Farnam Street letter to investors for the month of January 2020, titled, “Thought Experiment: Rise of the Auto-Buyers.”

Imagine ten people sitting around a table. They’re all very different, spanning the spectrum of age, belief, creed, lifestyle, and risk preference. At the center of the table lies a black box. Once per year, the box prints bonafide dollar bills. The ten people all have pieces of paper which we’ll call claim tickets. These tickets confer the right to a proportion of the newly created bills. No one knows how many bills will be printed every year. Every weekday from 9:30am-4pm ET, the ten people are allowed to trade claim tickets with each other, creating a price for the tickets.

Q4 2019 hedge fund letters, conferences and more

Some participants base their estimates on the quantity of dollar bills the box might print in the next few years. And some play the game by guessing the changes in others’ moods and buying and selling in front of them. Some trade tickets often, others only occasionally. It’s a rich ecosystem of independent views and methodologies.

There’s a natural symmetry to the table. One person thinks the box will be stingy this year and is willing to part with a portion of their tickets for a lower price. By definition, the trade requires an optimist on the other end who thinks they’re getting a good deal.

There can be a lot of churn as no one really knows what the next print will be. But generally the people who are optimistic are cancelled out by the pessimistic. The price at which tickets change hands is usually close to accurate. Such is the power of the wisdom of crowds.

Stocks and auto-buyers

A new dynamic arises. One of the younger people at the table decides they aren’t going to guess the next print. Why bother? They’re just going to buy claim tickets at the prevailing price. They happen to be buying from the oldest, most experienced person who needs the money for retirement. No problem, as there are still nine people examining the box and the errors continue to cancel and crowd wisdom holds.

The next youngest decides they don’t want to guess either; two of the ten are now automatic buyers. For whatever reason, the price begins to rise. The most conservative at the table feels the price is too rich and sells to the two auto-buyers.

The price ticks higher still, blessing everyone remaining at the table with the feeling of more wealth. Nevermind that nothing they do changes the yield of the box1. The participants who are willing to provide liquidity (meaning take the other side of the auto-buyer’s trade), sell and sit on the sidelines.

Noticing you can get rich without any of the work of box-sleuthing, two more participants join the autobuyer bandwagon2. Their share of claim tickets come from the next most conservative person who feels uncomfortable with the high prices. They feel the box simply isn’t worth that much based on what it is likely to print.

The siren’s song of the auto-buyers is strong. Their wealth, as measured by the price of what they recently bought, keeps rising. And it required no work! It’s hard not to feel like you know something your remaining tablemates don’t. One of the previously conservative people feel they are missing out and is seduced to join the auto-buyers. They feel they need more returns to meet retirement goals. At this point, half of the table is enjoying the fruits of no labor while the prices drift from historical norms.

Here’s where it gets weird3.

With so many auto-buyers, the price starts to go parabolic. The conservatives punch out of the game, leaving only price insensitive participants. The auto-buyers have never felt wealthier, or smarter. Yet due to the high price, each trade they make buys fewer claim tickets. With near infinite prices, they’re buying next to nothing each round. Every time they spend more and get less. Yet the future has never appeared brighter! Ticket prices blast through new highs every day. Their swollen brokerage statements reflect their obvious genius.

Eventually, we find the price which takes out the last price-conscious person. With only auto-buyers and no one left to buy from, the prices go fully asymptotic.

But alas, what goes up, must come down. Infinity doesn’t exist in man, nature, or markets. And like anything asymptotic, the down is equally breathtaking. Our auto-buyers become auto-sellers, each thinking they can leave the ball before the clock strikes midnight. Let someone else hold the bag, so the logic goes.

It’s a long way down before the conservative buyers are coaxed back to the table. Auto-buyer fortunes are lost, although it begs the question, were those fortunes real to begin with? A market’s price is only worth the quality of thought exerted by the participants. Are untethered marks merely aberrational wealth?

Meanwhile, our black box quietly prints next year’s cash like clockwork, ignorant of the machinations of man.

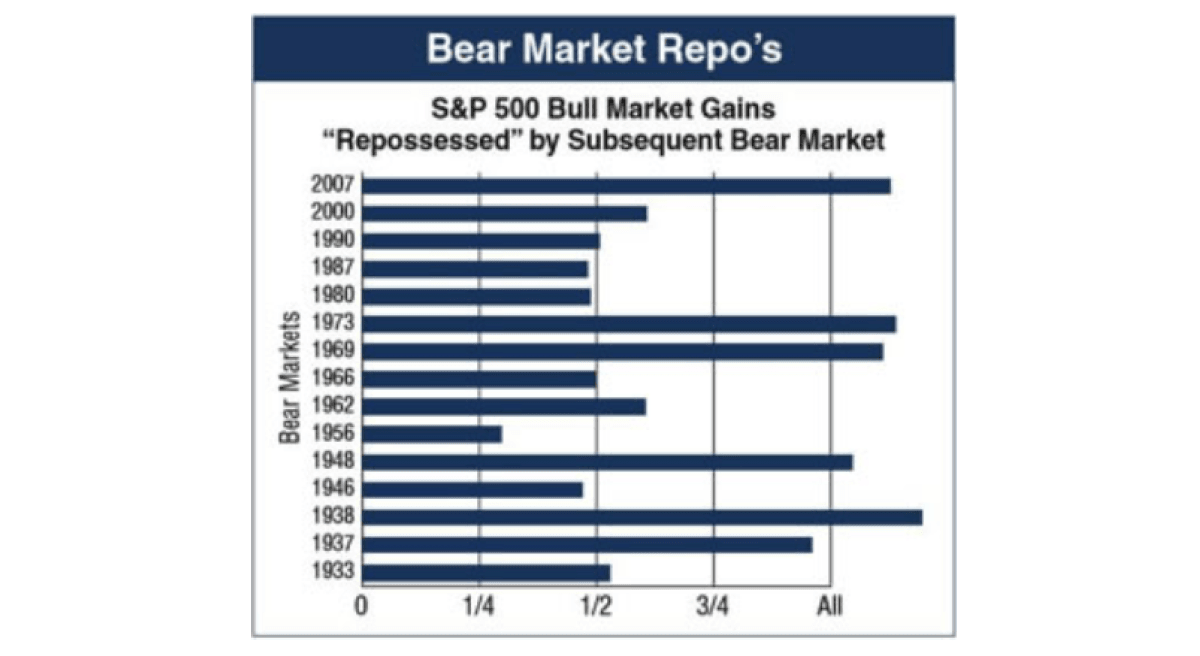

The below chart shows the history of “repossessed” wealth from swings in the S&P 500.

The chart below shows that in the short run, “valuation adjustments” drive more than half of the return. This is equivalent to sentiment changing, i.e. animal spirits. In the long run, the sentiment factor fades and it’s what the box produces which matters. The underlying results of the businesses drive long term outcomes.

Auto-Buyers On Mount Parabola

Our auto-buyer allegory was a generic representation of every bubble in history. The seeds sprout from a good idea taken too far. Tulips in 1636. The South Seas in 1719. The Nifty Fifty in the 1960s. Japan in 1988. Tech and telecom in 1999. Las Vegas condos in 2005. Bitcoin in 2017. Cannabis in 2018.

Or increasingly it seems, passive indexing today. Every bubble requires investors to dampen their critical thinking and become buyers at any price. Only an auto-buyer mentality can dislocate prices so far from economic gravity.

The return for the stock market in 2019 was quite odd. The price went up by 30%, yet earnings didn’t budge. All of the change was attributable to “valuation adjustment.” The black box was a zero.

It’s quite possible we’ll see the continued parabolic melt up of the S&P 500, as the orgy of index buyers climax together. It will feel magnificent if you are a participant, and dreadful if you are abstinent.

If you’re a value-conscious investor, I have bad news. It’s likely to get more painful before you find inevitable redemption. Most fundamental metrics are approaching the valuations of the Dot Com bubble. Some are already more expensive. But there’s nothing that says 1999 has to be the high water mark for reckless buying. This could get even uglier for conservative investors.

Yet have faith that there’s always a morning after. Raise your hand if you believe that the eventual flood of “Markets in Turmoil” CNBC headlines won’t someday spook auto-buyer index holders. Will they actually be buyers through thick and thin, which is the vital assumption of every backtest? Have we suspended human nature? Color me skeptical.

Sir Isaac Newton was one of the smartest men to ever walk the earth--he literally invented calculus. (Who among us has created an entire branch of mathematics?) Yet he was seduced and ruined by the South Seas Bubble.

We never know where we are on Mount Parabola. We only know there is an inescapable ultimatum. Would you prefer to look foolish before or after the bubble bursts?

Value-conscious investors have to be willing to watch from the sidelines, abstain from the madness, and pay the full FOMO freight. It hurts now, and the pain will only ratchet up with every uptick and celebratory headline. Conservative investors are advised to tie themselves to the mast of rationality and avoid the sirens’ call of ephemeral quotational wealth. Sometimes market prices aren’t to be trusted. Unless you’re liquidating everything today, you likely aren’t as wealthy as your account statement reads.

Despite all the madness, the black box will keep printing money. You can do well if you buy at the right price.

Same as it ever was.

Corporate Governance in the Age of Indexing

In 1965, the CEO-to-worker pay ratio was 20-to-1. By 2018, it had jumped to 278-to-1. How did pay structures get so lopsided? Shouldn’t someone have stepped in?

Yes, someone should have stepped in: the owners of the companies. But if you’re a passive index holder, you abdicated that responsibility to Vanguard, Blackrock, State Street or Fidelity. It wasn’t a custodian like Vanguard’s job to mind the henhouse. It was the job of the owners of the company.

Hard Truth: If you own an index fund, you waive your right to complain about CEO compensation.

In 2019, Lyft went public. With the increased transparency of SEC filing, it was discovered the company had 46 million restricted stock units (RSU) outstanding. RSUs are a way to incentivize employees, but they can become a big bill for owners. In the case of Lyft, the RSUs would cost owners $2-4 billion, depending on the IPO price. This represented a 20-25% ownership stake of the company being granted to employees. Corporations who grant extravagant stock options do so at the expense of the owners. There are no free lunches.

Hard Truth: If you own an index fund, you waive your right to complain about option dilution.

From 2008-2017, the pharmaceutical giant Merck distributed 133% of profits back to shareholders via dividends and share buybacks. Yes, they paid out more than they took in. Those resources could have gone toward research, saving lives, and the next blockbuster drug. The strategy seems obviously shortsighted. How come no one stepped up to tell them to think long term?

Notice in the chart below how percentage of cash flow seems to correlate with times of market euphoria? Will 2020 be any different from 1999 or 2007?

Analysis initiated by SEC Commissioner Robert Jackson Jr. revealed that in the eight days following a buyback announcement, executives on average sold five times as much stock as they had on an ordinary day. Management is effectively cashing out at the owners’ expense when they know the price will be supported by internal buybacks. How come no one is stopping them?

Hard Truth: If you own an index fund, you waive the right to complain about myopic corporate strategy and share buybacks.

Sir Winston Churchill once said, “Capitalism is the worst economic system, except for all the others.” That remains true, but proper capitalism requires thoughtful stewards, meritocratic outcomes, and engaged owners. If we all abdicate our responsibilities, we risk perversion of the system that’s created more positive effects for humanity than arguably any other single phenomenon. Hope is not lost as history tends to move in cycles. We’re in need of the pendulum to change direction.

Hard Truth: This too shall pass.

Trading Fees

As you may have heard, many brokerage houses have reduced their standard trading fees to zero. This includes our custodian Schwab. If it weren’t for the nosebleed high prices around the world, it’s never been a better time to be an investor. Longer term, we’re incredibly optimistic about the world, and especially the U.S. It’s only today’s valuations which create a sour taste. There’s a lot to be happy about. Even with the fees going to zero, it’s unlikely you’ll see a big uptick in trading in your account during normal markets. Moving in and out doesn’t fit our style. However, there may be more rebalancing and nibbling around the edges since the cost has evaporated.

As always, we’re thankful to have such great partners in this wealth creation journey.

Jake & Lonnie

- I’m ignoring reflexivity for simplicity’s sake.

- This behavior isn’t necessarily illogical. When participants start to wonder if others know something they don’t, they guess at this “private information” and often undermine their own viewpoints. This game theory dynamic goes by the fancy name “information cascade.”

- Economists have simulated similar dynamics and found around 50% could be the tipping point.