ValueWalk’s Raul Panganiban interviews Crescat Capital’s Kevin Smith And Tavi Costa, discussing their trade of the century idea. In this part, Tavi and Kevin discuss the passive investing bubble and the ETF industry, the sectors which are not in a bubble, and their portfolio construction process.

Q4 2019 hedge fund letters, conferences and more

Raul Panganiban: Yeah. On the passive investing bubble isn’t for the market cap weighted indexes, or is that for the ETF industry as a whole?

Crescat Capital’s Kevin Smith And Tavi Costa

Kevin Smith: Well, it’s, it’s really for the stock market as a whole and certainly the ETF industry is part of that the market cap and weighted indices are part of that. You know, it’s interesting to look at you know, that’s why we we like to look at things like median stock prices and median EV to sales, for instance, in the s&p 500 is is something that is more than twice what it was at the tech bubble peak.

A lot of people like Tavi look at [inaudible] doesn’t it doesn’t include debt and the capital structure of the corporation will record corporate leverage today the you know, it’s it’s interesting because in the market cap weighted indices and ETFs that you know a lot of the companies that has been generated and that it become the most overweighted there are ones that have been generating strong positive free cash flow and and earnings and and maybe don’t have as much debt.

You know the the FANG stocks and apples of the world and yet and you know but they’re also record profit margins and and they’re they’re cyclical companies too and so it makes valuations appear lower than they really are when you when you have those market cap weighted giants skewing things and that’s why we like to look at things like median EV to sales which includes dead it takes, it takes margin out which are cyclical out of the picture of profit margins.

And you know, but you know but we don’t just look at that you know, we’ve got eight eight different indicators that valuation indicators that in their composite show that we are the most recently reached the most record overvalued stock market here in the in the US ever and you know, it’s kind of interesting because we say with China’s the biggest bubble in the world today the biggest credit bubble and currency bubble, and yet we also have the biggest, you know, equity stock market bubble here too and, and so, you know, it forces us to be tactical bears right now and and that doesn’t mean that we’re not going to be to be buying things but we think there’s much lower prices ahead.

Tavi Costa: And when you look at specifically to sector two, I mean, they’ll the brass of the market has never been so frothy and then you can look at that by separating into sectors and an EV to sales aggregate ratio or median as well and we see there is that in during the tech bubble you had the technology sector was probably predominantly the problem at the time and you have the communication surfaces sector was also a problem industrials is also problem back then, and then in no way or I should say.

06-07 was more not so much in the sector was more than banking, and some home builders were extremely frothy at the time but today when it looked at there’s eight out of 11 sectors today they’re at record valuations. In other words, they’re above the 90 percentile historically of the EV to sales in aggregate.

So, you know, we look at that it certainly has to do with that passive investing phenomena. And I think that it’s it’s it’s going to be brutal when when the whole when the whole thing unfolds, and I just started I think when if we get back to markets or work as a pendulum cynical back usually just for the median valuation, they go back even further than that. And that’s what we’ve seen throughout history when when, when there is a real market crash.

So I think that it’s the possibility for the client that is over the medium reversion which medium reversion just means another 50% or so declined, and I think it’s possibility for even further declines is very high. So especially given that that broth or that breath of of market frothiness in general so.

Raul Panganiban: And you know, with like the ETF market blowing up in different Yeah, like thematic ETFs, and everything’s being wrapped up in a passive way. Are we gonna start seeing those kind of just in a way like not really not as much launches going forward, and then more than consolidating and falling also?

Kevin Smith: Well, perhaps, I mean, I think that, you know, it’s interesting that that, you know, the few sectors that that aren’t in a bubble today its financials and, and, and health care and energy. And, and and so, you know that you know, each each you know, each cycle is different and that, you know, the housing bubble was was a financial sector bubble, the banking bubble, the subprime bubble here and it and, you know, we’ve kind of been through that war

Kevin Smith: So, when you talk about fighting the last war, I don’t know that I think that the banks here in the US and the, you know, in the brokerage industry and the, I don’t know about the investment industry, but the, the, you know, maybe not going to be as as you know, we’ll survive and what we’ve learned with the fit You know with the federal with the Federal Reserve coming in and the more likelihood of seen a fiscal response this time around I think we are going to try to save the financial system you know you know in a way that that will keep the financial system alive.

But it won’t prevent it from from will prevent stock prices from from declining you know by by a lot and and it adds it and you know, an interesting dynamic to the precious metals because you know what you talked about fighting the last war and we get this objection so much that aren’t aren’t precious metal stocks also going to get get slaughtered and silver and even gold when when the downturn happens and we’ve already started to see that over the past couple of weeks with with with precious metal stock prices coming down 25% or so already, and they were down.

Like more than twice as much as that in that in that little window in Late 2008. And so, but I think what’s what’s unique this time is the Fed is obviously much more eager to come in sooner. This whole idea of of them coming in after the repo crisis, actually they people thought they were going to preempt the downturn and it just created an even bigger bubble.

But you know, we got the panics 50% you know, rate cut, we could go or whenever it was, and then and then the wheels really came off. But, if this fit, you know, the point is, there is an alternative to to stocks, even on the long side, and we think it’s precious metals, and it’s not likely to have as big of a interim correction today as it did in 2008. Because the Fed is going to become coming in. We are going to have fiscal response and we think that’s just even more dynamic for the precious metals.

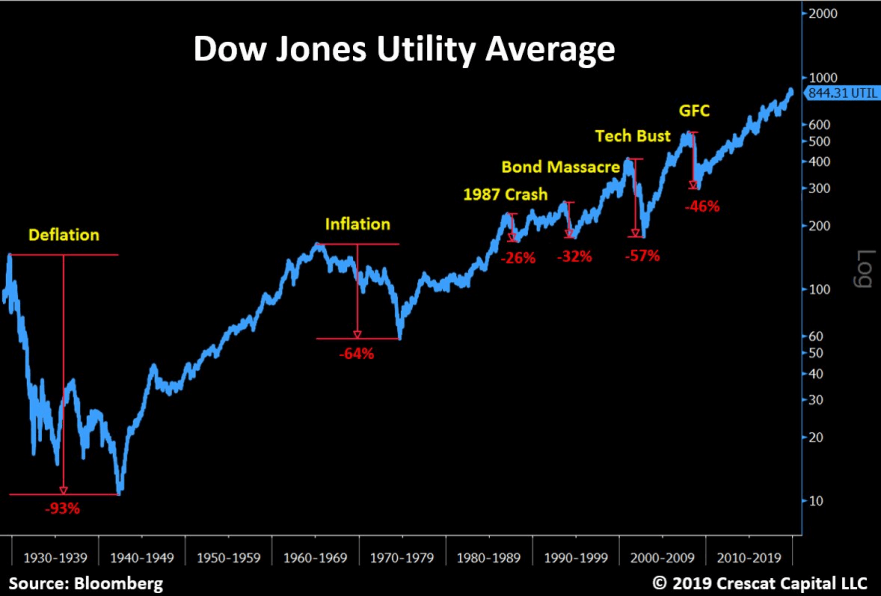

But the other the other industries are you know as Tavi said there’s eight of them that are record high historical valuations relative to their own historical multiples and you know, and and some people think they can hide it hide out in utilities for instance, because utilities are defensive sector utilities are actually the most overvalued sector in our model relative to their own history relative to fundamentals and mean just they look like Chinese companies, you know, just bleeding negative free cash flow, massive debt.

And people are, are, are, are chasing these things like their defences, well, they go down in every business cycle, they go down. In deflationary depressions, they go down and inflationary recessions and and we see massive dividend cuts ahead for the utility industries of people. Chasing because they they yield more than, than then treasury bonds, but we see dividend cuts ahead for that space.

Tavi Costa: Not also one thing we haven’t touched that is the private equity industry in general, you know that you have venture capital activity as being, you know, completely fading as being plunging. There’s a barometer from Bloomberg that looks at the activity is, you know, through volumes in dollar volumes, there’s an exit deals, there’s a number of deals, and you looked at that itself. 50% is June of 2019. It really started when you had that we work of failing situation, back in June and, and also, at a time when we had a tonne of the IPO, failing failing stories like Uber and Lyft. And beyond me, it was a big one as well at the time.

Now watch what’s going on with with with high yields and leveraged loans and you’re seeing, you know, again, the cost of capital rising, CEOs rising right now it’s getting costly to fund those those money losing businesses. Those are businesses that would never exist probably in other decades were the cost of capital was much higher, like in the 70s or so.

And that if you remember, I mean, what’s been kind of propping up the market has been buybacks and financial engineering. And I think that if yields begin to rise, as we’ve seen now, I think it’s going to be it’s going to be possible to to continue to prop up equity markets to levels that we’ve seen so far. So I think this is the beginning of a bear market for for equity markets overall. And but and not just not just for the public market, but private equity too.

And I think private equity started last year and now public market is catching up to that now, and you know, the cheap money is drying out very quickly here and I think that investors may or may is starting to wake up To the risks that we’re seeing that we’ve been talking about for some time now. This this volatility that we saw recently, it really was a regime change of for the equity markets. And I think it’s, it’s only going to get worse as we go through here.

Kevin Smith: Yeah, I was talking to a pension consultant recently in an eat and he was saying that, while the the, you know, the pension funds that I consult to me, they’re going to be fine because they own a lot of private equity. And, you know, it’s, you know, you know, it’s going to be it’s one of the most illiquid asset classes that there is and as the overall stock market declines and pension funds are, are hurting and you know, and people are trying to get the money out of the market some. That’s just one, one sector that we see a lot of problems ahead as the tide goes out.

Raul Panganiban: The private equity, also the private debt market, you’re seeing deteriorating conditions there, as well?

Kevin Smith: Yes. Oh, well, one of our short positions and the global macro fund is, you know, our put options on on high yield bond ETFs. And, that’s, you know, credit spreads, have corporate data has a record tight or close to record tight and, and, you know, that’s just another unwind that will be a part of the of this downturn in the corporate debts at record record highs. And for the US at large, and a lot of that has been a private equity buyout binge. You know, they’re, you know, that’s just part of the business cycle that we’re going to have to see turned down.

Raul Panganiban: Yeah, so can you tell me about your portfolio construction process? And how you manage all your ideas? And how do you wait your How do you position your best ideas?

Kevin Smith: Okay, so we have a bit the thematic process applies to all four of our strategies here at crest scat and and we, you know, we’ll wait are our themes based upon our conviction in those themes and we use now we use models to help us do the risk weighting on it’s not I wish it were our own model that we came up with but on that one, but we’re happy just to use the Bloomberg conditional value at risk model for that because it’s it’s it’s a convenient mathematical way just kind of different and unique from from how we how we pick the pick the securities in the first place.

We have limits that we that we adhere to, not that we can’t you know not that those are settings don’t, but we we try to be very transparent about about how we, how we set those those limits. And and it helps us you know, to it forces us to not get too out of control when it comes to taking risk.

Kevin Smith: But we are willing to take risk in order to see the return ultimate returns from our ideas come to fruition. And you know, and that means that we do we do take a little bit more risk than your average global macro hedge fund out there and even long short or long short fund. In our long only strategies like our large cap strategy, it also means when we’re when we’re as tactically bearish as we are today that we’re not we can have up to 50% cash in the portfolio and we do we have 50% cash in our long only equity strategy. So it’s a tactical, global, macro oriented long only equity value strategy.

And then large cap and we could, if we can’t find a lot of things to buy, we don’t have a lot of things to buy outside of three healthcare stocks, one tech stock and about about eight different precious metals, mining companies, you know, we have a lot of cash and we can we can do that. So, so it’s a genetic attribution, it’s using the C virus model, it’s been able to be flexible and tactical. And that’s how we manage risk.

Tavi Costa: Yes, through the quad models of fundamental and macro models that we that really helps to generate ideas but not so much in a systematic way. But But, you know, the models are key though they serve as a guide to really identify where we are in the cycle and but discipline is you know, plays an important role in the process too, with respect to signals that they generate and but both value a lot of the human power to To kind of disentangle this the market narrative overall and we work intensively on refreshing the portfolio.

I would say especially Kevin Smith does a lot of that, looking at, you know, each of the positions and make sure that that, that there are better models are in line with in terms of the the ranking of those positions that we have in terms of the model, that, you know, that, that they’re so supported by those, that those tools and in I tend to focus a little more in the narrative side of the macro side and, and that, you know, plays great as a team and, but identifying the big macro trends, as they said is huge.

And sometimes a lot of those are driven by crediting balances as we’ve seen in places like China today. But it’s finding a lot of the, you know, from a position perspective is making sure we still have a very directional play, but in a diversified way still, and so in other words, rather than just being long gold, as a You know, finding a lot of different ways that you can find asymmetric bets on precious metals overall, regardless if it is to a selective basket of mining stocks or call options on gold or call options and platinum when it when it’s the right time to do it, silver and so forth.

See the full interview with kevin smith and Tavi Costa on ValueWalkPremium