Obsession, Brand, and Why Amazon Might Buy Schwab

If Amazon got into the investing business, they would probably buy Schwab. Although the two companies on the surface appear to be dramatically different from one another, they both share an obsession with improving customer value and experience. Schwab, the original discount brokerage, was founded in 1972 and could be considered the first real customer-oriented brand. Schwab has a long history of mergers and acquisitions designed to improve customer experience, beginning with lowering trading costs, while Schwab’s total elimination of commissions resembles Amazon Prime’s free two-day shipping and Prime video streaming service: membership in one program entitles you to nearly unlimited value in another. It’s possible that Charles Schwab may have indirectly inspired the Amazon Flywheel; recall that Jeff Bezos was a relentless Wall Street hedge fund wonk before he founded Amazon.

Q4 2019 hedge fund letters, conferences and more

The Customer Obsession Flywheel

The Amazon Flywheel is a virtuous cycle centered on low customer prices, tight business cost structures, and zealously solid and convenient customer experiences. The flywheel is like a parlay bet. Using the financial wizardry of negative cash flow equity, Amazon was able to repeatedly invest in the infrastructure required to reduce the cost of serving customers while improving the quality of the customer experience.

Total customer obsession is the most difficult brand promise an organization can make. Customer-obsessed companies tend to morph their focus to meet customer needs, often entering completely new markets. Jeff Bezos is famous for saying, “We’re firm on vision but flexible on details.” It rings true.

It would be hard to call Amazon a bookselling business, a retailer, or even a marketplace anymore. Indeed, 58% of Amazon’s operating income was driven by AWS, it’s cloud infrastructure services unit, in Q4 2019. Similarly, Schwab began life as a brokerage business. It’s an advisory and offers ETF products, but it generated 57% of its 2018 revenues from banking. Schwab also offers some unique benefits that retail banks generally do not, like free ATM transactions worldwide. How very Amazonian.

Customer obsession demands a long-term view and great investor patience but can pay off big. It took twenty-odd years of losses, many false starts, and more than a few lucky strikes in new lines of business for Amazon to turn a profit. The Seattle behemoth is now as much a data and IT company as it is a retailer, evidenced by the fact that most of their business is managing mission critical data for other businesses.

Obsession Means Finding Better Quality Cash Flow Sources In New Markets

Cash flow is the lifeblood of corporate wealth, and the market is upstream from cash flow. Tim Abler of the Financial Times writes, “If you want to know what your future cash flow will look like, investigate where it comes from - the market”. Ambler explains that corporate boards “devote nine times more attention to spending and counting cash flow than to wondering where it comes from and how it could be increased.” His research indicates that companies that study the sources of cash flow are more profitable. Customer obsessed companies do this well.

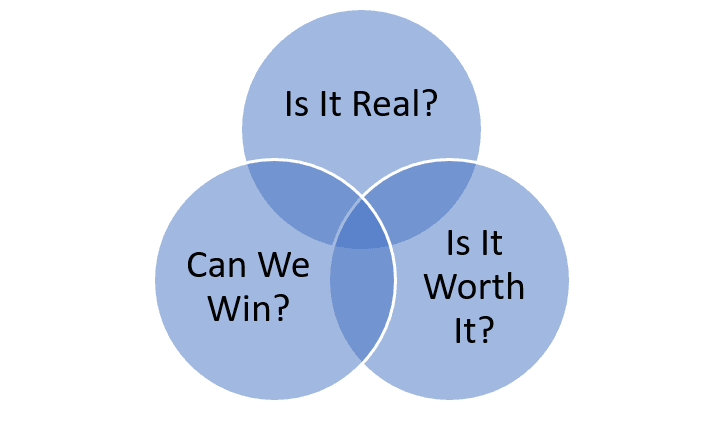

Dr. Steven Eppinger’s MIT Approach to Design Thinking program begins with three overlapping circles in a Venn Diagram. The circles represent questions posed in a 2007 Harvard Business Review Article about managing risk and reward in an innovation portfolio. The circles are labeled Real, Win, and Worth It (RWW), and they are a research framework for determining the viability of a business initiative. The center point, where the three circles overlap, is the sweet spot where a go decision should be made. The framework prompts a series of business questions under the following headings:

- Is there a real market for this product/service/business?

- Can we win and succeed as a business in this market?

- Are the rewards for accepting the risk of entering this market worthwhile?

Customer obsessed businesses find new markets, assess the competition, and decide to enter markets when the rewards outweigh the risk. For customer obsessed companies, this is the rigid vision that creates the flexible details.

Customer Obsessed Brand Building

Studying the quality of upstream sources of cash flow, or the market, is a function of marketing. Although marketing is the voice of the corporate brand, its chief objective is to understand and communicate with customers. Brand studies show that companies with strong brands outperform others in all economic weather. Framed differently, strong brand management is a leading indicator of future cash flows.

Brand strength is evaluated by perception and measured through surveys, observation, and comparison. Strong brands are constructed on brand pillars. When the individual components of brand pillars are measured, weighted, and compared, they are called perceptual equity drivers. Think of them as a preponderance of perceptions that creates differentiation. For example, a brand may convey a perception of quality, convenience, or innovation, which means the brand has strong perceptual equity driver scores in these areas relative to other categories.

Ideally, branded investments solidify perceptual equity drivers that will predict and explain the vector and intensity of cash flows. That’s possible because perceptions drive specific behaviors, like consumption, recommendation, or advocacy. Savvy brands measure the connection between perceptions and behaviors because that link profoundly affects profit, growth, risk, cost-of-capital, and share price. Bezos recently kicked off a shareholder call by referencing Amazon’s top ranking in the American Customer Satisfaction Index survey.

In the broadest sense, brand equity is a collection of perceptions about a company and its people, ideas, and conduct. So, brand is everything people know - or think they know - about your company. Experts at Core Brand estimate that 14-21% of corporate value resides in brand. There are many companies that hire smart people to create new ideas. Companies that obsessively conduct themselves for the benefit of the consumer are far rarer.

The next time you consider an investment in a company, consider its level of customer obsession. Are they committed to bringing the best to the most for the least? Do they have the people, ideas, and customer-focused conduct required to win in current and new markets? Do they have the juice to create new markets? If their behavior matches their rhetoric, it might be a smart investment.