In this stock market environment it is important to be hedged. one of the hedges, not so much for a stock market crash but a hedge for more quantitative easing and money printing is to own gold. Even better than gold are gold miners as the risk is lower because you need to own less of them than physical gold to have the same hedging effect. I discuss the 10 largest gold mining stocks and will discuss all of the holdings of the VanEck Vectors Gold Miners ETF (NYSEARCA: GDX) to give you an overview of what there is so that you can find the best option for your portfolio.

Q4 2019 hedge fund letters, conferences and more

GDX Holdings: Invest In Gold With Gold Miners - 10 Stocks Analyzed

Transcript

Good day fellow investors. Now I have been saying already for a long time that everybody should own a little bit of gold in one's portfolio. Now you can own gold. If gold prices fall to let's say, 600, you lose 50%. If gold prices double, you double what you own the gold when you have your portfolio. However, if you own gold miners, if gold prices fall to 600, you probably lose everything. However, if gold prices double, you don't just double that part of your portfolio, you increase it by 5-10-20 times, depending on what miner you're buying.

In order to go deeper on that topic. I will discuss all the 50 holdings of the VanEck Vectors Gold Miners ETF (NYSEARCA: GDX), in order to show that every miner is different so each portfolio has to be approached has to be fitted with miners that fit that portfolio. And another story is that the VanEck Vectors Gold Miners ETF (NYSEARCA: GDX) is again an ETF that is skewed towards the biggest miners which we're going to discuss in this video are later make more videos about the miners that are positioned from 11 to 50 and that will give you a different picture of what you can invest in the gold mining industry.

GDX ETF

However, if you look at top 10 holdings of the ETF, you can see that 9.27 of it is in one company, Newmont Barrick has 7.2%, the top 10 have a 54% weight in the ETF. That is a lot because the remaining 40% have then 46% weight in the ETF. This means that you are very much skewed towards the biggest miners. And that's not really proper diversification because as we're going to see now, the biggest miners are a little bit expensive, especially the royalty companies. There is one too interesting among them.

So let's immediately start with discussing the miners. Before that just a quick note, when you're looking at miners lower costs, longer reserves, lower the risk, higher mining costs, higher debt, increase the risk of investing, however, also give much more leverage in case gold prices increased because the margins expand much, much better than with those where the margins are already big thanks to low mining costs, or know that.

Gold miners

The first company I want to discuss is Newmont Mining Corporation, the largest gold miner in the world, according to market capitalization. As you can see, all sustaining mining costs are around $900 per ounce, which gives them a margin of $400 per ounce which is a healthy margin, but also indicates that the company would be in trouble if gold prices fall close to that level.

Which is always a possibility you never know what will happen to gold prices. Mining costs are expected to be around 900 for the next 10 years, everything that I say is sourced from the relative Investor Relations page of the company. Operations are mostly focused 41% in North America, 41% in Australia, and a little bit of diversification in South America and Africa.

GDX holding: Newmont

What is very important here to know is that Newmont won't be able to increase its production, as its mines get depleted, and new project projects aren't big enough to replace and grow production. But Newmont offers stability with relatively low costs 900 per ounce.

The company has 12 years of operating reserves with an average grade to 1.2 grammes per tonne. Further, the company has been really lowering its debt in the last few years. And now the net that is just 1.1 billion which is relatively low for that company. A little bit about valuations, according to the company, a 100 gold price increase increases the cash flow per share by 67 cents.

But if that happens as it has happened, gold prices have improved by 100 in the last 12 months, it will still keep the price to earnings ratio high and close to 40. The free cash flow yield would however be in 2018. I'm saying this around five to 7% which is good or okay return in this environment if you expect stability if you want five to 7% that's good.

Newmont has room to run?

If gold prices double Newmont stock price would do well as it did in the last three years where where gold prices went from almost 1000 to the current 1300 and Newmont stock price increased 70%. So what you can expect from Newmont stability. Little low risk, of course it goes prices go down, Newmont stock will also fall and if gold prices go below 900, then there is a little bit more trouble.

But Newmont is one of the most fixed most stable gold miners that you can find. However, the price to cash flow expected is around 5 to 7%. Good returns perhaps a little bit better than the s&p 500. So if you're interested, you can really look at such a company. For me it's a little bit too expensive.

GDX holding: Barrick Gold

A little bit better than Newmont is Barrick Gold, especially because the price has declined a little bit. In the later spirit. Barrick was usually the largest gold miner but humans price went up and Barrick's price went down, as you can see, in the last year and a half from above 22. The current 14 Barrick had some problems with their subsidiary in Tanzania, and with their Veladero mine due to a leak incident. So that's perhaps one reason why the stock price has fallen. Nevertheless, it's still a very, very stable company.

There is 4 billion in debt. However, the maturity of that debt is post 2032. So very, very long term and even lower gold prices don't bring to refinancing problems, which means that the company is stable or should at least be stable. Further, all in sustaining costs are expected to be around 730, which is much lower than Newmont's, but there is higher debt in this case at Barrick's. So you are there at the end, as you have seen, the interest rate on the debt is 5.6%, 4 billion on 5.6% is pretty much.

Barrick vs Newmont

What is very interesting about Barrick is that it has the largest gold reserves in the world 86 million ounces. So that's pretty pretty important. So if Barrick's situation stabilises a bit, I wouldn't be surprised to see it have a price to cash flow yield of 10. A 10% cash flow yield which is very, very good and better than Newmont's.

So you might take take advantage again, if you want a company that will have stable production in the long term big pipeline, but producing a lot well diversified, then perhaps now Barrick is a little bit better than Newmont. If investing an ETF, an ETF will buy more of Newmont and less of Barrick. Even if Barrick is now cheaper, when the things reverts, an ETF will buy more of Barrick and less of Newmont, which will be cheaper. That's why I don't like ETFs I prefer to buy Barrick now that's cheaper than Newmont, and vice versa in another scenario.

GDX holding: Franco Nevada

All right, Franco Nevada is the third gold miner on the list. However, that's not really a gold miner that's a gold royalty company. There is a video where I describe what are gold royalty companies they invest in projects in the developing stage, and they get the royalty from the whole production for the rest of the life mind, which it has been proven a very very good business model since royalty companies became interesting and really grew in the last 15 years. And Franco Nevada is one that really did well in the past. However, that brings to price to cash flow ratio of 27 which leads to a yield of 3% which is one third of Barrick's yield or half of Newmont's. So, yes, they are good business model very low risk, however expensive.

GDX holding: Newcrest

Newcrest Miner is very interesting minor, an Australian minor that has an extremely long reserve life. You can see here that it has almost 30 years of ore to be mined at current rates, the cash flow yield is 8.5% and about to increase as Newcrest had some issues due to seismic event at its flagship mine 2017, so we could expect better results in 2018. Also, standing mining costs are below 800, so that's a great margin of safety in relation to gold prices. Given the margins of its mines, Newcrest have the potential to further grow in the future, which is not the case for Barrick and Newmont.

African mining operations

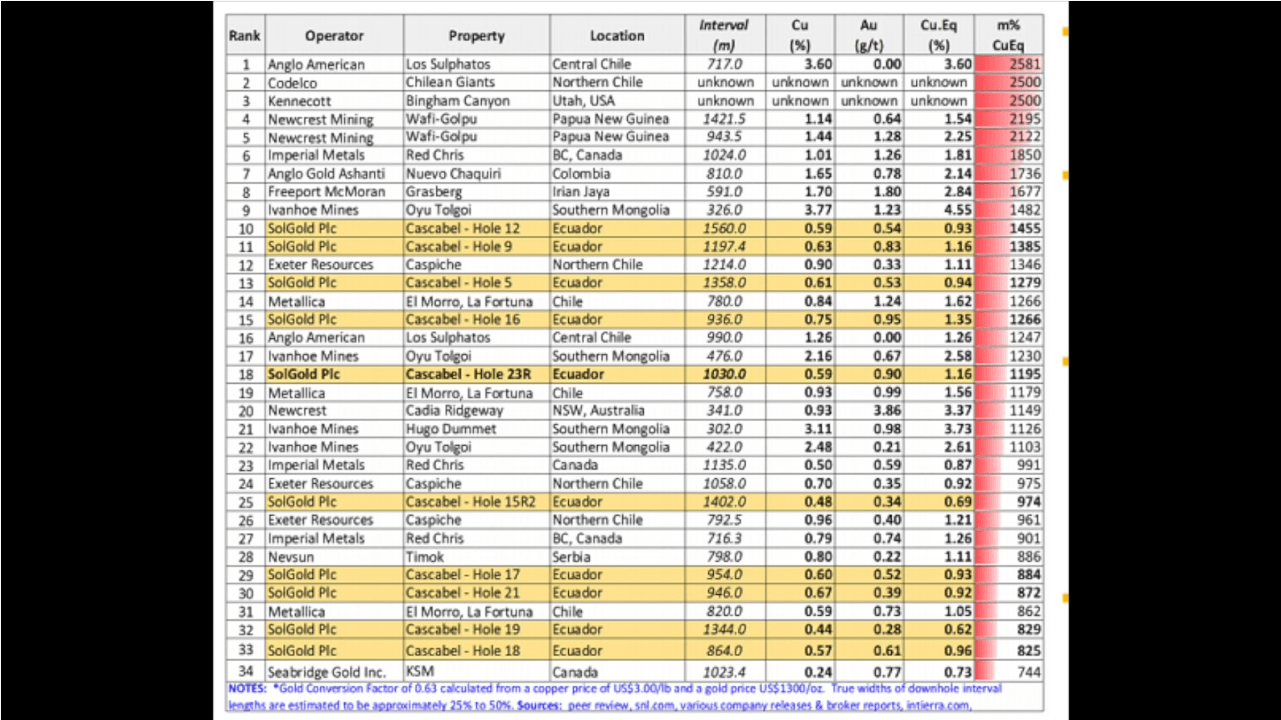

The pipeline, the Lihir mine increasing, Cardia increasing production, further increasing working on those production improvements, they can develop the Wafi-Golpu project in new Papa Guinea that have a lot of long term pipelines that can really increase production as the reserves are extremely, extremely long. So for the same price, you can get a growth company in comparison to Barrick and Newmont. Also Newcrest owns 14.5% of the SolGold project in Ecuador, which owns the potential tier one castable operation with extremely high copper and gold intersections. We if we look at the top copper intersection, we can see that SolGold has a lot of them from the top 30.

GDX holding: Top miners compared

However, you can also see that Newcrest is here on position four and five with the Wafi-Golpu project. Also with cadia and cell so very, very interesting. Gold copper miner with growth potential and extremely long reserve life. I have heard that Australian miners traded in Australia are priced lower than miners like Barriick and Newmont traded on the New York Stock Exchange. So just because it is an Australian miner, it doesn't deserve a lower valuation. So if you're looking for growth, stability, long term, great projects, then new crest might be an investment for you.

GDX holding: Gold Corp

Gold Corp is another company focused on the Americas, it's all in sustaining costs are $825. So in the middle of what we have seen up till now, and the company expects to lower its mining costs by 20%, in the next few years, increase production by 20% and increase reserves by 20%. If the company managed to do that, it would be one of the best gold performers in the next few years. You can see here that the portfolio is mostly focused in the Americas, Argentina, Chile, Canada and Mexico.

Cash flow analysis

However, to improve what they have been announcing they will spend a lot of money and their capital expenditure guidance is to spend around 800-900 million per year, which is a lot when you have an operating cash flow of 1 billion and that's something the market doesn't like.

So you can see that in the last three years Gold Crop's stock price has declined 48% which is a big difference when you compare it to Newmont that has increased 70%. Nevertheless, if they manage to do what they have promised, and you attach a price to cash flow of 9-9.5, which is current, the returns might be very, very good. So this is a reversal story to look at.

GDX holding: Angico Eagle

Agnico Eagle Mines will produce 1.5 million ounces of gold and expects to produce 2 million ounces of gold in 2020 when without in sustaining costs of $845. So another growth company that's focused on growth, the reserve grade is 2.2 grammes per tonne, which is much higher than the average. Most minds are in Canada, with one in Finland and three smaller mines in Mexico. So, major Canadian exposure lowers the political risk. However, most of Agnico's mines are underground, which can be costly and risky. Nevertheless, the company has been doing very well in the past. Safe jurisdiction, price to cash flow ratio is 15, which is a little bit high. Wheaton Precious Metals is another royalty company smaller than Franco Nevada. It has deals with 20 operating mines and nine development projects.

Dividend analysis

It has a dividend yield of one point 53% which is the highest we have seen up till now the price to cash flow is also high at 17.8, which applies a yield of four point something percent if I'm not Now royalty streaming company doesn't have development costs doesn't have to invest in capex, sustaining capex, whatever they just get, they just buy a little bit of gold at the low price usually around $400 per ounce, and then they can sell it at market price, which is a great business model.

So we can really look at price to cash flow, the best way to look at that is to price to earnings ratio as their mines get also depleted and the price to earnings ratio is 46. Which means that the yield is a little bit lower when compared to what they have invested in the past. So again, royalty companies, for me look expensive, they are great, they are good. They are growth, but they are a little bit expensive from an investment business common sense.

GDX holding: Rangold

Randgold Resources is an African focused minor with operations in Mali, Democratic Republic of Congo, DRC, Senegal and the Ivory Coast. Now it owns a Kibale mine is Congo where they have spent 2.5 billion and they expect production to increase in the next year. But there is always issues with local governments, the Democratic Republic of Congo has been changing the mining code, which would increase the taxes payable, while the government of the Ivory Coast has issues with illegal gold mining, non transparent exploration, permitting, etc. So, Africa jurisdiction, everybody is telling and that it is a problem and it is a problem.

Business analysis

If you invest 3 billion in a country you expect to get your money back for a long time. Not there is a government oh, let's increase their taxes because they have already invested they cannot back up and if they are not happy, they can always leave the country. That's a high risk and therefore it should be cheaper, the stock should be very cheap for that. However, the price to cash flow ratio is at 25 implying a 4% yield very low for the jurisdiction risk, I would expect a much higher yield for that risk.

Royalold is another royalty streaming company you can see that here in the invested in New Gold's rainy river, Barrick's Cortez and Gold Corp's Penasquito. There is a little risk now the price to cash flow is 18 implying a yield of what 5. something percent which is okay but you can see here how there is also risk with those miners because if they invested in a mine that is about to shut down or to be idled because of lower prices, then there is no revenues there is no royalty if mine doesn't produce. So you can see here that the stock price has gone down to around 30 in 2016, January and now is at 88. So if you're patient it based by such companies when nobody wants to look at gold, not when it's very expensive to do so.

GDX holding: Kinross

Kinross Gold, produces 2.5 million ounces growth per year at all sustaining costs of around 1000, which are a bit higher than what we mentioned previously, but has a price to cash flow of just six. But the price to free cash flow of 75 as the company has higher investment costs because it's developing a lot of projects, it's expected that all the projects will be developed at 2020 them as the company has now that maturity up to 2021, it can invest heavily, the Tasiat phase two will increase production from the current 250,000 ounces to 800,000 ounces. So if you want a growth story, this is a very interesting company.

GDX full holdings

However, the costs are a little bit higher, so you can expect higher leverage to gold prices from such companies. Now these are the bigger miners except from Newcrest. I wouldn't invest now in those because I am perhaps attracted by more risk and much higher potential. That gives me much more leverage because I want to keep a small part of my portfolio in gold and have a good effect on the other part of the portfolio because investing in gold in miners is a hedge, not an investment, because what is the value of gold. Apart from that, I really look forward to showing you the other 40 miners.

And then after we have seen all the 50 miners, you can get the great idea of what best fits your risk reward appetite, your portfolio and how to hedge it at this moment in time. It's extremely important that we are hedged for currency devaluation for market crashes for turmoil for more monetary the helicopter money and one way to be hedged is invested in gold miners. There are other hedges we will all cover them as it's a very, very interesting topic.