Stock market for beginners can be overwhelming! However, the best way to invest is to make it simple – don’t be a stock market speculator, be an investor. Over time, you might turn $1,000 into millions like our friend and one of the best investors ever, Peter Lynch, did. The first 90 pages of his stock market investing book are dedicated to stock market beginners. The following questions many stock market beginners wonder about are answered:

- What is a stock?

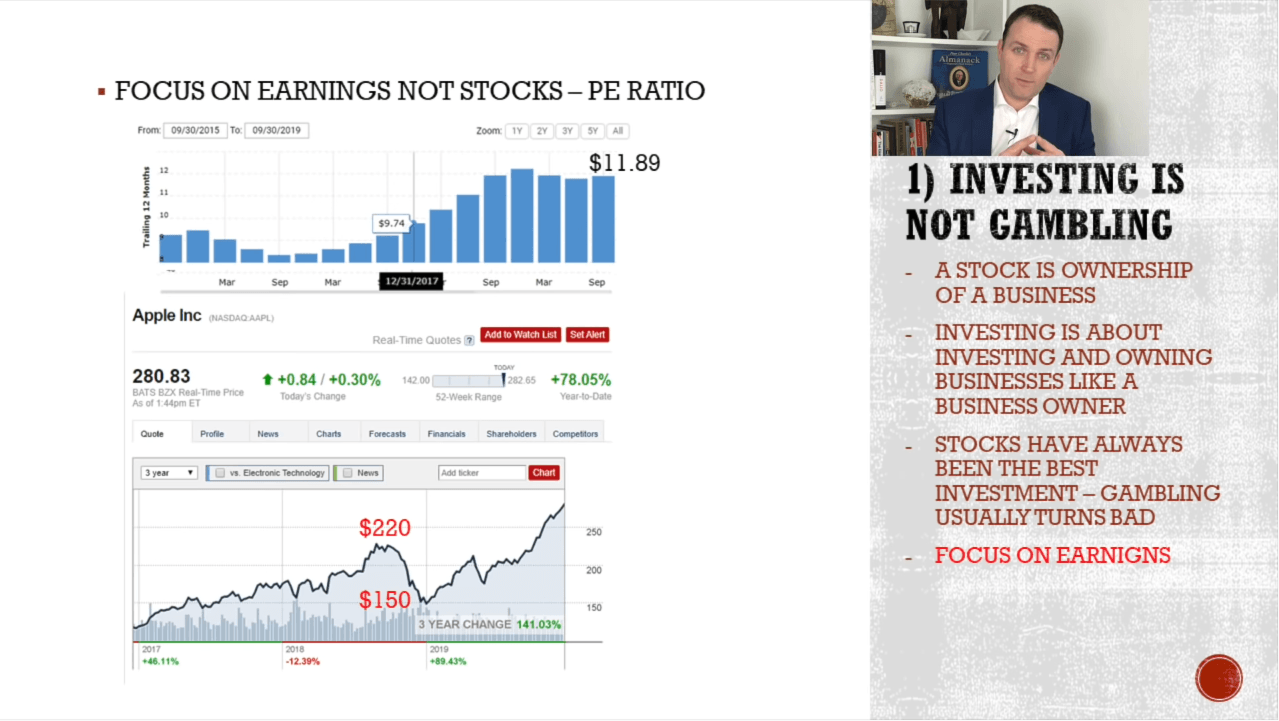

- What to focus on as a beginner?

- And what is a PE ratio?

- Is it risky to invest in stocks, is it gambling?

- How the stock market works?

- Is it worth to invest small sums?

- Should you invest in stocks at all? The mirror test!

- Is this a good time to start investing?

- Also, the questions probably every beginning investor has, are answered through 7 tips for beginners to make the knowledge applicable immediately.

Q3 2019 hedge fund letters, conferences and more

How To Invest For Stock Market Beginners 2020 - 7 Tips From the Best Investor Ever

Transcript

Good day fellow investors. One of the best investing books out there and it is the best because it was written by one of the best investors out there ever is, One Up On Wall Street by Peter Lynch and the first 90 pages of the book are dedicated to stock market beginners and how to prepare for investing. So the best investor ever is giving us tips on how to start investing and how to invest and this is summarised in this video.

Peter Lynch was Fidelity Magellan had investment manager for 14 years from 1977 to 1990, where he turned 1000 into $28,000, over 14 years for yearly investment return of 29.2%. 1000 into $28,000 and he's telling us how to do that too. But perhaps even more importantly, his wife invested $750 a year into her IRA account from 1974 to 1978. That's in total, just $4,500 invested, he managed that money, and he turned the that money into more than 10 million. Now the account has 8 million starting with just 450 and 3 million has been taken out for weddings and other things.

Peter Lynch's track record

So that's Peter Lynch over 40 years 20% and you can turn a few thousands into 10s of millions. If you want to learn how, if you want to have a similar path when it comes to investing over your investing life cycle, stick to this video. Also click like, subscribe to this channel and click that notification bell so that you get notified when there is a video out that's very important for you.

Let's start with the content. So I've tried to summarise all of this but an answer the most impact Questions that the stock market beginner might have? What is the stock? What's the price earnings ratio? How does the stock market work? How to start investing? Am I the right person to even invest? Is the stock market the gambling place? Is it worth to invest small sums, just $1,000. And we have seen how it is worth because you can turn 1000 into 10s of thousands and millions if you just follow the right steps.

And we're going to discuss those right steps. Extremely important steps to understand because 99% of people on the market are not following these steps. They are gambling, you have to be an investor and that's what makes all the difference when it comes to investing. you're investing in stocks, but what is a stock many say the stock market is for gamblers. But a stock is just a piece of paper electronic paper today, the three present ownership in a business so you are part owner of a business.

What stock market beginners can learn from Peter Lynch

So if you are a part owner of Walmart, Nike, Cargill and other big businesses, are those owners gamblers or are they investors? Sam Walton, the founder of Walmart was an investor, Nike investment, Cargill and all those big businesses. People don't go around telling Jeff Bezos or Bill Gates they are gamblers, no, those are investors. Those are mostly business owners. And that's the core concept also of Peter Lynch's, you have to be a business owner forget about the stock market. The stock market is just something that is the vehicle that gives you business ownership. And if you can get that then your investment path to millions is pretty well set.

Further on the gambling topic, yes, stocks are volatile, the prices go up and down because 99% of people in the stock market are gamblers. You have to be an investor and take advantage of the gamblers. And don't be taken advantage of. Because yes, stocks are volatile. And if you look at this chart, the white line that represents $1 invested in stocks in 1802. That turned into more than 1 million yes. $1 into 1 million. This the chart the line, the white line is very volatile.

But this doesn't mean that stocks are risky over the long term stock prices go up and down. Yes, but if you invest in businesses, businesses grow, businesses deliver earnings, dividends, so it's not really risky. You're just the business owner. It's risky to hold cash to hold bonds. Because if you hold cash $1 from 1802, is now just four point something cents, so we've lost 95% of the value due to inflation.