McIntyre Partnerships commentary for the fourth quarter ended December 31, 2019, providing an investment thesis for Chemours Co (NYSE:CC).

Q4 2019 hedge fund letters, conferences and more

Dear Partners,

I hope you all are having a pleasant start to the year.

Performance Review – FY 2019

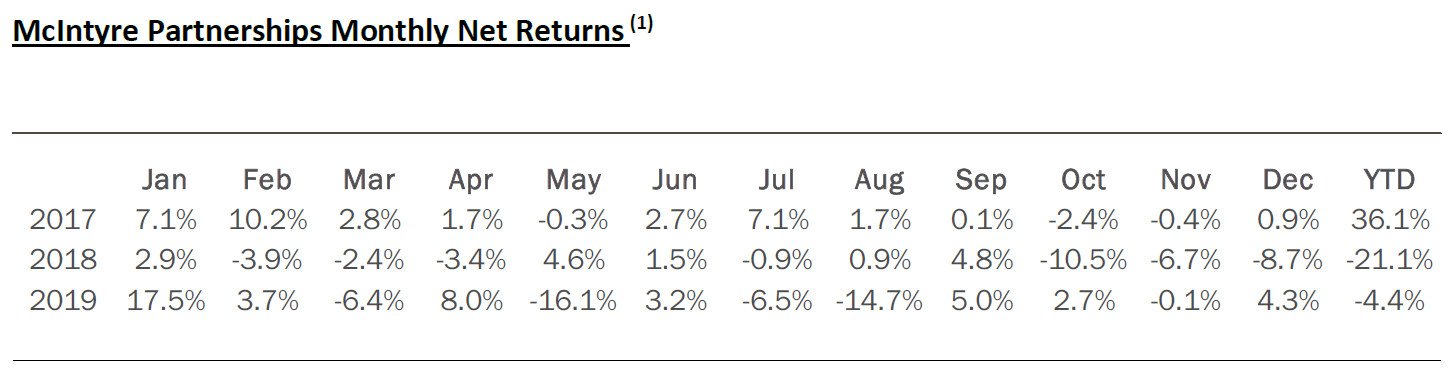

Through Year End 2019, McIntyre Partnerships returned approx. -3% gross and -4% net. This compares to S&P 500 and S&P 600 returns including dividends of 32% and 23%, respectively.

In a word, my performance sucked. While the partnerships’ absolute return was bad but not beyond comprehension, our relative performance was awful. The large gains we achieved in the first four months of the year reversed in Q2 and the fund has been volatile and treading water since. My underperformance over the last year is my personal worst since I began tracking my returns a decade ago.

Against which, the fund is in an odd spot. Our normally concentrated fund is even more so at present. Our Chemours Co (NYSE:CC) investment is the proverbial “big bet” where I am willing to put 50% or more of the fund’s assets into a specific investment that meets our rigorous standards – I consider it a “once in five years” type opportunity with zero fundamental long-term downside and multi-bagger upside. When I make the “big bet,” the fund will almost always be volatile until the investment is exited. We are also likely to experience losses when the bet is initially placed given my contrarian investing style. Compounding the loss in this particular “big bet,” CC was already a significant position before a steep, sudden fall – a negative short selling report and guidance reduction led to a ~70% drop in three months – resulted in multi-bagger upside. Netting this, the funds returns are lousy, the responsibility is mine alone, but our results are not outside the realm of what I think could happen given our strategy. The reality is the fund is concentrated and we are going to have 20% to 30% pullbacks occasionally. It does not make them fun and it is extra frustrating as the market breaks out to new highs.

Beyond NYSE:CC, which despite its significant volatility and sizing contributed under 50bps, our portfolio had several large movers in 2019. On the long side, FBHS and LILAK contributed >500bps each, SMTA contributed ~300-400bps, and CBS and Telesites contributed ~200bps each. Our only significant loser on the long side was our investment in GTX, which lost ~700bps. GTX had been a significant YTD winner, and I had added to our position as shares rose, but following the escalation of the trade wars, auto shares broadly fell and GTX fell even more so due to leverage. While my trading and timing was clearly wrong, I still believe my GTX thesis is correct. On the short side, we had minor single name losses but a substantial loss of ~600bps in our market hedge.

Portfolio Review – Exposures and Concentration

At year end, our exposures are ~120% long, ~40% short, and ~80% net. Our five largest positions were 96% gross exposure and our ten largest were 116%. However, our NYSE:CC investment is exceptionally large and has a significant options component which makes our exposures less meaningful at present.

Our five largest positions are CC, GTX, TPHS, uranium, and Permanent Bank. The first three are quite large while the last two are under 10% each.

Self-Reflection

“Markets have a way of separating egos from their money.” – George Soros

Taking a step back, I believe my 2019 performance falls into one of two categories:

A) My research is incorrect, and I have failed to admit it

B) I am early

When an investment is going poorly, early versus wrong is one of the most difficult things to consider. For any investor, conviction is a must, yet conviction bias – believing so deeply in something that your conviction blinds you to contrary facts – is arguably the single largest issue for a concentrated, contrarian strategy like ours. My philosophy is to keep it simple and lean heavily into the math and analysis. I revisit my reasoning for our three largest positions below.

Portfolio Review – Existing Positions

“Low price to book has correlated with good returns in the past. Momentum has correlated with good returns in the past. But valuation is causation. Stocks are ownership shares in businesses. I’m only interested in looking at things that have to do with that.” – Joel Greenblatt

We invest as owners of businesses. My primary goal as an analyst is to successfully estimate the future cash flows of our holdings. This is not necessarily different than a VC or hyper-growth investor who believes in the long-term story of new businesses. However, I strongly prefer investments with capacity for the return of cash in the near-to-medium term. My reasoning is that in the event of a sharp selloff, such as we have seen in NYSE:CC and GTX, the ability to return capital can drive a reweighting if my math is correct. Contrast this with hyper-growth tech companies with zero current FCF, where shares can pull back and stay there for years even if one’s thesis ultimately proves out – see AMZN from 2000 to 2009. Valuation is causation when they give you your money back. For the following investments, I believe the return of cash in the next 12-24 months will be substantial and represents a very real catalyst for our shares.

Chemours Co (NYSE:CC)

How did we get here?

When the fund launched in January 2017, Chemours was an ~25% position with shares trading $22. By the time I wrote my Q1 2017 letter, shares had rallied to ~$40 and I had reduced my position to ~12%, at the time commenting that shares were “10x my 2017 estimate.” At the end of 2017, shares had rallied to >$50 and I had essentially exited the position. In H2 2018, as shares pulled back to the high $20s, I again purchased a 20-25% position, which I explained in my Q3 2018 letter:

“CC now trades ~5x 2019 EPS, implying the market believes earnings have hit a cyclical peak, a recession is coming, and EPS is likely to decline significantly in the near term. While I do not have a strong view on the odds of a recession, I believe the market is substantially overestimating the cyclicality of CC’s earnings, which should be greater than $3 per share at trough and mid-cycle between $4-$6 versus a current share price of $30.”

In August 2019, shares plummeted to $12 and I quadrupled the number of Chemours shares owned at sub-$15 prices. In my Q3 Chemours update, I wrote “CC is exceptionally cheap, trading ~5x what I consider trough earnings and ~2x my mid-cycle estimates.” At present, consensus 2019, 2020 and 2021 EPS estimates are $2.40, $3.20 and $4. I have not bought or sold a single CC share since making the “big bet” in August.

Despite the enormous share price volatility and changing investor narratives over the last three years, my earnings expectations, and thus position sizing logic, have been consistent – I believe Chemours is a durably competitive advantaged company currently earning $5 in mid-cycle EPS with the ability to grow operating profits at a mid-to-high single digit rate with further EPS growth driven by buybacks. My estimates may or may not be correct – I lay out my thesis below – but wild share price movements will not change the cost/ton advantage of CC’s TiO2 facilities, the global demand for paint and plastic, the growth in demand for lower CO2 refrigerants, or the odds of giant, impending legal liabilities. My math and analysis are cold, sober, and unrelated to share price, beyond the impact of stock buybacks.

Thesis

NYSE:CC is chemical manufacturer, primarily of TiO2 and fluoroproducts, which I believe is a cyclical yet long-term stable business that can grow EBITDA at a mid-to-high single digit rate through the cycle, with further upside from share buybacks and dividends. During 2019, CC suffered two large fundamental setbacks, which along with overblown legal liability fears have driven shares to an extremely attractive 5x trough and 2x mid-cycle EPS valuation. Critically, I believe CC is one of the widest-moat businesses I have ever analyzed, enabling CC to work through its near-term issues without damaging its long-term competitive positioning. As the two fundamental issues are resolved and legal fears prove exaggerated, I believe earnings estimates will head higher and CC shares will substantially reweight. I believe CC will earn $5 in 2021 EPS/FCF, which given CC’s stated plan to return cash via buybacks should drive a significant reweighting towards at least an 8x multiple, or $40 per share.

For the last 60 years, Chemours has been the world’s low cost TiO2 producer by a wide margin due a mixture of scale, technical sophistication, and a proprietary process that results in an ~$300/ton competitive advantage versus peers. Compared to peers who on average earn $325/ton in EBITDA-capex at mid-cycle, NYSE:CC has a substantial advantage that drives profits at all points in the cycle. Further, TiO2 has no competitive substitutes, its primary end-markets grow inline with GDP, and CC has room to expand capacity, implying CC has a clear, albeit cyclical, runway of TiO2 earnings growth. The fluoroproduct division is a similar low-cost producer with GDP growth, albeit by a less-wide margin. Fluoroproducts also has a multi-year growth opportunity from its patent protected Opteon franchise, which should grow significantly due to regulations demanding lower CO2 refrigerant emissions. The combined divisions give CC a durable business which currently generates significant FCF and gives CC time to address its 2019 operating issues.

Regarding the near-term issues, first, the fluoroproducts division encountered issues scaling a plant and with quota enforcement in Europe. While the operational issues are largely resolved, the quota issue remains an overhang. Europe has a quota system to phase down “old technology” refrigerants, which contribute to global warming. For refrigerant producers like Chemours, the theoretical result is a decline in legally allowed volumes met with an increase in price as supply is rationed. However, in this round of reductions, the EU has horribly enforced its borders and allowed illegal imports to pour across them, hurting pricing and undoing the quota’s global warming benefit. Going forward, I expect the quota issue will remain a drag but the EBITDA reduction has already occurred and the segment should benefit from cost cutting initiatives and the continued growth of Opteon. I believe 2019 will mark a trough year for the segment.

Second, and more importantly, Chemours started a new TiO2 pricing strategy known as “Value Stabilization” where NYSE:CC sought to balance the TiO2 market and convert customers to long-term contracts. Effectively, CC decided to hold price and cede short-term volumes to end the boom-bust TiO2 cycle and “stabilize” the market. The initial rollout was rough and in hindsight poorly timed. Global industrial production declined and TiO2 customers destocked, which resulted in the largest TiO2 volume contraction in a generation. To maintain its “Value Stabilization” strategy, CC had to cede significant market share and its plants are currently operating at an ~60% utilization, down from ~90% in 2017. CC’s TiO2 EBITDA estimates have been cut in half and the business is operating at trough conditions.

Entering 2020, the TiO2 business is now at an interesting spot. Rather than the typical commodity chemical story where price and volume changes determine operating results, CC’s results will be driven by one question – will they or won’t they turn their plants back on. While bears will point to the difficulty in doing so, particularly questioning the impact on TiO2 prices and the time it might take to regain share, at the current share price, those points are irrelevant. If NYSE:CC management decides to increase operating rates, TiO2 EBITDA estimates are at trough and will head higher over time. I estimate a return to full capacity would increase TiO2 EBITDA $300-$400MM, a 30-40% increase in whole company EBITDA.

Critical to this question is Chemours’s management motivations and incentives. Long-time stock investors are all too familiar with horror mismanagement stories, where a CEO makes a bad decision then doubles down on it time and time again – stock investors are not the only ones susceptible to conviction bias. However, in the case of CC, we have high conviction that management intends to gradually return CC plants to full operation by 2021. We get this conviction from a pretty logical place – that’s what they said they would do and that’s what they are doing. On the Q2 2019 earnings calls, CEO Vergnano said, “We believe the second quarter was definitely the bottom and we’re starting to see pickup as we’re going forward.” Then, in Q3, volumes were up 10% sequentially, despite Q3’s typical seasonal sequential decline, with management commenting, “We’ve been aggressive at the plastic’s market, really working with our plastic’s customers to make it viable for them in terms of our offering. That’s really been the work. I would say, as you look towards fourth quarter, we continue to believe it will be flat to up from that standpoint.” CC has also confirmed to us and other investors in follow up meetings that they intend to regain their share in 2020.

I also take comfort in the large insider ownership, in particular CEO Mark Vergnano. The entire management team are significant shareholders and notably have acquired additional shares in the open market following the selloff. CEO Vergnano, however, is a substantial owner with ~650k shares, an additional ~650k “at the money” options, and ~250k option struck higher. At our YE 2020 price target of $40, that corresponds to an ~$30MM personal gain for the CEO, who has effectively his entire net worth in Chemours stock. In summary, the primary driver of NYSE:CC’s earnings story is turning on the plants, the CEO says they will do that and has been doing so, and he personally stands to multiply his net worth by doing so. I like being aligned with management.

PFAS

The other large weight on Chemours shares have been fears surrounding PFAS litigation. Despite the headlines and seemingly large complexity, NYSE:CC’s legal risks are relatively simple. CC currently faces manageable litigation which should result in under $250MM in total payouts in the next five years, and a low probability, yet difficult to quantify tail risk that the issue metastasizes into something larger in outer years. While those tail risks appear scary, most investments involve low probability, high potential tail risks and I am very confident that a worst case scenario outcome would take at minimum five years and more likely 10+ years to metastasize, which at current prices implies the entire float will be bought out beforehand.

In the next five years, Chemours faces continued clean up costs around former and existing DD/CC manufacturing sites, which currently run ~$50-$100MM a year and are already expensed in earnings (i.e. should not be deducted from NPV). Beyond that, NYSE:CC has a residual ~60 cases from a prior settlement, which I believe will be settled for under $100MM in H1 2020, and is a defendant in a large aqueous film forming foam (AFFF) litigation, which is primarily focused on PFOS, a chemical DD/CC never made. I assume DD/CC ends up “chipping in” $100MM into a multibillion settlement to make the AFFF lawsuit go away.

Beyond those lawsuits, Chemours faces the low probability tail risk that, despite significant evidence that 1) PFAS levels in the environment are not harmful and 2) DD/CC almost certainly are not the cause of the PFAS exposure anyways, litigation could metastasize into something bigger like asbestos or tobacco. I think it is prudent here to consider that the chemical industry is no stranger to large, ongoing legal tail risks yet with rare exception has survived them. Lead paint, PCBs, MTBE, etc. have been ongoing litigation risks for decades, despite that these products were pulled 30-50 years ago, and the results have been manageable. It’s also worth noting that the litigations that metastasized either involved signature diseases, like asbestos via mesothelioma, or huge scale issues like tobacco and opioids that killed thousands of people. PFAS have no signature disease and there is no evidence showing widescale serious harm. While PFAS have been linked to serious issues like kidney cancer, the chemicals have only been linked at exposure levels found in plant workers and communities near manufacturing facilities. Beyond plants, there is little evidence of harm and the types of harm alleged, such as high cholesterol and lower vaccine efficacy, are not going to win large sums. Instead, DD/CC face “why not” lawsuits where another defendant, such as 3M, caused the exposure but DD/CC get added to the lawsuit anyway because it costs nothing to add another initial defendant. For instance, in the AFFF litigation, there were over 100 initial complaints yet only two named DD/CC; however DD/CC were eventually added to the other claims because “why not.” In addition, DD/CC face “novel” state lawsuits alleging trace low part per trillion pollution levels – one part per trillion is one second in 31,700 years – hundreds of miles from DD/CC plants. I believe the “why not” and state lawsuits are unlikely to result in material damages, but must be monitored nonetheless.

While the outcome of the tail risks is impossible to know, what I am highly certain of is that litigation risk moves at a snail’s pace. For instance, Sherwin Williams (SHW) and other paint manufacturers have been in consistent, ongoing litigation over lead paint for over 30 years. Recently, in Q3 2019, SHW settled a case with the state of California alleging public nuisance, a claim which states are now suing DD/CC over. The case was originally filed in 2000 and alleged “billions of dollars in damages” and that the manufacturers “engaged in a cover up.” Eventually, SHW and other paint companies lost a $1.2B judgement in 2014, yet that judgment was slashed on appeal in 2017, and the parties finally settled for $305MM in 2019 – 19 years after the initial claim and 41 years after the product was pulled from market. Most PFAS litigation is recently filed and involves “novel” new claims, such as arguing DD/CC made a coating on a pizza box that is now present at trace PPT levels in New Hampshire’s flora and is thus “trespassing,” which will involve years of briefs, discovery, hearings, and appeals before even potentially reaching a trial stage, where an adverse event would likely again involve years of further appeals.

In the meantime, NYSE:CC’s near-term legal payouts will be small, its shares are cheap, and the company plans to return the bulk of FCF via buybacks. If my estimates are correct, at present prices, CC will buy out the entire float by 2023.

Five Year Target = $100

In the next five years, I believe Chemours shares have a high probability of large, multi-bagger returns. While the return potential is exceptional, the logic is straight forward: at present, CC should earn ~$5 in mid-cycle EPS, can grow mid-cycle EBITDA at a mid-to-high single digit rate, and as the shares are likely to trade at a depressed multiple (though I won’t complain if they don’t…), the buyback is likely to be substantial. Depending upon share price, the above math yields $10-$20 in 2025 EPS. Again, while the math is large, my 2025 EBITDA math is conservative. I assume $2.1B in 2025. One year ago, the consensus estimate for 2021 was also $2.1B. In effect, near-term NYSE:CC’s multiple may be constrained by PFAS and cyclical fears, but the long-term compounding effect of CC growing EBITDA and repurchasing shares under 10x is massive.

Garrett Motions (GTX)

GTX is a leading manufacturer in the moat-rich turbocharger (TB) market, with a global end-market, industry leading margins, and a strong medium-term growth story from hybrid penetration. The company was spun from Honeywell (HON) in Fall 2018, and we initiated a position around the spin. Shares rallied considerably through April; however, as global industrial production and auto trends turned for the worse, shares reversed and now sit at ~2x levered FCF and ~8x unlevered. While the equity is levered, I believe the leverage has favorable characteristics – half the leverage is term loans and bonds trading at par with sub 5% yields and the other half is a non-interest bearing asbestos liability that is PIK-able in a worst case event. GTX management aims to paydown net debt excluding asbestos to ~$1B before commencing capital returns, which implies GTX will be able to return $75-$150MM in capital per year starting in 2021 versus GTX’s current market cap of ~$650MM. In the event that global auto production, which is currently in a two-year downturn, were to improve, I believe my estimates are conservative. Historically, global automotive has returned to growth within four years of a recession and current auto production has contracted ~8-10% versus the Great Financial Crisis’s peak-to-trough decline of ~15-20%. I also believe GTX is under considerable shareholder pressure to pursue capital returns ahead of schedule.

Unlike most auto suppliers, who make commodity products with vanishingly small gross margins, GTX is truly a technology company. TBs are like mini-jet engines – that’s why HON was in it – that improve air efficiency in internal combustion engines (ICE), which is critical for auto OEMs as regulatory pressures in the EU and China push for sharply lower CO2 output (aka higher miles per gallon). GTX and BWA share a duopoly in the global TB market, which allows for stable pricing (best margins in autosupply) and stable market shares in a product that for regulatory reasons will be growing 500bps above market for the next five years. While global auto production is subject to macroeconomic whims, we are buying a business where the industry structure and GTX’s technological advantages provide a durable, and in the near term, growing cash flow stream.

GTX’s longer-term problem is that pure battery electric vehicles (BEV) are getting cheaper and regulations are pushing auto OEMs towards BEV adoption, thus ICE and related technologies are the proverbial horse to the car. My view is that, yes, that’s true and this business will eventually enter secular decline. However, I believe we are extremely early to that decline, TBs will grow overall penetration of ICE in the meantime, and there are large logistical issues to rapid growth. Pure BEVs are ~1% of global auto sales right now. One of the biggest current issues is BEV price, with typical BEVs 2x or higher in cost. Further, while price will eventually come down as batteries become cheaper in the next few years, even beyond price there are a host of issues that make rapid BEV adoption unlikely. The batteries take hours to charge and even “superchargers” take roughly an hour to add 100 miles; there isn’t enough charging infrastructure to enable long trips even if you don’t mind waiting; most Europeans and Asians park on the street so the cities must fundamentally be redesigned; there is a serious limit on available lithium to supply the batteries; etc. This is not a software disintermediation with zero incremental costs and instantaneous distribution but a fundamental reconfiguring of a global transportation network with hundreds of billions to trillions in costs spread across thousands of decision makers. It’s not an easy transition, pure BEVs currently have minimal market share, and in the meantime GTX has significant room to gain share of the existing ICE market as a near-term CO2 reduction tool. If BEVs are sub 30% market share in ten years, GTX could be a 10-20x bagger.

Some bears will also cite risk around autonomous vehicles (AV). The thesis is that driverless cars will drastically decrease the cost of ride share, which will push a consumer shift to carpooling and drive down the overall demand for cars. I am sympathetic to this argument – the single largest expense per ride in an Uber/Lyft is the salary of the driver – but I believe this technology is far from widespread deployment. At present, AV technologies are closer to “driver assist” and full AV technology is limited to small runs at slow speeds. To give perspective to what large scale AV adoption implies, in the USA, every day at noon there are roughly 20 million cars on the road with roughly two people per car. The AV bear case is saying “we are going to put 40 million people’s lives in the hands of a computer and it will happen really soon, even though it doesn’t exist at all right now, and by the way, we’ve recently run a couple of people over despite a safety driver sitting in the driver’s seat.” While I think it’s possible that full AVs will begin taking passengers at limited speeds in certain downtown areas in the next few years, I do not believe the technology exists to have an impact on overall auto demand in the next decade.

Trinity Place Holdings (TPHS)

Trinity Place Holdings (TPHS) is a relatively simple “workout”-esque security. The ~$3 stock has ~$2.50-$3.00 in easily valued investments and one other large bet: a new build residential construction in lower Manhattan called 77 Greenwich that I believe will yield $3-$5 in value by year end 2021, yielding a sum of the part (SOTP) of $5.50-$8.00, a ~80-165% return in two years. I initiated a modest position in Spring 2019 at ~$4 and resized the position when shares fell to $3 in late 2019. In the absence of any significant news, I attribute the year-end selloff to tax loss selling in an illiquid security. I believe TPHS shares are an opportunity where we stand to lose little, if any, if my thesis is incorrect and stand to make a great deal if 77 Greenwich is sold in line with my projections.

The critical variable in TPHS’s SOTP is what average sales price per square foot (PSF) 77 Greenwich ultimately achieves. Over the past few years, high-end NYC residential real estate has been in a bear market, and 77 Greenwich is unlikely to achieve the high IRRs management envisioned when development commenced. However, we are buying shares significantly below where the project was capitalized – between 2015 and 2017, TPHS priced several rights offerings between $6-$7.50 per share as well as at-the-market offerings which sold shares with an average price greater than $9. Our $3-$5 estimate corresponds to a $2,000-$2,500 PSF sales price. I believe the low end of my range is a floor for the asset and the high-end would only be achievable with an upturn in the NYC real estate market. Construction of 77 Greenwich is well over 50% finished with completion scheduled for the second half of 2020. Marketing and sales commenced in Spring 2019 and are scheduled for completion in 2021.

As the initial units are sold, I believe there is a possibility the market will see the relevant PSF price marks for the asset and shares could reweight in advance of completion. If not, I am comfortable with TPHS’s capital allocation policy, which is to acquire NYC residential real estate and/or return cash to shareholders via buybacks or dividends. I have met management numerous times and believe they are sincere in their capital allocation plans. They are also significant shareholders. Finally, TPHS is largely controlled by two rational shareholders, Michael Price and Third Avenue, who I believe care about the share price and are incentivized to properly allocate capital once the 77 Greenwich project is completed.

Business Operations Review

Our audit and tax prep are underway and should be completed soon. I’ll be reaching out to partners soon with further details.

As always, please feel free to contact me with any questions.

Sincerely,

Chris McIntyre