Canon said that it will end all ties with HP should Xerox take control of the U.S. office equipment maker, after Xerox launched its tender offer for HP last Monday, offering $18.40 in cash and 0.149 Xerox shares for each HP share. Canon CEO and Chairman Fujio Mitarai told Japan’s Nikkei news service that the company will end its 35-year relationship if Xerox succeeds in taking control of HP.

Q4 2019 hedge fund letters, conferences and more

HP, which buys laser printer components from Canon, is among the Japanese manufacturer's biggest customers, generating nearly 14% of its sales. But a takeover by Xerox would create a formidable rival to Canon's own office equipment business, with roughly double the Japanese company's annual sales. "The foundation of this partnership is, above all else, built upon a relationship of trust between the top management of both companies," including HP CEO Enrique Lores and Tuan Tran, head of its printing division, Mitarai said in a written interview with Nikkei.

"At the same time, it also involves a great deal of technological exchange gradually established over the decades-long relationship." Mitarai added that such a relationship "is not something that can be built overnight."

HP has said it will respond to the tender offer by Monday, having previously advised shareholders against Xerox’s offers, saying they undervalued the company "by failing to reflect the full value of HP’s assets and its standalone value creation plan." The board previously added that the part cash, part stock offer "principally offers HP stockholders something they already own."

Meanwhile, Xerox followed HP by expanding its slate of directors for a proxy contest over the takeover bid. HP increased the size of its board to 13 on February 27 and gave Xerox 10 days to advance an additional nominee. Xerox increased its slate to 12 and said it will seek to repeal any bylaws HP passed without shareholder approval after February 07, the last time the firm amended its bylaws.

What We'll Be Watching For This Week

- How will Pattern Energy Group shareholders vote regarding the company’s sale to Canada Pension Plan Investment Board at the meeting today?

- Will Macquarie Infrastructure raise its bid for Cincinatti Bell after Brookfield Infrastructure matched its $14.50 per share offer?

- How will shareholders of USA Technologies react to a shareholder proposal requesting permission to seek disgorgement of Hudson Executive Capital’s profits from its investment in the company?

Bonitas Research Short JinkoSolar

Bonitas Research took a short position in JinkoSolar, alleging the China-based solar power equipment manufacturer reported "fake sales and profits," and engaged in value destroying related-party transactions. In a report, Bonitas said it believed JinkoSolar had been "fattened up" with five separate equity issues and $2 billion in net debt "only to be stripped of value by insiders."

In particular, it noted that in October 2016, subsidiary JinkoPower, which Bonitas called JinkoSolar's most valuable asset, was sold to chairman Xiande Li at a discounted $455 million valuation. But one month later JinkoPower received an independent appraisal valuation of $720 million, accompanied by a PRC insider equity raise at a $788 million valuation, the short seller said. "We believe that JinkoSolar Holding… exists for the sole purpose of developing PRC assets with JKS’ cash that were disposed to Chairman Li at a significant discount to market," Bonitas wrote.

Bonitas also claims JinkoSolar faked sales and profits in its SEC reported financials, omitted $42 million in liabilities from its balance sheet, and engaged in multiple undisclosed related party transactions "to benefit insiders at the expense of minority shareholders." The short seller predicted that the value of the NYSE-traded stock would fall to zero.

In a Thursday press release, JinkSolar said it "is aware of and has carefully reviewed the short seller report," adding that it denies the "unsubstantiated statements and misleading conclusions" in Bonitas’ report. Despite the publication of the report, the company’s shares closed up 3.2% on Wednesday.

Chart Of The Week

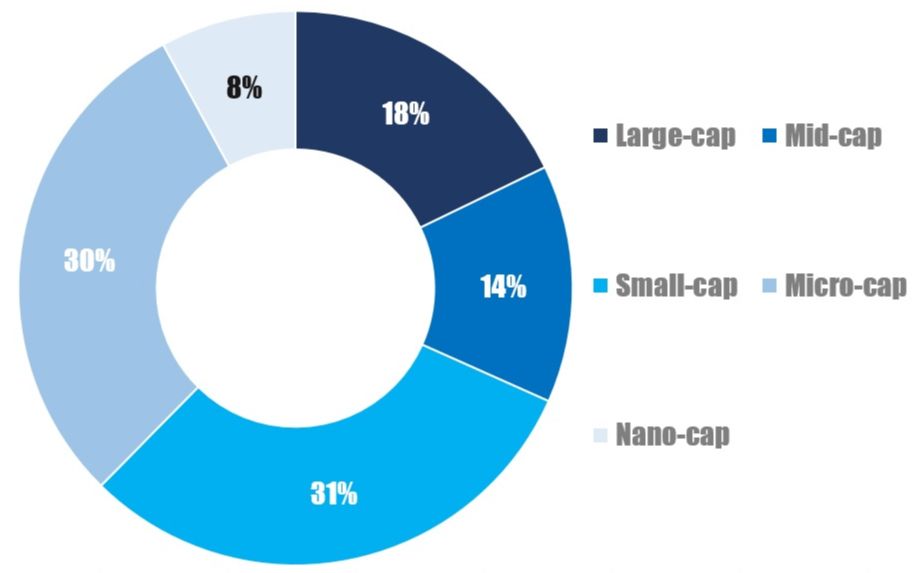

The amount of companies that have been publicly subjected to demands by investors with a primary or partial focus on activist strategies between January 01, 2020 and March 06, 2020.

Note: rounding may lead to summation errors.