Arquitos Capital Management commentary for the fourth quarter ended December 31, 2019 discussing the difference between temporary versus permanent capital loss.

Reality is that which, when you stop believing in it, doesn’t go away. – Philip K. Dick

Q4 2019 hedge fund letters, conferences and more

Dear Partner:

Arquitos returned -14.7% net of fees in 2019, compared to 31.5% for the S&P 500. Our annualized net return since the April 10, 2012 launch is 15.9%. Please see page five for more information.

At our annual meeting this past September, I referenced Winston Churchill’s quote, “If you’re going through hell, keep going.”

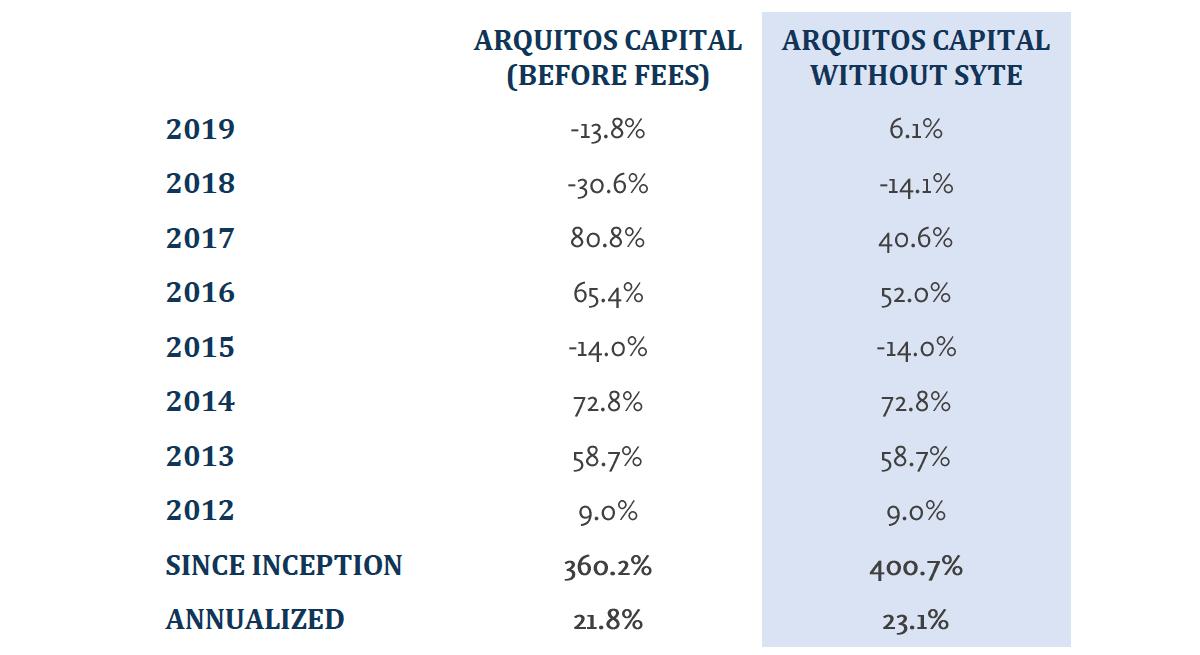

We have been going through hell the last two years but, if you’ll allow me to mix metaphors, the end of the tunnel is within sight. The primary driver of our underperformance over the past two years, both absolute and relative, has been our position in Enterprise Diversified (SYTE). I presented a chart at our annual meeting which showed our results with and without SYTE. I’ve updated it through December 31 and provide it below:

As you can see, having SYTE in the portfolio has had a negative effect overall. On a gross basis, before fees, the portfolio since inception would have performed 1.3% better annually without our SYTE ownership. The position has also dramatically increased the fund’s volatility over the past three years.

In retrospect, I should have put our SYTE position in a side pocket in 2016. It is an ultra-long-term bet. The short-term performance is irrelevant, but the structure of a fund like Arquitos requires this type of reporting. While it is an option to side-pocket it in the future so only investors who want exposure to SYTE can get it through that method, now is not the appropriate time. SYTE’s current valuation prevents it. Shares currently trade for less than SYTE’s holding in Alluvial, meaning that shares trade for far less than liquidation value at today’s price.

The asset management arm of the business, Willow Oak Asset Management, is making exciting progress. Willow Oak helped Geoff Gannon and Andrew Kuhn at Focus Compounding Capital Management launch their hedge fund on January 1. Focused Compounding has tremendous long-term potential, and Willow Oak is glad to be a part of it. Alluvial Fund and Bonhoeffer Fund each had a successful 2019 and are wellpositioned for 2020. Willow Oak continues to pursue new opportunities and partnerships in the asset management space.

While Willow Oak has great potential, its current set-up causes hyper-cyclicality in its results. The funds have not generated significant performance fees over the past few years. The management fee shares that Willow Oak earns keep the lights on, but the performance fees really drive net income. The result is that in a year like 2018 and 2019, Willow Oak gets no credit for the relationships it has built because the short-term net income isn’t there. The opposite is true in a year when all of the funds have positive performance and have met their high-water marks. Willow Oak then probably gets more credit than it deserves in the short-term.

That hyper-cyclicality leads to more volatility. Over time, there is a way for the parent company of Willow Oak to take advantage of this for the benefit of all shareholders, including Arquitos. Ideally SYTE would be large enough that it would buy back shares at current valuations, for example. First, though, we need to build the business and get it to scale.

As we enter a new year, this is a good opportunity to remind investors what Arquitos is, our philosophy and strategy, and what our advantage is. Our philosophy is what we believe. Our strategy is how we carry out the philosophy.

Arquitos Philosophy

Arquitos Capital is long biased because we believe in human ingenuity and progress. We believe that we should take a concentrated position when we discover an unusually attractive opportunity.

We are industry agnostic in order to have the freedom to invest in the best opportunities. We believe that alignment of interests is key to investment success—among the portfolio manager, the investors in the fund, and the companies in which we invest.

When we own shares, we own a piece of the business itself. For that reason, we take a fundamental, bottom-up approach to research.

We believe the greatest advantage in the markets is a long-term perspective. This allows us to use volatility to our advantage, as an opportunity, and not a risk.

Arquitos Strategy

We look for companies that provide safety because of their balance sheet strength, but that also have long-term reinvestment opportunities. This balance sheet to income statement approach provides the opportunity for exponential gains, while also ensuring that the risk of permanent capital loss is low.

We mitigate risk by refusing to buy on portfolio margin, by only investing in opportunities when the chance of permanent capital loss is unusually low, and by looking for companies with a high level of alignment through insider ownership. We never want to be put in a position where we are forced to sell because of factors outside of our control, and we always want to make sure that companies we own treat us as partners.

We typically own around 12 companies. Our top five positions have historically made up approximately 75% of the fund. We are generally focused on North American companies. We maintain a market hedge to protect against Black Swan events.

We look for companies where incentives are aligned with ours: high insider ownership, accretive share buybacks, investor-friendly policies, and other similar indicators.

We source ideas from primary sources such as regulatory filings and on-the-ground research, through our industry contacts and network, and by looking at unique company-specific situations where the perception of market participants may differ from the reality.

Arquitos Edge: Temporary vs permanent capital loss

Arquitos Capital’s edge is our ability to take a concentrated position in a company when the odds of success are heavily in our favor. We have demonstrated success over the fund’s eight-year history with making large allocations in companies where there is a high level of alignment, where the company was led by an effective capital allocator, and where the risk of permanent capital loss was low due to the strength of the company’s balance sheet.

Each of those characteristics must exist in order for us to take a meaningful position. Mohnish Pabrai has rightfully described these companies as being in the category of “heads I win, tails I don’t lose much.”

On the three occasions since 2012 where we have made an unusually large allocation in one company, the company had significant internal reinvestment opportunities in addition to balance sheet safety. Each of these large investments led to significant gains for the portfolio.

These unusually attractive opportunities don’t come across very often, so patience and discipline are key. Thank you again for your investment. We look forward to 2020!

Best regards,

Steven L. Kiel