The following is the unofficial transcript of a CNBC interview with Omega Advisors Chairman and CEO Leon Cooperman on “CNBC’s “Squawk Box” (M-F 6AM – 9AM) today, Wednesday, February 26th. Guest host Social Capital Founder and CEO Chamath Palihapitiya also speaks with Cooperman.

WHERE: CNBC’s “Squawk Box”

Q4 2019 hedge fund letters, conferences and more

Watch CNBC's full interview with Omega Advisors CEO Leon Cooperman

All references must be sourced to CNBC.

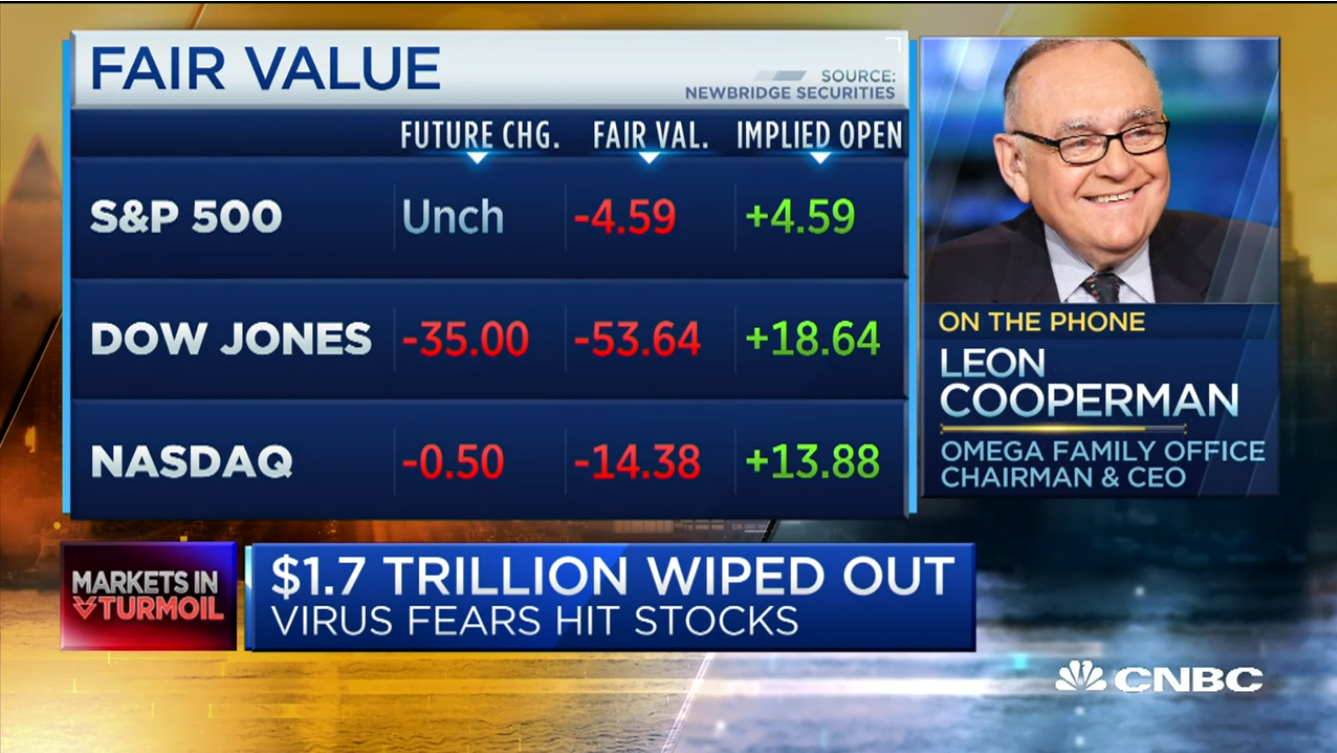

BECKY QUICK: Joining us now by phone, to try to put this in some perspective, is Omega Advisors Chairman and CEO Leon Cooperman. He’s Omega Family Office Chairman and CEO. And Lee, we have talked an awful lot about this, the volatility that we have seen the last couple of days and the straight down action. Are you a buyer or a seller in the market today?

OMEGA ADVISORS CHAIRMAN AND CEO LEON COOPERMAN: I’m doing both, but I would say that on balance, I would be a buyer. I think the significance of an event for the market as a function of the market. It was discounted when the event occurred. If you go back to – I was on with one of your colleagues, Scott Wapner, on February 18th. And I said the market was knocking on the door of euphoria and there were lots of issues that were being absorbed by the market. I’ve lost a lot of money the last few days, don’t get me wrong, because I’m an investor.

But I would say that you have to have a strong opinion about two issues. One is the Coronavirus. Does it get under control in a reasonable time frame? And second is that we don’t have a socialist or a communist in the White House. Okay. I have n expertise in the Coronavirus, other than my confidence that mankind will conquer this problem. And I think it will be resolved by June. And again, I want to make it very clear, I have no particular expertise in that regard. Second, I don’t think—

JOE KERNEN: Which problem, Lee? The socialist problem or the Coronavirus problem?

LEON COOPERMAN: No, the Coronavirus.

JOE KERNEN: Okay.

LEON COOPERMAN: The socialist problem, we’ll have to see.

JOE KERNEN: Might not be conquered by June.

LEON COOPERMAN: I don’t think the country is so leftest in its orientation that a Bernie Sanders or an Elizabeth Warren will be elected President. You know, Bernie Sanders, we’ve got to make it very clear. He is not a socialist. He is rather a communist. Socialists advocate wealth redistribution. Communists advocate nationalizing the means of production and tearing down the house that wealth built. That’s his approach. De facto spoke so positively about Fidel Castro.

I went to Cuba three years ago. Okay. Now I have said this on your program I think more than once, but I’ll say it again. The Cuban people are a hard-working industrious very good people. They are prospering in Miami. You go to Cuba and what do you see? They get a quarter of a chicken once a month for their protein rationing. It takes two hours to get from the suburbs to downtown Havana because they do not have an organized transportation system. It costs $3.85 a minute to get a cell phone, so they can’t afford cell phones.

They get no satellite service, no newspaper service and they lived in dilapidated conditions. And that is socialism or communism versus capitalism. It doesn’t make any sense. You know, and we’ll have to see this play out. I listened to the debate last night. You know, I just don’t think the country is prepared for socialism.

CHAMATH PALIHAPITIYA: What do you say to the 50-million-plus people that believe that if you read the policies and take socialism aside, he looks like a social democrat that is akined to a politician in the Nordic countries than he does to, you know, Fidel Castro 2.0.?

LEON COOPERMAN: I don’t know. That’s not how Bernie Sanders sounds to me. My main hang up has been all along the constant attacking of wealthy people. The villainizing of the billionaire class. Now I luckily got into the billionaire class. But I’m one of these guys, I’m going to give it all away. I don’t care much about money, okay. I don’t get it. You know, I look at a Mike Bloomberg, the way he is treated in these debates, when he’s attacked. Mike Bloomberg knew unemployment. He lost out in a power struggle in his mid-30s.

He had his vision of building the machine. And he built a ubiquitous machine that you need in you’re in the investment business. And he has built a $60 billion net worth. He gave away $9 billion to charity on his own, well before he became involved in a big political way. He did a fabulous job as Mayor of New York, okay, in the biggest city in the world. And they’re attacking him. And he had a great line in the last debate where he said I’m the only guy on this platform that built a business. Tey all looked at each other blank. Bernie Sanders hasn’t worked a day in his life.

CHAMATH PALIHAPITIYA: Again, I just think at the end of the day, look, I have been equally blessed as you. So, I’m in the same fortunate position.

But at the end of the day if the worst thing that happens is people name call us a little bit, and call us billionaires and detached, that’s not such a -- it’s not the worst thing in the world if it allows us to wake up to the reality that a lot of people haven’t been able to participate in what is really been, you know, an equity market expansion, where folks like you and I who can be, you know, long equities in a massive way, levered up, you know, access to certain products can do well to a degree that everybody else can’t.

So, I think what people are saying is let’s just acknowledge that that’s happened. And, it’s not a name calling. We shouldn’t just be so--

LEON COOPERMAN: It goes beyond that. It goes beyond that. I’m a believer in the progressive income tax structure. I believe rich people should pay more. Okay. But what we have to do is a nation is agree upon what should maximum marginal tax rate be on wealthy people. That will define the revenue yield to the government, and then we have to size the government to that revenue yield. Now I’m prepared to work six months a year for the government and six months for myself. That’s a 50% marginal tax rate. Unfortunately, depending on which state you live in, you’re already past that, between state and federal income taxes. And it gets to be confiscatory.

There’s a great comment that I read recently, by Thomas Sowell, who said “Since this is an era when many people are concerned about fairness and social justice, what is your fair share of what someone else has worked for?’ Okay. I’m willing to give -- pay a 50% marginal tax. I have no problem with that. Okay. I just think that the dialogue is destructive. It’s not inclusive. So, I’ll give a perfect example. I spoke at the Delivering Alpha conference a number of months ago.

Nothing whatsoever was said about politics. The moderator, Scott Wapner, asked me a question after I gave my presentation and said what do I think the market would do if Elizabeth Warren was elected president. And I said it would go down 25%. I think you had a different view. I heard you previously. And the next day she Tweets, Leon, I’m only looking for 2%, give others a chance at the American dream. She has no clue about anything about me. Okay. I gave away several hundred thousand in the last few years to charity.

CHAMATH PALIHAPITIYA: I think that’s amazing.

LEON COOPERMAN: Let me finish please, if I may. I sent 500 kids to college in Newark, New Jersey. I pay their tuition. Okay. But I decided to take the high road, okay. Like Michelle Obama said, “When they go low, we go high.” I sent her a well written letter, very conciliatory, very respectful with a closing paragraph that all of us have to work together to deal with the issues. But there are issues. I don’t deny that. There are issues.

My approach to solving the issues is through education and hopefully fast economic growth. What does she do? She puts out a bullshit, you know, excuse me, comment, insider trader and owned stock in Navigant. Very constructive. The Wall Street Journal wrote an editorial page comment that day that she said that. It said ‘Mr. Cooperman won the case. What is she accusing him of?’ But it was nothing constructive.

She was a politician in the worse sense of the word. Okay. And we need people that see the issues. I like that in certain respects Mike Bloomberg is a Republican and in certain presidents he’s a Democrat. He’s voting issues. We have to avoid the labels. We have to work together in a cooperative manner. And all of this income differentiation has been really the result of monetary policy.

ANDREW ROSS SORKIN: Leon, I want to get a response from Chomath. But I want to add one other piece to it. And I’ll speak, not for you, but I’ll add another element to this, which is, assuming that a Bernie Sanders or an Elizabeth Warren were put into office and I know that you’re okay with maybe some of the criticism, the vocal criticism that they have about the billionaire class. But the question is, from a policy perspective are you okay or encouraging of the policy?

And to the extent that you can appoint the head of the Department of Justice, and say, you know, please go look at these individuals, if you could say, you know, if you can appoint the head of the SEC, who is maybe going to look into various companies in a more aggressive way – I’m not saying they shouldn’t, I’m just raising the issues. Even if you have a completely divided Congress, how you see this playing itself out.

CHAMATH PALIHAPITIYA: If -- it doesn’t matter who gets elected in my opinion. I have sort of generally lost faith in the power and the impact of the presidency in domestic policy for years. It has generally the case that the President of the United States is given one hall pass to do one piece of meaningful legislation in the first two years of their term, at which point the American population either flips the House or flips the Senate and creates stasis. And it has happened relatively predictably now. I think it will continue to happen.

And so, the question is what do we think is the most likely thing to happen? When trump came into office the only thing that they were able to get done in which Republicans were able to coral the wagons was tax cuts and tax change. But everything else basically came to a grinding halt. Obama was the same thing--

LEON COOPERAN: I’ll agree with that. I think that when Trump -- I’m not a Trump fan, okay, but I believe the man deserves a certain amount of credit for what is going on. You know, I don’t like his style. And so, at the end of the day you have to vote your values or your pocketbook. I’m at a stage in my life where I want to vote my values and my values tell me that it is wrong to call Mitt Romney a jackass, it’s wrong to tell Rick Tillerson he’s dumb as a rock, it’s wrong to degradate John McCain, who was a true war hero.

It’s wrong basically to say John Dingell is looking up and not down, even though I have completely different political views to him. Okay. But the president deserves credit.

Okay. When he came in it was like they took the foot off of the foot of the economy. The economy and the stock market is at a record high. Unemployment for minorities is at a record low. Overall employment is at a record high. We have opened up a long overdue constructive dialogue on trade with China. We focused attention on legal immigration. All of this is good stuff. The problem with this is deportment. And I analogize him to Ronald Reagan. Ronald Reagan was a very beloved president.

Okay, when Ronald Reagan ran for office, he said he had a three-pronged program. Prong one, Get the government off the backs of people. I’m going to do that by reducing taxes and regulation. Ditto for Trump. He said I’m going to restore the lost prestige in the United States after the Carter years. I’m going to do that by rebuilding the fence. Ditto for Trump. The third thing—

JOE KERNEN: Let’s get back to – the crux of the matter is, even if you soft soap Bernie Sanders’ policies and say it’s a Nordic style, Democratic socialism, it would still reverse a lot of these positive things that just happened. It’s that simple. 60 trillion dollars on a Green New Deal or 50 trillion dollars on Medicare for all is not just having a conversation about people that haven’t participated—I know they’re not going to be able--

LEON COOPERMAN: There’s a lot of free stuff. the young people relate to that.

CHAMATH PALIHAPITIYA: Let’s be practical. They are not going to be able to get these things done.

JOE KERNEN: Talking about -- the evenness that we’re talking about –

LEON COOPERMAN: We don’t need a gridlock in government. We don’t need a gridlock in government.

JOE KERNEN: --not understand economics anymore. To not understand the capitalism got us where we are. So, you can have these great high minded Nordic social democratic conversations. But it’s a dangerous place you’re trying to take it. You’re saying we can’t get there, so just have a conversation. But why not acknowledge that it’s capitalism and free markets that got us where we are? Okay, good.

CHAMATH PALIHAPITIYA: Last time I checked, we’re allowed to have diversity of opinion.

JOE KERNEN: Okay, fine.

CHAMATH PALIHAPITIYA: I think you’re missing an entire cohort of young people

JOE KERNEN: You’ve got Bernie Sanders leading the pack in the Democratic field and that is a problem for Democrats.

CHAMATH PALIHAPITIYA: Yeah, but I – my -- how –

JOE KERNEN: If you think that’s okay that he’s going to get the nomination, that’s fine. I think you have dug -- Democrats have –

CHAMATH PALIHAPITIYA: I take a lot of energy in learning about what’s happening. I take a lot of energy in reframing--

JOE KERNEN: We’re stuck with Bernie versus Trump. That could be the end result of all of this.

CHAMATH PALIHAPITIYA: How many –

LEON COOPERMAN: Let me do this. You guys wanted to talk about the market—we can talk about politics.

JOE KERNEN: Go ahead, Leon. We weren’t going to talk politics, but—socialism is dangerous.

LEON COOPERMAN: Basically, as I said at the outset—as I said at the outset, the significance of the events of the market is a function of what the market is going to do. If you go back a week ago, 3,400 in the market. You know on the door of euphoria. Okay. All of a sudden, this is a sexist analogy, I have to be very careful.

But all of a sudden, the beautiful lady or the handsome man developed a blemish. And the blemish was the Coronavirus. And then what happens is these quantitative algorithmic traders take over and they create a level of volatility that destabilizes. If you have a view of the Coronavirus, okay, and I tend to have an optimistic take that by June we’ll resolve it. Again, I have no expertise in that regard. I do not think that the country is ready to elect a socialist. Okay.

That I think that the correction is healthy for the market. Even though I’ve lost a ton of money, it’s healthy. It took out some of this euphoria. You go back a week ago—I don’t own a share, I don’t know anything about Virgin Galactic, but if we look at Tesla, Virgin Galactic and what the Fed has created here. They have created a very speculative environment. There’s zero quest of money. It basically forces speculation. We have taken some air out of the bubble and that’s constructive. If I had a guess, and this just a guess, we’re not far from a correction low. Again, it’s predicated on the two assumptions that I’m making. And the market will splash around for a while and then go back up.

You know, I looked, and the S&P is yielding well above Fed funds, well above the ten-year government. Companies are growing. There’s the ability such to -- the capital structure, given multiple on stocks versus where interest rates are. And the normal creations of bear markets are accelerating inflation, recession, hostile fed or significant geopolitical events that you cannot forecast. And whether that’s Coronavirus or that significant geopolitical specific event, we’ll have to wait and see. But my guess is it will be controlled. And that’s my story.

BECKY QUICK: You said you’re a net buyer today. Were you a net buyer of stocks yesterday, too?

LEON COOPERMAN: I’m doing a little bit every day. I can’t pick the bottom. I’m doing a little bit every day. I mean, I’ve got three earnings call at 8:30 of companies we’re involved with. You know, I find a lot of value in the market. If you’re sticking with big companies like a Cigna or United—look at United Airlines. They came out with their commentary. The stock is trading at six times what they expect to earn this year. They took out guidance because they can’t give you guidance until they know what happens to the virus.

They brought back close to 40% to their company in the last five or six years at -- prices. And they generate substantial free cash flow and it’s a six multiple stocks. So, I have a large position, but I added a little bit to that one. And, I just find a lot of attractively priced stocks and I do a little bit of buying every day. And I do some selling too. Harvest -- is where I think that the risk-reward isn’t particularly favorable. But I’m engaged. But I think it requires a view on the Coronavirus and a view of politics.

BECKY QUICK: Can I ask you very quickly, I know that you have three conference calls that you just mentioned that you have to jump off for. But last week I think with Scott Wapner you said that you think Bernie Sanders is a bigger threat to the market than the coronavirus. Do you still think that’s true after the last couple of days?

LEON COOPERMAN: Yeah. It was a good thorough line. But yeah. Because I believe the Coronavirus will be history by June, that’s a view, okay, I take that position. But I think what made America great is our commitment to capitalism. Sure, do we have flaws, we have problems. Absolutely. But what he advocates is a 6 trillion-dollar deficit. And the deficit is already a trillion. And I don’t want to depend upon a divided government to basically freeze him. I think we have to work together as a country to deal with our problems.

Not have a divided government. But yes, I believe that Bernie Sanders – what he represents – this boosting of Castro, the attacking of Israel, the free everything. Free everything. You know, sure, it’s appealing. Free.

But, you know, basically, it’s not realistic. It’s not realistic. The problem with socialism, I’m quoting Margaret Thatcher, the problem with socialism is that you eventually run out of other people’s money. You know, he wants to spend somebody else’s money. Let him get a job and work for a living, rather than feed off the government, you know—

BECKY QUICK: Lee—we held--

LEON COOPERMAN: That’s it. Don’t get me too upset.

BECKY QUICK: We have held you past the time we promised we’d let you go. We want to thank you very much for being with us today, calling in, so--

LEON COOPERMAN: Okay. Thanks. Good luck. Keep fighting the good fight. Keep fighting the good fight.

BECKY QUICK: Lee Cooperman. Thank you.