Every new moment brings even more spectacular news. The last time I have seen the news cycle move so quickly was when Lehman Brothers collapsed. I still remember my disbelief on that Sunday night when the Fed announced they would not rescue the now infamous bank. Nothing before or after that moments captures my feelings as tightly as today with the COVID-19 Pandemic raging.

I want to address a few aspects and why I think the situation is a lot less dire today.

COVID-19 Pandemic not like 2008

Firstly, the economy is much more sound than when the financial crisis shook the globe. The entire economy will be grounding to an unprecedented halt over the next few weeks, but things are otherwise fundamentally sound. After Lehman collapsed, we were incredibly close to banking runs and the entire global financial system collapsing.

Today, the Government will need (and will provide) a massive stimulus to help workers over the next few weeks, after the virus is defeated the economy is in good shape could head for a gigantic V-shaped recovery. We can already see coordinated action from the Federal Reserve and other banks; next will come Congress’ turn.

Government to act strong

I favor direct checks to all Americans to provide those who need it most. I think the GOP and many centrist Democrats will prefer bailing out large businesses, but the public sentiment will not allow that and favour a much more direct and middle-class friendly approach.

Stocks are not nearly as cheap as 2009, but there are bargains after the massive plunge. Even though everything has been hammered sectors like energy got hit with a particular vengeance and seemed to be no brainier for anyone with a long term perspective. I am not a commodity trader, but I would add if there were a way to bet long Oil over 3-10 years it would be a great bet.

Indeed, I remember saying how going long Oil was evident in 09, but USO and OIL ETFs are inferior instruments for that purpose. I am not sure there is an option (if you know any, please do share) so I have opted for SPDR S&P Oil & Gas Explore & Prod. (NYSE: XOP). I bought some last week, and if it dips, I will buy some more. I do not buy individual stocks, if you do, so I guarantee there are some real diamonds in the rough right now.

COVID-19 Pandemic and treasuries

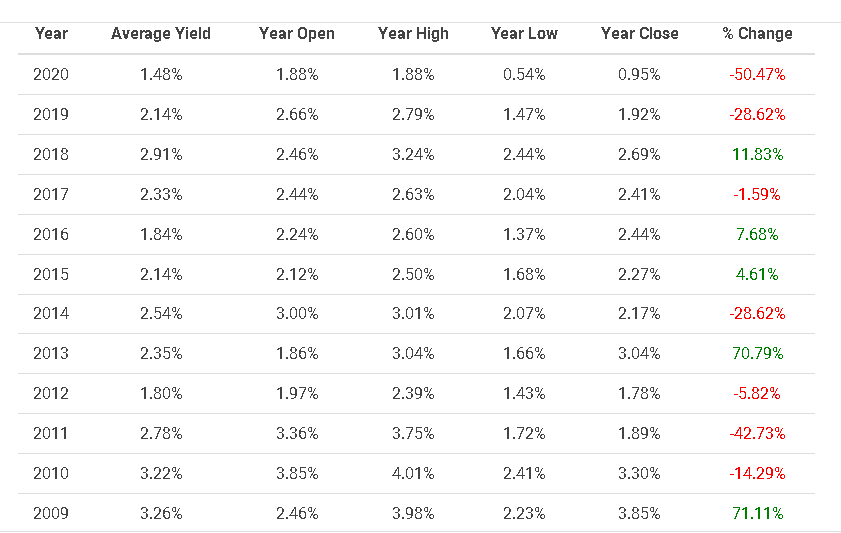

In terms of a relative basis, the ten years was close to (what in hindsight was a mouthwatering yield of) 4% in 2009. So I agree on absolute basis stocks were cheaper but money has to go somewhere and nowadays the ten years is below 1%. The alternatives are minimum for safe havens (crypto has shown yet again it is not one).

When comparing options, buying UST makes no sense unless you need to park cash and will need the money soon. Right now, you can buy a diversified portfolio of energy companies for $9.46 compared to $24.48 just a couple of months ago. The good thing with ETFs is you cannot go bankrupt.

Again, if you do individual security analysis and feel comfortable going concentrated that has merits too. In March 2009, I had no idea what banks would go bankrupt, but I know the sector was cheap so I bought XLF. I got fortunate with my timing, but my thesis was sound the financial system would survive in some form and XLF would triple in a few months.

The US Government should have acted sooner. I have been watching the COVID-19 Pandemic since early January and bought face masks in mid-January. I never expected things to get so dire so close to home, but I did realize we are reaching an inflexion point. As I tweeted recently, the Federal Government will be forced to act. We are now at that point.

As iv been telling ppl the past few days, the entire country is going to go on lockdown in the next few weeks via mostly uncoordinated announcements by state, local and business announcements – Trump can still pre-empt this all and declare a national emergency

— Jacob Wolinsky (@JacobWolinsky) March 11, 2020

You cannot time the bottom

Trump did not want to crash the global economy but its too late now that the economy will temporarily be shut down. Trump will finally move quickly to do what is needed on both the medical front and fiscal/monetary arena to solve the COVID-19 Pandemic.

Is this the bottom? I have no idea. I do know that in terms of fighting the coronavirus, we are not done yet, but are markets at the bottom? My guess would be no, but it’s no more than the flip of a coin. However, I remember in March 2009 how unusual the rally seemed – a few banks announced that they were profitable for a couple of months in 2009 and stocks soared. EVERYTHING ELSE pointed to gloom and doom. Indeed, Dr Doom himself predicted banks would be nationalized in a few months.

If you were trying to read sentiment to guess when the S&P 500 would bottom you missed out on the best gains: This has been the case with other rallies, and it WILL BE the case when markets pick up from this bear market. Maybe you are Jim Simons and have some crazy quant model to predict when to buy – if so great! For the rest of you, I guarantee you cannot spot when the upturn happens.

Human elements

The human element is very tragic and far more critical than stocks, which is why I favoured intense action early on. However, the good news is that America and the world are now taking this seriously, and we will defeat this disease. Also, it does seem that the COVID-19 Pandemic is dangerous for even the young. Still, it is not at the level of the Black Plague or even remotely similar to the fatality rates of more recent plagues like Ebola.

However, we are lucky that events like the COVID-19 Pandemic are considered shocking since we are so used to prosperity and good. Here is a beautiful passage my wife wrote about my grandmother who I was particularly close with and who passed away a few years ago. I will copy and paste as inspiration for those who think money is the most important thing to worry about.

COVID-19 Pandemic: We are lucky compared to others

Just to keep things in perspective: ppl are complaining about being quarantined / their kids being home from school when they as parents need to work. I can’t help think of our “bubby”, a holocaust survivor, who managed to survive the war by hiding in a barn and in the woods during the war. She was “quarantined”, kept inside a barn, hidden, forced to remain quiet, spending time picking lice out of her and her sister’s hair/ clothes. She didn’t know how long the “quarantine” would last. And she wasn’t sitting in her cozy house with the heat on, with videos to watch, or Skype calls to her family, or medicine to take when she felt ill. And she didn’t even have enough food to eat and watched her mother die of starvation.

Yet we have stock piles of food and food stores that are eager to deliver and get your business. She was forced into the forest for months in the winter at 1 point when neighbors reported on them to the Nazis. So crank up your thermostat, cuddle with your kids on the couch, give them an extra hug, and be in the moment. If you have health, you have wealth, as Rav Avigdor Miller used to say. Count your blessing and think about what a bunch of spoiled weaklings we are. If Bubby got through it, you’ll be just fine