The Broad Market Index was down 14.98% last week and 44% of stocks out-performed the index. Capital markets are performing well as the tools, laws and procedures introduced during the financial crisis are providing liquidity and allowing markets to clear. During the 2008 financial crisis it was a sharp drop in liquidity (cash-to-trade) that caused markets to stop functioning and securities could not be sold at any price. However, we witnessed a V shaped recovery in 2009 for several reasons.

Q4 2019 hedge fund letters, conferences and more

We May Not See A 2008 like V Shaped Recovery

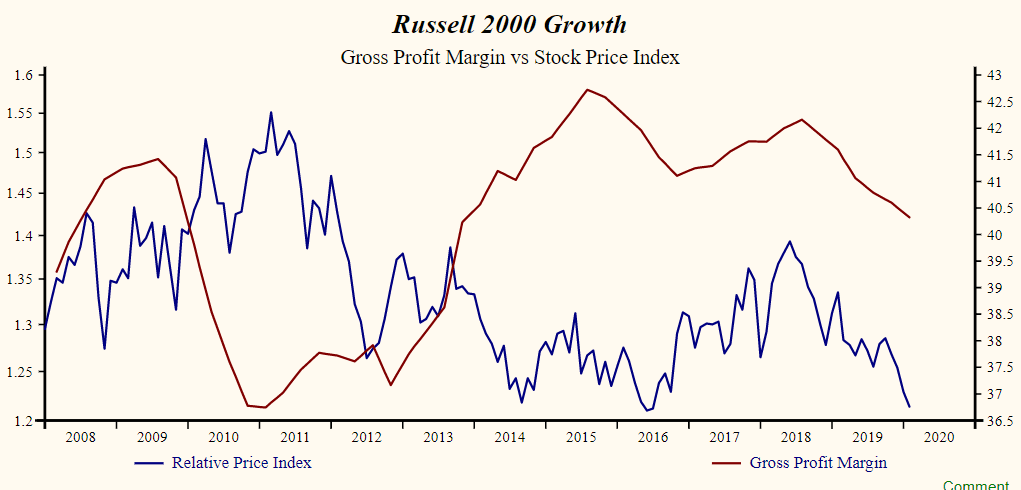

That threatened financial failure for a broad range of companies, and, after few legal and bureaucratic changes, the Fed flushed the system with $Trillions of cash. At the end of 2008 companies where recording a broad increase in the gross profit margin as financial stresses forced the reduction of inventories and the unwinding of receivables-both as loans to customers and as securities (CDOs).

Companies became cash rich as the financial markets recovered and in 2009, we witnessed a V shaped recovery for US stocks as the crisis eased and the global central banks went to extraordinary lengths to push up asset prices. It is becoming clear that the current crisis will not be resolved in the same way.

Last week the functioning market was evident. Although treasury Bonds staged their largest one-day advance in history on Friday, it was only government guaranteed debt that participated. It is becoming clearer that the crisis will impair cash flow of families and that fixed obligations like rent, mortgage payments and taxes will be deferred as people assess their short-term cash.

Increased risk of default caused yields on mortgages (MBS), Real Estate Investment Trusts, banks, utilities and Municipal Bonds to jump even as Treasury Bond yields dropped. That is a functioning market, but the impact was a steep drop in prices for securities that traditionally have been defensive in a falling market.

Any Place To Hide?

Back then there was no place to hide in 2008, many ETFs and funds traded to a discount to their portfolio value (NAV) as the rush to sell pushed prices lower. Even our MINT cash alternative where, with an ultrashort duration, we have no default or interest rate risk, the ETF on Friday traded at a 1% discount to NAV.

Here is where we remember that past share prices do not forecast the future. The big drop in share prices this month takes the decline relative to bonds to 54% since the September 2018 peak. In the financial crisis drop and the tech bubble drop, shares declined over 60% relative to bonds. Since corporate growth is still high and falling, the Fed response to the crisis will not have the same effect as it did in 2008 and the recovery from here will not be V shaped.

Important To Be In Action

Although it is reasonable to wait for the next round of corporate growth numbers (completed end of May), accounts with large cash positions should be using this rare stock-price rout to buy stable growth companies with improving growth attributes and strong financial condition.

The Buy-Everything (passive) approach that has been more popular with investors over the past decade is failing now and, with a very uncertain path to growth recovery, it will fail in the future. If the crisis drags on, a broad swath of companies will deal with negative cash flow when access to financing is constrained and cost of financing is increasing.

These zombie companies will impair broad market indexes like never before. For now, we need quality and acceleration. Those were plentiful after the 2008 financial crisis. Now they are few.