With the 2020 Presidential election less than 12 months away, many of our clients have been asking how we think about investments during an election year. As human beings, each person on our team has their own set of political preferences, but as research analysts, we try to approach polarizing topics (like politics) in the most objective way possible. This article will lean heavily on data to examine the historical experience of investing in election years, the concept of the election cycle, and the upcoming presidential election in particular. Our discussion is predicated on stock market performance data that dates back 84 years and covers the 21 presidential elections following the great depression.

Stock Market Performance in Presidential Election Years

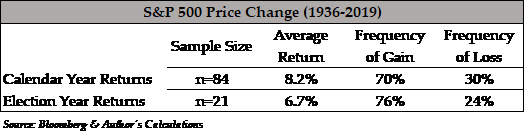

Do presidential elections influence the stock market? Perhaps the proximity of an election affects market fundamentals or investor sentiment every four years in a predictable way. The table below highlights what we have observed over the last 84 years. To set the baseline, if we look at all years from 1936 through 2019, calendar year returns for the S&P 500 averaged 8.2% and returns were positive 70% of the time. If instead, we isolate the 21 election years over the same period, we find that returns averaged 6.7% with positive returns 76% of the time. Given the limited sample size and normal variation, it appears that stock markets behave quite normally during election years.

Q3 2019 hedge fund letters, conferences and more

Stock Market Performance Based on Party in Power

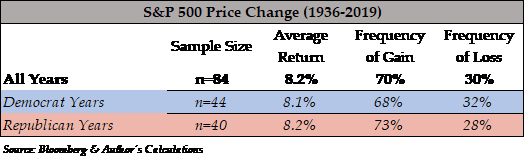

So it would appear that an election year itself does not carry heavy influence over market outcomes, but it must make a difference which party wins the election, right? Conventional wisdom might suggest that a republican administration (generally assumed to be more business-friendly), would be better for stocks, but the data simply doesn’t bear it out. As highlighted in the table below, there has been virtually no discernable difference in stock market price returns based on which party was in the White House in a given year. Over the last 84 years, across 11 democratic administrations and 10 republican administrations, stock prices have risen a little better than 8% with similar success rates (frequency of gains) regardless of who was in power.

Playing Off of the Election Cycle

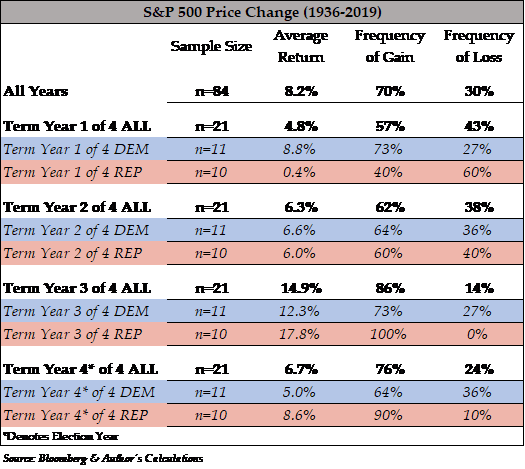

Historical stock market performance data suggests that on average, market returns in election years are average. History also suggests that on average, the political affiliation of the person occupying the White House does not matter. Is there anything to glean from the broader election cycle? Below, we dissect the four-year presidential term by year and by political affiliation. Term year three of four (the year prior to an election year) stands out with average returns of 14.9%, or nearly double the baseline average of 8.2% across all years. Thus far, 2019 is on track to keep the “year three” trend alive under a republican administration. If the pattern holds, we would expect moderating returns in the 2020 election year based on the data.

Are We Just Data Mining?

In fairness, moderating returns in 2020 would be a reasonable expectation following a year like 2019 even in the absence of an upcoming election. In fact, it appears that election years specifically, and the election cycle broadly carry little influence over market outcomes. That said, the stock market performance data is far from useless. At the most basic level, the 84-year history tells us that the U.S. stock market prices appreciate roughly 8% per year over the long term. It also tells us that in most years, the market is up and mathematically, the up-years outweigh the down-years.

Our takeaway is reinforcement of one of the key tenets of our investment philosophy, which states: “A long-term perspective and disciplined approach lead to improved outcomes over time.” Engaging with your advisor to develop a deep understanding of your risk tolerance, to create a plan, and to keep fees and taxes low are ways you can win as an investor, regardless of who wins the election

But what if Warren, or Sanders, or Trump, or [insert name here] Wins?

Despite the data, there is no shortage of bold market predictions based on potential election outcomes – and this is nothing new. Several well-known hedge fund managers have recently described the market Armageddon that would occur if Trump were defeated in 2020. Interestingly, in 2016, many experts were predicting that a Trump presidency would completely derail markets, and as recently as last month, analysts from Raymond James predicted that the market could rally on a Trump resignation. We view all such predictions with a great deal of skepticism as there is very limited data to suggest that one individual (even the president of the United States) will single-handedly move the markets dramatically higher or lower.

Vote with your ballot, not your portfolio

Just to reiterate, this article is not intended to express a political view or to suggest that one candidate or another will be better for stock market performance in 2020. On the contrary, we believe history suggests that the 2020 outcome will carry very little influence amid a wide range of exogenous factors at play. We recommend investors consider their portfolios in time horizons that extend well beyond the next presidential term and re-evaluate your risk profile if a shorter-term dislocation in the market will derail pursuit of your financial goals. Otherwise, stay disciplined and let your ballot do the talking in November.

Please contact any member of the Greenleaf Trust team with questions.

SOURCES:

https://www.thebalance.com/presidential-elections-and-stock-market-returns-2388526

Nicholas A. Juhle, CFA, Senior Vice President and Director of Research, Greenleaf Trust

As senior vice president and director of investment research at Greenleaf Trust, Nick creates comprehensive investment solutions to help clients reach their financial goals. He is the chair of the investment committee, responsible for portfolio-level investment decisions and outcomes. Nick joined Greenleaf Trust in 2012 from Robert W. Baird & Company. He holds a bachelor’s degree in business administration from the University of Michigan Ross School of Business. Nick is a CFA® charterholder and a member of the CFA® Institute.