Choice Equity Funds commentary for the fourth quarter ended December 31, 2019, providing an investment thesis on Hooker Furniture Corporation (NASDAQ:HOFT).

Q4 2019 hedge fund letters, conferences and more

Dear Investor:

US markets finished the year strong in Q4, adding to already healthy year-to-date gains. Small caps were up +9.9% in the fourth quarter and +25.5% for the year, while large caps were up +9.1% and +31.5%, respectively. Our portfolio finished -10.4% on a net basis for the fourth quarter, putting our performance at +3.9% for the year. This latest update now means $1 invested in our portfolio since becoming independent in 2017 is worth $1.42 versus our Small/Large blended benchmark of $1.34.

Executive Summary

In this letter, we discuss the primary drivers of performance in the quarter. We then discuss new portfolio additions Spectrum Brands (SPB), Hooker Furniture (HOFT) and Duluth Trading Co. (DLTH). Then I offer a few thoughts about our turning three years old before closing with a few thoughts on our investment outlook.

Q4 Performance Commentary

Suffice it to say, Q4 was a frustrating one for us. While markets ended the year on a strong note culminating in a banner year for equities, two of our holdings experienced large price declines that left us with a disappointing finish to what had been a promising year. Only a little more than 90 days ago with our portfolio up +16% net versus small caps +14%, I confess I had looked forward to the possibility of announcing our three year birthday with three consecutive years of strong absolute and relative performance (also with a tax loss for our taxable investors). But position marks can change quickly as they did in Q4. And while that is the unfortunate message of today, it also provides cause for optimism for tomorrow.

BXC – Bluelinx’s ~55% quarterly price decline was the largest driver of performance, detracting ~8% from our returns for the quarter. As you know, we have been investors in this company at various position sizes for a number of years, and the company’s stock continues to be among the most volatile I have encountered. Since the company announced the Cedar Creek deal early in 2018, investors have been willing to assign values of as much as $410M for the equity, to as little as $81M as they did one day this past December. These highly divergent opinions have been driven primarily by the company’s leverage profile, wavering views on the health of the company’s housing end markets and on opinions regarding management’s abilities to integrate the deal successfully. With investors seemingly in agreement that the housing market has emerged from a brief spell of recessionary-like conditions from the winter of 2018/19, investors were expecting to see meaningful progress on deal integration efforts.

However, based on the 3Q results reported in November, the company looks to have taken a step backwards. As the deal synergies were primarily built around removing redundant supply chain costs from the combined entities, investors were anticipating steady product volumes to result in higher profits on a shrinking cost base. Instead, deal integration efforts created complications moving products through the company’s supply chain. Some orders were not met while others that were came at higher expense as the company had to rely on extra labor and freight to get products where they needed to be on time. While spending more to fulfill customer orders was the right thing to do for the business, it made for a very ugly quarter. Costs were up, revenues were down, and investors who were anticipating EBITDA around ~$29M or more, instead got ~$19M. Many who had piled into the stock on this integration thesis would question the merits of the deal and management’s ability to integrate it successfully. Investors exited abruptly, and shares were more than cut in half in less than a week.

While the Q3 results on a standalone basis call into question the deal’s viability, a bigger picture view can be helpful. As our interactions with management here predate the deal, it is helpful to recall prior to these missteps I had previously observed management to be credible, trustworthy and capable operators. Though there have clearly been missteps in its integration, most issues appear self-inflicted, temporary and solvable. There are other reasons to believe prospects will improve as well. After meeting with management at their headquarters in Atlanta, it is clear they have redoubled their efforts to protect their volumes and a recent press release confirms progress in these efforts through the first seven weeks of Q4. While some of the cost take-outs have assuredly been delayed, they do sound ultimately achievable. Housing market indicators are supportive, and if the sentiment I gathered from walking the floor at the International Builder’s Show in Las Vegas two weeks ago is any indication, it would seem participants are quite optimistic and supportive of a view that this year may see as much as 7% growth or more in single family housing starts. Additionally, while insider purchasing alone never makes an investment thesis, it is a clear positive to see several executives see value in shares and have been buying at these lower levels.

Recent prices around $12 per share seem to assign very little likelihood to the prospects of a successful integration. But should the company continue to generate volume growth and ultimately capture the previously targeted cost synergies, it seems quite plausible they could generate as much as $3 to $6 dollars per share in free cash flow, levels that could be achieved on a run rate basis as soon as this summer in an optimistic case. So, for these reasons, we are standing pat and observing closely.

HOME – Recent portfolio addition At Home was also a detractor in the quarter although its loss was not as severe in terms of magnitude or impact to the portfolio. Even so, it’s ~40% price decline came at an unfortunate time for our portfolio and was enough to more than offset gains in other positions. Much of our investment thesis behind At Home was built around the notion that the company’s earnings were temporarily depressed due to soft industry conditions, growth investments and other external factors that valuation implied may be permanent.

While the 3Q earnings came in largely as expected, the guide for 4Q was a disappointment relative to expectations. Bears point to the weak same store sales growth guidance and suggest these conditions are permanent and reflect a business model that is no longer relevant. Bulls suggest the business model seemed fine just 18 months ago and view softness as temporary considering participants across the entire home furnishings category have seen equally weaker sales results across similar time periods. While December’s report was clearly a mixed bag and points to still soft industry conditions, it contained little from a fundamental basis that suggests free cash flow and same store sales metrics cannot improve in the coming year, in part aided by growth again picking up across the category. Of course, only time will tell.

Portfolio Activity

In the quarter, we made three new investments.

SPB – Spectrum Brands is a conglomeration of brands including many you may know, like Spectracide, Black and Decker, Kwikset and George Foreman. As the successor to Rayovac Corporation, the company traces its roots to The French Battery Company in Wisconsin around 1906. Today, the company owns nearly 60 brands across four segments: Hardware & Home Improvement, Home and Personal Care, Global Pet Care, and Home and Garden. The portfolio of brands has seen quite a bit of activity over the years, initially with the company beginning efforts to diversify away from the battery business in 2003 with acquisitions of Remington Products and United Pet Group.

The portfolio activity has continued, although since Dave Maura took over in April 2018 as CEO, the company has been pruning the portfolio more than anything. Last year, sales of the Energizer battery business and the Global Auto Care business brought in north of $3B and enabled the company to de-lever to a more comfortable leverage ratio near ~3x. Today, the streamlined portfolio has 15 healthy brands that drive close to 80% of the company’s sales. While some brands are of course performing better than others, many have been reinvigorated with fresh capital, brand updates and new product launches in an effort to drive improving organic growth.

With much of the major portfolio activity seemingly behind them and modest leverage relative to the healthy recurring cash flows the brands generate, the management team views the shares as a bargain and has been acting accordingly. Trading a little under 9x LTM EBITDA and targeting $7 of free cash flow per share next year, insiders have been purchasing stock while the company continues to purchase shares at a consistent pace, positioning this house of brands to be a more steady and reliable performer going forward.

HOFT – Hooker Furniture is an overlooked small cap designer, manufacturer and importer of furniture. The nearly 100-year-old company owns furniture brands covering all tiers of the marketplace – from high end to mass market. While it is not a family owned company per se, it kind of looks like one as CEO Paul Toms has family ties to the same company where he has been CEO since 2000. The company has a strong balance sheet, generates impressive free cash flow and has better than average returns on capital, particularly for a furniture player. One reason for this is a result of the company’s pivot years ago to a mostly asset-light importer / distributor business model in which the company sells its products through vendor partners. This channel-agnostic approach allows the company to both minimize real estate costs and also redirect product to channels with the best growth prospects. While it is a quiet company in a fairly boring industry, its financial characteristics, sub 10x forward PE ratio and strong management suggest it is an attractive investment. A more detailed write-up is included in the Appendix and can be found on our website.

DLTH – Duluth Trading, as you may know from their quirky television ads, is a brand of mostly outdoor garments for men and women. Created in 1989 by three construction workers in Duluth, MN, the company expanded into a catalog-based brand of portable products and outdoor workwear apparel winning fans for its high quality, durable products and attentive customer service. Chairman Steve Schlecht purchased the brand in 2000, and from there the brand grew quickly, leading to its IPO in 2015. With strong sales growth and the potential to achieve its $1B sales target, the omnichannel brand attracted a base of growth investors who cheered its expansion. Its store base expanded from nine to 61 and shares surged from its IPO price of $12 to $39 in just a few years. (For those interested in learning more about the brand, there’s a good book by the company that came out in 2018, incidentally right about the time shares peaked, called The Art of Building a Brand.)

But the aggressive pace of growth had costs. New stores would start to show a worrisome trend in important productivity measures while expansion efforts would subsequently necessitate large infrastructure investments from distribution center and inventory management system upgrades. The company would also face pressure at the gross margin line from discounting and shipping revenues that were being competed away. By 2019, the company’s operating margins had fallen below their pre-IPO level, and by late last year, shares were more the 25% below their IPO price.

Despite the growing pains, there remains a lot to like about the company. Importantly, brand engagement remains strong. The company is one of only a few that has the luxury of going the omnichannel route from catalogue house origins rather than as a legacy store-based retailer. And because it controls the distribution of its products which are sold only in its stores or on its website rather than through third parties, it has a strong ability to protect its premium brand. It also sources only minimally from abroad, so tariffs have not negatively impacted the company to the level it has peers. Lastly, the company carries only modest leverage and is likely to generate healthy cash flow as it harvests the infrastructure investments which have mostly already been made.

Recently, Founder Steve Schlecht has returned to the CEO post and has slowed the breakneck pace of store openings while refocusing the company on profitable growth. He seems motivated to succeed, given he owns nearly 9M shares or almost $75M worth. Trading at ~6x 2020E EBITDA versus more established brands at 8 – 12x, it seems the current valuation assigns very little likelihood to the company continuing a successful march to its goal to be a $1B brand.

Some Thoughts On Our Investment Approach

The recent turn of the calendar marks our three-year birthday, one of many arbitrary short-term finish lines in the investment profession. Given the passing of this mile marker – and the way we stumbled across it – I thought I would take the opportunity to briefly discuss our investment approach.

Much of our approach is focused on winning the medium term. I am not trying to buy winning stocks for one quarter. Nor am I trying to buy winning stocks for ten years. Instead our focus is centered around evaluating the intrinsic value of a business, which I typically do based on a three-year forward projection of potential cash flows. To attempt to minimize risk and maximize return, we make investments only when we feel we have an opportunity to double our money or better over this period.

This is not an arbitrary time horizon; rather, it is a framework I have chosen for a number of reasons. It is a tax sensible strategy that I believe allows us to capitalize on market and stock specific volatility and enables us to participate in many different setups that occur in the market frequently. They include companies that are overlooked, underappreciated or even hated. Sometimes, share prices get punished simply for the short-term negative impact on earnings from growth investments. Or perhaps the company in question is a cyclical company, preferably just in front of a looming inflection point in their growth trajectory. Typically, I’m looking for good businesses suffering from a temporary condition of some sort and seek to buy the growing cash flow streams of these companies at a discount. The phrase “buying a growing $.50 dollar” is one that fairly well encapsulates this approach. When executed well, this affords us an opportunity to benefit doubly: first by capturing the increasing intrinsic value of a company and then by profiting from the closing of the gap of price to value.

I believe this approach is the best path to follow in order to produce a rewarding return stream that is driven more by our companies and their results than by the markets in which they trade. For the 11 quarters since we started in 2017, we have done this quite well. But given the declines just suffered and their impact on our performance, some may wonder why do it this way, or why bother with stocks that carry such volatility. Of course, these types of massive declines do not happen to Berkshire Hathaway. Or Apple. Or other megacaps. But they happen to small caps. And that is precisely why we focus our efforts here. These moves clearly outweigh the fluctuations of a company’s intrinsic value and this sort of price volatility is indicative of the opportunity set at hand.

But these outsized moves also represent risks. And particularly in the case of small caps where a few large investors’ actions can sometimes move a stock substantially, ones to always be mindful of. Given these considerations, I think it is clear there is some room for improvement in managing the short-term conditions that can accompany stocks in this space. Owning an opportunity when it is being created is clearly less profitable than starting anew from an uncompromised capital base. So, going forward, I believe a little extra attention to things like the positioning of other investors will be a sound and profitable addition to the implementation of our strategy that has served us so well up to this point.

2020 Outlook

Markets ended the year on a high note, as some of the real and perceived headwinds to growth faded to the background. Primary drivers of this improved sentiment seem to be an accommodative Fed who has achieved a steepening of the yield curve and a trade situation which at a minimum seems to no longer be getting any worse. Many of the industrial businesses which have seen negative or flat growth seem to be bottoming out. Perhaps most importantly, a healthy US consumer continues to be the workhorse that drives this economy.

As always, there is plenty to worry about, and I suspect our political hopefuls will make every effort to point out any shortcomings in our economy or the geopolitical landscape as they offer their own views on how best to lead our nation. The Coronavirus also looks like a headwind, but not an insurmountable one if it proves to be similar in scale and severity to prior airborne illnesses like SARS. But despite some pockets of relative weakness, the economy remains healthy and earnings look biased to again move higher after stalling out for parts of 2019.

Our portfolio has seen some turnover given new positions seem to offer a more attractive risk / reward. At present, it is an eclectic bunch of stocks that appears set to perform well in this environment. Though our holdings will assuredly be influenced by the market direction in the short term, in the medium to longer term, our performance will be driven by the results of these specific companies and the unfolding catalysts that lie ahead.

Conclusion

In closing, while I know our approach will not yield outperformance each and every quarter, I continue to believe it will be well worth our while over the long haul. Perhaps more importantly, given the overwhelming majority of our investable assets are invested alongside yours, we would never ask investors to assume risks we ourselves will not.

Thank you for your continued support as we work to grow our capital together. As always, we are happy to discuss our investment outlook with you at your convenience. Please reach out any time.

Best regards,

Mitchell Scott, CFA

Portfolio Manager

- All market and company data is sourced from Factset and company filings and is current as of 12/31/19.

- CEF uses the S&P 500, Russell 2000, a custom Blended Small/Large Benchmark and the Barclays Hedged Long/Short indices as its primary benchmarks. The S&P 500 and Russell 2000 are common large and small cap US equities-based indices. The custom Blended Small/Large Benchmark is provided to capture a larger proportion of small cap performance versus large cap performance (at a 3:1 ratio) due to the similarly high proportion of small caps found on the Good Businesses Focus List as well as the strategy’s general preference of having an investment mix more heavily weighted towards investment in small caps. The Barclays Hedged Long/Short index (an index of equities-based hedge funds) serves as an appropriate benchmark over the long-term given the index has a similar long-term goal of capital appreciation through equities investing.

- CEF Net Returns are hypothetical results calculated from actual gross results in a manner consistent with the 1% management fee and 18% performance fee offered to clients.

Appendix 1

Hooker Furniture – Investment Thesis

Hooker Furniture is an overlooked small cap designer, manufacturer and importer of furniture. The nearly 100-year-old company owns furniture brands covering all tiers of the marketplace – from high end to mass market. Recent tariff issues have led to gross margin contraction that we believe is set to reverse. With the stock trading at ~9x forward earnings, we think shares are too cheap for a company that is set to grow EPS, EBITDA and Free Cash Flow by as much as 30%+ next year as margins normalize. Our base case price target for Hooker is $40 per share. Long term, we see multi-bagger potential with a path to north of $70 with higher sales growth, structural margin improvement in the Home Meridian segment and accretive acquisitions. Put simply, Hooker today trades at a trough earnings multiple on depressed earnings. With strong management, a clean balance sheet and a strong near and long-term outlook from normalizing margins, we believe Hooker presents a highly compelling small cap investment opportunity.

Hooker Furniture: Reason For Opportunity

Hooker Furniture, along with many other furniture-related players, is available at attractive multiples of normalized earnings and cash flow today due mainly to two factors: 1) sales declines during calendar 2019 driven by demand sluggishness and 2) tariffs. We believe the first issue is mostly behind them, as retailers have begun to normalize inventory while the furniture category has resumed growth after a few quarters of weakness. The second issue also looks to be nearly resolved, with the company set to end 2020 with around 20% of production in China (down from 40%). This transition out of China should enable the company to recapture their prior gross margin levels, which we expect will begin to show up in the coming quarters.

Variant Perception

Furniture stocks of all kinds have been on sale for much of 2019. The consensus view is that furniture importers and manufacturers like Hooker Furniture will struggle mightily without Chinese manufacturing. However, we do not think this is the case. According to Barclays, 50% of furniture manufacturing in 2018 was done in Vietnam – up from a single digit percentage just a decade ago. Vietnam has become a powerhouse for furniture manufacturing, making the transition from China into Vietnam relatively seamless. As for Hooker, 40% of sales were sourced from China in the 1H of 2019. That amount is expected to reach 20% by the second half of next year and decline even further after that.

The other area of confusion, we believe, is the nature of Hooker’s business model. Hooker is an asset-light furniture importer and distributor, with only a small portion of its revenue dedicated to high end manufacturing here in the U.S. As a distributor of several well-regarded brands, the company has chosen to forego physical retail stores. Instead, the company employs a channel-agnostic approach that allows it to grow with partners like Costco and Wayfair that have successfully figured out how to reach the customer. While a smart strategic model, its highly variable operating cost model also carries minimal capex needs leading to high free cash flow conversion.

Hooker Furniture: The Business

What it is – Hooker Furniture is a designer, manufacturer, distributor and importer of furniture, both casegoods and upholstered furniture1. The company has a history of profitability through all economic cycles, has a solid balance sheet and generates low double digit returns on tangible capital. Unlike its publicly traded peers (BSET, LZB, ETH), they do not have their own stores. The company, instead, sells its branded furniture through independent retailers (mom and pop stores), club stores, department stores and e-commerce (Wayfair, Amazon). Their approach is completely channel agnostic. This puts them on the same side of the table as their channel partners, instead of competing against them by opening stores. This decision to not open stores has been in the Hooker philosophy for many decades, as doing so would cut off other channels of distribution. Hooker Furniture also does not go direct-to-consumer. E-commerce comprises 15% of sales and, as a channel, has grown at a 15% CAGR over the past 5 years.

Corporate history – The company was founded in 1924 by Clyde Hooker Jr and is located in Martinsville, VA. Steady leadership and a long-term owner’s mentality have allowed the company to successfully the navigate the twists and turns the US furniture industry has endured over the years. Hooker Furniture maintains a long-tenured management team, with CEO Paul Toms having held the position since 2000, and CFO Paul Huckfeldt having been with the company since 2004. Toms is the grandson of Clyde Hooker Jr. In 2000, nearly 70% of Hooker sales were from furniture made in their factories in the U.S. That changed as production moved to China, and in 2007, Hooker fully exited the manufacture of domestic wood furniture in the U.S. It is also worth noting ~20% of shares used to be held by the company’s ESOP, though this was dissolved over a decade ago.

Capital Allocation– Historically, Hooker concentrated on their core products and built up a substantial war chest of cash after committing to modest growth in annual dividends. More recently, the company signaled a more aggressive approach towards acquisitions in early calendar 2016 with the acquisition of Home Meridian International for $100M. Home Meridian put Hooker Furniture in the mass market channel where they previously had minimal presence. We believe the Home Meridian acquisition was done at around 5x EBITDA. They continued this acquisition path when they re-entered the domestic manufacture of upholstered furniture by acquiring North Carolina based Shenandoah in 2018 for $40M. These two deals complete the brand portfolio, positioning Hooker across most major price points. We believe these two deals also create substantial value for shareholders. The company has committed to using all free cash flow to pay down debt. Gross debt today is a very modest $26M versus our estimate of $40M in adjusted EBITDA this year. We believe the company will continue to evaluate acquisitions where they make sense and continue to pay down debt and build up cash.

Hooker Furniture: Investment Considerations

Long history – HOFT has been in the furniture business for nearly 100 years. CEO Paul Toms has family ties to the business and has been in place at the company since 2000. This long history also results in strong relationships with the many mom and pop furniture dealers throughout the country that carry Hooker’s furniture brands.

Margin improvement – Current gross margins are depressed primarily due to tariffs. We believe this is being worked through and anticipate gross margin normalization in the next 6-18 months.

Pristine balance sheet – Hooker Furniture has a rock-solid balance sheet with $26M of gross debt as of the end of the most recent quarter. Hooker, unlike its peers, also has no stores and therefore has no lease liabilities. We suspect the company will again be debt free in three to four quarters and will continue to maintain and likely grow it’s $0.15 quarterly dividend.

Asset light / high ROIC business model – The company’s low variable cost operating model also requires little in the way of ongoing maintenance capex. This flexibility has allowed the company to remain profitable across various cycles, including 2008 and 2009. Accordingly, Hooker Furniturehas historically generated a very respectable low teens return on equity. Because of the large balance of intangibles and goodwill, the returns on tangible equity are considerably higher.

Brand positioning – With the acquisition of Home Meridian in January 2016, the company is now solidly positioned across all price points in the furniture market.

Channel agnostic approach – Hooker Furniture has held fast to its strategic decision to not open stores. This has enabled it to efficiently and flexibly partner with any number of store or non-store-based retailers who have found varying degrees of success in reaching the customer in the current dynamic and changing retail environment. The company is well positioned with Costco who is a near 10% customer, as well as Wayfair, who we believe is an ~8% customer. This also means the company has little exposure or liabilities tied to real estate locations like malls that have seen declining foot traffic trends. Accordingly, Hooker’s store-based retail sales closely mirrors the industry average of 85% as a mix of sales.

Ecommerce – Approximately 15% of Hooker Furniture’s sales are through e-commerce. As they do not own any stores, they also do not own any direct-to-consumer websites or offerings. Hooker has developed, and will likely continue to develop, packable furniture that is easy to ship and assemble at the customers’ home. Their higher end products are also available for white glove delivery. We note the company has a strong relationship with Wayfair as a channel partner and actually see some blood relatives of the current Hooker team that are long time employees there.

Share gain initiatives – The company continues to come up with innovative products and packaging to gain share in the industry. For example, they are currently rolling out ready-to-assemble furniture that is exclusive to Walmart.com and Target.com. If successful, these products will likely end up in physical stores as well as continue to be sold online.

Supportive macro backdrop – Low interest rates, increasing household formation amongst millennials and low unemployment are all excellent tailwinds for furniture purchases. Census data for the home décor and furnishing segment of the economy went through a rough patch starting in November 2018 and continuing into 20192. Sales in this area of the economy posted negative monthly declines on a year-over-year basis from November 2018 through June 2019. Only recently has the data begun to turn positive, with the most recent September and August both turning positive at around 1% year over year.

Growth Prospects

Sales growth – In a normalized environment, we see topline likely to go grow at mid-single digits rate or a little better. This incorporates furniture category type growth of moderately GDP plus as well as a 1 – 2% for inflation. Share gain opportunities could add a further 1 – 2% to the topline. In the short term, we see the potential for a bit of a bounce-back year as inventory and demand normalize. Even so, our forecasts lean on the conservative side as we use only mid-single digit growth in our base and bull cases.

Continued Margin Expansion – Our projections below go out to FY21, ended January 2021. In our base case, we have margins approaching – but not hitting – those reached between FY16 and FY18. Therefore, there is more upside to our assumptions as we get back to that 21.5% gross margin number previously achieved by the company.

M&A – The company has outlined a goal for $1B in top line sales by 2025. In our mind, they’ll likely achieve this through organic growth and M&A. M&A was historically done at less than 6x EBITDA. We would support any deals done at or around the multiple paid for Home Meridian, which we estimate to be 5x EBITDA.

Valuation

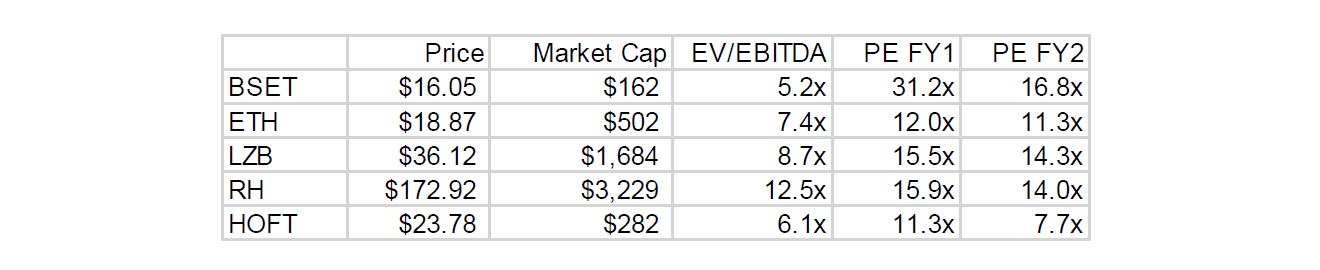

Analyst coverage is light for Hooker Furniture, with just one analyst (Sidoti) covering the company. Hooker trades at a steep discount to all its peers on earnings and EBITDA, which we do not think is justified.

Furthermore, Hooker Furniture does not own retail stores – and therefore does not carry the additional leasing liabilities like many of its peers.

Prospective Returns

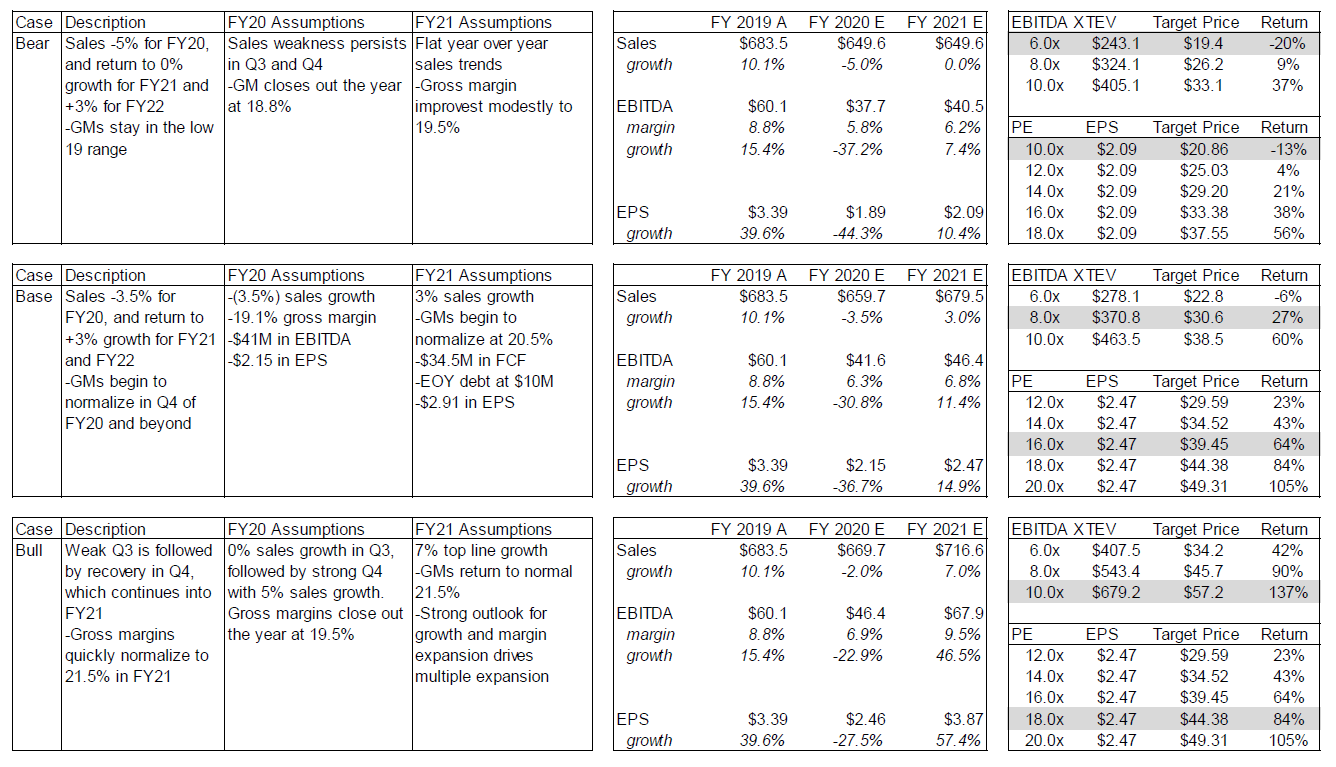

The main question for projecting future earnings and cash flow for Hooker Furniture is gross margins. Can the company return to the 21.5%+ gross margin it put up from FY16-FY18? We believe it can. In fact, management has called out the potential for an additional 50 bps of margin expansion in the Home Meridian segment in future years. This is certainly not baked into the price, nor is it baked into our estimates. In our base and bull cases, we assume moderate sales growth, which could also prove to be conservative. Lastly, we have not attempted to model in additional accretive acquisitions. We suspect the company will begin to evaluate new deals after they pay down debt over the next few quarters.

Our Base case scenario assumes a gradual return to normal for gross margins. We expect for the full year FY21, Hooker Furniture will put up a 20.5% gross margin, with a clear line of site to 21.5% in FY22 and beyond. Sales growth assumptions are a modest 3% per year for FY21. We’ve valued the company on a conservative earnings multiple of 16x, which we think is a fair multiple for a business with low double digit returns on tangible capital. We think the story continues to be one of execution and margin improvement for FY22 and beyond. We assume no value for incremental M&A.

Our Bull case reflects a faster “return to par” for gross margins. This comes from the company effectively moving production out of China and strategically increasing price on Chinese-sourced goods. We think there is additional upside through execution in the Home Meridian segment, where the company has called out the potential for 50 bps or more of margin expansion. Longer term, the company calls out an aspirational goal of $1B in sales for 2024. We believe this is certainly in the realm of possibility with strategic M&A. $1B in sales at or around a 6% net margin gets us to $5 per share in earnings power. At peer multiples, this would imply a $74 share price – a triple from here.

Our Bear case assumes minimal margin recovery along with no growth in top line sales for FY21. Despite weaker margins, we still believe the company will be free cash flow positive, as well as profitable on a GAAP Net Income basis. Per our conversations with management, the company – in its 94-year history – has only lost money a handful of times. We note that they have not lost money on a full year basis anytime in the past 10 years.

Risks

- Cyclicality. Furniture, either casegoods or upholstered, are large ticket items for most consumers. A weaker economy will naturally result in weaker furniture sales.

- Sourcing. The company aims to have 20% of its furniture sourced from China in the next 12-24 months. If this fails to occur, margins will continue to be depressed.

- M&A. The company does not have a long history of doing deals. Their stated goal of additional acquisitions down the road could bring on added risk.

- Customer concentration. The Home Meridian segment sells through club stores who are very dominant due to their size and overall purchasing power. They squeezed HM on margins earlier this calendar year and could do it again in the future. While they do not have a 10% or greater customer, their top 5 customers accounted for nearly 1/3 of sales in FY19.

- Trends. Hooker Furniture must stay on top of style trends to stay relevant and excite both the retailers who sell their product, as well as the end consumer who uses the product.

- Tariffs. The tariff situation is unpredictable, and it is possible they could be levied on Vietnam. This would pose a serious threat to the U.S. furniture industry, as ~50% of all US furniture is sourced from Vietnam.

Catalysts

- Earnings reports. The company does a good job providing a near term outlook every quarter. We expect this will continue and think future earnings reports could provide clarity on the path toward margin normalization.

- Share repurchases. The company does not have a history of major share repurchases. However, with insiders buying and cash continuing to build, management and the board may begin to evaluate this as a capital allocation option.

- M&A. The company has done two deals totaling $140M over the past few years at attractive multiples. There is potential for more deals like this, which we would generally view as a positive.

- Insider buys. Insiders, who have rarely purchased stock in the past, have collectively purchased nearly $600,000 worth of Hooker Furniture stock since the beginning of the year.