Quant investing strategies have grown in popularity in recent years, but that could be about to change. One firm points out that several issues are causing distortions in correlations, causing many factors and quant models to perform strangely. This has made stock picking a lot more complicated, and with the recent change in momentum among equities, things could get even more difficult.

Q4 2019 hedge fund letters, conferences and more

Macro factors are more important for quant investing

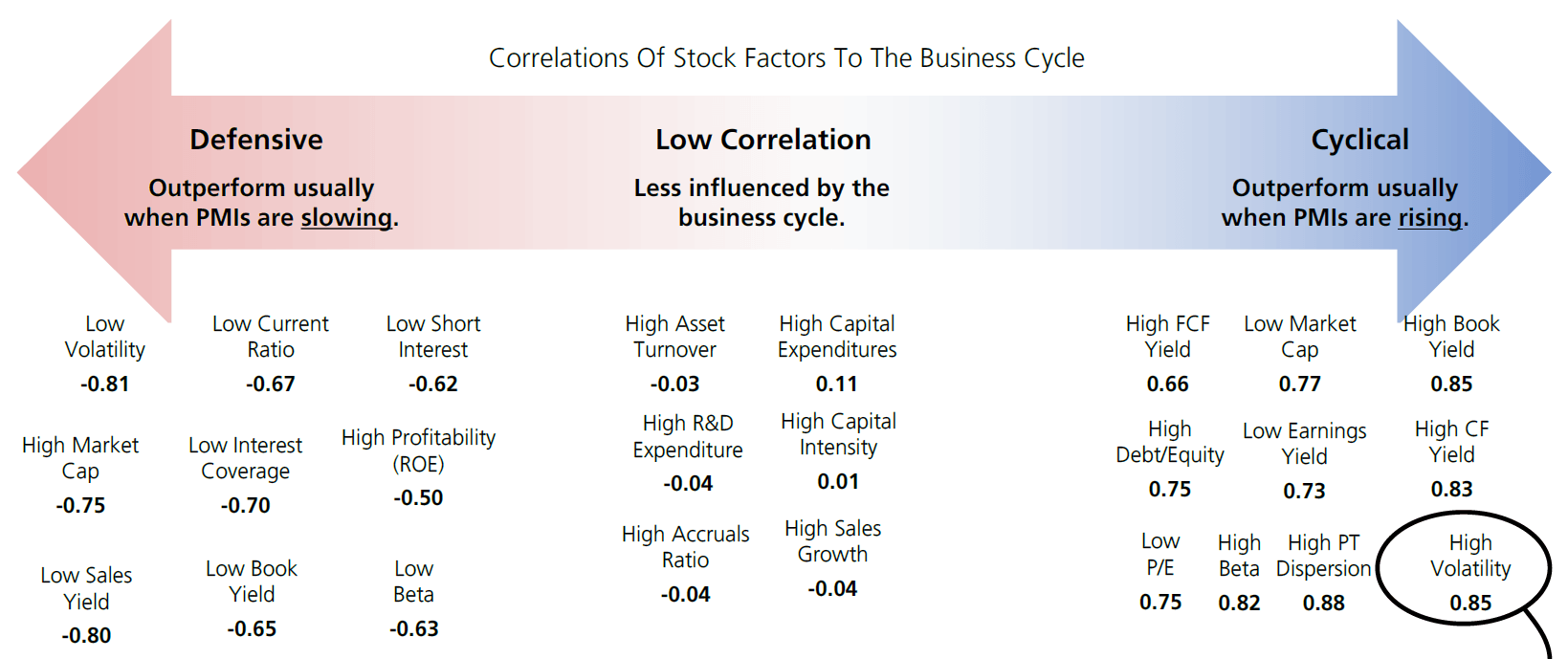

In a report dated Feb. 25, UBS strategist Francois Trahan and team looked at the affect of macroeconomic factors on quant investing. They said macro forces have had a greater influence on quant investing factors since the financial crisis. In fact, most of the stock-picking factors are strongly correlated to the business cycle. However, they weren't before the global financial crisis.

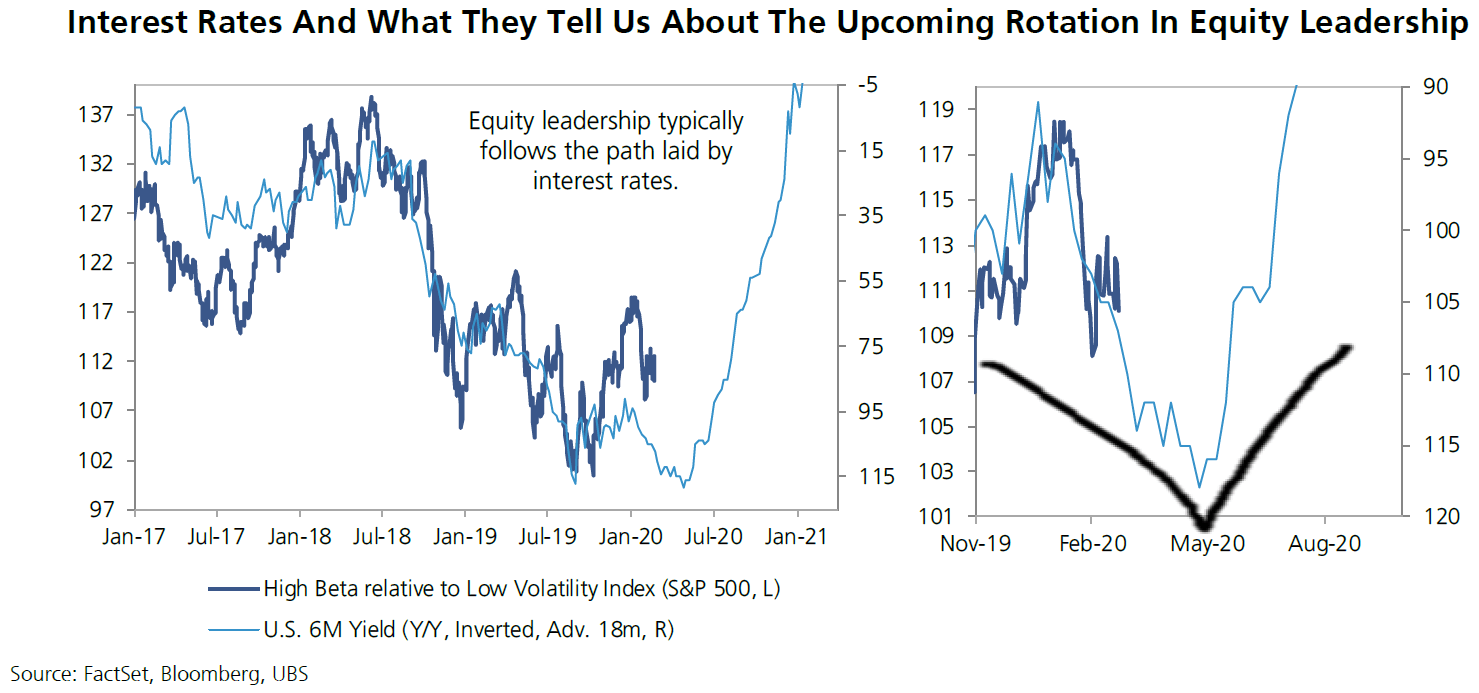

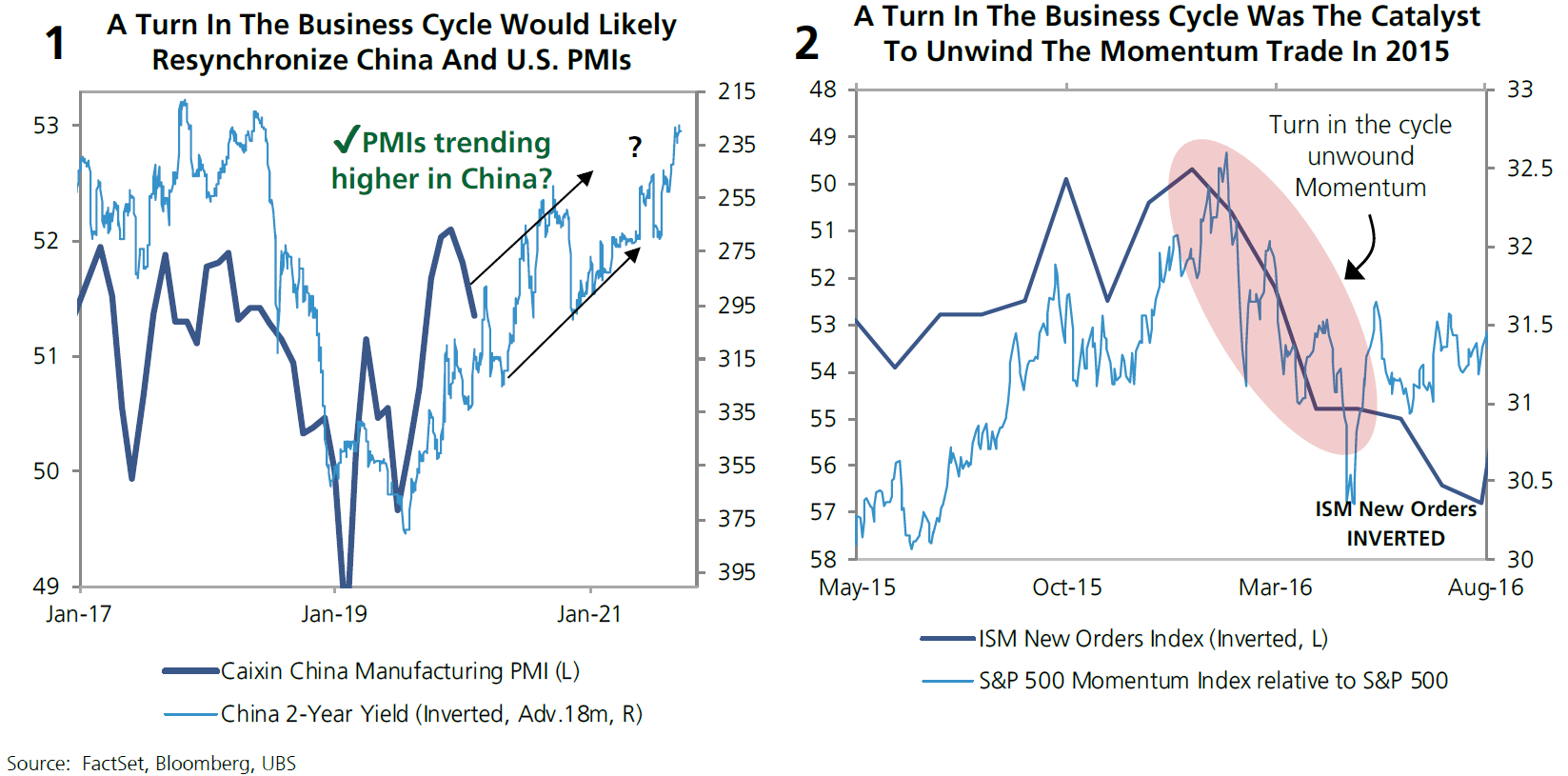

Whenever there is an inflection point in the business cycle, there is a change in leadership and other behaviors among equities. The UBS team found that one way to help time an upcoming inflection point in the cycle is to look at where interest rates have moved in the past.

Based on recent changes in the interest rates, they expect a bottom in the PMIs sometime around the second quarter. With that bottom, they predict a leadership change in the equity market.

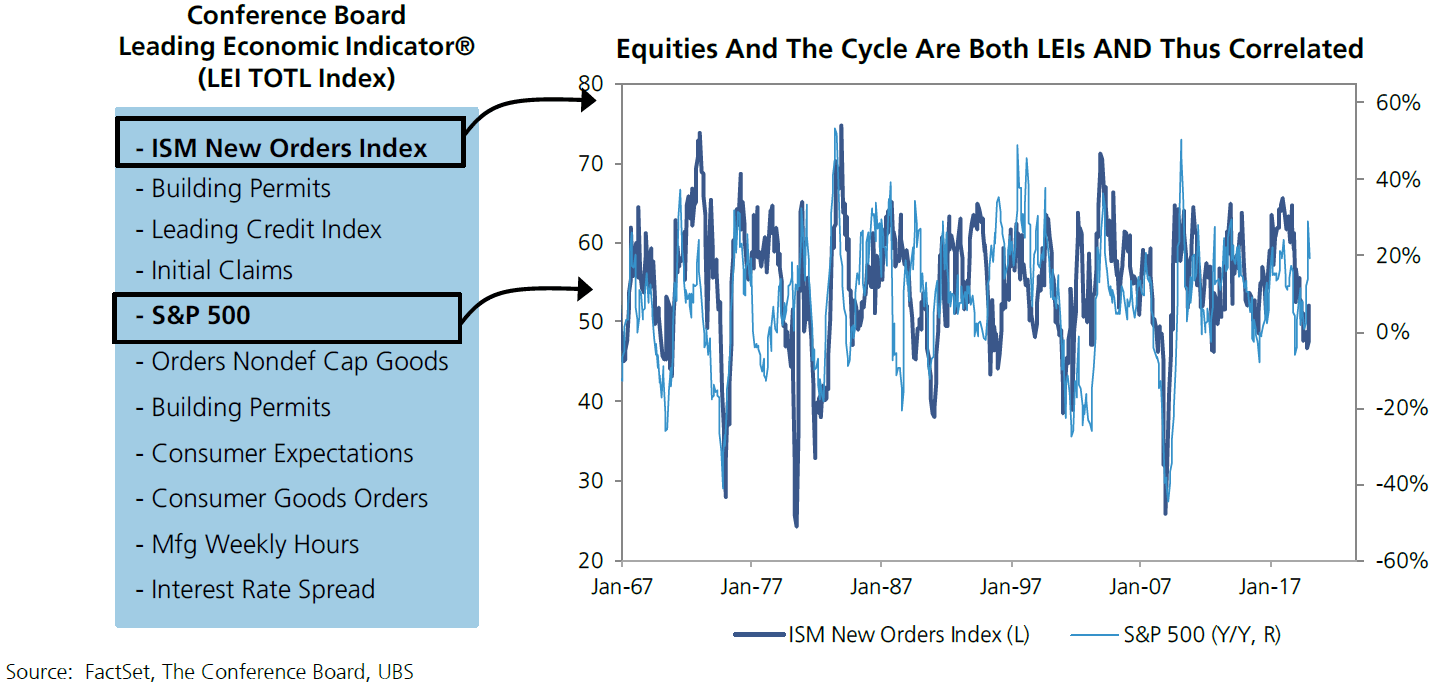

While inflection points in the business cycle impact equities, they said equities are also leading indicators of where the cycle is going. They note that the S&P 500 is part of the Conference Board's Leading Economic Indicator series as it correlates with some parts of the series. All of these parts are lading indicators for the nation's GDP.

They add that while this is the extent to which many people believe macro factors affect the financial markets, the impacts are much greater than this.

How investment strategies correlate to the business cycle

The UBS team also noted that different strategies offer different levels of correlation with the business cycle. The most negatively correlated strategies include Warren Buffett's and Peter Lynch's strategies. Mixed arbitrage and macro hedge funds also tend to be negatively correlated with the business cycle. On the other hand, distressed hedge fund strategies and event-driven hedge funds tend to be positively correlated with the business cycle.

They showed which factors are most correlated with the business cycle now, compared to their correlations 20 years ago. However, they also noted that just because there has been a strong correlation between certain factors and the business cycle, it doesn't mean that correlation will continue.Analytics

Breakdown in factor correlations in quant investing

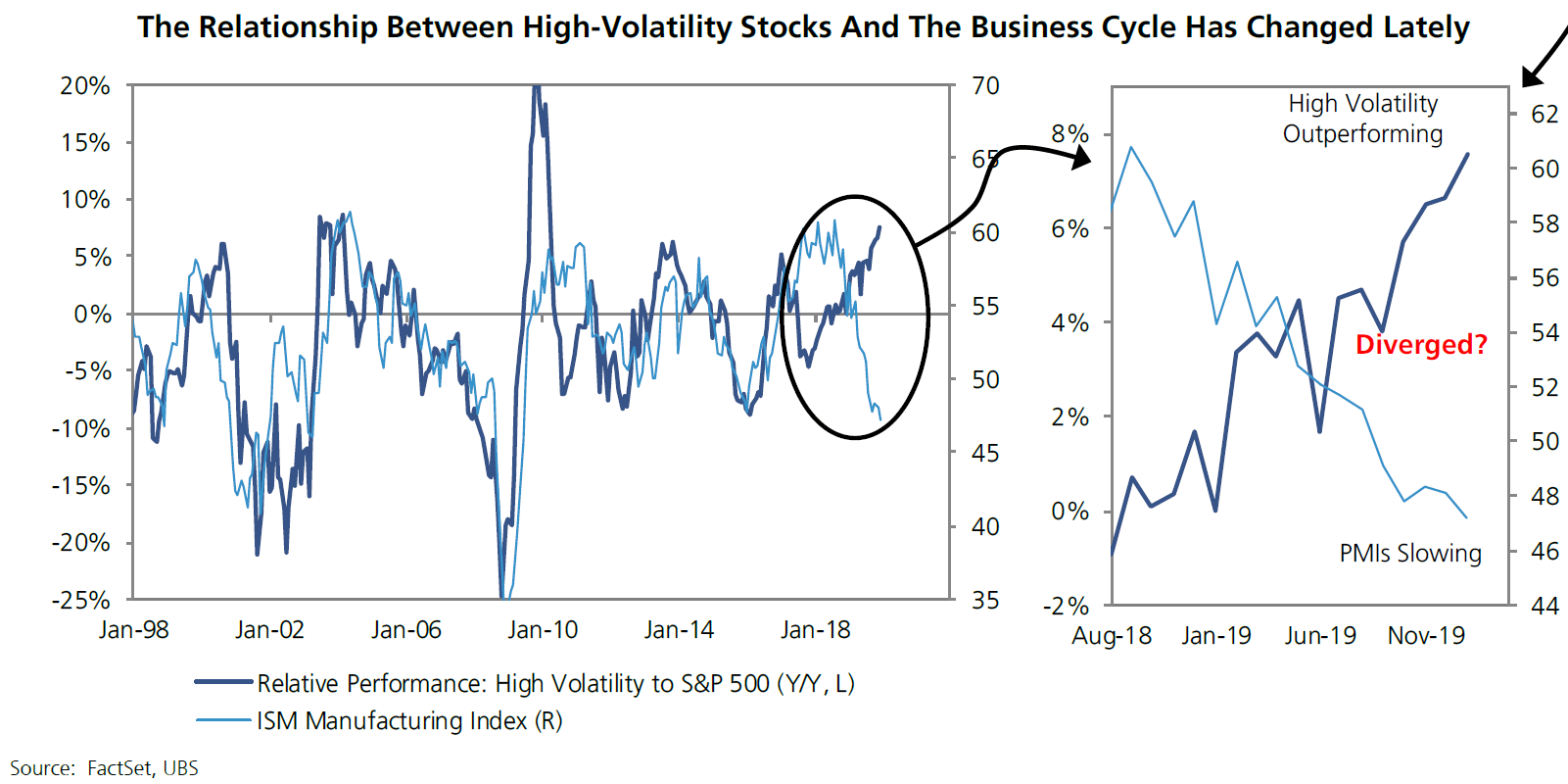

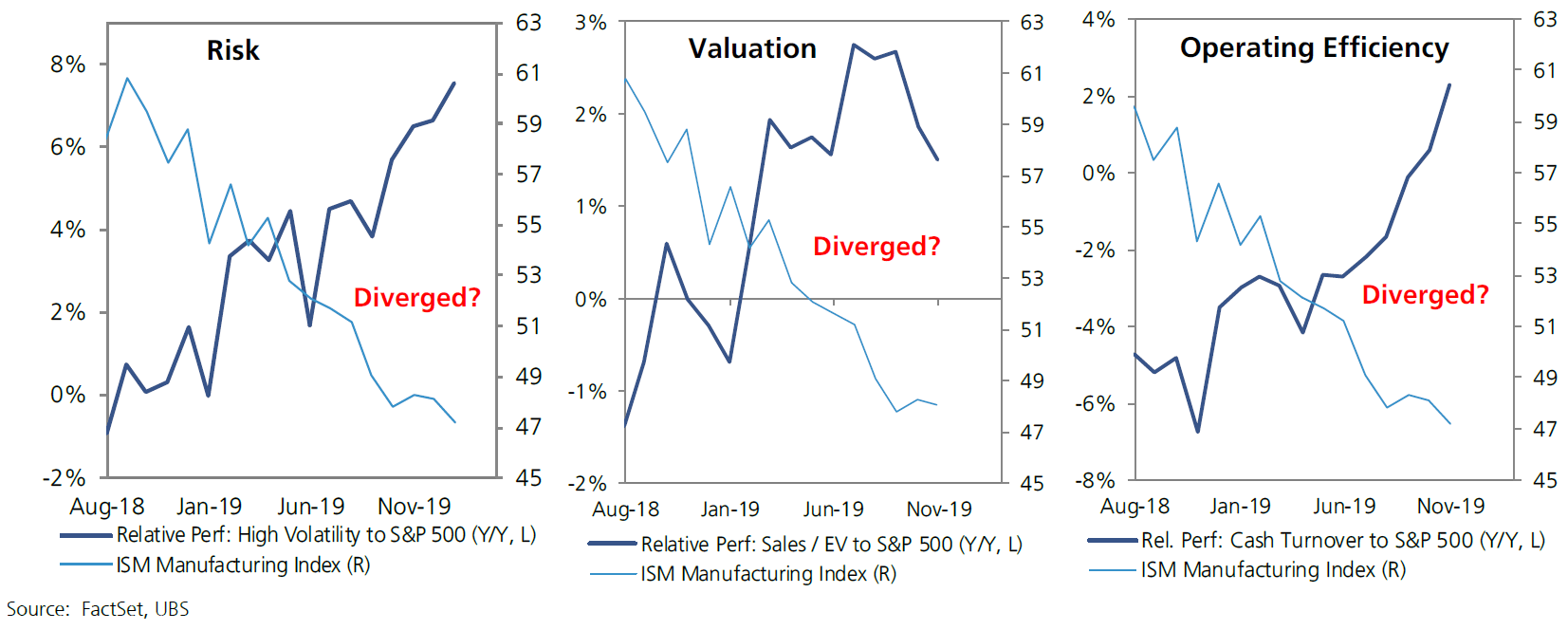

The UBS team describes the change behavior of the volatility factor "strange given how positively skewed the correlation normally is." They also note that this behavior is a key example of how dangerous it can be to "employ data blindly" in quant investing models.

While the correlation in the volatility factor has broken down, so have the correlations of several other factors. They said many factors are producing "unusual results" for portfolio managers and quant investing strategists recently.

They note that investors have been paying a "parabolic" premium for growth and momentum recently. They believe it's due to the slowdown in PMIs that began at the end of 2017 and hit a cycle low at the end of last year.

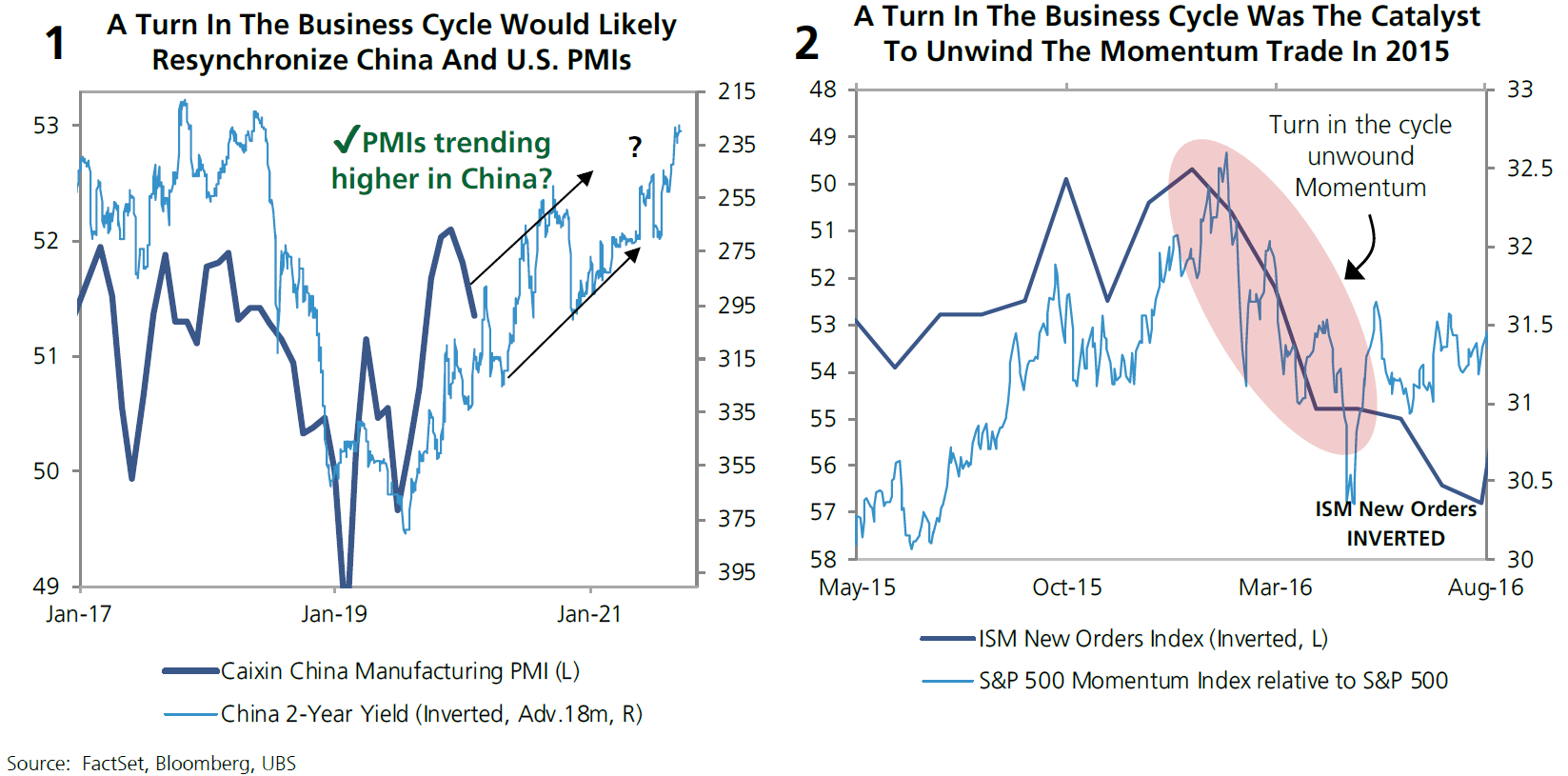

"In other words, two years of slowing PMIs, which enhanced investors' preferences for Growth, have made Momentum as a factor a 'safe haven' for investors, and as a result an over-crowded trade," they explained. "A second macro phenomenon that appears to have created distortions in equity leadership is the unsynchronized recovery across some of the world's largest economies, specifically the earlier recovery in China versus the U.S. or Europe."

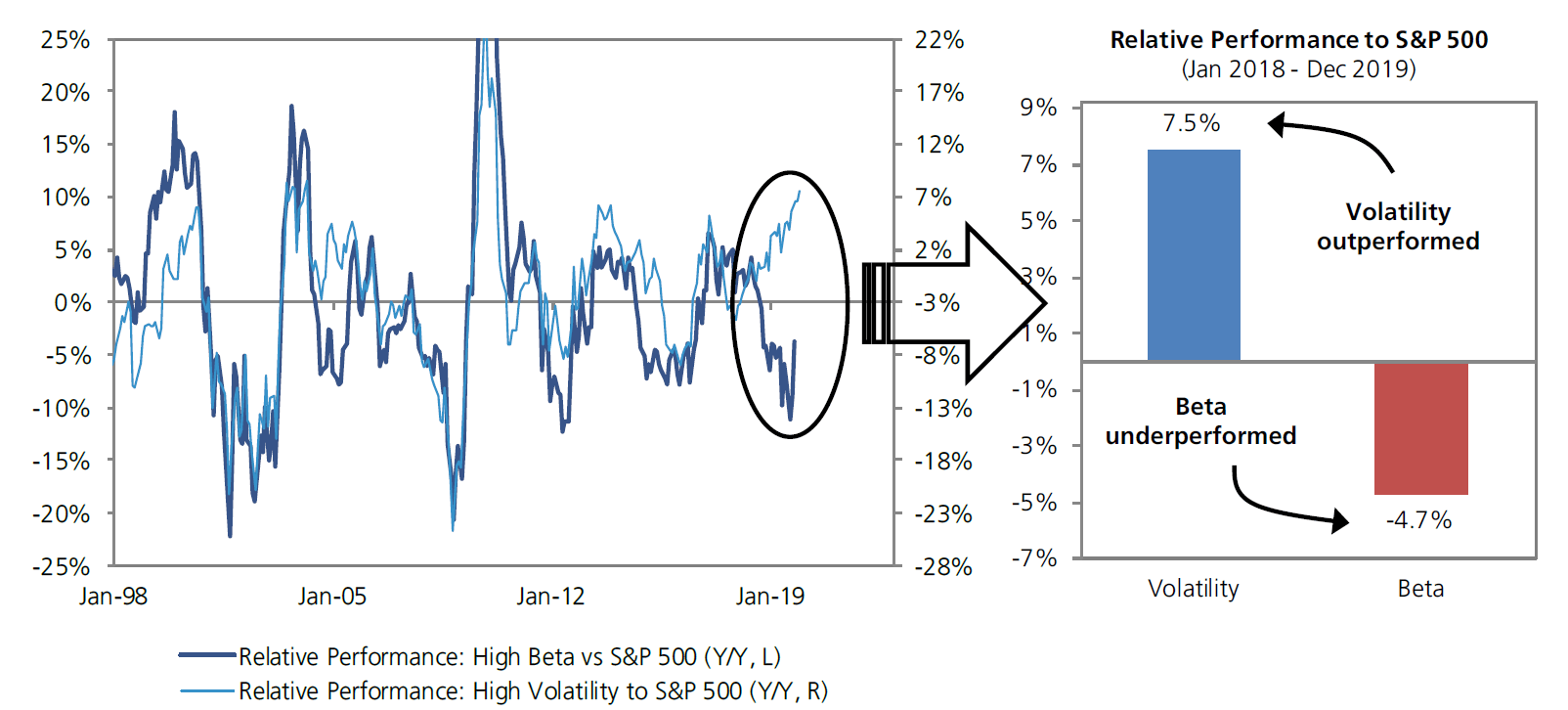

The UBS team also describes the divergence of beta and volatility as "one of the strangest events taking place in quant" investing. High volatility has been outperforming even though leading indicators have declined over the last two years.

On the other hand, high beta has been underperforming, which was as expected because of the deceleration in leading economic indicators. This divergence is highly unusual.

They add that beta has been following interest rates, but it's unclear why volatility is outperforming.

Historically, some quant factors that have been correlated with U.S. PMIs are now more closely correlated with China's PMIs, which have been moving in the opposite direction of U.S. PMIs. This has created even more distortion in the world of quant investing.

Momentum crowding and narrow leadership in equities

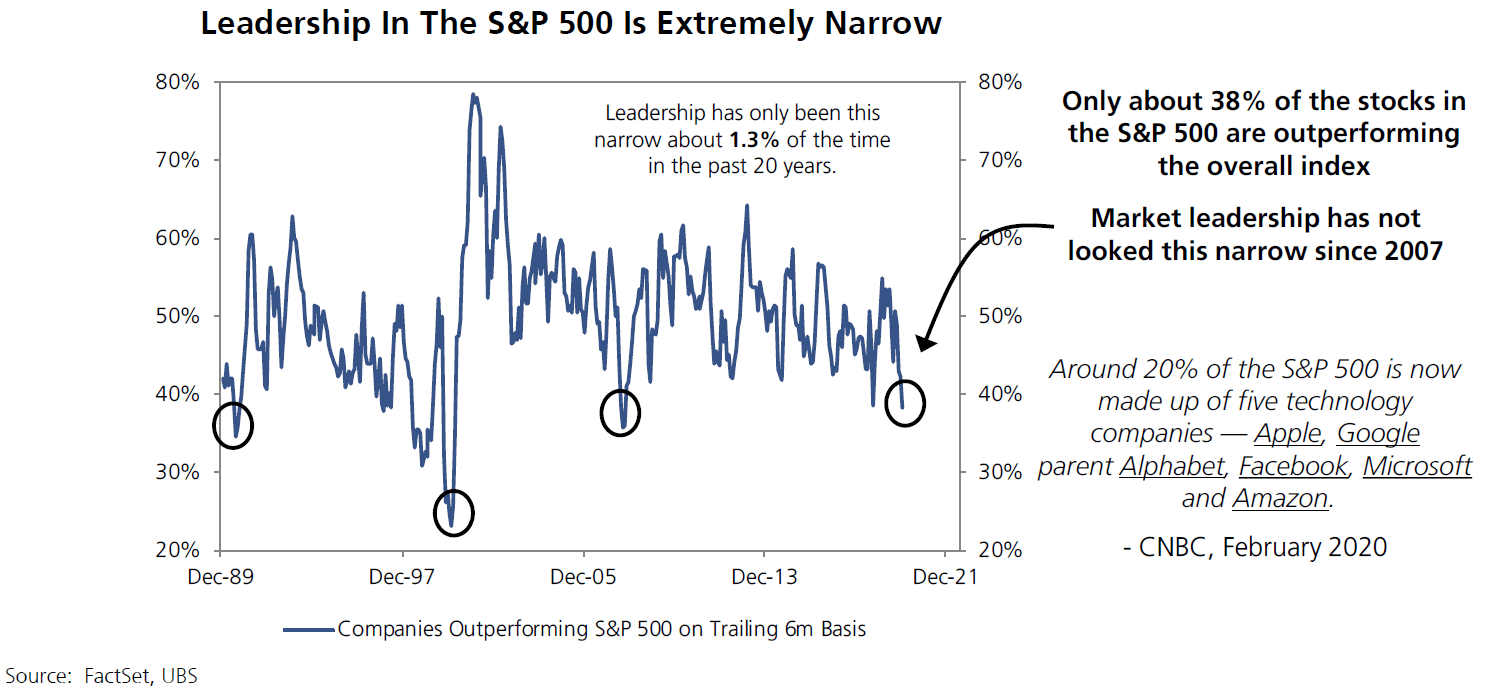

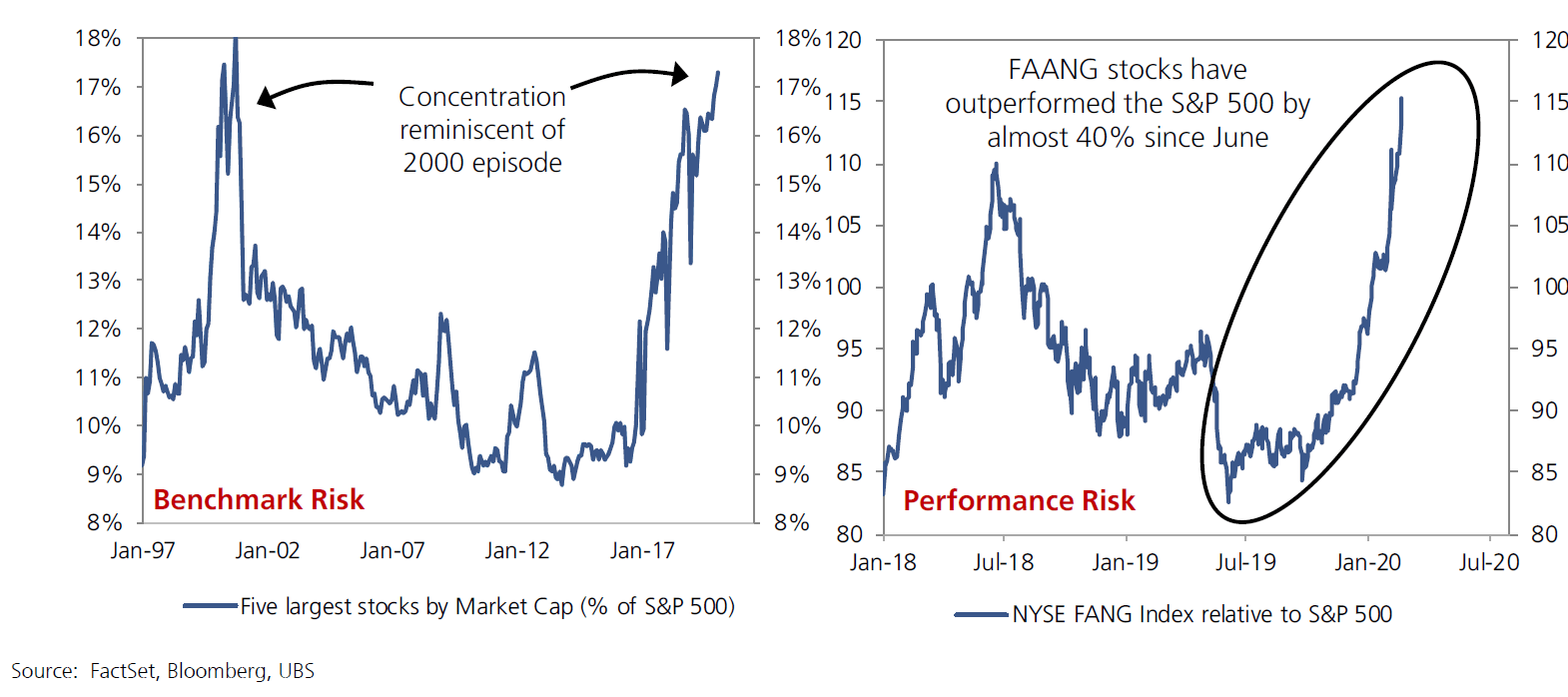

The UBS team believes the biggest distortion in quant investing and equity leadership is actually the root cause of most of the problems. Less than 40% of the stocks in the S&P 500 have outperformed over the last six months, which is the lowest level since 2007.

While it's not unusual for market leadership to increase and decrease over time, it is unusual to have such a narrow bad. It has only been more narrow than it is currently 1.3% of the time over the last two decades.

They also called attention to another level of narrowness within the 38% of S&P stocks that are outperforming. The five biggest stocks in the index account for more than 17% of its market capitalization. Thus, they have "an extreme level of influence" on the S&P's performance.

"Leadership like this creates near impossible conditions for portfolio managers to operate under as they are almost forced to own these five names, no matter how expensive, to have any hope of beating their benchmark," they wrote. "It's a bit of a leadership/benchmark catch-22."

Here's when things could change

So while the bulls have been in control of momentum, the business cycle suggests the bears could take over, but how quickly might that happen? The UBS team believes the distortions in quant factors should end when there's an inflection in the ISM.

They note that interest rates indicate that a trough in the business cycle is approaching. They expect this trough sometime in the second quarter. When the cycle reaches its bottom, PMIs and other leading indicators should recover.

After leading economic indicators start to recover, equity leadership should shift away from defensive positioning and toward cyclical segments. Historically, this has triggered unwinding of crowded trades like momentum. Investors start to prefer the cheaper cyclical stocks they had been avoiding.

When the cycle turns positive, it will also bring the U.S. back in line with China's upward-moving PMI.