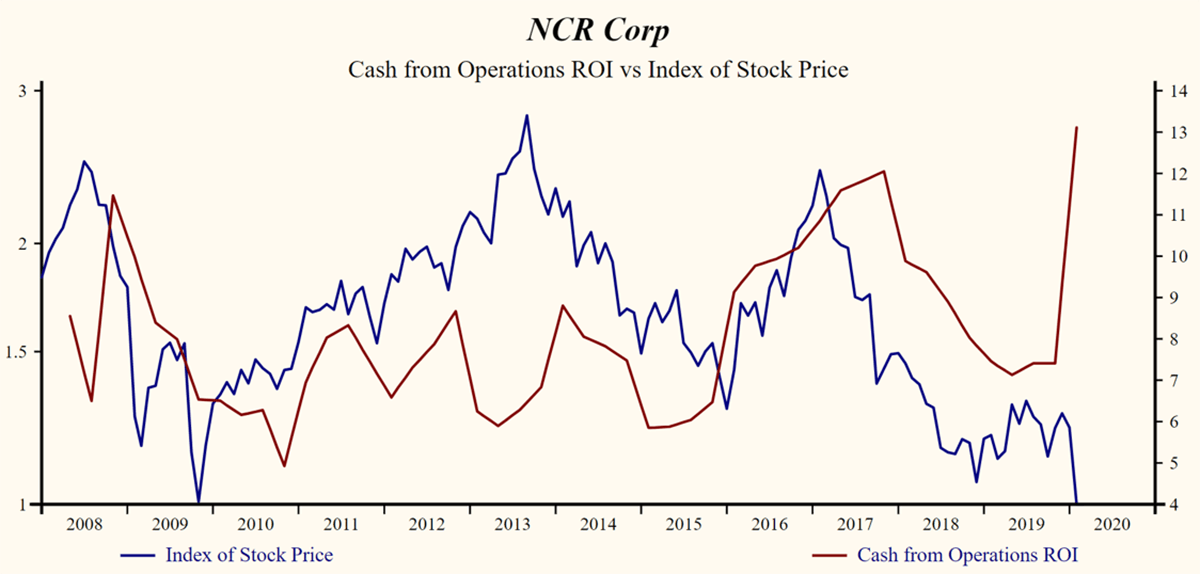

Cash from operations ROI continues to increase and has been historically correlated (39%) with the direction of the share price.

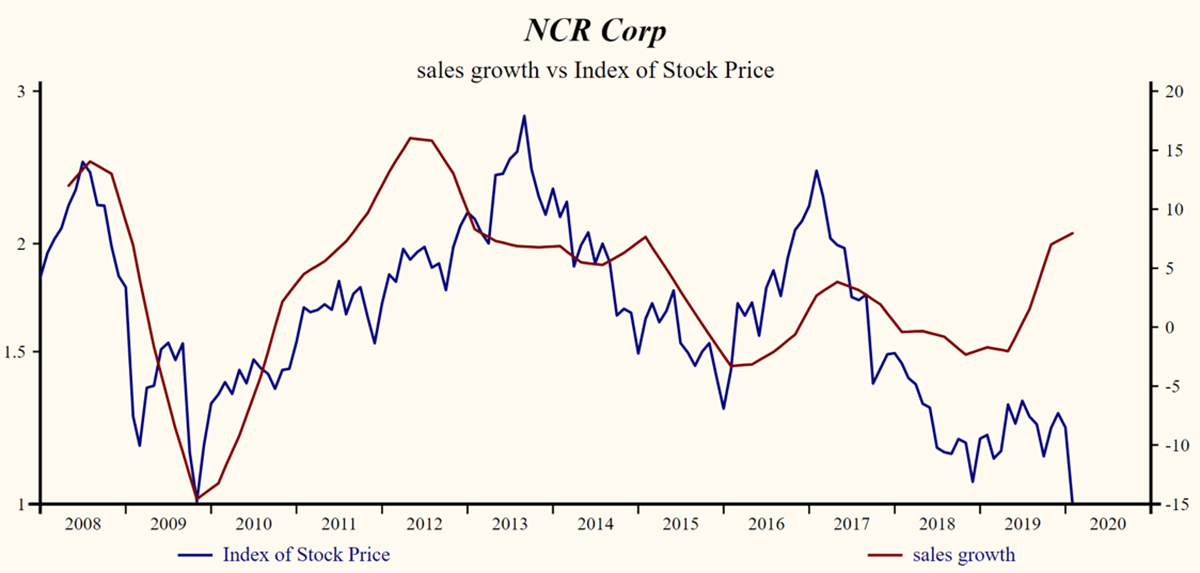

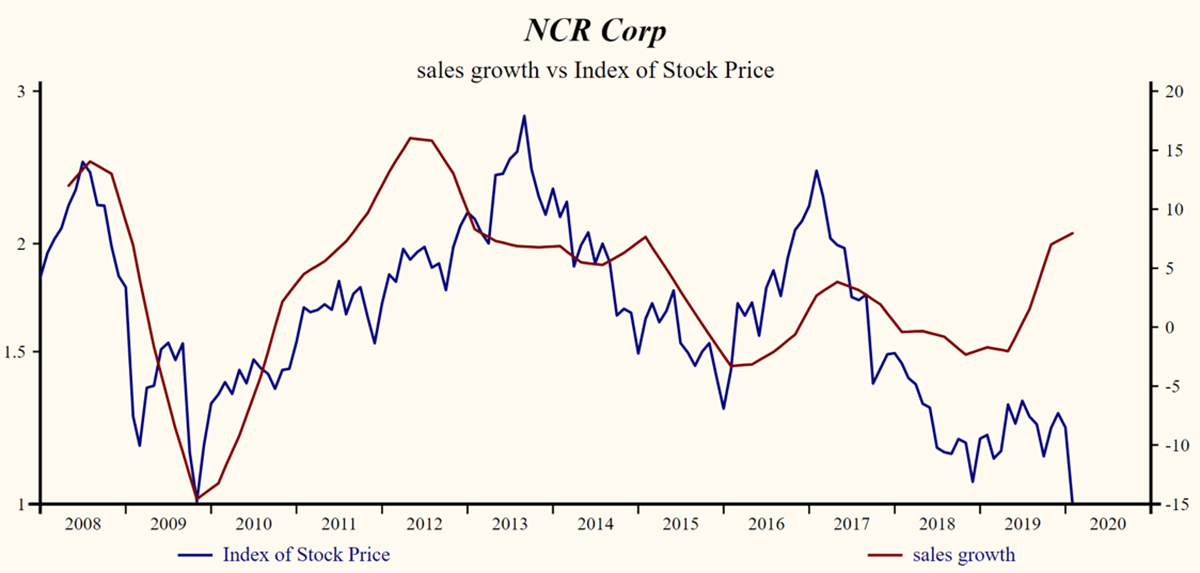

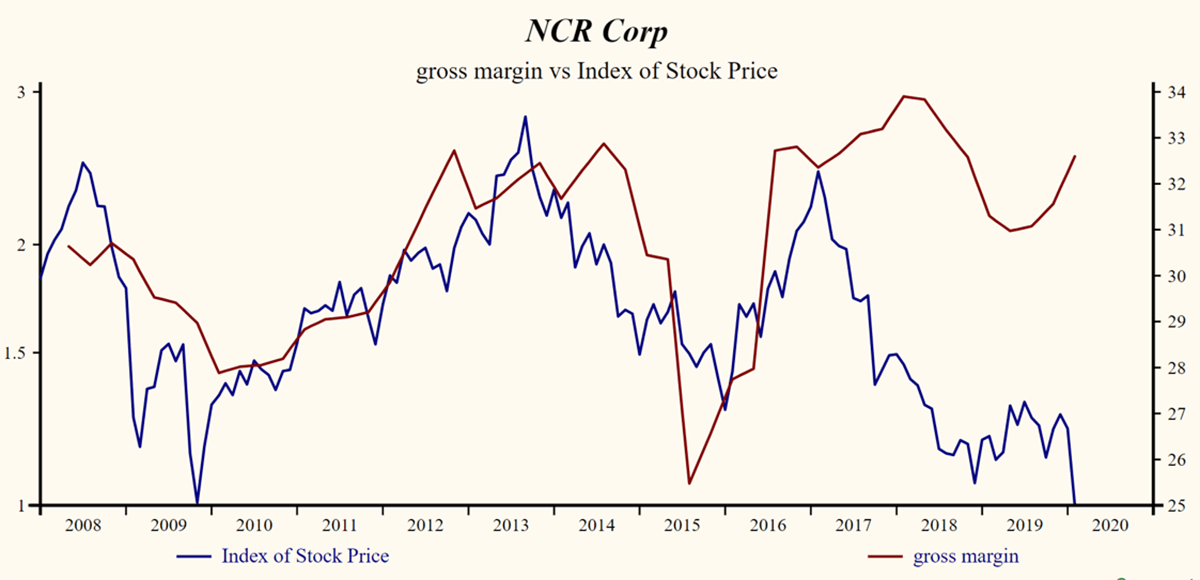

Higher sales growth has been 16% correlated with the share price with a one quarter lead. More importantly, the gross profit margin continues to rebound strongly and has been 61% correlated with the share price with a one quarter lead. Inventories are down and has been 64% correlated with the share price with a one quarter lead which increases the chance of a further increase in the gross margin.

SG&A expenses are low and stable in the record of the Index. That implies that the company has further capability to accelerate EBITDA relative to sales with lower costs. SG&A expenses are falling at a more rapid rate than the gross margin, producing a rising EBITDA margin.

NCR Corporation shares are trading at lower-end of the volatility range in a 14-month rising relative share price trend. The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.