Whitney Tilson’s email to investors discussing his analyst’s take on Conagra Brands Inc (NYSE:CAG); The Moldy Whopper; Shocking director resignation letter; Social media awash with scorn for ‘sloping toilet’

1) Last month, Alex Griese joined the Empire Financial Research team as an analyst. He’s down at the Consumer Analyst Group of New York’s (“CAGNY”) conference in Boca Raton, Florida this week and has attended the presentations from a number of companies over the past few days. I asked him to do a short write-up of the most interesting one he saw, and here’s what he sent…

Q4 2019 hedge fund letters, conferences and more

I didn't have high expectations for Conagra Brands Inc (CAG), which owns food brands such as Slim Jim, Hunt's, Chef Boyardee, Orville Redenbacher's, Birds Eye, Marie Callender's, Healthy Choice, Reddi-wip, and Vlasic. To my surprise, however, the company gave a compelling presentation... despite (or perhaps because of) the fact that the stock has been an absolute dog. It's around $30 per share today, which is lower than the $35 it reached in mid-1997 nearly 23 years ago, and has fallen by nearly 40% from its all-time high near $50 in late 2016. Take a look at this long-term stock chart...

But I'm more interested in the performance of the business, not the stock, so let's take a look at Conagra's revenue and operating income since the 2004 fiscal year...

Conagra Brands Inc Analysis

There are two things that jump out at me here...

First, look at how the business performed in 2008 and 2009. During the financial crisis, Conagra's profits rose, which shows how recession-resistant the business is. Nearly a dozen years into the bull market, I'm increasingly looking for companies like this (though Conagra does have $10.6 billion in net debt, equal to 4.9 times trailing EBITDA).

Second, after a significant decline from 2013 to 2016, the top line has grown nicely since then. Even better, Conagra Brands Inc has had success expanding its margins, leading to operating income more than doubling. To be sure, this growth is mostly due to the $10.9 billion acquisition of Pinnacle Foods in late 2018 – I would certainly hope that such a huge acquisition would lead to some gains! – but the company has also generated organic growth in both frozen foods and snacks.

When a company's stock price gets hammered during a period when both its revenue and profits are growing strongly, that's the kind of disconnect that catches my attention.

Part of the stock's weakness is due to Conagra Brands Inc reducing its full-year guidance on Monday. The company lowered many targets due to weak sales in the fiscal third quarter, which knocked the stock down by 9%. During its presentation yesterday, Conagra said sales had picked up in the past week, but investors are clearly taking a wait-and-see attitude...

What really excited me about the company is that I think it's doing some clever things on the social media front, which can really drive a consumer-oriented business' top line. For example, Restaurant Brands (QSR) saw 34.4% comparable sales growth at its Popeyes chain last quarter after its chicken sandwich went viral. A thinly veiled tweet by Chick-fil-A and a two-word response by Popeyes ("y'all good?") led to shortages of the sandwich at nearly every Popeyes the very next day... and the company was completely out of stock just two weeks later. Here's a New York Times article about it.

A similar trend is occurring right now with Conagra Brands Inc's Slim Jim beef jerky (though on a smaller scale). A superfan started posting about the brand, coining the nickname "Long Bois" for the product and "Long Boi Gang" for fans (who are doing funny, viral things like bringing a 10-foot-long Slim Jim on the NYC subway). As a result, the number of followers of Slim Jim's Instagram page has skyrocketed over the past year from 5,000 to 800,000!

2) Speaking of companies doing unusual things to attract attention, check out this 45-second video, The Moldy Whopper, that Burger King (also owned by Restaurant Brands) posted. Using time-lapse photography, it shows how disgusting a Whopper gets when it's left out for 34 days. Burger King's caption is: "the beauty of real food is that it gets ugly. that's why we are rolling out a WHOPPER that is free from artificial preservatives. isn't it beautiful?" It's sort of counterintuitive to try to sell a product by showing it becoming nasty and ugly, but the video has more than 1.2 million views!

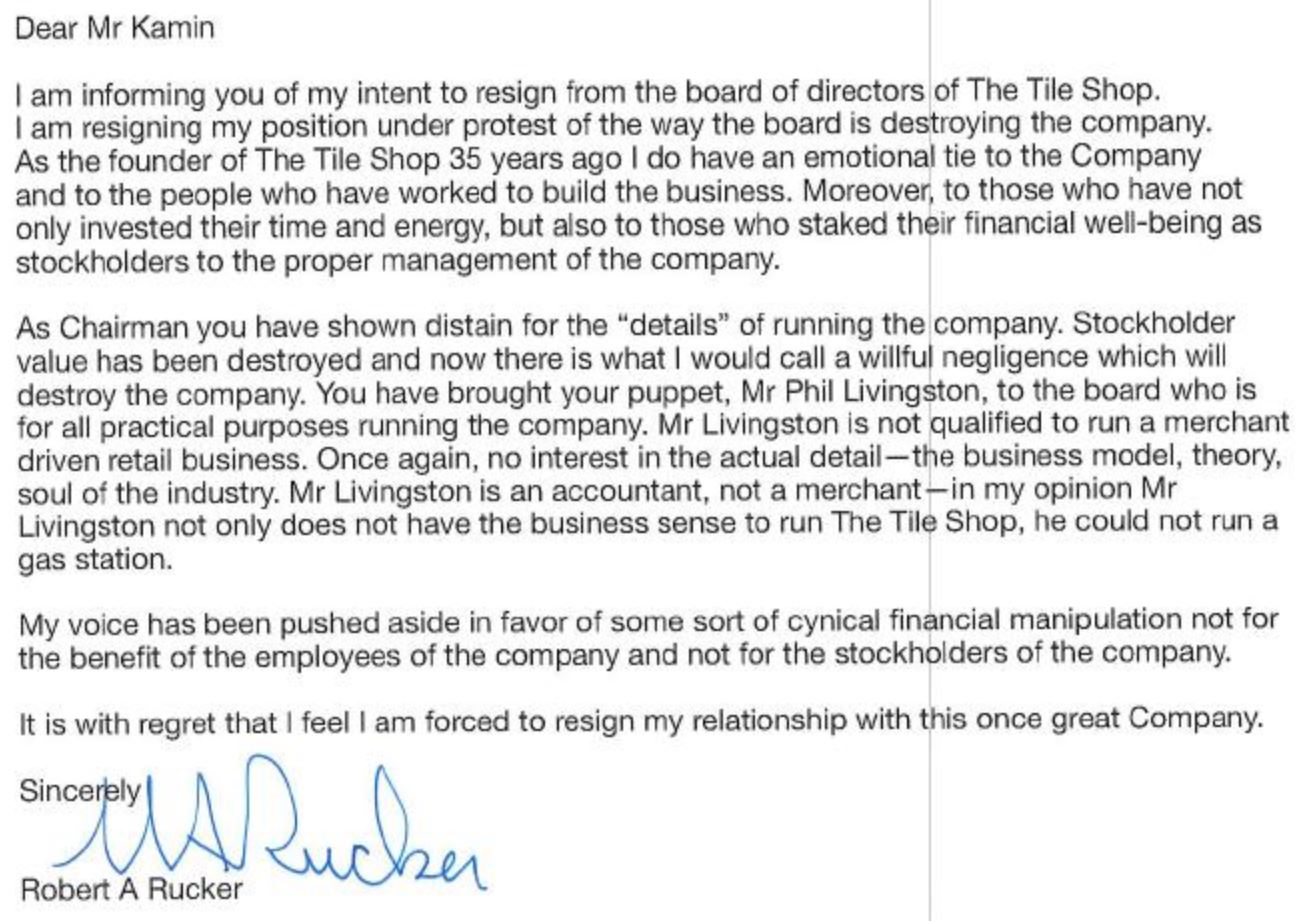

3) I've looked at flooring retailer Tile Shop (TTSH) a few times over the years, but thankfully stayed away – the stock has declined by 90% in the past 32 months. Founder Robert Rucker recently resigned from the board, and earlier this month he released a scathing letter... the likes of which I've never seen before. Best line: "in my opinion, Mr. Livingston not only does not have the business sense to run The Tile Shop, he could not run a gas station." Here's the full letter:

4) This cracked me up: A company has designed an uncomfortable toilet to discourage employees from taking long breaks on it! Here's an article from the BBC about it: Social media awash with scorn for 'sloping toilet.'

Best regards,

Whitney