Whitney Tilson’s email to investors discussing the best three e-mails he has ever written; Why I’m even more optimistic and bought stocks this morning; Is it immoral for me to give investment advice right now?; Reader feedback and my replies; Volunteering to build a field hospital in Central Park.

Q4 2019 hedge fund letters, conferences and more

Tilson's Best Three E-mails

1) I continue to believe you can't have an opinion on stocks until you first have an opinion on how the coronavirus crisis will play out, so I spent the entire weekend collecting even more data and opinions... doing even more reading, thinking, and analyzing... and writing three long e-mails to the 3,400-plus people on my coronavirus e-mail list.

Here are links to each of them, with their subject lines:

- How we could solve the coronavirus crisis tomorrow; I'm buying stocks on Monday; Abbott Labs with a GAME CHANGER test; Vo; South Korea; New Rochelle; Positive trends in NYC and NYS; charts from the U.S. and around the world

- Reader feedback and my replies

- Is it immoral for me to give investment advice right now?; More reader feedback and my replies; Fauci says 200,000 deaths in the U.S. are possible – and why my guess is much lower; My views on experts; Nice e-mails

I'm biased, of course, but I think these e-mails are among the best I've ever written. I hope you agree!

Since I know many folks won't get to read all of them (they're 27 pages in total), I'd like to summarize some of the highlights...

2) Based on a number of factors that I outlined in my first e-mail (above), I'm even more confident in the conclusion I made in my report last week, "Why I'm Optimistic That We'll Soon Stop the Coronavirus"(posted here):

I'm cautiously optimistic that the measures we've ramped up over the past couple of weeks are having their desired effect, sharply reducing the coronavirus' replication rate.

If I'm right, the growth in the number of newly infected Americans is already slowing dramatically – and will soon plateau and then decline, which is exactly what happened in China's Hubei province...

This would translate into a range of 10,000 to 20,000 U.S. deaths this year. Every one them is heartbreaking, of course, but to put this in perspective, it would be a small fraction of the 37,000 from traffic fatalities or nearly 150,000 from lung cancer.

[Yesterday, I increased my estimate to 25,000 to 50,000 deaths. That's a big number, – but 75% below Dr. Anthony Fauci's latest estimate of 100,000 to 200,000 deaths.]As it becomes clear that we've controlled the spread of the virus and know exactly where the outbreaks are – which could happen as soon as a couple of weeks from now – we can start bringing our economy back to life.

If I boil it down, I'm betting on humanity – in particular, I think we'll be surprised by: a) the world's scientists (every day there are exciting new developments like this: France Officially Sanctions Drug After 78 Of 80 Patients Recover From COVID-19 Within Five Days)... and b) how people behave and treat each other during this time of crisis.

To be clear, however, I'm not sure I see the end of this crisis with any clarity whatsoever. What I do think I see, though, is the beginning of the end... the proverbial light at the end of the tunnel (which, fair warning, is sometimes an oncoming train instead!).

My increased optimism about our country and the world has important investment implications. Over the past month, I've shifted my family's total net worth (excluding the value of our only non-liquid asset, our apartment) from 15% stocks to 63%... and took that to 67% this morning.

Is It Immoral For Me To Give Investment Advice?

3) One of my readers forwarded one of my e-mails to a friend, who sent me this doozy of a response:

You [sic] comments are nothing less than disgusting. You want to make a profit out of deaths. Buying the right stocks of the companies that serve the death and seriously ill. You must be watching Fox news too much. You should be ashamed to even email this crap to anyone. Don't even reply to me!

I'm really glad to have the opportunity to address this because I heard something similar (though less harsh) from another friend. He said, in essence, that my giving investment advice – in particular, my ideas on how to profit amidst these turbulent markets – during this time of global trauma, suffering, and death is unseemly and even immoral.

Here was my reply:

Respectfully, you are completely wrong.

I have 5,000-plus paid subscribers and 37,000-plus readers of my daily investing e-mail.

Nearly all of them have seen their life's savings decimated and are rightly extremely worried if not outright panicked (including my mom!).

This is a typical e-mail that I just received:

Thank you for sharing such thoughtful and rigorous research and for giving many of us much-needed hope. I lost a ton of our family's net worth over the past month (we have two daughters 8 and 11). I know there are many others experiencing much worse but I feel I deeply betrayed them and did not keep them safe (by taking too much risk). After panic selling last week I will try to lean into the inevitable weakness over the next few weeks to attempt to make it back. Thanks again for giving me hope that I'll have a second chance.

This reader – and many, many others – are counting on me to rationally evaluate everything: the virus, the economy, what governments and business leaders around the world are doing and might do, etc., so that I can tell people what to do with their money.

Is the virus going to spread unchecked throughout the world, killing millions or tens of millions? If I thought so, I'd tell my readers to sell everything they own (and do the same myself).

Or should they sit tight?

Or have markets overreacted to the terrible fear and uncertainty today, creating the best time to buy stocks since the global financial crisis?

For now, I think the latter (though I reserve the right to change my mind, because the facts are changing very quickly every day).

I believe that if investors hold on or, especially, have the guts to add to their investments, they will eventually make back much of the hideous losses they've suffered – perhaps even fairly quickly (though, to be very conservative, I'd guess the S&P 500 won't surpass the all-time high it hit on February 19 until later next year or 2022).

It's not only my job, it's my duty to think about investing – yes, even during times like these!

Best regards,

Whitney

Reader Feedback And My Replies regarding giving investment advice

4) Here are some quick replies to other readers:

- One accused me of lacking empathy. My reply: If I have ever given anyone the impression that my heart isn't breaking for all off the trauma, suffering, and death occurring all over the world (in fact, right across the street from me!), then shame on me.

- Another accused me of being complacent. My reply: Are you kidding?! Just because I think I see the light at the end of the tunnel, the last thing on earth I am is complacent.

- Another accused me of "being negligent in inducing a false sense of security for your readers." My reply: Anyone who's feeling a "sense of security" right now has lost their mind, so I am certainly not advocating that. What I am saying, is that I'm bullish on stocks. But not because I'm complacent or feeling secure, but rather because I'm counting on Americans to be as scared as I am about how bad this could get if we don't do what's needed to stop the spread of the virus. But I have faith that the American people will do what's needed and therefore we'll get through this faster than investors expect – and that means stocks will go up.

- Finally, one accused me of being overly confident in my views and predictions with giving investment advice. My reply: I have indeed stuck my neck out, being slightly optimistic in a time of near-universal pessimism. But I have always acknowledged that there's a tremendously wide range of expected outcomes, so: a) I could be wrong (one reason I'm only 63% invested, not 100%!)... and b) I could change my mind at any time. I long ago learned the hard way the perils of digging in my heels, blocking out disconfirming opinions and data, and refusing to admit I was wrong and change my mind (if warranted).

5) One reader asked: "It sounds like you agree most of the U.S. could be back to more normal like by Easter?" I replied:

No! When I say that I think we'll have the virus under control within a couple of weeks, I am saying that it's no longer growing exponentially, threating to overwhelm hospitals around the country and likely killing hundreds of thousands of Americans.

Specifically, I predict that daily new cases (people testing positive) will peak. Here's what the chart looks like as of this moment:

To be clear, there will still be new infections, cases, hospitalizations, and deaths (deaths will be the last to peak because they are the furthest lagging indicator).

There will also be localized outbreaks in which new cases will not have peaked – those areas will need to ramp up/continue the strongest measures.

So even under the most optimistic scenario, we're a long ways from being out of the woods.

But I'm hopeful that in many parts of the country, some people will be able to start returning to work by Easter (April 12) (while being very cautious about social distancing, etc.). Then, maybe some restaurants that were closed can start reopening, but with tables spread further apart. You get the idea...

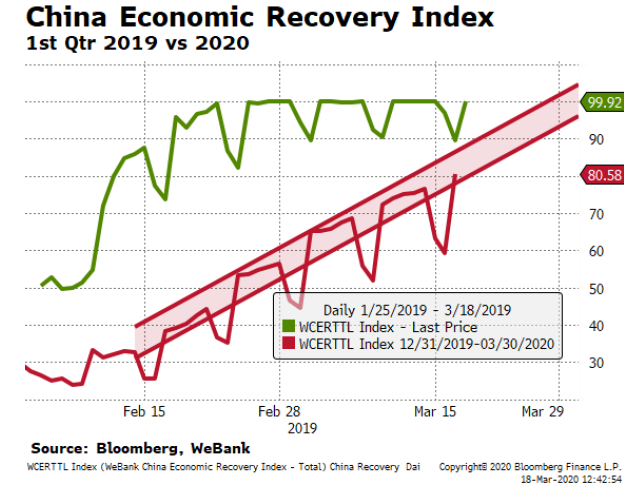

Look at China: their number of daily news cases dropped below 1,000 on February 19 – a month and a half ago – and the country is definitely reopening, but they're far from normal. Here's a chart of China's "economic recovery index" that a friend sent me:

The green line is 2019. You can see economic activity ramping up to baseline (100) as the Lunar New Year ends.

This year, economic activity was a massive 50%-70% lower in February, but has been steadily ramping up – but as of a week ago is still about 20% below last year's level.

That's actually better than I would have guessed, in light of their near-total lockdown, but 20% is still a lot!