It was another very slow week for new company filings as we wile our way through the annual lull related to the later filing deadline for annual financial statements. Meanwhile stronger share prices reflect an optimism that is inconsistent with the recent drop in corporate growth. It is the third consecutive decline in average sales growth and the average gross profit margin is down at US companies from the highest level since 1999 and for the first time since 2017. But is there still a diamond in Lindsay Manufacturing (NYSE:LNN) shares?

The upcoming annual financial statements will give us an update of the growth trend. The recent SEC filing update is 3% complete. The volume of SEC filings will increase in coming weeks. Historically lower corporate growth is associated with lower share prices.

Q4 2019 hedge fund letters, conferences and more

The Broad Market Index was up 1.97% last week and 56% of stocks out-performed the index.

Lindsay Manufacturing: Investors do not wait. Act now!

(This post is not investment advice. Please speak to a financial advisor)

The population of extended-share-price companies has increased with the rally in shares last month. This provides many good opportunities to sell lower growth companies at attractive prices. Otos will help you find them.

Lindsay Manufacturing Co (LNN) $104.660 BUY this rich company getting better ▼(21)%

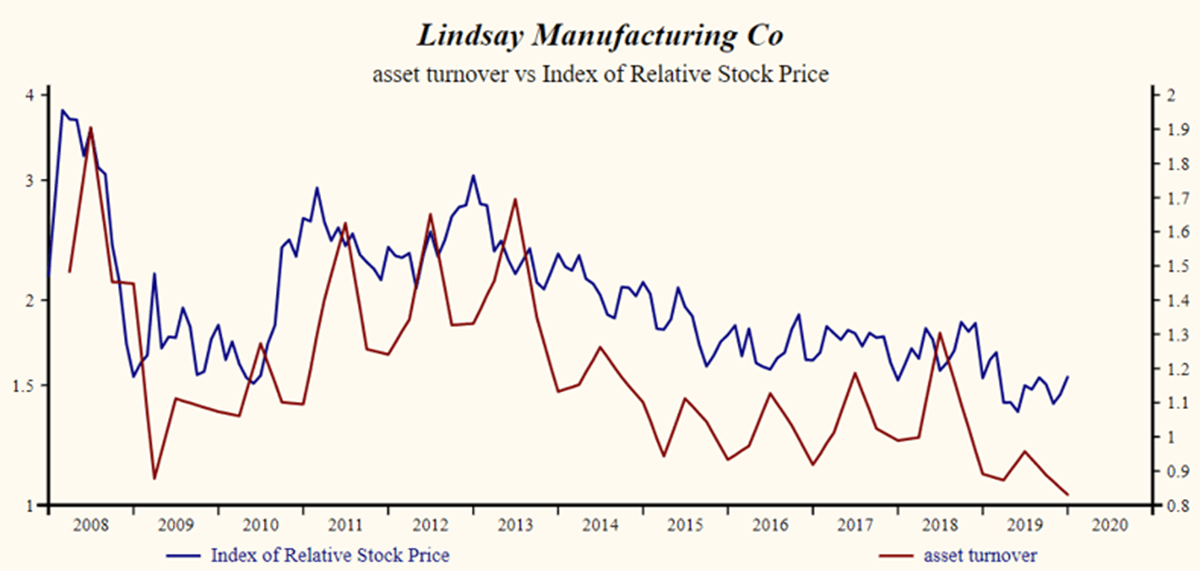

Lindsay Manufacturing Co has been an exceptionally profitable company with persistently high cash return on total capital of 22.5% on average over the past 20 years. Over the long term, the shares of Lindsay Manufacturing Co have declined by 17% relative to the broad market index.

The shares have been highly correlated with trends in Growth Factors. The dominant factor in the Growth group is gross margin which has been 78% correlated with the share price with a four-quarter lead.

More recently, the shares of Lindsay Manufacturing Co have declined by 17% since the October 2017 high.

The shares are trading at upper-end of the volatility range in a 15-month falling relative share price trend. Despite the recently extended share price, the broad improvement in fundamentals forces a reversal of Otos September 2017 sell decision.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.