The gold price climbed more than 3% after the Federal Reserve announced an emergency cut to the federal funds rate target. Although the yellow metal topped $1,640 an ounce, it stopped short of $1,650. Some have been concerned that consumer demand for gold would weigh on the price, but Goldman Sachs analysts say investment demand will far outweigh any reduction in demand for gold from jewelry.

Q4 2019 hedge fund letters, conferences and more

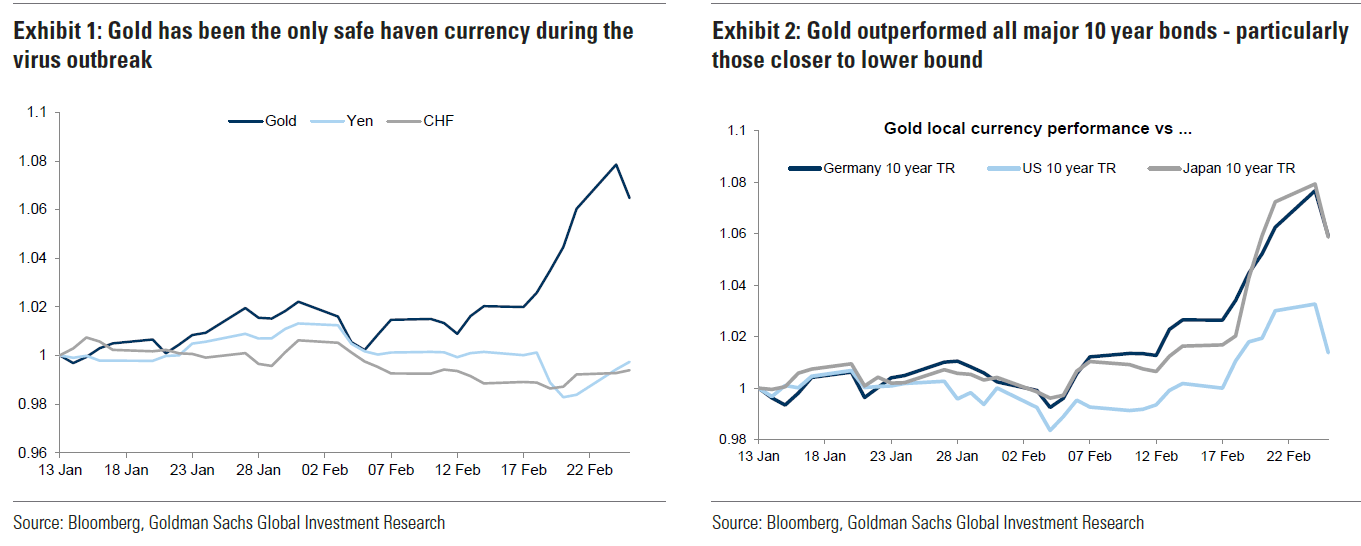

In a note last week, Goldman analyst Mikhail Sprogis noted that the gold price has moved higher amid the spread of the coronavirus in Europe and the Middle East. The yellow metal has been the only safe haven as traditional safe haven currencies like the yen and Swiss franc have underperformed it.

The gold price also outperformed other traditional safe haven assets like 10-year bonds in all major G10 currencies. The outperformance was especially large against German and Japanese bonds as the gold price climbed more in the euro and yen.

Further, central banks have very limited room to loosen monetary policies and reduce yields. He added that as rates get closer to their lower bound, gold looks more and more like the safest haven for investment demand.

Investment demand for gold greater than consumer loss

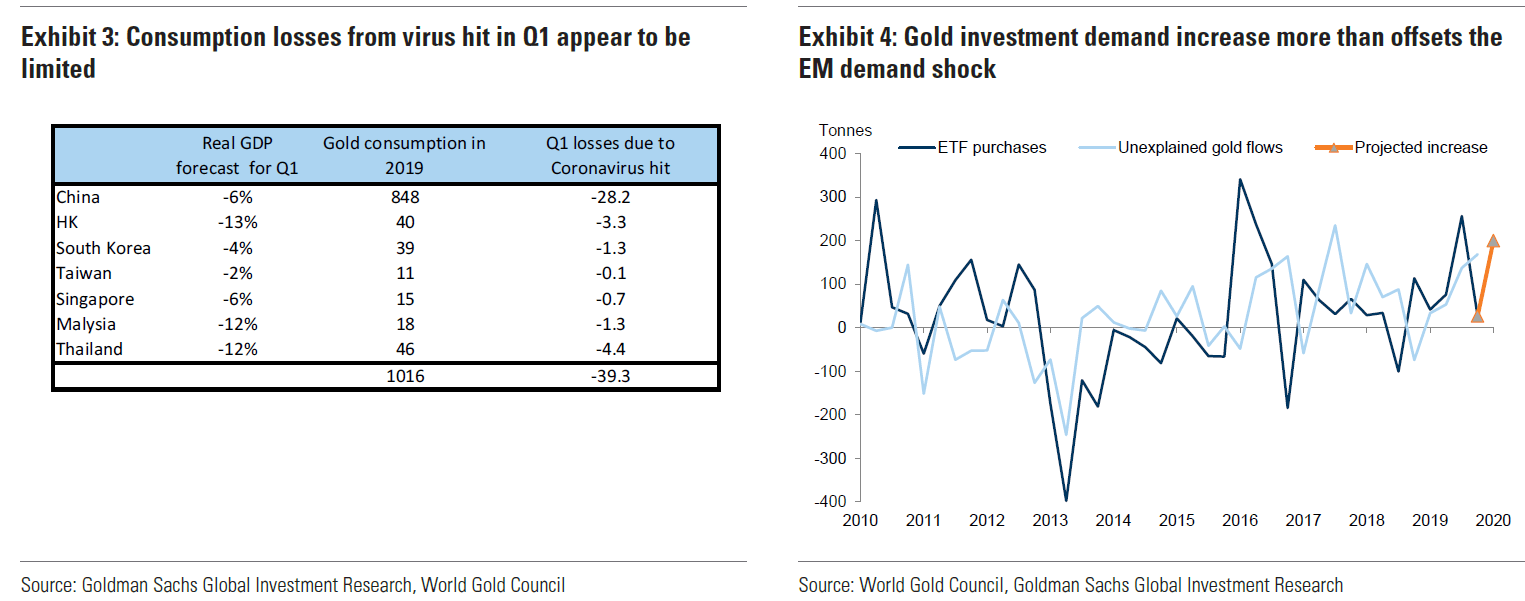

Sprogis said fear-driven investment demand for gold has been much greater than the consumer demand that was lost due to the negative wealth shock to consumers in emerging markets resulting from the shutdown of China. He estimates that gold purchases will fall 2.6% for every 1% to China's real GDP growth.

Goldman economists are forecasting a 6% contraction in GDP for the first quarter, which implies a loss of only 28 tons in demand for gold. Adding in the losses in consumer demand for gold from other East Asian countries suggests a loss of 40 tons.

However, they said gold exchange-traded funds have significantly boosted their demand for gold. Since Jan. 12, extra demand for gold from ETFs has amounted to 130 tons. If this shift continues, total ETF demand for gold could hit 200 tons by the end of the first quarter.

They add that the actual increase in gold investments could end up being twice as large as that due to non-transparent purchases of the yellow metal. Thus, the fear effect of the coronavirus more than offsets any shock to wealth due to quarantines in emerging markets.

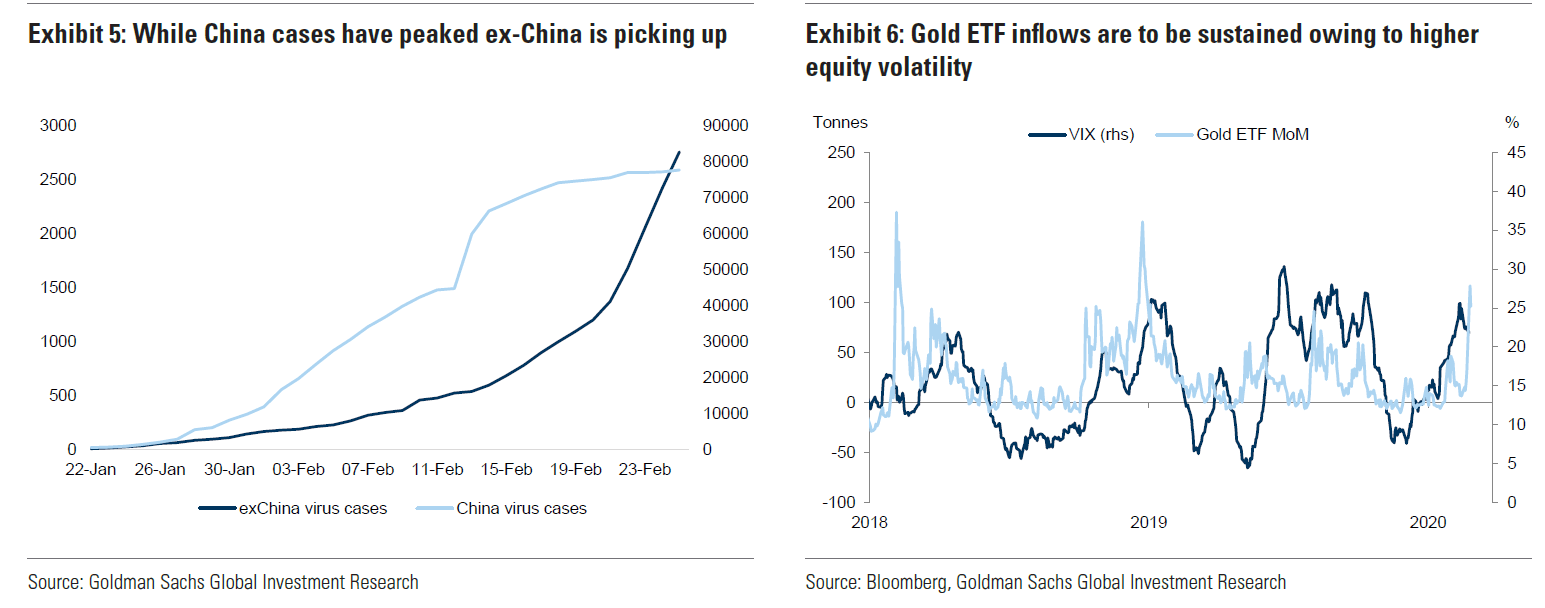

The number of new cases in China has been on the decline, but outside the country, the number of new casts is still climbing. Even inside China, the economy hasn't fully restarted, Sprogins added. The effect of the shutdown on global supply chains is only now becoming apparent.

Because of the pickup in coronavirus cases outside China, he expects global equities to remain volatile. As a result, he expects gold ETF flows to remain strong as funds are poured into ETFs in search of protection from equity volatility.

More support for gold demand

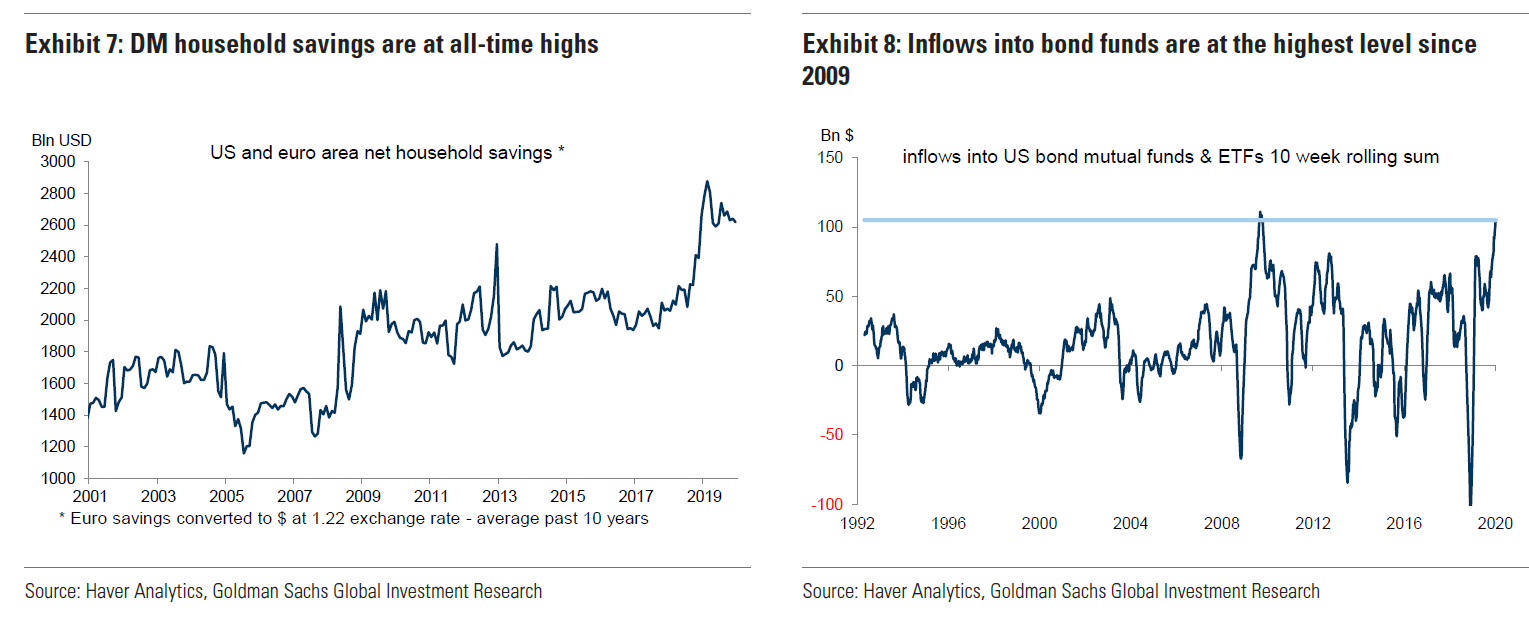

Sprogins also believes the large amount of savings in developed market households will further boost investment demand for gold. He noted that household savings are at historically high levels as capital expenditures remain low. The result is a shortage of places to invest.

He also pointed out that inflows to bond mutual funds and ETFs are at their highest level since 2009. These flows represent a good indicator of retail demand for defensive assets.

Meanwhile, the global supply of government bonds is restricted due to central bank purchases causing a deficit in high-quality assets. As a result, demand for portfolio alternatives like gold is also increased.

Gold versus bonds

The Goldman Sachs analyst sees gold as a more attractive investment option than bonds. He said the yellow metal has a greater capacity to rise during the next recession, while bonds may be held back by the lower bound on interest rates.

He also pointed out that gold serves as a better hedge against the risk of overshoots in inflation. Further, the yellow metal benefits from being exposed to growth in EM dollar GDP relative to mine supply. He believes this exposure creates a 5% per annum upward long-term trend in the gold price.

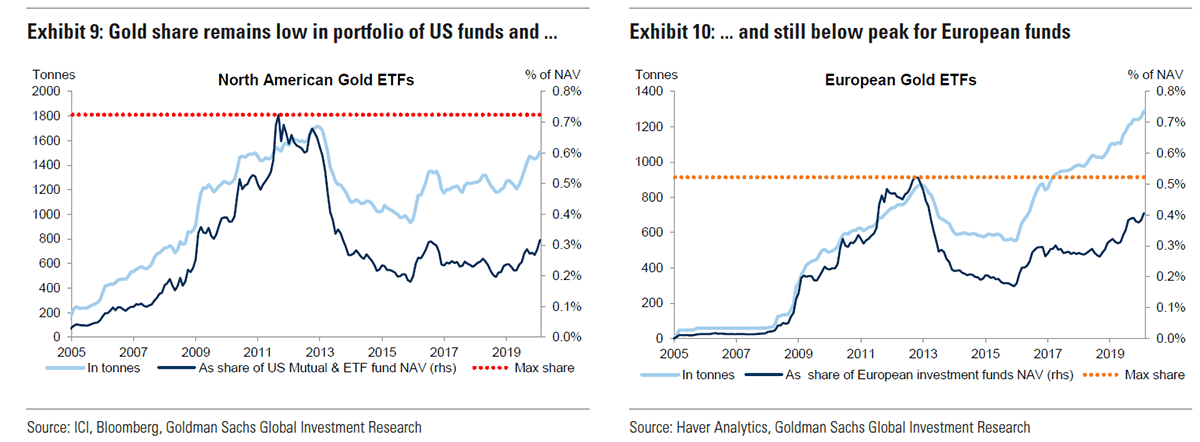

Sprogins also said allocations to gold in investor portfolios remains very low. The value of gold ETFs compared to the net asset value of funds in North America and Europe suggests that gold ETFs are valued at only 0.3% to 0.4% of the funds' net asset value. He added that this is far below the peak allocation in 2011 and 2012, so there is plenty of room for investment funds to rotate further into gold.

Gold price to $1,800 an ounce

The Goldman analyst sees the gold price at $1,700 an ounce in three months, $1,750 an ounce in six months and $1,800 an ounce in 12 months. These new targets compare to his previous expectation of a flat gold price of $1,600 an ounce.

If the coronavirus effect spreads into the second quarter, he believes the gold price could top $1,800 an ounce after only three months.