In this video, Crescat fund managers, Kevin Smith and Tavi Costa, discuss what they call the three legs of the macro trade of the century.

Long Gold, Short Chinese Renminbi And Short US Stocks: The Three Legs Of The Macro Trade Of The Century

Q4 2019 hedge fund letters, conferences and more

Transcript

I think more than any other chart in this whole presentation this chart sums up just in one quick snapshot here. What's going on in China? China has increased its banking assets from about 9% of global GDP in 2005, to as much as 50% of global GDP in 2018, when it peaked out and that's the important thing to note is that China, China's banking asset growth already peaked in 2018 relative to global GDP, as Tavi said earlier, China's been responsible for about 60% of global GDP growth since the global financial crisis. This is how they were able to do it through this impossible unbelievable growth in their banking system. And, you know, when when does the growth stock windows China's Minsky moment arise, as they say.

And this chart, it shows the term Minsky moment is here, when they can no longer grow their banking assets to drive that world GDP and we think the banking assets are so overstated, to begin with, and so laden with non performing loans that have been unrecognised. That is, it's just Impossible and now you have the potential for you know, for runs on on the banks themselves, as we believe has already started in Hong Kong.

How the yuan ties in

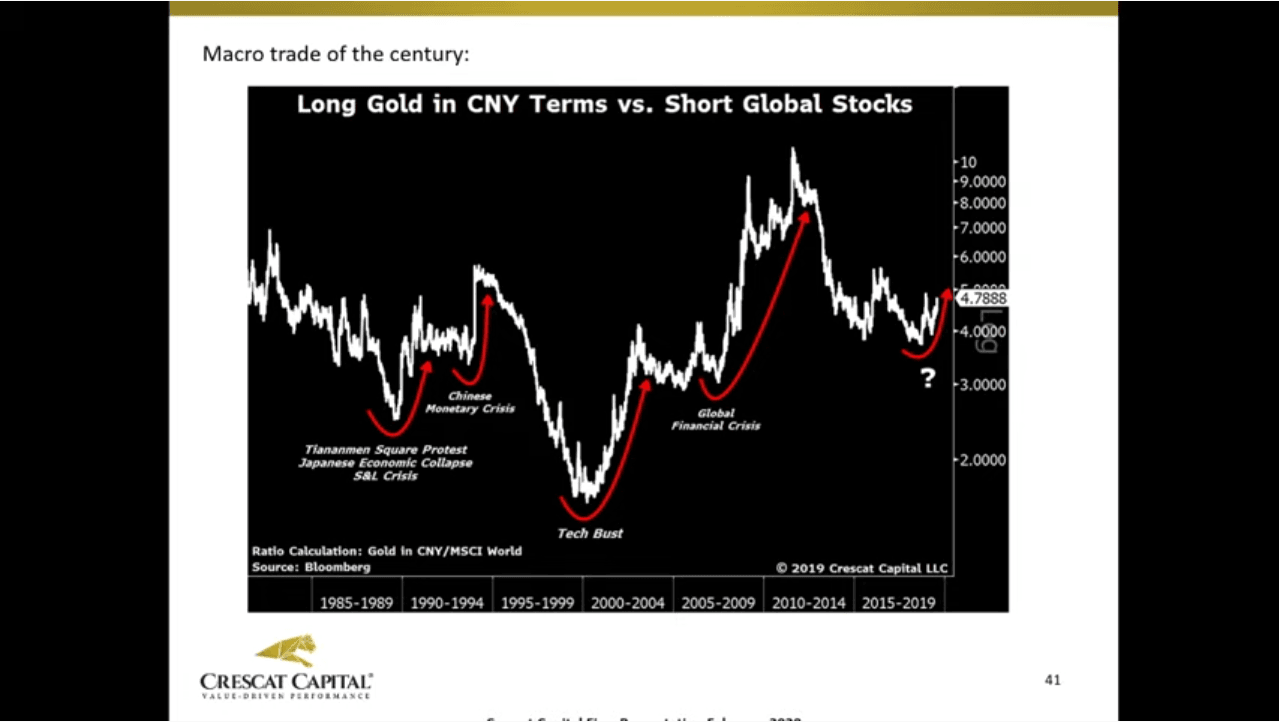

Now here we're looking at gold in in CNY terms when you have a big communist country think of the USSR or even a smaller one like like Venezuela or an emerging market what you tend to see when a highly debt laden emerging market on ultimately faces of financial crisis. What you see is a gold in local currency terms tends to to break out and explode.

And of course, what you have going on is that you're having a currency crisis, whether it's Argentina, Venezuela, you know what you've seen with Turkey or something bigger like we have in China today, but this is only the beginning of gold breaking out in in local currency terms. A lot of people say Crescat, you know, if you're bullish on gold, which we are, how can you be how can you How can you not also bearish on the US dollar? Well, we're actually bullish on the US dollar relative to a lot of emerging market currencies, China and the Hong Kong dollar in particular that we want to be long gold in these other currencies, we want to be long gold and dollars too, because we think the Fed is ultimately going to have to come in even bigger when these other bubbles burst.

But this is this is you know, this is two legs of the macro trade of the century in one picture right here and we think it's only begun to breakout that is gold in CNY terms. Here we put all three legs of the macro trade of the century together and so we're looking at being long gold, being short the Chinese Renminbi, and being short US stocks are this is actually short global stocks.

Short US stocks

So short the MSCI world index, which is the largest component is US stocks. And you can see why there was the Tiananmen Square protests, the Chinese monetary crisis in 1994, the tech bust, the global financial crisis, when we get into a global economic downturn, these are these are three kind of macro legs that you want to have on and the setup has never been better today.

Now at Crescat, we are going for alpha, relative to these simple macro components, as we indicated were long were long precious metals, mining stocks, in addition to gold and silver, from from junior explorers all the way up to the bigger producers.

We are you know, we have a basket of the most overvalued stocks in the US market ever. I've got an equity quant model that I have been using to manage money now for over 20 years. And it is identified some some of the most incredible overvalued short opportunities that I have ever seen today.

US stock market bubble?

So you know, we're going for alpha through a portfolio, you know, as well as having this core kind of macro trade on the Chinese currency, we're really going for an asymmetric trade here. This is where we think we have something that is akin to the big short and that is that, you know, throughput options. For instance, on the Hong Kong dollar, it's a currency that's been tagged for, for 40 years.

It has 1% implied volatility, you know, to be able to get, were able to get something like 4x exposure in our global macro fund by only risking 1% of NAV per quarter. And, you know, the China Yuan it's a similar asymmetric opportunity, that's not a fully pegged currency anymore, it's a managed currency. But we think is one that could have a devaluation similar to the Asian currencies and the Asian crisis, which are done an average of 70%. So here's a picture of the macro trade of the century. Tavi, do you have a comment on this?

No, I think this is this is where the opportunity lies ahead. As Kevin said, I think it's incredible when you look at indebted emerging market economies and how they, when they have issues, you know, a lot of times you have currencies devaluing or you have even sometimes equity markets go up and local currency turns. We've had that situation many times in the past, but the one thing that actually happens, you know, constantly is being or more reliably I should say is that how gold prices tends to rise in local currency terms.

Long gold

And it's another way to see is just how a lot of people have been saying now gold has not hasn't done anything but going sideways or down the last few years and it's not right I mean, that's gold prices have done incredibly well and have service as an insurance or as a safe haven asset in other places like Brazil, Argentina, Turkey, Venezuela, you name it.

And I think this is you know, we've never seen such a peak reliance on central banks overall, this is a huge problem in the markets that we see today is this reliance from investors overall thinking that the central banks have this magic of preventing cycles from turning.

I want to ask everyone there, you know, do you know any what's the track record of central bank's being able to do in that and never have it? They they're doing terrible with that actually. So we think that that's, it's this time it's no different at some point the credit imbalances that are happening in China are a big deal.

The coronavirus issue is is something that obviously there's never the right time in the right place for that to happen. It's it's a terrible thing for the world. But when you think about that for a minute, I mean, it's it happened at the worst place at the worst time actually being China. It's a historic credit imbalance. It is the tip of the iceberg in our view for the Chinese economy.

Macro trade and China

There's so many imbalances and now you have inflation rising at the same time. When you have that sort of toxic combination and in the Chinese economy, we really view that the timing has never been greater than the now to be short the Chinese currency. And a lot of people say well, but they have a lot of foreign reserves.

Well foreign reserves, let's just remember when you sell foreign reserves, that's a tightening policy. It's a lot easier for China to revalue its currency at a much depreciated base relative to the dollar, then then just sell foreign reserves and continue to kick the can down the road by at the same time as you have a downturn in the economy domestically speaking.

So I think this is a big time to be a macro investor and looking at your opportunities of how to profit from a lot of this imbalances. There's a plenty charts showing the timing indicators and why now, everyone should be aware of instead of relying the central banks will have your back for the following months.

So we like to conclude the presentation here, and we'd be very interested in reaching out to any of you and talking one on one if you have any interest in diving deeper into these ideas into our strategies, here's some contact information. We have an open website Crescat.net and we encourage you to go to go check that out as well. So we want to conclude the presentation. Thank you very much for your time.

Yeah, thanks for following us or work and then we really appreciate that. We'll be in touch soon. Thank you.