In the forty years that I have been studying and participating in investment markets, the current conditions are among the most challenging. That may sound odd – interest rates are low, credit spreads are tight, stock prices are near records, real estate has recovered from the great crash to reach new highs. But those are exactly the problems. What matters to investors is how their investments will perform in the future, not how they have done in the past. And going forward all the past good news are the reasons that times are so perilous today. Prices have been pushed to historic levels. The uncertainty in the geo-political environment such as ongoing trade disputes, the upcoming US presidential election and the unpredictable nature of the Trump presidency have largely been brushed off by the market in its continuous march upward. There is a reason that Warren Buffett is sitting on $128 billion in cash at Berkshire Hathaway. Let’s run through the major asset categories and ask what they offer today.

Fixed income

Yields are near historic lows. The current yield on the ten-year Treasury bond has dropped to 1.83%% as shown in the exhibit below. The Vanguard ETF of intermediate-term high-grade corporate bonds has a yield of 2.76% – again near historic lows. Of course, yields are higher if you are willing to bear more risk, but not by much. For example, the Vanguard high-yield fund has a yield of 4.50%. However, with low-grade bonds there is the risk of default and accompanying lower yields if a recession arrives. To make matters worse, if inflation were to accelerate investors would face capital losses across the board on fixed income securities. In short, fixed income securities currently offer anemic returns combined with the potential for substantial capital losses. Not a happy combination for investors.

Stocks

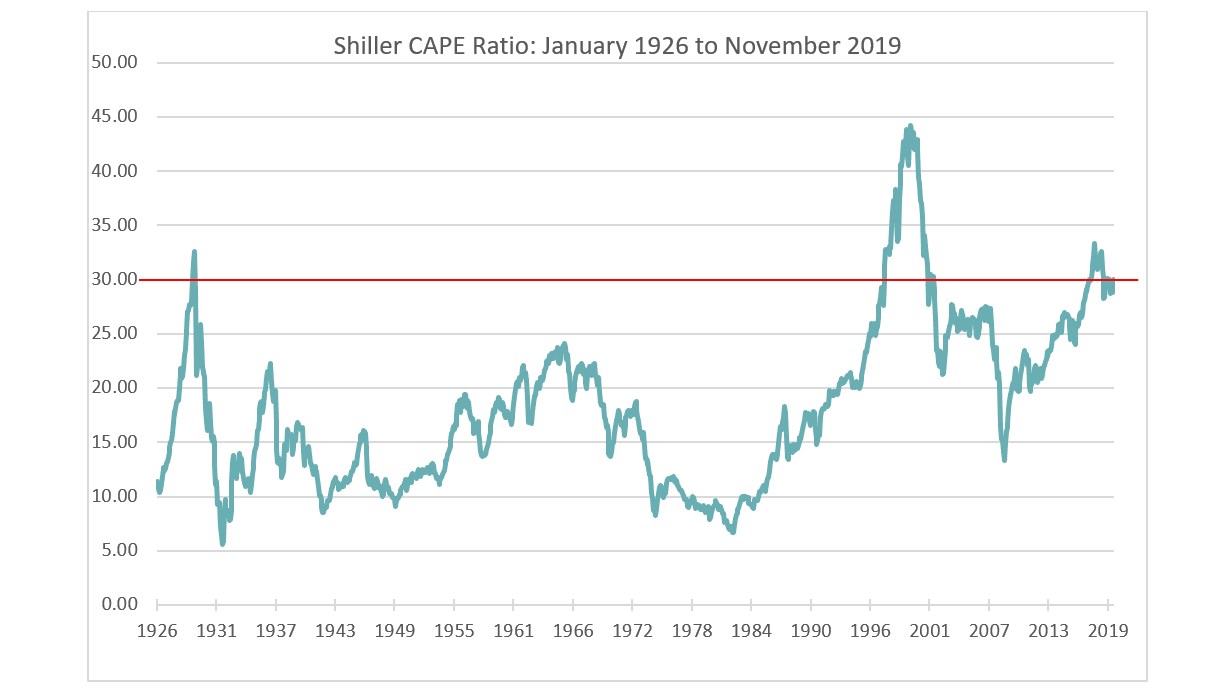

The yields on fixed income securities also affect stock prices because they are the foundation of the discount rate at which future cash flows are discounted when valuing stocks. The lower the discount rate, the higher the stock price and the lower the expected return on an equity investment. The falling interest rates partially explain the rise in the Shiller CAPE index, shown below, to levels matched only during 1929 and the dot.com boom. The Shiller index measures prices relative to earnings, but earnings are also at extraordinary levels relative to GDP. Finally, GDP growth itself has slowed to around 2%, so aggregate economic growth cannot be an impetus for future stock prices increases. In summary, regarding stocks it is hard to see stock prices rising much in the next few years.

Turning to individual stocks, many are close to bubble levels. Stocks such as Roku, Shopify and Beyond Meat, among others, have seen dramatic gains over the last year. Of course, not all stocks are bubble stocks. There are attractive opportunities but finding them requires careful economic analysis and avoidance of popular, crowded, stocks, particularly those in the technology space. If Warren Buffett is having a hard time finding attractively priced stocks, normal investors should be particularly careful.

In short, these are trying times for equity investors.

Real Estate

Low interest rates and correspondingly low discount rates have the same impact on real estate assets as they do on common stocks. Asset values rise and expected returns fall. Like fixed income securities, commercial property prices are high. However, real estate is such a large, heterogenous class that this is not true of all properties, but careful selection is clearly in order. There is one added risk with real estate. Never a liquid asset, real property tends to become especially illiquid during downturns. If we were to enter a recession, it would be difficult to sell depreciating properties. For this reason, investors should place reasonable limits on the fraction of their wealth in real estate.

Options and Other Derivatives

Due to the long bull market, many investors have portfolios with large embedded capital gains, particularly in tech stocks that have run-up the most. This makes investment management more difficult because sharply appreciated positions cannot be sold without generating large tax obligations. One way to manage the situation, especially considering the overall high level of stock prices, is by careful use of stock options. For instance, selling call options in the proper proportions can provide added income and downside protection. To be fair, such option hedging strategies are not a free lunch. Some upside potential must be foregone to provide the added income and downside protection. Furthermore, option premia are currently low because the benign investment environment has led to low expected future volatility. Nonetheless, in current circumstances the benefits provided by thoughtful option selling may well outweigh the costs. It is a strategy every investor, particularly those with large unrealized capital gains should consider.

About the Author

Bradford Cornell is an emeritus Professor of Financial Economics at the Anderson School of Management at UCLA. Prof. Cornell has taught courses on Applied Corporate Finance, Investment Banking, and Corporate Valuation. He is currently developing a new course on Energy, Climate Change and Finance. Professor Cornell received his Masters degree in Statistics and his PhD in Financial Economics from Stanford University.

In his academic capacity, Professor Cornell has published more than 125 articles on a wide variety of topics in applied finance, particularly empirical analysis of asset pricing models. He is also the author of Corporate Valuation: Tools for Effective Appraisal and Decision Making, published by Business One Irwin, The Equity Risk Premium and the Long-Run Future of the Stock Market, published by John Wiley and Conceptual Foundations of Investing published by John Wiley. He is a past Director and Vice-President of the Western Finance Association and a past Director of the American Finance Association.

As a consultant, Professor Cornell has provided testimony and expert analysis in some of the largest and most widely publicized finance related cases in the United States. Among his clients are AT&T, Berkshire Hathaway, Bristol-Myers, Citigroup, Credit Suisse, General Motors, Goldman Sachs, Merck, Microsoft, Morgan Stanley, PG&E, Price Waterhouse, Verizon, Walt Disney and various agencies of the United States Government.

Professor Cornell is also a senior advisor to Rayliant Global Investors and to the Cornell Capital Group. In both capacities, he provides advice on fundamental investment valuation.

In his free time Prof. Cornell enjoys cycling and golf.

Website: www.cornell-capital.com