Banks’ Machine Learning/AI-based Equity Algorithms Are Not Only Gaining Traction but Generating Alpha, Says New TABB Research Study

Banks are Competing in a “Survival of the Fittest” Race for the Top Spot on Investors‘ Algo Wheels

Q4 2019 hedge fund letters, conferences and more

AI In Sell-Side Equity Algorithms: Survival Of The Fittest

NEW YORK, LONDON, March 12, 2020 – In new research published today, TABB Group says the sell-side is in a “survival of the fittest” race for the top spot in buy-side clients’ algo wheels.

According to New York-based senior equity analyst Michael Mollemans, who wrote "AI in Sell-Side Equity Algorithms: Survival of the Fittest," the sell-side's artificial intelligence (AI) equity algorithm ecosystem has expanded after years of development work to a point where significant AI-attributable excess returns have finally begun to be realized in the past two years.

As automated performance measurement applications like algo wheels are driving broker selection decisions, competition to build better, faster, smarter algorithms has become a war of attrition. "Now more than ever," says Mollemans, "not keeping up means you’re going backwards, which is why we believe consolidation in the algorithmic trading space will continue, just as the sell-side overall continues to consolidate.”

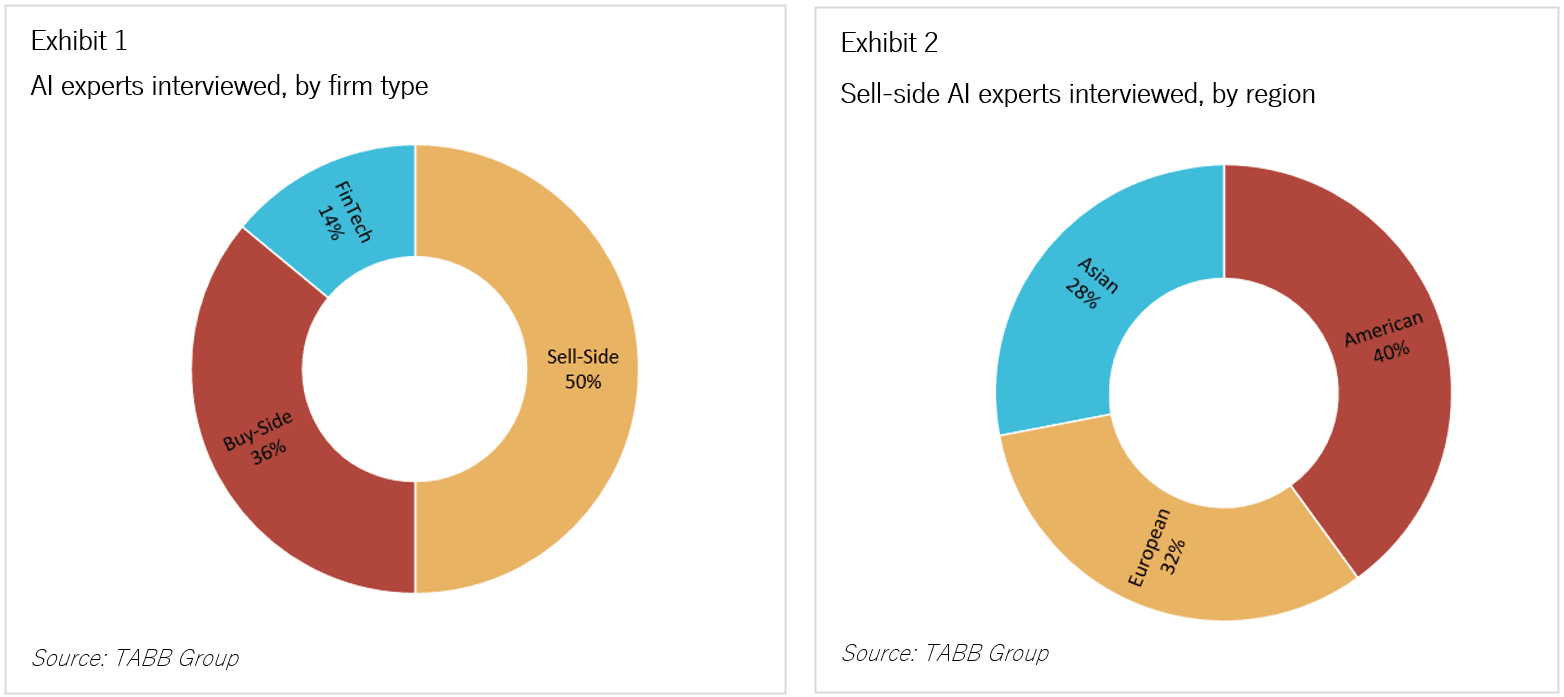

TABB Group interviewed 50 AI algorithm experts from the buy side, sell side, and fintech vendors and produced AI algo ecosystem case studies on U.S., European, and Asian banks. The 27 page, 9-exhibit report, created to help traders gain depth and breadth of insight and a better understanding about what’s happening “under the hood” in their AI algorithms, covers eight key areas:

- How sell-side firms must stay ahead of rapidly evolving, AI-algo data science

- Improvements in performance attributable to AI models

- Leveraging economies of scale and development budgets to support advanced AI ecosystems

- AI applications focusing on scheduling, price and volume prediction, spread capture, strategy and parameter selection and venue-routing decisions

- “Explainable AI”

- Turning a “black box” algo into a “clear box”

- Utilizing proprietary data unavailable to competitors

- How oversight and governance procedures will become more sophisticated

Whats Next For Banks In The Global Algorithmic Trading Space

Moving forward, Mollemans believes that only a few banks will dominate the global algorithmic trading space in the next five years. “The most significant challenge is the changing science of AI and the growing investment needed to transition from traditional algos to AI. Some of these AI-based techniques, like t-SNE, were not even in existence 10 years ago. In fact, 41% of sell-side firms interviewed launched their client-based AI algos only last year.”

Among the 50 AI experts interviewed, 50% are on the sell-side, 36% buy-side and 14% AI- services fintech firms (Exhibit 1). Forty percent of the sell-side AI specialists are from American banks, 32% European banks and 28% Asian banks. All of the sell-side experts are with large- and mid-size banks, as smaller firms are not yet offering AI-driven algos (Exhibit 2).

"AI in Sell-Side Equity Algorithms: Survival of the Fittest" is available for download by TABB equities, fixed income, derivatives and fintech clients and pre-qualified media at https://research.tabbgroup.com/search/grid. For more information or to purchase the report, write to [email protected].

About TABB Group

With offices in New York and London, TABB Group is the international research and consulting firm focused exclusively on capital markets, based on the interview-based, “first-person knowledge” research methodology developed by Larry Tabb. For more information, visit www.tabbgroup.com.