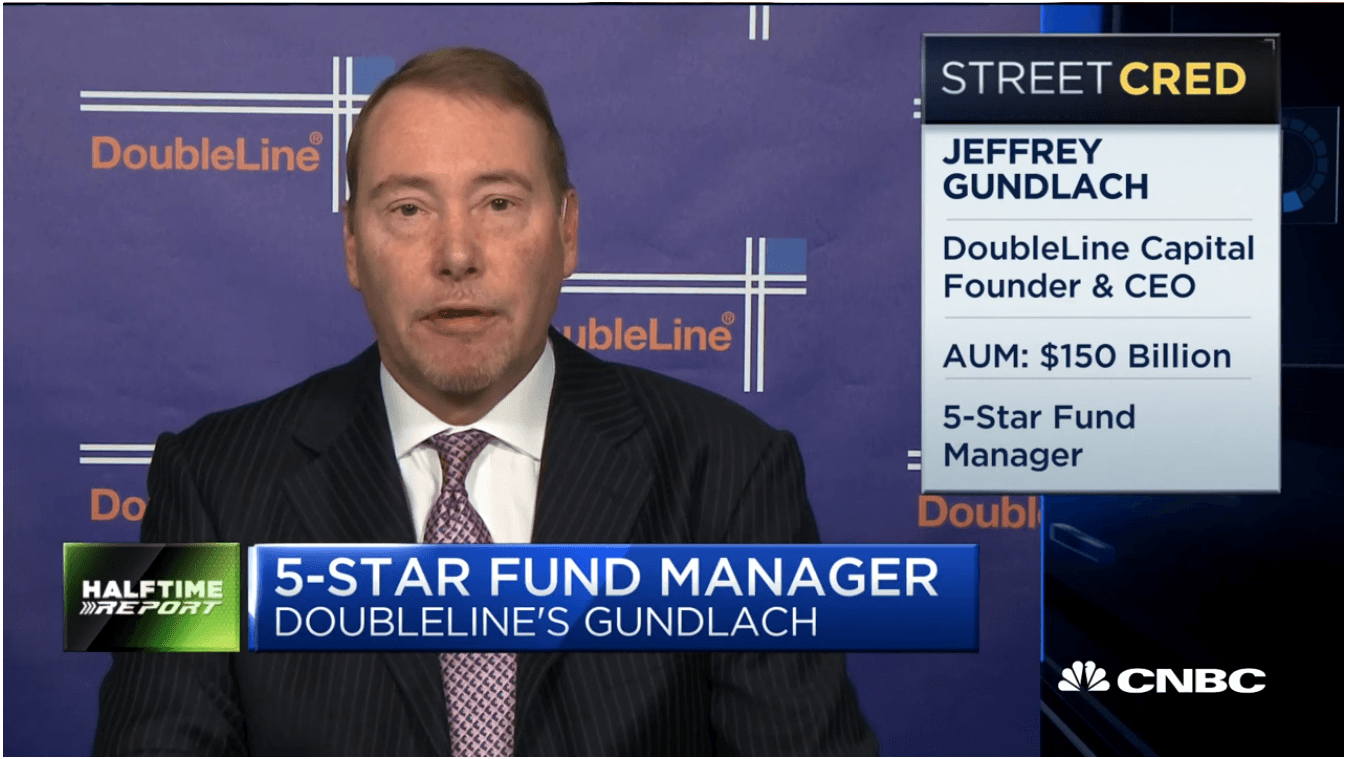

CNBC Exclusive: CNBC Excerpts: DoubleLine Capital CEO Jeffrey Edward Gundlach Speaks with CNBC’s Scott Wapner on CNBC’s “Fast Money Halftime Report”

WHEN: Today, Thursday, March 5, 2020

WHERE: CNBC’s “Fast Money Halftime Report”

Q4 2019 hedge fund letters, conferences and more

The following is the unofficial transcript of excerpts from a CNBC EXCLUSIVE interview with DoubleLine Capital CEO Jeffrey Edward Gundlach and CNBC’s Scott Wapner on CNBC’s “Fast Money Halftime Report” (M-F 12PM – 1PM) today, Thursday, March 5. The following is a link to video of the interview on CNBC.com:

Watch CNBC’s full interview with Jeffrey Edward Gundlach

All references must be sourced to CNBC.

Jeffrey Edward Gundlach on Fed Cuts but No Negative:

I think they cut 50 at the next meeting. In just two weeks, I think that's going to happen... I don't think we go to negative rates. I think Jay Powell understands that negative rates are fatal to global financial system. If we go to negative rates, there will be capital destruction en masse.

On Foolhardy:

And, obviously, the airlines are in free fall for good reason. And small business activity is going to contract. I think it is foolhardy to think anything other than this is going to take a major hit to short-term economic growth. Maybe grocery store sales will go up on a short-term spike. But all other kind of social activity is grinding to a standstill.

On Cut Was Justified:

I think cutting rates was justified, for sure. I mean, I don't like the way sort of in which it was done. It feels like, you know, they were between a rock and a hard place. I mean, the Fed – I think, when I say panic, the Fed in their most recent press conference, took a victory lap, talking about how they had finally reached a stable place in policy and that they could be on hold for the foreseeable future, maybe even the entire world. That we are in a good place. That policy rates were appropriate. And I don't know, I thought it was a little bit of hubris at this time.

Jeffrey Edward Gundlach On Ten-Year:

I think we are pretty near the low right now. I mean, maybe we get to 80 basis points on the ten year. And I don't really believe in the 25-basis point ten year, I think that's just extrapolating the move that already happened. I think that the short rates are definitely going lower. There is absolutely no upward pressure on short rates. But we are starting to see a steepening yield curve in a way that's noticeable.

On Caution:

You can't blame the Fed for cutting the rates 50. They are just probably going to have to do it again, because this situation doesn't seem to be doing anything but continuing. And you know, you see the press conference with the President and the physicians, on top of this coronavirus situation, and they are saying that they might have a vaccine in like a year, year and a half. So, nobody knows what is happening here. And so, caution is appropriate.

Jeffrey Edward Gundlach On Gold:

I turned bullish on gold in the summer of 2018 on my Total Return webcast when it was at 1190. And it just seems to me, as I talked about my Just Markets webcast, which is up on DoubleLine.com on a replay, that the dollar is going to get weaker. And the dollar getting weaker seems to be a policy. The Fed cutting rates, slashing rates is clearly going to be dollar negative. And that means that gold is going to go higher.

On Financials and Transports:

In terms of markets, I mean, I just think that the two sectors that are just falling knives are financials and transports. And I don't see anything that's going the reverse that until we get through the other side this valley of this sort of travel shutdown.