In this video, Sven Carlin discusses how you can spot fraud and how to avoid losing money when it comes to investing. You probably will not need this for immediate application to your stock market portfolio, but is something that might save you a lot of money in the future. The key when it comes to investing in stocks the key are earnings. However, from the top line – revenue, to the bottom line – earnings, there is a lot in between.

Q4 2019 hedge fund letters, conferences and more

How To Sport Fraud And Avoid Losing Money

Transcript

Good day fellow investors. This will be an introductory video on how to spot fraud, how to avoid mistakes, how to avoid losing money when it comes to investing, how to avoid misrepresented earnings. This is part of 60-70 page report that I have published on my free stock market investing course.

So if you haven't enrolled there, please enroll in the description of the video below. So let's immediately start with the video discussing what it is all about how to spot those fraud things, how to simply stay away from that, and I'm going to call Rudyard Kipling here six honest serving men, they will tell you all you know, so what, why, when, how, where and who, apply common sense, and that's all you need.

We're going to discuss simple steps that will keep you out of trouble, avoid losing money, how to spot those signs and then of course, it's always about the cash. One great movie that I urge you to watch online or on Netflix is the China hustle discussing Muddy Waters that will use some examples, which is a hedge fund that looks for those frauds, then finds them short the stock and discloses the fraud. It doesn't always work well. So it's very interesting how the market works. But it's a very interesting story, and each investor should look at that movie. It's really a movie that I recommend.

Accounting tricks

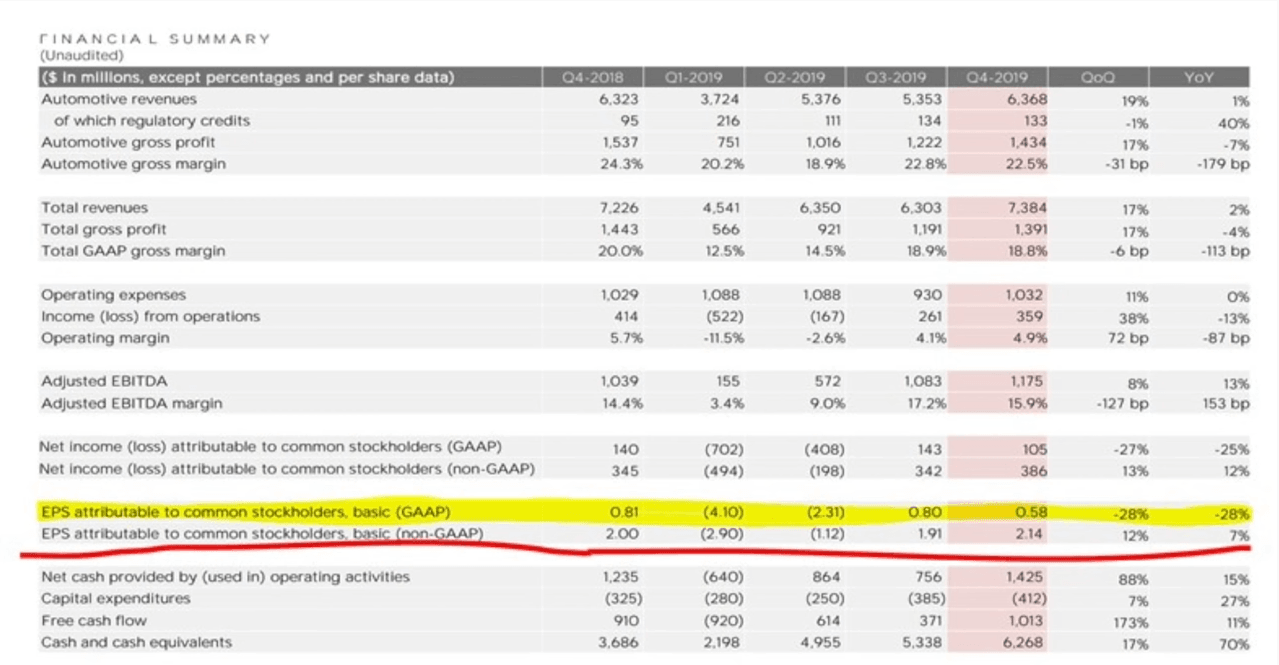

So let's start. Now, how to identify problems? Well, the first issue is aggressive accounting GAAP versus non-GAAP principles, generally accepted accounting principles. And this is just an example from a car company that I will use, not to mention it so I don't get sued, but look at the earnings per share attributable to common stockholders basic GAAP. So in each of the last quarters, the earnings to common stockholders are much lower when you use generally accepted accounting principles, and then adjusted non-GAAP those are much, much better and everything looks extremely well.

So that's something investors that something companies use to make the situation look better. And then it's up to you whether you want to believe the company or stick to generally accepted accounting principles. Just an example here to see how companies improve what they do, how they can work on their earnings to make it look differently.

Why is this so important? Perhaps it might not be fraud, it might not be utter fraud, but this is the most important thing. Fraud you go to jail misrepresentation of earnings you get defined by the stock goes down anyway. And if we listen to Warren Buffett avoid losing money, then it's simple. If you see something fishy, you simply avoid it, buying a stock is like buying a second hand car, you see a car and then you have to start researching asking the question, what is odd with the car? What doesn't work so that you don't buy something wrong and avoid losing money?

Examples of scams

Let's go on with the examples. So the key is okay, everything starts with the revenues. And then you have a lot of things in between till you come to the bottom. This is again, this car company that I'm using public investment in the relationship data. The revenues in the fourth quarter was 6.3 billion. However, the net income was 100 billion gap and 400 million non gap so that's a huge difference.

And there is a lot in between adjusted EBITDA, what are expenses, what are not expensive, what goes into expenses, what are earnings, what are capitalised earnings, and you see how just small changes there have a big impact on the bottom line. So you always start looking at the top line and then you see, okay, where does it lead? Of course, this is something very important.

Channel stuffing

Just the sentence down below, you can surely read it, read and it tells you what you need to know. Of course you can't reat it because it's always in small print. So read the footnotes of the accounting report. It tells you what goes into the accounts, what detracts from that revenues and how it works.

Example, stuffing the channel a company that recognises revenue they call a customer tell them oh buy in December so that we can charge record the purchase in December so that we can have better growing revenues for our investors and we'll give you a discount. And at some point, something like that works but only as long as you have investors to keep buying your products at the discount. ahead of time. This is something you have to be very wary about and there are a lot of ways you can check that. Days accounts receivable, are those days accounts receivable going up? If yes, then you know there is something fishy might not be, might well be.

Revenue tweaks

Going back to the car company I was discussing accounts receivables in a year are up 40% sales are up just 1.1% for the comparative quarters. So okay, that's something that one has to look into before investing. The key is to compare the change in accounts receivable with the rate of change in revenue, ideally over the number of quarters over a number of years.

Ask yourselves are there any significant differences in the rate of change? Do you know what's going on? Why is the allowance for doubtful accounts sufficient to cover future collection problems? Look at the accounts receivable days for each quarters and ask yourself if any trend is steadily improving or getting worse. So just a little bit of ideas on what to do when it comes to this. The key is, as always, as I mentioning, don't lose money over the long term.

Other examples percentage of completion accounting, estimation future revenue streams, discount rates, pension obligations, accounts payable, inventory management, and all of that you can read more in the report on my investment course because it's a 70 page report, and I can't make two hour videos to explain everything in detail.

Cash is king

Cash is always King as we said. Turnover is vanity, profit is sanity, but cash is king. So this is an example for Muddy Waters - RINO stock, cash and cash equivalents after they got the hundred million from their IPO quickly went down over the coming quarters. They had access cost and earnings that went also up 10 times so something that they added to the earnings, who knows based on what. And then if you look at the total current assets, those are pretty stable 240-270-270, total assets also growing, everything looks fine.

But if you look at the advances for inventory from 34 to 64 million, and you see that there are a lot of oddities, and the result was a simple growing to zero as Muddy Waters exposed then. Another company that gives a good explanation of accounting, acquisition accounting is BMG Foods. It's a company that acquired all those brands about the foods, grew fast and in 2015. I analysed it and I said it's not going to end well and I was wrong for a whole year.

The stock was 36 when I analysed it, I wrote an article about it. And then it went up to 50% up only to come to the inevitable because the accounting was aggressive, a lot of goodwill, which makes things tricky and risky. Goodwill also something you can read and I will make a special video about it so please subscribe and click that notification bell if you're watching this on YouTube.

Avoid losing money in scam companies

Capitalised costs another company, you again going back to the car company. So cumulatively capitalised costs, so they are putting it as an asset, even if it is a cost, 5 billion on property, plant and equipment of 10 billion again, an oddity that you just I'm not saying anything, I'm not implying anything. You just need to check the long term how that is going on. Always management check the management.

So what are they doing wrong? Is it that they are focusing on growth no matter the cost, they're trying to pretend everything is good or they're really tackling down issues and problems. WeWork, Adam Neumann is getting 1.7 billion to leave the company he ran into the ground. So always check the gurus, the heroes, what are they doing.

Insiders resigning

They will do things just to keep their story alive for as long as it goes because the paycheck they get is not that much related to the long term investing success that other investors get. Also check their management, how many resigning CFOs are there, Tesla had a lot of them which might mean nothing but might also mean something. With auditors. It's very simple. auditors are paid by the company to audit the company. They have standard procedures and they will very rarely find something so forget about auditors.

Look for a lot of things pension fund assets being changed to liabilities, high leverage, poor cash flow, increase of debt, receivables taking longer and longer to pay back, dividends not supported by earnings, doing something just for the market, leverage going up, look at the governance, taking underlying profits, no real profits, they exclude the bad news adjusted profits, deferral selling costs, etc. Irregular, exceptional items turning up each year for the adjusted earnings and look to being optimistic about the amount owed by customer and its recovery.

Avoid losing money investing

Another short by Muddy Water is an excellent example, TAL Education, they discuss how it was a fraud. They are taking money out of the company but it doesn't matter. The stock is just exploding and now has a price earnings ratio 336 no matter what they found, so it's about the market always, but we as long term investors really have to be careful and better avoid questionable things. Another thing management related party transactions always see whether the management has your best interest. Tesla owners have settled the claims for saving, bailing out Solar City, bailing out Elon Musk, his private loans, etc.

So, Elon Musk is still in court for that and we'll just see how it works. So this is something that you might not be able to apply immediately. But if you read the report and look at such things somewhere down the road in the next 10-20-15 years, I hope this saves you once a lot of money by not investing in some risky stock, and that's why we have made this report and we have made this video.

Investing is about accumulating knowledge over time, and then doing the right thing when it's necessary to be done not doing a lot of things constantly acquiring knowledge and then buying big when the time to buy big and saying no when there is a time to say no. Thank you for watching and I will see you in the next video.