Welcome to the first update of the new quarter. New financial statements are still few and mostly from companies with fiscal quarters ended November. Annual financial statements will begin to appear in volume in mid-February. With overall corporate growth falling at a faster rate in the third quarter financial statements of US companies this is a good time to review potentially the best and worst looking industries from 2019 – let’s start with small companies index.

2019 Best and Worst industries

Q4 2019 hedge fund letters, conferences and more

Locate portfolios in shares of companies with stable and rising growth. Otos will help you find them as the new financial statements (annual for 2019) are reported in the coming weeks.

Do not wait. Act now!

The population of extended-share-price companies has increased with the rally in shares last month. This provides many good opportunities to sell lower growth companies at attractive prices. Otos will help you find them.

Consumer Staples-Small Companies

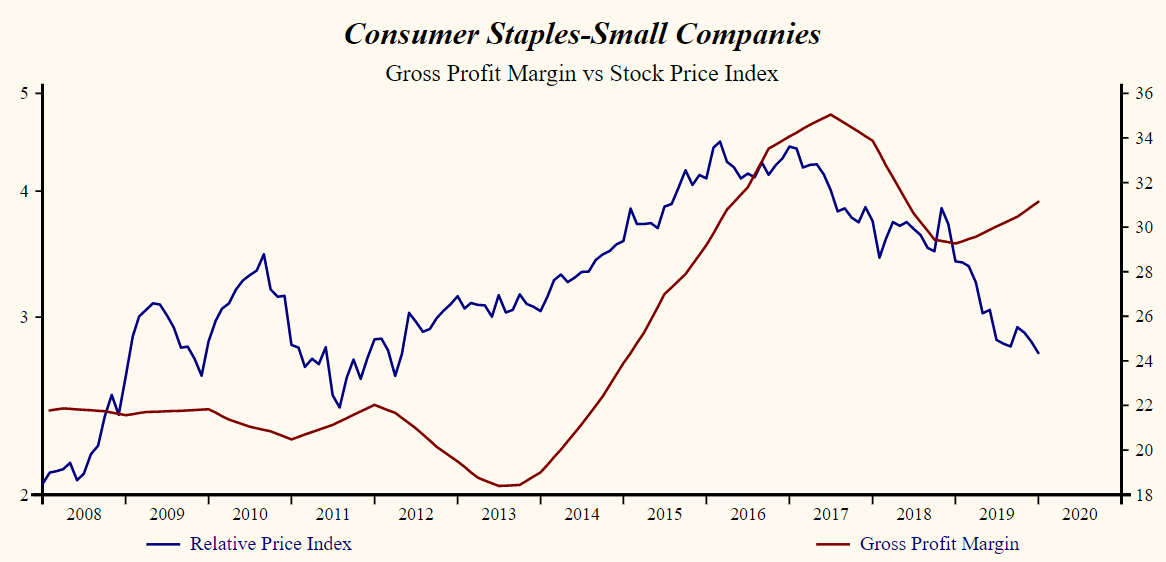

Monday, January 6, 2020: The share price index of the Consumer Staples-Small Companies Index has declined by 40% relative to the Otos Total Market index since the February 2016 high. Current relative price to sales is near the lowest level in the record of the Index.

Last week the share price index of the Consumer Staples-Small Companies Index advanced by 0.2% compared to a 0.4% advance for the Otos Total Market Index. Gaining stocks in the Consumer Staples-Small Companies Index numbered 14 or 53.8% of the Index total compared to a 23.6% gaining stocks frequency across the 3,979 stocks in the Otos U.S. stocks universe.

We have collected fourth quarter sales data for all the comparable record companies in the Consumer Staples-Small Companies Index. The Index capital weighted average sales growth rate is 5.9%. The proportion of Index market capital accounted for by rising sales growth companies is down to 38.8%, compared to 42.3% last quarter.

Currently, sales growth is low in the record of the Consumer Staples-Small Companies Index and lower than last quarter.

The proportion of total market capital accounted for by rising gross profit margin companies is up to 70.1% compared to 58.6% last quarter.

The Index is recording a rising gross margin. Inventories are down, improving the chance of a further increase in the gross margin. SG&A expenses are high in the record of the Index but rising. That implies that the Index may be capable of accelerating EBITDA relative to sales with lower costs but has yet to achieve a cost reduction. The gross margin is rising at a faster rate than SG&A expenses, producing a rising EBITDA margin. Interest costs are high in the record of the Index and rising. Higher interest costs not only slow cash flow growth but are often associated with lower valuation.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

Energy-Small Companies Index

Monday, January 6, 2020: The share price index of the Energy-Small Companies Index has declined by 97% relative to the Otos Total Market index since the February 2015 high. Current relative price to sales is at the lower-end of the range in the record of the Index.

Last week the share price index of the Energy-Small Companies Index fell by 0.1% compared to a 0.4% advance for the Otos Total Market Index. Gaining stocks in the Energy-Small Companies Index numbered 29 or 60.4% of the Index total compared to a 23.6% gaining stocks frequency across the 3,979 stocks in the Otos U.S. stocks universe.

There are 8 stocks in this Index with unusually depressed share prices. There are no current buy decisions in that group. Last week there were no depressed-share-price buy ideas in this Index.

We have collected fourth quarter sales data for all the comparable record companies in the Energy-Small Companies Index. The Index capital weighted average sales growth rate is 5.3%. The proportion of Index market capital accounted for by rising sales growth companies is down to 8.9%, compared to 35.1% last quarter.

Currently, sales growth is low in the record of the Energy-Small Companies Index and lower than last quarter.

The proportion of total market capital accounted for by rising gross profit margin companies is down to 36.1% compared to 40.0% last quarter.

The Index is recording a high and falling gross margin. Inventories are up, diminishing the chance of a further increase in the gross margin. SG&A expenses are high in the record of the Index but rising. That implies that the Index may be capable of accelerating EBITDA relative to sales with lower costs but has yet to achieve a cost reduction. Lower gross margins and higher SG&A expenses are producing a deceleration in EBITDA relative to sales. Interest costs are high in the record of the Index and rising. Higher interest costs not only slow cash flow growth but are often associated with lower valuation.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.