Planning for retirement is a great way to invest in your financial future, but those who start too late (or not at all) may find that retirement isn’t all about sailboats and running after grandkids. Without proper and early retirement consideration, Americans are likely to find themselves regretting not setting aside enough funds for those 20 – or more – unemployed years.

Q4 2019 hedge fund letters, conferences and more

An Early Retirement Consideration: The Majority Of People Have A Retirement Plan

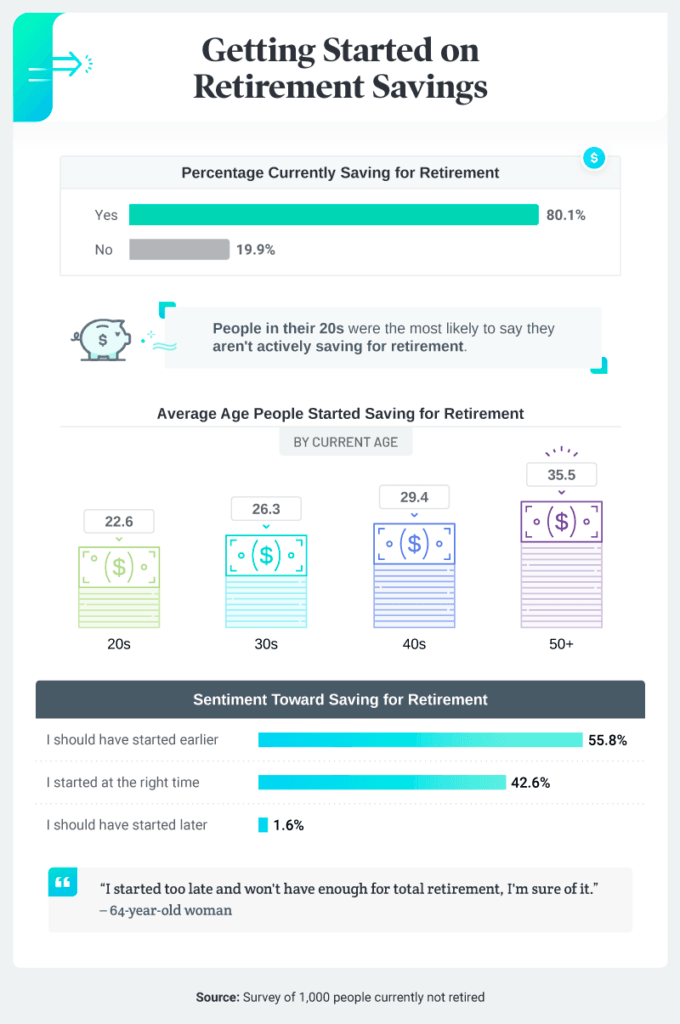

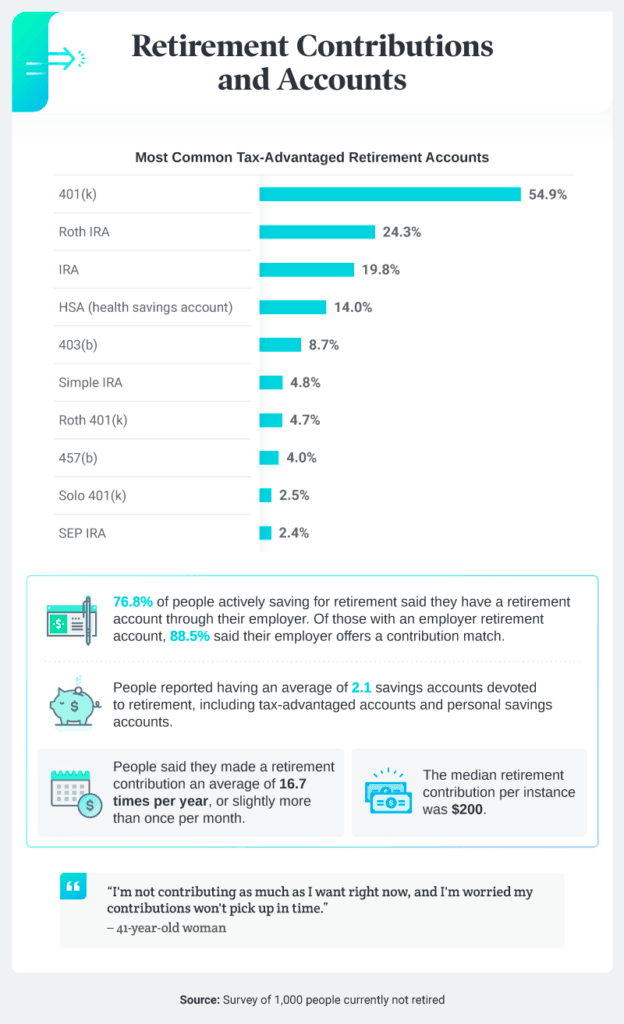

As far as retirement planning goes, there are many options, including a 401(k), Roth IRA, and a traditional IRA, as well as a health savings account (HSA) or 457(b), which is for government employees. When Medical Alert Buyers Guide surveyed 1,000 people saving for retirement, it found that of the 80.1% of Americans who were currently saving for retirement, 54.9% were participating in a 401(k) plan.

A Head Start

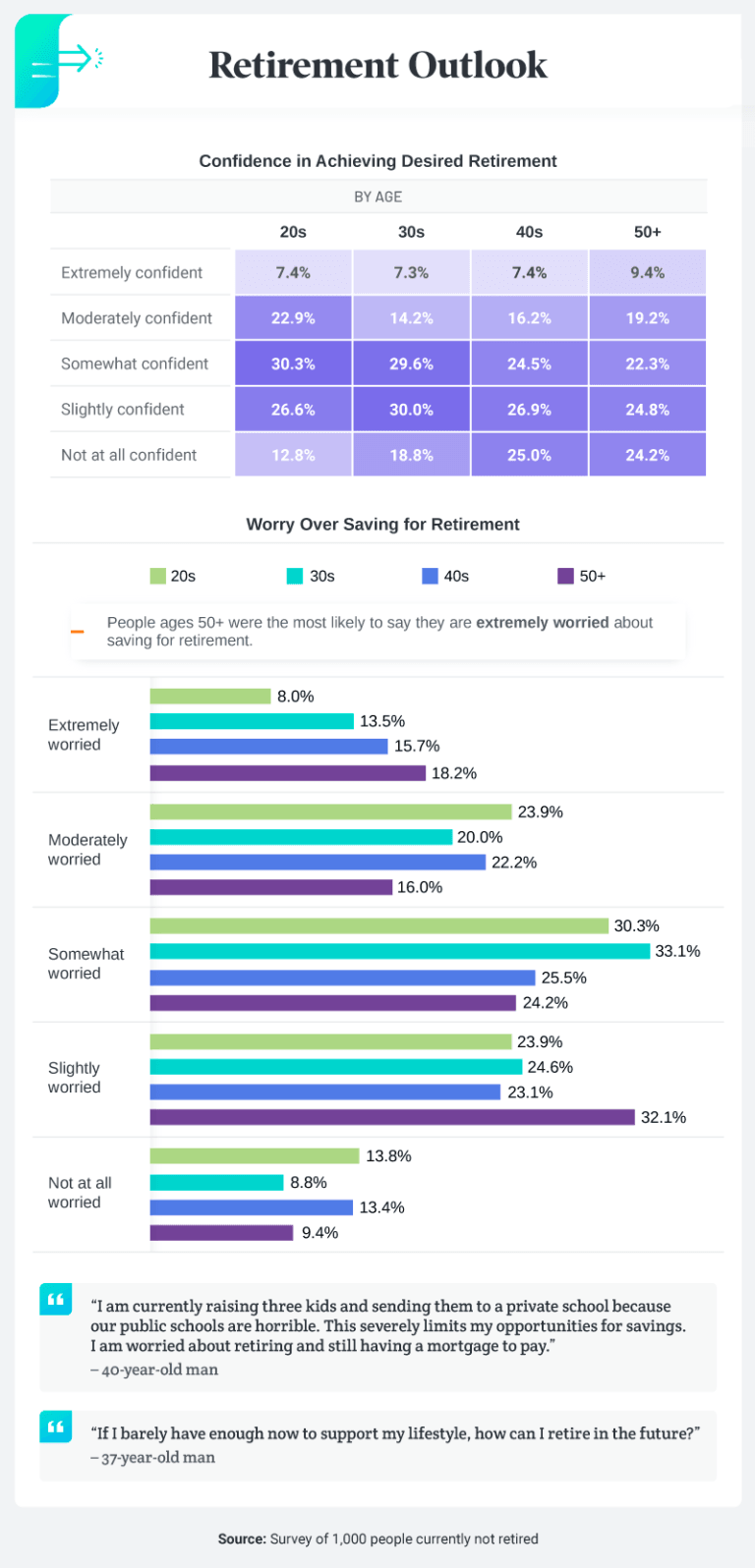

According to the World Economic Forum, the average retiree is going to outlive their savings, some by eight years and others by nearly two decades. This staggering statistic suggests that Americans should question whether they will have enough saved to support themselves throughout retirement.

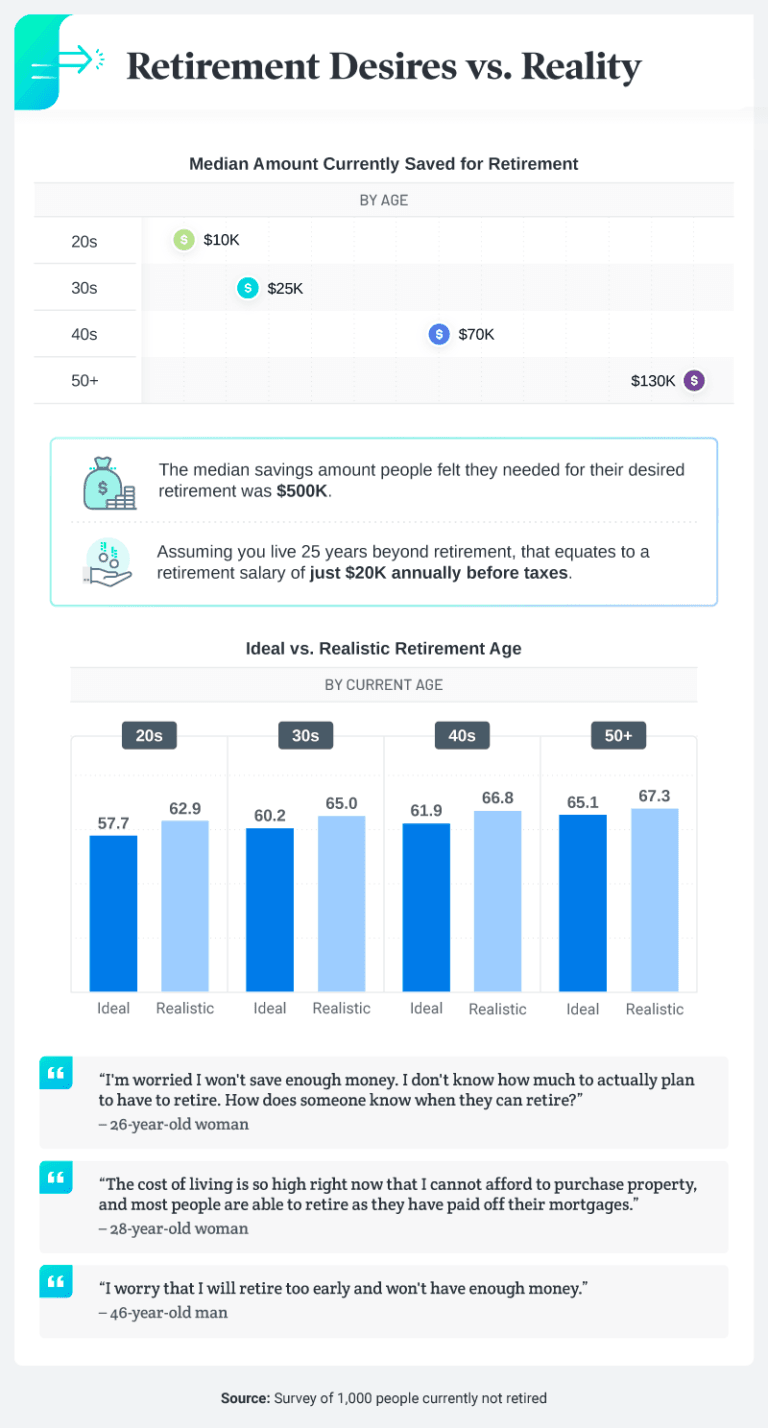

According to the Medical Alert Buyers Guide survey, people aged 50 and older had about $130,000 saved for retirement, and most people said $500,000 was the ideal amount needed to best prepare for retirement. By those accounts, the average American living 25 years beyond retirement would have to live off $20,000 per year (before taxes), which is only about $8,000 above the poverty line for people aged 65 and older. Nearly 56% of people wished they had started saving for retirement sooner, which is always a good idea.

Retirement Considerations: The Savings Sweet Spot

To best prepare yourself, start saving for retirement now – in your 20s, ideally. When you get that first job after college, leaving the workforce may be the last thing on your mind, but participating in an employer-backed 401(k) plan can mean living comfortably four decades later.

Although 20-somethings were more likely to report not worrying at all about retirement savings, they’re not exactly neglecting their retirement responsibilities. For some, there just isn’t enough income to dedicate to an unseen future when present bills (or student loans) are greater worries. Still, Americans aged 20 to 29 said they have a median of $10,000 saved for retirement, and most reported they started saving for their golden years at the average age of 22.6.

Retirement Is on Americans’ Minds

Americans are considering retirement, and the majority of them are planning. However, what they do save may not be enough to support them when they retire. As the cost of living adjusts, people with a fixed income may struggle financially if not given proper support. The best way to ensure that you’re covered when a desirable monthly paycheck stops coming in is to think about the future today. Don’t wait until you’re 65 to wonder if you should have saved more sooner.