Happy New Year! 2019 was a year the bulls were in charge, seemingly erasing all the painful memory of the miserable 2018 when almost everyone lost money.

But rest assured, the environment for short selling is robust, and has almost never been more attractive. There are a couple reasons why. First, the equity market rally in 2019 was largely based on an interest rate cut induced multiple expansion, and a belief that the trade wars will deescalate. Large cap corporate earnings didn’t grow much (particularly after removing the effect of inflated stock repurchases, and un-policed Non-GAAP adjustments), and now companies must prove in 2020 that their historic multiple expansion is warranted. This sets up many stocks for extreme earnings disappointment relative to inflated expectations, and complacent investor psychology that no work is required to make money being long in the stock market.

Q4 2019 hedge fund letters, conferences and more

Passive investing and the activist approach

Secondly, passive investing overtook active investing in 2019. Passive investing has one big drawback in that it generally requires indiscriminate buying (all stocks good and bad) to mimic a benchmark, and assumes that the financial reporting of companies are fairly stated. This is often an inaccurate assumption. At Spruce Point, we dig beyond the numbers to determine if they are accurate, sustainable and fairly represented, and take an activist approach. Passive investing by its nature doesn’t do this, or try to affect change for a better outcome. While short-selling will always be difficult, with unique forensic research and an activist approach, it will still be possible for short selling to add alpha in 2020.

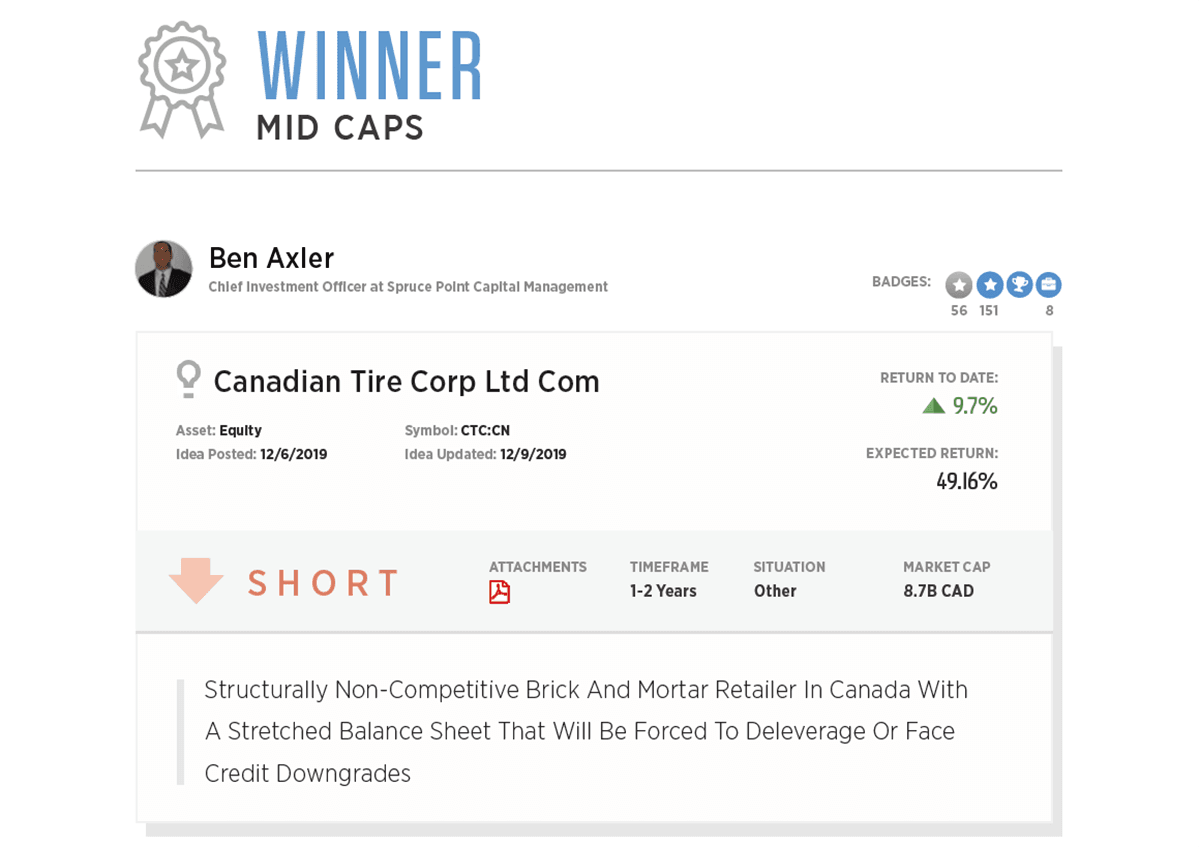

With this in mind, we are pleased to share that Canadian Tire (TSX: CTC/CTC.A) was recently selected as the Top Midcap idea by Sumzero from over 80 submissions, and was independently voted on by 31 financial professionals. For the full idea list can be found here. But we're not done, we're just getting started....

Tomorrow we will offer another compelling Midcap "Strong Sell" opinion. We will explain why we believe this company is showing signs of stress, spinning excuses, and using ridiculous and flawed financial metrics to inflate its growth. Miraculously, investors aren't asking any questions, and blindly rewarding the company with a significant multiple expansion, pushing its share price to all-time highs, and allowing insiders to cash out at inflated prices. It's a complete embarrassment to the financial system to allow this to happen. Please help us fight back against the destructive forces plaguing our financial system that undermine the confidence and credibility of financial reporting.

The full contents of our report will be available on our website. We also encourage readers to follow us on Twitter @sprucepointcap where we will have exclusive content.